Certificate for Accounting Professionals Proposal

advertisement

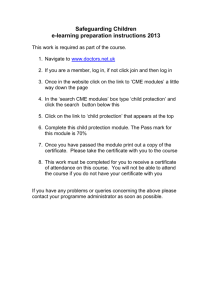

May 1, 2015 Program Proposal for Certificate for Accounting Professionals College of Business California State University, Monterey Bay Spring 2015 Proposed launch semester: Summer, 2016 By: Dr. Catherina Ku Dr. Chi-Chun Chou 1 Table of Contents Certificate for Accounting Professionals ......................................................................... 3 Title and brief description. ....................................................................................... 3 Rationale or need for the proposed certificate program........................................... 3 Learning outcomes for the proposed certificate program. ..................................... 13 Course descriptions. ............................................................................................... 16 Names of faculty. ................................................................................................... 17 Added resources or courses from inside or outside the department. ..................... 18 Current and projected enrollments for the next three years. .................................. 18 Modes of delivery for the proposed certificate program ....................................... 19 Submission procedures. ......................................................................................... 19 Attachment list. ...................................................................................................... 20 2 California State University Monterey Bay Academic Affairs Division Program Proposal Certificate for Accounting Professionals 1) Provide a title and brief description for the proposed certification program, indicating if the proposed program is to be offered for academic credit, Continuing Education Units (CEUs), or no credit. Proposed Certification program title: Certificate for Accounting Professionals This program is going to be offered for academic credit. 2) Provide a rationale or need for the proposed certification program. Document how the need is not currently being met and how this program will meet the need and benefit the community. Where appropriate, link to the vision and academic plans of the University. This online Certificate for Accounting Professionals is designed for students in the accounting concentration needing additional accounting units to qualify to sit for the Certified Public Accountant (CPA) exam or to get their CPA license approved. In addition, this Certificate will also fulfill the need for non-CPAs in business, non-profit, and government institutions who require professional and conceptual knowledge in specific areas in accounting. This program promotes the major key elements of the CSUMB Vision Statement, especially with regard to the collaboration with local and regional partners, and to the embracing of diversity, ethics, and equity. Each of these key aspects and their respective connections to the CSUMB Vision Statement are discussed below: Enhancing partnerships and supporting the business community – This program will reinforce the College of Business’s (COB) ongoing partnerships with local accounting firms (Hayashi Wayland Accounting & Consulting LLP, Ryan & McDonald LLP, Brandon & Tibbs Accountants, PMB Helin Donovan etc.) and the California Society of Certified Public Accountants (CalCPA) to bring value to the community. With the support and sponsorship of these firms (i.e. providing scholarships and book rewards to accounting students in the concentration), this program will benefit students and the community. This program will provide accounting professionals with the latest knowledge to meet continuing changes in standards in the accounting and auditing areas. In addition, the courses offered will prepare professionals in accounting firms to sit for the CPA exam. 3 Reinforcing the concepts of responsible business as addressed in the COB vision and mission – This program will incorporate elements of the COB vision of responsible business as defined by the five-dimensioned lens of People, Ethics, Equity, Planet, and Profit. For example, one of the proposed courses in this program – BUS 588 Ethics for Accounting Professionals - will address the CPA ethics and professional conduct code and social responsibility; this is congruent with the COB’s vision and mission statements as well as the CSUMB Vision Statement. Promoting diversity and equity as described in the CSUMB Vision – This program is online and will target those students and professionals who may have fewer options to continue their education. These potential students are likely to come from diverse backgrounds in the tri-county area. The ethnic profile from our May, 2014 survey was: 46% white, 41% Hispanic, 12% Asian and 1% black. This shows the diversity of students who would be served. In addition, 63% were female and 37% were male (see Attachment 1 for more details and Attachment 2 for the survey questionnaire). From our CSUMB profile, 54% of students are first generation and are typically from lower income backgrounds as shown in the Institutional Assessment and Research (IAR) data. Providing a holistic view of service – The focus on responsible business includes not just Profit as a focus but also an awareness of serving key stakeholders within the community. Therefore, the Certificate program will include concepts related to accounting policy that impact both the institution internally as well as its constituencies. The focus on Planet will ensure that our students are aware of new environmental cost accounting practices designed to improve the quality of decision making. This program will also encourage our students to participate in the COB sponsored Volunteer Income Tax Assistant (VITA) program under the People/Social and Equity foci. Each year, this volunteer tax service in Monterey County helps low income families get tax credits and refunds. Emphasizing the importance of ethics for accounting professionals – Within the past decade, fraud and financial scandals have resulted in more stringent standards being adopted by regulatory agencies and professional associations. Students will study and comprehend the code of accounting professional conduct, the Sarbanes-Oxley Act, CPA professionals’ liability to third parties, liability under the common law, criminal liability, civil liability, environmental liability and liability under the Federal Securities laws, etc. Students will study and discuss a variety of cases under the Ethics focus that emphasize the application of standards and the consequences of social, economic, personal and legal impacts when moral and professional conduct breaks down. The rationale and demand for the certificate program are as follows: The California Qualification Requirements as specified in legislation enacted in January, 2014, indicated that a CPA candidate must: 1) meet the minimum of 150 undergraduate semester units, 2) take at least 30 accounting units, and 3) take at least 10 units in ethics courses. (Note: Candidates who have bachelor’s degrees with 120 semester units can sit for the CPA exam; however, it takes 150 semester units to receive CPA licensure.) Table 1 summarizes the average credits earned by CSUMB accounting graduates in the last three years. As shown in Table 1, these students need at least four additional units in accounting courses and three units in an accounting ethics course to meet the CPA 4 requirements. Effective January 1, 2017, the California State Board of Accountancy will require a course devoted to accounting ethics for anyone applying for CPA licensure. This shows that adding a certificate program offering more than eight credit hours, including an accounting ethics course, would help students meet the CPA licensure requirements. Table 1: Profile of Average Credits Earned by CSUMB Accounting Students Academic Year CPA 201420132012Units req. 15 14 13 Total bachelor’s degree units earned 134 140 148 150 Required additional units to fulfill 150 units 16 10 2 Total accounting units earned 26 26 26 30 Required additional accounting units to fulfill 30 units 4 4 4 Units earned in Ethics Studies (defined by California Board of Accountancy) 7 7 7 BUS 206 Business Law – 3 units 10 BUS 300S Business Ethics in Action – 4 units Required additional accounting ethics units to fulfill 3 3 3 10 units Source: Estimated from CMS of CSUMB, April 2015 In order to determine the demand for courses, in November 2014 we surveyed our accounting students to determine the number of courses they felt should be in the concentration. The survey results show that 68% of the students are willing to take three or four courses. (Note: The November survey results are provided in Attachment 3 and the survey questionnaire is provided in Attachment 4.) Table 2: Number of Courses Accounting Students are Willing to Take in the Certificate for Accounting Professionals Courses to Take Responses Percent Two 10 10.4% Three 30 31.3% Four 35 36.4% Five 6 6.3% Six 15 15.6% Total 96 100.0% Source: College of Business Survey of CSUMB Students, Nov. 2014 (Question 4, Attachment 3) Based on this survey result, the COB developed the Certificate for Accounting Professionals with four courses for a total of 16 credit units. As shown in Table 3, according to the 2013 Trends Report of the American Institution of Certified Public Accountants (AICPA), the demand forecast shows that 11% of small 5 firms in the U.S. were planning to hire more new accounting graduates while 26% of all CPA firms were planning to do so. All the midsize firms planned to hire more new accounting graduates. For large and international firms, 50% and 74% respectively planned to hire more new accounting graduates. Table 3: Demand Forecast – New Accounting Graduates to be Hired in 2012 Firm Size Higher The same lower All CPA firms 26% 63% 11% Small firms (<10 CPAs) 11% 74% 15% Midsize firms (10-49 CPAs) 100% Large firms (50-200 CPAs) 50% 50% National or International firms (>200 CPAs) 74% 25% Source: AICPA 2013 Trends Report In order to determine the demand for accountants and auditors who may or may not work for accounting firms, we explored the data from the Bureau of Labor Statistics of the United States Department of Labor. The results are shown in Table 4. According to the data, the employment of accountants and auditors is anticipated to grow 13% from 2012 to 2022. This growth rate exceeds the average growth rate of 11% for all jobs classifications during the same period. Table 4: Demand for Accountants and Auditors, 2012-2022 Number of Jobs, 2012 1,275,400 Job Outlook, 2012-22 13% Employment Change, 2012-22 166,700 Source: Bureau of Labor Statistics, 2012 In addition, we explored the data provided in the California Labor Market and Economics Analysis 2012, developed by the Labor Market Information Division of the California Employment Development Department. The summary report included accounting professionals employed in businesses. In Table 5, the data show that the growth rate from 2012 to 2022 in California will be over 15.5%. This growth rate is higher than the national growth rate provided by the U.S. Bureau of Labor Statistics. Table 5: Summary Report for the Employment of Accounting Professionals Year 2012 2022 Difference Growth rate Employ number 163,136 188,366 25,200 15.45% Source: California Labor Market and Economics Analysis 2012 In summary, there is sufficient evidence to support the demand for accounting professionals who will need continuing education to update their expertise and knowledge of evolving accounting standards and practice. The proposed certificate program will not only meet the need for 6 continuing education but also meet the need to prepare students for an advanced career in professional services (e.g. CPA and tax firms), corporations, government sectors, and not-forprofit organizations. The evidence that there is student demand at CSUMB and other institutions for a CPA certificate program is provided below. Provide evidence that there is student demand for this type of program. In addition to the aggregated employment data provided above, the COB conducted two surveys to better understand student demand for the Certificate for Accounting Professionals. The first survey was conducted in May 2014. A second survey was conducted in November 2014 to increase the sample size. The results of these two surveys are summarized in Tables 6 through 13. The May survey was distributed in three classes to ascertain student interest in the Certificate for Accounting Professionals in the college. The three classes in which the survey was administered were all undergraduate business classes, including two accounting classes. The same survey was also emailed to alumni who had graduated as accounting concentration students in the previous two years. A total of 110 students/alumni took the survey, of which 109 students/alumni provided responses that were usable. As mentioned earlier, the detailed results along with the questions are provided in Attachment 1. The questionnaire used is included as Attachment 2 to this proposal. The results are discussed in subsequent paragraphs. Among the 109 (usable) respondents to the survey, there were 78 accounting concentration students, 19 were not in the accounting concentration, and 12 were alumni. Table 6 shows the number and percentage of respondents who expressed interest in CSUMB launching a Certificate for Accounting Professionals. The majority of respondents (69%) were either interested or very interested in the launch of the Certificate program. Table 6: Level of Interest in CSUMB Launch of a Certificate for Accounting Professionals Level of Interest Responses Percent Very Interested 50 45.9% Interested 25 22.9% Not Sure 17 15.6% Not Interested 14 12.8% Not very interested 3 2.8% Total 109 100.0% Source: College of Business Survey of CSUMB Students, May 2014 (Question 1, Attachment 1) Another survey was conducted in November in three additional accounting classes that were not included in the May sample. Attachment 3 contains detailed information on the November survey, and Attachment 4 contains the November survey questionnaire. There were 96 usable responses to the November survey, of which 87 were accounting students and 9 alumni; all student responses were from the accounting concentration. 7 Table 7 shows the result of the first question in the November survey, indicating the number and percentage of respondents who expressed interest in CSUMB launching a Certificate for Accounting Professionals. The majority of respondents (90%) were either interested or very interested in the launch of the Certificate program. This higher percentage than in the previous sample presented in Table 6 shows that the interest in the certificate increases significantly when only accounting concentration students are included in the sample. Table 7: Level of Interest in CSUMB Launch of a Certificate for Accounting Professionals Level of Interest Responses Percent Very Interested 51 53.2% Interested 35 36.5% Not Sure 8 8.3% Not Interested 1 1.0% Not very Interested 1 1.0% Total 96 100.0% Source: College of Business Survey of CSUMB Students, Nov. 2014 (Question 1, Attachment 3) In the May survey, additional questions were asked that were not included in the November survey. The results of these additional questions appear in Tables 8 through 11. Table 8 shows the number and percentage of respondents in the May survey who expressed interest in enrolling in a Certificate for Accounting Professionals. As can be seen in the table, the majority of the 109 respondents (64%) were either interested or very interested in enrolling in a Certificate for Accounting Professionals. The previous question on “launch” was to determine the student interest in CSUMB creating a new program versus this question, which was designed to determine if the students would actually take the Certificate. Table 8: Respondents Interested in Enrolling in the Certificate for Accounting Professionals Interest in Enrolling Responses Percent Very Interested 46 42.2% Interested 24 22.0% Not Sure 18 16.5% Not Interested 14 12.8% Not very interested 7 6.4% Total 109 100.0% Source: College of Business Survey of CSUMB Students, May 2014 (Question 3, Attachment 1) Table 9 shows the number and percentage of respondents who would consider enrolling in a Certificate for Accounting Professionals, if the program were offered immediately. As can be seen in the table, 58% of the respondents were either likely or very likely to enroll in a Certificate immediately. It seems that very few students interested in enrolling in a Certificate program are likely to defer taking the program. 8 Table 9: Respondents Who Would Consider Enrolling in the Certificate for Accounting Professionals Immediately Enroll Immediately Responses Percent Very Likely 39 35.5% Likely 25 22.7% Not Sure 23 20.9% Not Likely 14 12.7% Not very Likely 9 8.2% Total 110 100.0% Source: College of Business Survey of CSUMB Students, May 2014 (Question 5, Attachment 1) Table 10 shows the number and percentage of respondents who think their friends or classmates would likely enroll in a Certificate for Accounting Professionals. In Table 10, 72% of the respondents thought that their friends or classmates would be either likely or very likely to enroll in a Certificate. Table 10: Respondents’ Friends/Classmates Interest in Enrolling in a Certificate for Accounting Professionals Friends/Classmates Responses Percent Interest Very Likely 34 31.8% Likely 43 40.2% Not Sure 22 20.6% Not Likely 5 4.7% Not very Likely 3 2.8% Total 107 100.0% Source: College of Business Survey of CSUMB Students, May 2014 (Question 7, Attachment 1) Table 11 shows the number and percentage of respondents who think that current and future CSUMB students would be interested in a Certificate for Accounting Professionals. In Table 11, 85% thought current and future CSUMB students would be either interested or very interested in a Certificate for Accounting Professionals. Table 11: Respondent Perception of Current and Future CSUMB Students Interest in a Certificate for Accounting Professionals Other CSUMB Students Responses Percent Interest Very Interested 42 39.3% Interested 49 45.8% Not Sure 15 14.0% Not Interested 0 0.0% Not very interested 1 0.9% Total 107 100.0% Source: College of Business Survey of CSUMB Students, May 2014 (Question 9, Attachment 1) In the November 2014 survey, a question not asked in the May survey was added. Table 12 shows the respondents willingness to consider taking the CPA exam after finishing 9 undergraduate requirements. It shows that 78% were either very likely or likely to take the CPA exam. Table 12: Respondents’ Willingness to Consider Taking the CPA Exam after Finishing Undergraduate Requirements Willingness to Take the Responses Percent CPA Exam Very Likely 50 52.1% Likely 25 26.0% Not Sure 18 18.8% Not Likely 2 2.1% Not very Likely 1 1.0% Total 96 100.0% Source: College of Business Survey of CSUMB Students, Nov. 2014 (Question 2, Attachment 3) In summary, it can be seen that interest in the Certificate for Accounting Professionals is very strong. The survey responses indicated a strong interest in the program from the perspective of general attractiveness, the interest of friends, and potential current or future willingness to enroll in the certificate program. Analysis of Competitor Programs We conducted a competitive analysis of universities that offer post-baccalaureate programs in accounting. Table 13 focuses on selected programs in California with the exception of Kaplan University. In California, we found six universities offering online certificate programs. The number of courses in these programs ranged from six to nine courses, for a total of 24 to 45 units. Kaplan has a certificate program with four courses. There is no campus within the CSU system that offers a Certificate for Accounting Professionals. CSUMB will be first in the CSU system to offer a Certificate for Accounting Professionals. There are eight universities within the CSU system that offer a Master’s degree in Accounting. They are CSU Fullerton, CSU Long Beach, CSU Northridge, CSU Sacramento, CSU San Francisco, CSU San Jose, Cal Poly Pomona, and Cal Poly San Luis Obispo. Table 13 provides a summary report of the competitor analysis. Santa Clara University, Kaplan University, and Saint Mary’s College of California are the three universities that are not in the California public university system. However, Santa Clara University offers a certificate of “Advanced Accounting Proficiency,” which offers eight courses with a total of 45 units. Saint Mary’s does not offer the Certificate for Accounting Professionals; only Kaplan offers a nationwide program “Graduate Certificate in Accounting,” which is very similar to our Certificate for Accounting Professionals. Kaplan University’s program is completely online and requires four courses for a total of 16 units. However, the course for accounting ethics for professionals is not included in Kaplan’s program. The accounting ethics for professionals course will be a required course for CPA licensure starting in 2017. CSUMB will be the only university offering a Certificate for Accounting Professionals with the specified accounting 10 ethics for professionals course in California. The complete competitor analysis is provided as Attachment 5. In addition, the data summarized in Table 13 indicates that six out of the nine programs offering either a Certificate or a Master’s degree require over 30 units; the California standards require 30 accounting units for a CPA licensure. Our Certificate for Accounting Professionals focuses on business students who graduate from the CSU system with more than 120 units. With the additional 12 units in accounting and four units in the accounting ethics course in the CSUMB program, CSU students will fulfill the requirements for CPA licensure when they take our Certificate program. 11 Table 13: California Competitor Analysis Summary University UC Berkeley Extension Program Title Number of required courses 8 Elective courses offered Total required units 24 Accounting Certificate Accounting Certificate UCLA Extension 9 16 40 (include Ethics in Accounting) UC Davis Extension Accounting Certificate 4+2 8 24 Professional Certificate in UC Riverside Extension 8+1 4 36 Accounting UC Santa Barbara Professional Accounting 9 36 Extension Certificate of Advanced Santa Clara University Accounting Proficiency 8 45 Program Graduate Certificate in Kaplan University 4 16 Accounting Master of Science in Kaplan University 13 52 Accounting Master of Science in 10 40 Accounting Saint Mary's College of Boot Camp (is required of students who either do Credits for CA Additional not have a major in accounting or major in ACCTG 200 & fee $3,000 accounting but have a GPA below 2.75) ACCTG 201 Source: Websites of Competitor Programs, 2014 Mode online online online online online Daily 14-week summer or Weekly nine-month (Saturday) online online online 8 weeks, in hybrid 12 In summary, CSUMB’s Certificate for Accounting Professionals optimizes the cost, time, and value to prospective students seeking more accounting skills and preparation for CPA licensure. Our Certificate for Accounting Professionals is unique; based on the evidence from the student surveys, the demand will be sustainable. It can also be seen that the certificate programs offered in California are designed as online programs. 3) List and briefly (and clearly) describe the learning outcomes for the proposed certificate program. These should be comparable in length to those that would appear in the catalog. For credit-bearing certificates, learning outcomes equivalent to a minimum number of 12 units is ordinarily expected. The target students for the Certificate for Accounting Professionals are those who need additional education units in accounting subjects and the specific accounting ethics course that is required for California CPA licensure. Table 14 lists the major learning outcomes of the Certificate for Accounting Professionals for the four proposed courses. The three major learning outcomes for the program are: MLO 1: Demonstrate and apply business knowledge and skills MLO 2: Become skilled critical thinkers MLO 3: Demonstrate and apply competency in quantitative skills 13 Table 14: Major Learning Outcomes of the Certification for Accounting Program MLO1: MLO2: Become MLO3: Demonstrate Demonstrate and skilled critical and apply competency in apply business thinkers: Will quantitative skills: Will knowledge and skills: analyze and synthesize investigate, analyze and Major Will analyze and relevant evidence in evaluate data using Learning apply the concepts, business scenarios and quantitative tools to Outcomes theories, models and cases to determine propose changes in (MLOs) tools for accounting patterns, trends and accounting processes, decision management options that result in practices and financial evidence-based decisions recommendations BUS 582 Students are Students are Students are expected Auditing and expected to learn how expected to create to use audit software Assurance to plan, manage and auditing procedures to packages, such as Audit lead an effective audit assess financial Command Language engagement, including statements by using (ACL), to collect and audit planning, risk various analytical analyze audit evidence assessment, techniques and critical and design appropriate management thinking processes. computerized audit philosophy and procedures. responsibilities. Students apply Students are Students are expected accounting concepts expected to apply to analyze enterprise and tools to build critical analysis databases and are BUS 586 information systems procedures to review expected to apply Accounting and analyze the internal control flowchart software to Information organizational systems of diagram organizational Systems effectiveness and organizations looking functions and efficiency and for patterns and information flow recommend discrepancies. procedures. improvements. 14 Table 14: Major Learning Outcomes of the Certification for Accounting Program (continued) MLO1: MLO2: Become MLO3: Demonstrate Demonstrate and skilled critical and apply competency in apply business thinkers: Will quantitative skills knowledge and skills: analyze and synthesize : Will investigate, Major Will analyze and relevant evidence in analyze and evaluate Learning apply the concepts, business scenarios and data using quantitative Outcomes theories, models and cases to determine tools to propose changes (MLOs) tools for accounting patterns, trends and in accounting processes, decision management options that result in practices and financial evidence-based decisions recommendations Students are Students are Students are expected expected to learn how expected to apply to apply financial data to create appropriate ethical concepts to analysis to create BUS 588 accounting policies for cases, scenarios, and transparency and Ethics ethical and effective ethical dilemmas, disclosure of enterprise Accounting management using frameworks of risks that enhance Professionals decisions. critical thinking to financial decision enhance the quality of making. accounting decisions. Students are Students are Students are expected expected to utilize expected to utilize to utilize spreadsheet and analytical skills and critical analysis other quantitative tools to BUS 684 accounting tools to procedures to evaluate examine business Fin. Meas., evaluate risk companies’ financial performance and evaluate Anal., management, financial measurement systems the strength of a business Report. performance and the and performance. by analyzing relevant impact of management decisions. Source: College of Business, 2015 financial data. 15 4) List and briefly describe courses or other pathways for meeting the requirements for the proposed certificate program. Course descriptions (if course-based approaches are applied) should be short and comparable to those that would appear in the catalog. The proposal should indicate which courses would be new and which are existing; for existing courses, please specify the frequency of the course offering (as described in the current catalog), and any proposed scheduling changes. Other pathways for meeting the stated requirements should be clear and specific enough for a student to follow. There are four courses required in the Certificate for Accounting Professionals. The major learning outcomes are listed above in Table 14. The course descriptions for the four courses are listed below. BUS 582 Auditing and Assurance: This course focuses on auditing theory, practice, philosophy & the environment of the auditing profession. Topics include general auditing standards, professional conduct & ethics, legal liability, audit evidence, audit planning, internal control, auditing sampling, risk assessment, & accounts assurance. Examines SOX and SEC requirements for public companies, applying critical thinking for ethical dilemmas faced by auditors. (Offered as classroom-based, hybrid, or online) Restricted to Senior and Graduate Level Standing Only Units: 4 BUS 586 Accounting Information Systems: Examines the accounting data that is collected, stored, and processed by computer technology under GAAP accounting practices. Analyzes the efficiency & effectiveness of information technology infrastructure & the operations. Integrates SOX and discuss the ethics, fraud, documents flow, segregation of duties, computer processing, including the risk of cloud computing, and the related control activities in a corporation. (Offered class-based, hybrid, or online) Restricted to Senior and Graduate Level Standing Only Units: 4 BUS 588 Ethics - Accounting Professionals: Examines the AICPA Code of Professional Conduct as well as the additional requirements for auditors of public companies expressed in the Institute of Internal Auditors Codes of Ethics. Develops critical thinking frameworks to assess cases of ethical dilemmas frequently encountered by accounting professionals. Explores legal requirements & liabilities that govern the accounting profession. (Offered as class-based, hybrid or online) Restricted to Senior and Graduate Level Standing Only Units: 4 BUS 684 Fin. Meas., Anal., Report.: This course focuses on the analysis of managers' financial measurement, reporting and disclosure strategies and the effects of such strategies on firms' equity values. Examines various institutional settings and economic contexts in which managers make financial measurement, reporting and disclosure choices, paying attention to the quality and credibility of the information disclosed. The course helps students develop both financial 16 statement preparation and analysis skills as applied to business decisions. (Note: Not currently in the 2015-2016 catalog.) Units: 4 5) Names of faculty and/or the academic unit responsible for offering and monitoring the quality of the program shall be provided. List faculty advisors and/or contact people, providing a statement of their qualifications for delivering the proposed certificate program. For credit-bearing certificates, faculty qualifications are the standing qualifications for University faculty. For non-credit certificates, appropriate University faculty are expected to review and approve the qualifications of those offering the certificate program. Dr. Catherina Ku, Associate Professor of Accounting, will be the advisor and the contact person for the program. Dr. Ku received her PhD degree in Management/Accounting Information Systems and has taught accounting-related courses for 25 years. She is currently the lead coordinator for the accounting and finance curricula and the advisor for students in the accounting concentration. Dr. Ku will teach BUS 582: Auditing and Assurance and BUS 684: Financial Measurement, Analysis and Reporting. Dr. Chi Chun Chou, Associate Professor of Accounting, will teach BUS 586: Accounting Information Systems in the certificate program. Dr. Chou received his PhD degree in Accounting and has taught accounting related courses for 18 years. His specialty is in accounting information systems and auditing. Jeffrey Froshman, Distinguished Lecturer of Accounting, has been teaching accounting at the CSUMB College of Business since January 1996. Jeff currently teaches Personal Financial Management and Income Tax. He is also a tax professional who has owned his own firm and worked for the Internal Revenue Service for many years. He is currently a a Financial Consultant at Wells Fargo Advisors. He will be an alternative lecturer for the courses in the certificate program. Loretta Thompson, Lecturer of Accounting, has been working with small and large businesses for the last 35 years in the accounting area. She has rich experience in forensic accounting, based on her professional service experience in various industries and with various business clients. She has taught Ethics and Values to hundreds of supervisors and managers in the tri-county area through her Leadership Academies and through private contracts. She will team teach BUS 588: Ethics for Accounting Professionals with Dr. Marylou Shockley (see below). Dr. Marylou Shockley, Professor of Management and International Business, is currently the Chair of the College of Business at CSUMB. Dr. Shockley has a doctoral degree from Oxford University in the United Kingdom. Her focus is on management and corporate governance from a social responsibility perspective, including ethics. Dr. Shockley and Loretta Thompson will team teach BUS 588: Ethics for Accounting Professionals. 17 The College of Business (COB) is now in the process of hiring new faculty in accounting, one of whom will start in Fall 2015. He/she will teach one of the four courses on an as-required basis, based on his/her expertise. Table 15 provides the list of faculty members who will teach in the program. Table 15: List of Certificate Program Faculty Name Catherina Ku Chi Chun Chou Jeffrey Froshman Rank Associate professor Associate Professor Distinguished Lecturer Employment Tenured Tenure-Track Wells Fargo Advisors CSUMB Lecturer CSUMB Lecturer Tenured CSUMB (new hire) Loretta Thompson Marylou Shockley New Accounting faculty Adjunct Professor Assistant/Associate professor Source: College of Business, 2015 Degree Ph.D. Ph.D. Masters Masters D. Phil Ph.D. 6) State any added resources or courses from inside or outside the department that would be required to deliver the proposed certificate program. Indicate any resources not covered by the self-support model of Extended Education. Obtain required signatures on the accompanying approval sheet ("Approval Sheet for the Creation of New Certificate Programs") from Chairs in charge of those resources. For BUS 582, the Audit Command Language (ACL) software will come with the textbook. Therefore, no additional IT resources will be required in this course. For other courses, no additional resources will be required as well, other than faculty, who are also required to meet the growing number of accounting students in the BSBA Concentration in Accounting. No faculty will be hired or dedicated solely to teaching in this certificate program. These courses will be taught in an online mode. COB will use iLearn as the learning management system. 7) State current and projected enrollments for the next three years, indicating the basis for those projections. As indicated in Tables 6 through 9, 69% of the first sample of business and accounting concentration students were interested or very interested in the launch of a CPA certification program; 90% of accounting concentration students in the second survey sample indicated interest or great interest in the launch of the CPA certification program; 64% indicated that they would like to enroll in such a program; and 58% indicated that they were either interested or very interested in enrolling in such a program if it were offered immediately. Applying these proportions to the 110 students who are currently in the two classes in the accounting concentration, this would give an upper bound of 99 18 students (applying the 90% proportion) and a lower bound of 64 students (applying the 58% proportion) who would like to enroll in the program. Then applying the proportion of the number of seniors in the sample (38%), the upper bound enrollments for the first year would be 35 students and the lower bound enrollments for the first year would be 24 students. Taking the lower bound enrollment as the conservative estimate of those who would enroll and allowing a 20% attrition at this stage of the enrollment funnel, the expected number of students enrolling in Year 1 would be 20 students. Assuming a growth rate of 25% in each of the next two years as the reputation and word-of-mouth for the program builds, the number of students would be 25 in Year 2 and 32 in Year 3. This growth rate is reasonable given that non-accounting majors and non-CPA bound accounting concentration students would also be willing to enroll in such a certificate program. Projections based on these numbers are provided in Table 16 below, with a further anticipated attrition rate of 5% to account for those who would change their mind after enrolling. Table 16: Estimated Enrollments in the Certificate for Accounting Professionals Program Enrollments Year 1 Year 2 Projected Admissions 20 25 (per course) Anticipated Attrition Rate 5% 5% Anticipated Attrition 1 1 Projected Enrollment 19 24 (per course) Source: College of Business Estimate, 2015 Year 3 32 5% 2 30 8) State modes of delivery for the proposed certificate program (i.e. distributed, in class, etc.) After reviewing the modality of offering by competitors in Table 13, the program will be offered in the online format. The College of Business has significant and comprehensive experience in offering a full-fledged online MBA program since 2008 with approximately 200 students enrolled every year. It will transfer the knowledge and experience it has running such an online program to the certificate program. 9) Submit proposals for certificates of academic achievement (credit) to the appropriate Chairs(s) and qualified faculty (defined as CSUMB faculty who have expertise in the academic field and/or CSUMB faculty who will participate in the design and/or delivery of the certificate curriculum). The Chair(s) shall then submit the proposed certificate program along with their recommendations to their Dean and to the Dean of Extended Education and International Programs for review in accordance with the Policy on Credit and Non-credit Certificate Programs. Upon approval, the Chair(s) and Deans shall sign the accompanying approval sheet. 19 10) The Deans submit the proposal to the Analyst in the Office of the Provost. Upon confirmation that the certificate will be offered through Extended Education, the Analyst forwards the proposal to the Academic Senate Executive Committee. ASEC charges the Senate Curriculum Committee Council with review of proposal. The certificate program was discussed with the Dean of Extended Education and International Programs through whom this program will be offered as a self-support program. 11) The SCCC submits the proposal and its recommendation to the AVP for Academic Planning. 12) The Provost will review the proposal. An official notification indicating the Provost’s approval and designated implementation date will be sent to the campus. The proposed certificate program shall not be offered until the date indicated in the official notification. Attachment List Attachment 1: First Survey Results – May 2014 Attachment 2: Questionnaire for the May survey – May 2014 Attachment 3: November Survey Results – Nov 2014 Attachment 4: Questionnaire for the November survey – Nov 2014 Attachment 5: Competitor Analysis 20