Risk Analysis & Risk Management for Providers in the

Taming Uncertainty:

Risk Management in the 21

st

Century

David T. Wilber

Chief Operating Officer / CARF Surveyor

What is RISK ?

Definition of Risk Management

The act of controlling any threats to the organization’s:

Goodwill

People

Property

Income

Ability to accomplish goals

The Difference Between

Incident Analysis and Risk Assessment

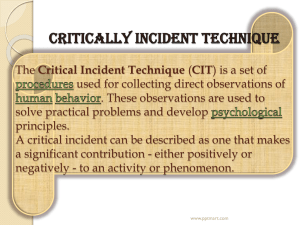

Incident Analysis:

Establishes a cause for an incident that has already happened.

Focuses on analyzing the reasons for the incident and development of strategies to prevent future incidents.

Risk Assessment:

Focuses on identification of potential exposures to prevent incidents from happening.

Breaks business decisions down into bite sized pieces to enable preplanning for loss control and mitigation strategies.

The only alternative to risk management is crisis management --- and crisis management is much more expensive, time consuming and embarrassing.

JAMES LAM, Enterprise Risk Management, Wiley Finance © 2003

Goals of Risk Management

For the organization to:

Protect physical and financial assets

Protect intangible assets (e.g., goodwill and reputation)

Prepare for operational crisis (Tolerate Uncertainty)

Provide a safe environment for all employees, persons receiving services and visitors

Promote a “healthy” risk culture – It’s safe to talk about risk. Open and transparent.

Develop a common and consistent approach to risk across the organization. Not intuition-based.

Goals of Risk Management

Things will happen…they always do…!

Survival: Not going under due to unforeseen circumstances.

Continuity of operations: Avoiding Business interruption-shutdowns

Sustainability and profitability: Maintaining your mission

Low Risk Organizations will have these factors in place.

Risk management plan

Continuity of Operations plan

Technology Plan

Risk Management Team

Staff Training and competency testing

Corporate Compliance program

Ethical Code of Conduct that includes witnessing of documents etc.

Social Media Policies

Accreditation: CARF-The Rehabilitation Accreditation Commission

Process of Risk Management

Step 1

A Simple Framework

Step 2 Step 3 Step 4 Step 5

Establish

Objectives

Identify

Risks &

Controls

Assess

Risks &

Controls

Evaluate

& Take

Action

Monitor

&

Report

Communicate, learn, improve

Categorizing Risk – Comprehensive

1.

Political Risk

2.

Financial Risk

3.

Service Delivery or Operational Risk

4.

People / HR Risk

5.

Information/Knowledge Risk

6.

Strategic / Policy Risk

7.

Stakeholder Satisfaction / Public Perception Risk

8.

Legal / Compliance Risk

9.

Technology Risk

10.

Governance / Organizational Risk

11.

Privacy Risk

12.

Security Risk

13.

Equity Risk

14. Safety

NEW

Slide 9

Perils Causing Loss

Natural Perils:

Human Perils:

Economic

Perils:

Social Media Risk

From Philadelphia Insurance:

From Philadelphia Insurance:

Department:

Site:

TYPE OF RISK

FIRE

MEDICAL EMERGENCY

ELECTRIC SHOCK

SPILLS/ HAZARDOUS

EXPOSURE

ADVERSE WEATHER

“TORNADOS”

BOMBS / TERRORISM

MISSING PERSONS

POISONING

PSYCHIATRIC EMERGENCY

VEHICLE EMERGENCY

SUSPICIOUS MAIL

Probability

High

5 ←

VULNERABILITY ANALYSIS CHART

Date:

Person Completing Form:

Low

→ 1

Human

Impact

High Impact 5

Property

Impact

←---------------→

Business

Impact

Internal

Resources

1 Low Impact

Weak

5 ◄

Resources

External

Resources

► 1 Strong

Resources

Total

You still have to assess those “other risks”

1

2

5

4

3

Risk rating

…

Combining impact and likelihood

RISK PRIORITIZATION MATRIX

RISK

I x L

A Risk Prioritization Matrix can be helpful in prioritizing risks

Plot of event probability versus impact

RISK

I x L

1

RISK

I x L

2 3

LIKELIHOOD

4 5

Slide 15

Note that the zones are not symmetrical across the matrix

High impact low probability events much more important than likely low impact events

Pick the High value Targets!

Polling Question

What is the average # of accidents that go unreported for every one reported accident?

1.29

2.48

4.71

6.26

Accident under-reporting among employees: Testing the moderating influence of psychological safety climate and supervisor enforcement of safety practices

Tahira M. Probst & Armando X. Estrada, Department of Psychology, Washington State University,

June 2009

The Approach-Your toolkit –

education, job aids, templates

Incorporates risk information into the strategic direction-setting, making decisions that consider established risk tolerance levels.

Takes a systems approach to managing risk at the strategic, operational and project levels which is continuous, proactive and systematic.

Fosters a working culture that values learning, innovation, responsible risk-taking and continuous improvement.

Add value not work. We developed forms and templates.

Develop and deliver educational sessions – usually attended by all leadership members at a minimum. Include risk 101 and time for them to discuss how to apply concepts to their specific worksite.

Develop teams in actual risk assessments.

Process of Risk Management

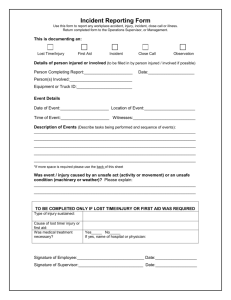

Identify available techniques for reducing or eliminating loss exposures

What are Loss Prevention/

Risk Control Methods?

Avoidance – There’s a great deal of risk. You don’t want to assume the risk and it can’t be transferred, so you avoid the risk altogether

Loss Prevention – Reduces the frequency or likelihood of a “particular” loss. Examples include:

Improve security measures to reduce the possibility of arson or theft.

Improve maintenance of facilities to reduce the possibility of a tripping hazard.

Loss Reduction – Reduces the severity or cost of a “particular” loss. Examples include:

Require the use of hearing protection to reduce the chance of a hearing loss.

Reduce the cost of workers’ compensation claims through the use of return to work programs.

Segregate Losses – Arrange your agency’s activities and assets to prevent one event from causing loss to the whole.

Contractually transfer the risk.

Process of Risk Management

Select and implement desired loss reduction techniques

Personal protective equipment.

Housekeeping, repair, and maintenance.

Inspections.

Tools and equipment.

Supervision.

Policies, procedures, and process.

Contract management and administration.

Effective Risk Management

Monitoring and Control

Continually monitor risks to identify any change in the status, or if they turn into an issue.

Hold regular risk reviews

To identify actions outstanding, risk probability and impact

Remove risks that have passed

Identify new risks

The Risk Management Plan should specify the risks, risk responses, and mechanisms used to control the process

Need to continuously monitor for risk triggers

Potential risk events should be identified early in a project and monitoring for such events immediately commence

Each risk is assigned to a specific position

Has the expertise & authority to identify & response to an event

Need environment where problems are readily reported, embraced & solved

IRM RISKS AND CONTROLS

The following table describes the risks and mitigating controls and related information. As controls are implemented or changed, their status will be updated.

Risk Rating Impact = significant, moderate or minor (S, M, m) and Likelihood = high, medium or low (H, M, or L)

Responsible Org &

Name (Implement /

ID Number Operate) Risk Control

Category: Financial

None in this category

Category: Equity

None in this category

Category: Service Delivery or Operational

064

065

Person A

Person B

055 – Insufficient knowledge transfer

102 – Conflicting management instructions

Update impacted policies and procedures for integration into knowledge support tools.

Harmonizing policies and procedures (e.g., access procedures – X has one and Y has one – there needs to be one process/policy/procedure).

M

056 – Lack of communication (Serious service delivery issues)

352 – Different business and IT processes (incident management)

(a) IT incident and Triage (harmonization between IT and Business).

(b) X and Y need to develop an incident management process/service to deal with issues that arise during service delivery.

Roles and responsibilities need to be defined in both organizations: from a stewardship perspective on the ministry side, and from a service delivery/reporting perspective on the agency side. The process/service ensures that incident/issues are communicated as per agreement requirements; well tracked and reported.

M

Risk

Rating

(Impact)

Risk

Rating

(likelihood) Date Required Status

M

M

31-Mar-09

31-Mar-09

Refer to Privacy

Action Plan Work on

Ongoing Operations

Commitments

Report

(a, b) Refer to ongoing Operations

IRM document

Process of Risk Management

Annual Report results of loss reduction techniques

Include results in performance improvement activities

Exposure

Maltreatment of

Individuals

Risk Control Mechanism Responsibility

Fines, loss of licenses, loss of Individuals

Maintain current knowledge of

Human Rights (DBHDS)

Annual training of all direct support staff in Human Rights

(DBHDS)

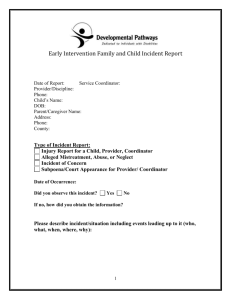

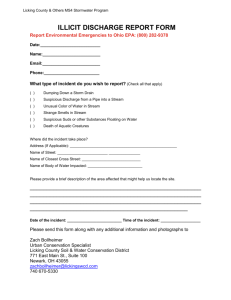

Incident Report Process

Internal Investigation process

Director of Program and

Quality Services, Senior

Leadership Team,

Management Team

Change in population -

Diversity

Loss of Individuals Develop new and innovative programs to meet the changing needs

Program evaluation and satisfaction surveys

Follow trends

Senior Leadership Team,

Management Team

Legislative/ Rule

Changes

Wage and Hour Issues

Increased costs without increased funding

Not implementing rule changes correctly

Loss of funding

Actively monitor legislative activities through trade associations – vaACCSES, VNPP,

VAAPSE, ArcVA

Management Team

Wage and Hour Audit Maintain current knowledge of wage and hour rules and regulations

Provide staff with wage and hour training

Management Team

Accounting staff

Loss of work

Downturn in economy

Loss of income

Loss of Individuals

Loss of community jobs

Loss of facility based jobs

Loss of income

Monitor marketing capabilities

Develop aggressive marketing plan

Plan for alternative activities

Implement volunteer opportunities and alternative activities

Diversify program options throughout agency

Management Team,

Director of Business

Development

Management Team

Review

Date

Annually

Annually

Annually

Annually

Annually

Annually

29

Questions?

Thank you

You don’t know what you don’t know…

Better to know….

David T. Wilber

Chief Operating Officer / CARF Surveyor dwilber@VersAbility.org