airca m 11 Poloncarz 4-14

advertisement

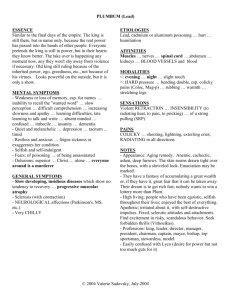

The “Credit” Crisis Growing Pains within the Emerging Carbon Markets April 14, 2008 Kevin Poloncarz The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Overview • • • • • • Market Mechanisms in General Offsets • Concepts/ Criteria/ Additionality Case Studies • Enhanced Oil Recovery • Long Lived Wood Products Federal Trade Commission’s (FTC) and State Attorneys’ General Interest Voluntary Standards • CCAR The Climate Action Reserve • SCAQMD SoCal Climate Solutions Exchange Why participate in voluntary (i.e., pre-compliance) markets? 2 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Market Mechanisms • Cap-and-Trade • Sets a cap and declining balances on emissions • Allocation and/or auction of allowances • Trading occurs • Trued-up periodically with agency • vs. command-and-control 3 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Market Mechanisms • Cap-and-Trade • US SOx/NOx Acid Rain Program trading system • SCAQMD’s RECLAIM program • US delegation prevailed upon international community to accept market mechanisms during Kyoto negotiations. • European Union Emission Trading Scheme (EU ETS) • Phase 1 2005-2007: learning phase: over-allocation; fuel switching; price for allowances crashed • Phase 2 2008-2012: 1st Kyoto Commitment Period • As of April 3, price for delivery of ton of carbon in 12/08 at $36; expectation that will rise to $37-54 by 2010 (which is $915 higher than estimated one year ago). 4 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Market Mechanisms • Post-Kyoto? • AB 32’s goal and even longer-term 2050 goal sent signal of carbon price in future. • Start-date for program coincides with end of first Kyoto commitment period in 2012. • Massachusetts v. EPA, 127 S. Ct. 1438 (2007) • Citigroup, JPMorgan Chase and Morgan Stanley: “The Carbon Principles” • Commodities Future Trading Commission (CFTC) now says carbon credits poised to become “leading global derivates product” in next four or five years. 5 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Market Mechanisms • Why oppose market mechanisms? • Problems with paying to pollute • Localized impacts of carbon, but co-pollutants • CARB must consider whether market-based mechanism will result in “direct, indirect, and cumulative... localized impacts within communities that are already adversely impacted by air pollution” and design mechanism “to prevent any increase in emissions of toxic air contaminants or criteria air pollutants.” Cal. Health & Saf. C. §38750(b)(1), (2). • Obstacles and opposition are not insignificant. • Safety valve/ linkage/ offsets 6 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Offsets • Expected to play supporting role in any comprehensive market-based solution. • Reductions would not occur under business-as-usual (BAU). • April 4: CARB says considering allowing offsets both in capand-trade and command-and-control (i.e., direct) regulation. • Kyoto credits: created through Bonn and Marrakech COPs: • Clean Development Mechanism (CDM) certified emission reductions (CERs) in developing nations • Joint Implementation (JI) emission reduction units (ERUs) in Annex I, post-Soviet transitional economies • EU Linking Directive 7 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Offsets • Voluntary (pre-compliance) markets • Participation to enhance “green” image, respond to shareholder or consumer demand, or undertake serious “precompliance” reduction measures outside of own footprint. • Learn-by-doing: inventorying, evaluating reductions, verifying them, participating in registration process, trading platform. • Media exposé: voluntary carbon markets plagued by a number of high-profile instances where value of reductions called into question. • Project never occurs; double sales • Lowest hanging fruit was high GWP pollutants in China. 8 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Offsets • Criteria: Reductions must be real, verified, permanent, and additional. • Recent maturity, but... • Perceptions shaped by voluntary carbon markets may stand as obstacle to development of regulatory scheme incorporating offsets. 9 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Additionality Baseline Emissions Volume of CERs Emissions of the CDM project (to be monitored along crediting period) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Years of operation of the project 10 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Additionality • How to demonstrate difference between project and BAU? • WBCSD and WRI: “While the basic concept of additionality may be easy to understand, there is no common agreement about how to prove that a project activity and its baseline scenario are different.” • CDM EB Methodological Tool for the demonstration of additionality • • • “Legal, regulatory or institutional test” = surplus “Technology test”, “barriers analysis”, and “common practice test = performance standard? “Investment test” • Decisive reason for implementing project • • Not necessarily that project would fail but for offsets revenue.. But need to point to significant costs or risk-taking. 11 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Additionality • Project-by-project vs. performance standard “Best in practice” RGGI model rules Market Advisory Committee CCAR’s Climate Action Reserve AB 32 requires that offsets must be “in addition to any greenhouse gas reduction otherwise required by law or regulation, and any other greenhouse gas emission reduction that would otherwise occur.” (Cal. Health & Saf. C. § 38562(d)(2).) • Ultimately, a question of policy. • • • • • 12 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Case Study #1: Enhanced Oil Recovery • • EOR experimenting with geologic sequestration for decades. • Supercritical carbon injected into depleted oil basins. • Produces substantial amount of oil (10-15% more), which “floats” on heavier carbon. • Geologic reservoirs successfully confined oil. • IPCC special report stressed need for geological sequestration. CDM EB referred decision to UNFCCC MOP. • Permanence and additionality questions • “But-for” investment test creates preference for projects with inherently low IRR. 13 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Case Study #1: EOR • Wrong incentives? • Why not support technologies with marginally better prospects of widespread adoption and implementation? • Like making loan to debtor least likely to repay? • What are goals of offsets program? • Development/ promotion of technologies likely to succeed on broad-scale without credits revenue? • Increasing liquidity/ learning regarding carbon markets? • Establishing integrity/ confidence in role of markets? 14 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Case Study #2: Chicago Climate Exchange (CCX) Long-Lived Wood Products (LLWP) Credits • Tradable Carbon Financial Instruments (CFIs) include both Exchange Allowances and Offsets. • Voluntary commitments of CCX members: • Phase I (2003-2006): 4% below baseline • Phase II (2007-2010): 6% below baseline • Offsets may be used to satisfy some portion of cap. • Registered by members or aggregators. 15 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Case Study #2: CCX LLWP Credits • Exchange Forestry Offsets (XFOs) • Reforestation/ conservation management results in net carbon sinks. • Total carbon stock sequestered within standing live and dead wood, lying dead wood, etc., is measured by forester; represents “baseline” scenario. • Net increase in carbon stock from implementation of “project” verified over time results in XFOs. • Aggregators bundle together small pools. 16 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Case Study #2: CCX LLWP Credits • All harvested carbon “emitted” to atmosphere. • Calculation of net carbon sinks should be able to credit amount of carbon remaining sequestered in long-lived wood products (LLWP) after 100 years. • Continued use as furniture or in construction • Sequestered within landfills • Typically not registered and only reported as secondary effect or “optional” pool. 17 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Case Study #2: CCX LLWP Credits • Sub-Prime Credits? • As of December 2007, CCX now has protocol allowing members and aggregators to report and register carbon sequestered by LLWP. • CCX to issue XFOs even where underlying timberlands not registered as conservation management project. • Contract limits downstream rights to credits. • Verifier confirms that meets sustainable harvesting standards and sales receipts. 18 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Case Study #2: CCX LLWP Credits • Additionality? • Potential “double-counting” issues? • When market forces converge with GHG reductions, how do you disaggregate environmental benefits? • So what? Shouldn’t we motivate parties up and down supply chain to make choices limiting climate change impacts? • Real risk is that undermines confidence in not only the subprime players, but the standard bearers as well. • Once XFOs issued = CFIs. 19 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets The Federal Bail-Out • FTC’s Update to Green Guides on Environmental Marketing Claims (16 CFR§260 et seq.) • To address claims of being “green” • To address market in carbon offsets and RECs • FTC Act makes unlawful deceptive acts and practices in or affecting commerce (15 USC § 45, 52). “Safe-harbor” for environmental marketing claims if: • • • • clearly qualify statements, clarify whether claim applies to product or packaging, not overstate environmental benefit, and make basis for comparative claims clear (16 CFR § 260.6). 20 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets The Federal Bail-Out • • • • Carbon offsets raise issues, both in the sale of the offset itself and in the marketing claims made by purchasers (who claim the offset to promote “carbon neutrality” of products or operations). FTC raises questions, not only regarding double-counting and verification standards, but regarding importance of “additionality”. Attorneys General of VT/ CA have taken active role in comments. Legislative proposals in CA: • AB 1851 (Nava): Process for assuring voluntary offsets meet consistent standards. • AB 3001 (Hancock): Voluntary Carbon Offset Commission; donations invested in environmentally sound offset projects. 21 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Can the Market Fix Itself? • FTC/ AGs could stifle nascent markets and chill participation. • Lack of credibility undermines compliance markets. • Voluntary Certification Schemes: • • • • • CDM Gold Standard for Voluntary Offsets Voluntary Carbon Standard Center for Resource Solutions’ “Green-e” Climate CCAR’s Climate Action Reserve SCAQMD’s SoCal Climate Solutions Exchange 22 The “Credit” Crisis Growing Pains within the Emerging Carbon Markets Should Consumers Avoid Voluntary Markets? • Depends on goals • To stockpile credits before prices rise? • To support claims of carbon neutrality? • To gain valuable experience in trading platform and inventorying/ evaluating emissions reductions? • Learn by asking questions of offsets providers: • Should avoid offsets providers who cannot or are unwilling to answer questions. • Might favor un-aggregated projects where consumer can conduct due diligence. 23 Boston Hartford Hong Kong London Los Angeles New York Orange County Circular 230 Disclosure: Internal Revenue Service regulations provide that, for the purpose of avoiding certain penalties under the Internal Revenue Code, taxpayers may rely only on opinions of counsel that meet specific requirements set forth in the regulations, including a requirement that such opinions contain extensive factual and legal discussion and analysis. Any tax advice that may be contained herein does not constitute an opinion that meets the requirements of the regulations. Any such tax advice therefore cannot be used, and was not intended or written to be used, for the purpose of avoiding any federal tax penalties that the Internal Revenue Service may attempt to impose. San Francisco Santa Monica Silicon Valley Tokyo 2008 Bingham McCutchen LLP 150 Federal Street, Boston, MA 02110-1726 ATTORNEY ADVERTISING Walnut Creek To communicate with us regarding protection of your personal information or if you would like to subscribe or unsubscribe to some or all of Bingham McCutchen LLP’s electronic and mail communications, please notify our Washington privacy administrator at privacyUS@bingham.com or privacyUK@bingham.com. Our privacy policy is available at www.bingham.com/privacy.asp. We can also be reached by mail in the U.S. at 150 Federal Street, Boston, MA 02110-1726, ATT: Privacy Administrator, or in the U.K. at 41 Lothbury, London, England EC2R 7HF, ATT: Privacy Administrator, or in the U.S. by telephone at 617.951.8000. bingham.com This communication is being circulated to Bingham McCutchen LLP’s clients and friends. It is not intended to provide legal advice addressed to a particular situation. Prior results do not guarantee in a similar outcome.