tax & legal update - Greater Cincinnati Relocation Council

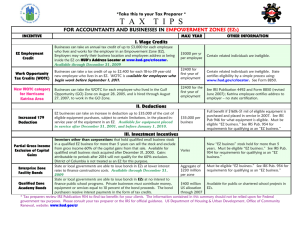

advertisement

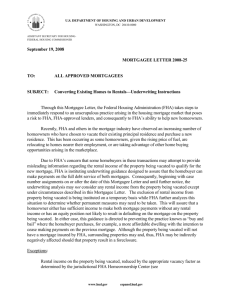

GCRC Spring Meeting 2010 WELCOME Introduction Katy Meinhardt GCRC President Thank You to Our Sponsors! TAX & LEGAL UPDATE GCRC Spring Meeting 2010 – Prepared by Peter K. Scott – Worldwide ERC Tax Counsel – Topics IRS Employment Tax Audits Begin Homebuyer Credit Issues Underwater Homeowner Programs – – Additional FAQs on New RESPA Rule – HUD “HAMP” program FNMA “Deed for Lease” Deductibility of Loan Origination Fees Anti-flipping Timing Rules Suspended Tax Relief for Defective Drywall? Legislative Outlook IRS Audits New IRS employment tax audit program – – – IRS will perform detailed employment tax audits, beginning in February of 2010, on some 6,000 businesses Purpose of audits is to identify employment tax issues needing attention Will cover worker classification, fringe benefits (including relocation), officers’ compensation, employee expense reimbursement plans (for example, temporary assignment issues), and nonfiling issues Companies will be selected at random IRS Audits – – – Audits are in addition to those ordinarily conducted IRS will hire significant numbers of additional agents to perform them Issues to watch out for: Timing of withholding and deposits for relocation benefits. Many companies continue to incorrectly cut off withholding on these items before year end Renewal of attacks on BVO programs, particularly those with additional risk-reduction techniques that cause short holding periods Home sale audits continue, but at a much reduced pace, and IRS seems to have de-emphasized the issue since Rev. Rul. 2005-74. Not clear whether new audit program will cause issue to re-emerge Homebuyer Credit Credit was extended and expanded effective November 6, 2009 Will now be in effect for sales before May 1, 2010, and until June 30, 2009 for closings of binding contracts entered before May 1 Credit remains up to $8,000 for first-time homebuyers New credit for “long-time” homeowners who have used their prior residence as their principal residence for five consecutive years of the eight before the new purchase. Credit is up to $6,500 Income limits have been raised, from $75,000 to $125,000 (single), $150,000 to $225,000 (married) Homes eligible for credit cannot exceed $800,000 Homebuyer Credit Gross-up issue: what if taxable relocation benefits push homeowner beyond income limit? – – Less likely with higher income limits But more likely with long-time homeowners eligible Law has provisions that may help – – – First time homebuyer in 2009 may elect to claim credit on an amended 2008 return, rather than 2009. If relocation benefits paid in 2009, claiming credit for 2008 may eliminate gross-up problem Long-time homeowner who buys in 2010 may elect to claim credit on either 2009 or 2010 return. (Note this option does not apply to long-time homeowner buyers between Nov. 6, 2009 and December 31, 2009) In either case, the expanded income limitations will apply, regardless of which year the credit is claimed in Homebuyer Credit Law still requires that credit be repaid if home disposed of within three years of purchase – – There is no exception for relocation If employee who claimed the credit is moved within three years, company will have to decide whether to compensate for the required repayment. An item to consider when deciding whether to move an employee, or which employee to move Homebuyer Credit Some employees may qualify who are not first-time homebuyers – – Long-time homeowners (5 consecutive years as principal residence out of last 8) Employees who moved out of their old house over three years ago and rented in a destination location (for example, returning expats, or employees on long-term assignments). Even if they maintained ownership of the old home in the interim, they qualify because they did not own a principal residence during the three years preceding their purchase Homebuyer Credit Other issues to consider: – – While the credit is available until June 30, 2010 if a binding contract to purchase is entered into by April 30, 2010, new construction requires not only closing, but occupancy by June 30 There are significant new documentation requirements that must accompany the return claiming the credit (a copy of the HUD-1 or, for new construction, a copy of the occupancy certificate). Longtime homeowners must attach documents such as Forms 1098, property tax records, homeowner insurance records, or other documents to show they were living in the house for five consecutive years. As a result, taxpayers claiming the credit cannot file electronically. IRS is revamping its systems to detect fraud, and incorporate new rules, and will not begin processing homebuyer credit returns until mid-February. Refunds may take several additional weeks. Homebuyer Credit What will happen this Spring? – – – Home sales are again down (both new & existing) Some of that is due to acceleration of sales due to November scheduled expiration of homebuyer credit Some due to weather If sales do not improve, pressure will build on Congress to renew/extend homebuyer credit NAR, Homebuilder, Mortgage Lenders are already working on an extension Underwater Homeowner Programs Numerous programs, both governmental and private, are in place. Goal is to reduce foreclosures, usually by modifying mortgages Pace has been slow, millions of mortgage resets will occur in 2010 that may provoke more homeowners to walk away Two new developments are encouraging HUD Campaign to Revitalize HAMP Campaign to help borrowers in the trial phase of their modified mortgages convert to permanent modifications under the Home Affordable Modification Program (HAMP). Data released in December showed an acceleration in the rate at which borrowers were approved for permanent modifications; as of that month, more than 100,000 permanent modifications had been approved, including 66,000 that borrowers have accepted and the remainder in completion stage. HUD Campaign to Revitalize HAMP HAMP was designed to allow eligible homeowners to reduce monthly mortgage payments to a point which is sustainable over the mortgage term. Several million homeowners are estimated to be eligible for the program and more than one million have received modification offers. Since the program is a government sponsored loan modification, it requires a considerable amount of paperwork, comparable to that required in a new mortgage application, as well as proof of changed circumstances justifying the homeowner’s need. Many of the outstanding unaccepted offers are the result of the borrower’s failure to submit the necessary documentation. The new HUD initiative is designed to coax qualified borrowers to do so. HUD Campaign to Revitalize HAMP The program is aimed at the borrowers who can make substantial payments on the revised mortgage, and does not address the fate of the unemployed, or those whose house is so far underwater that it makes financial sense to abandon the property to foreclosure, or to opt for bankruptcy. The program can be useful to employed, cash strapped homeowners. Fannie Mae Announces “Deed for Lease” Program Fannie Mae introduced the “Deed-for-Lease” Program (D4L), a program designed to minimize displacement, deterioration of neighborhoods caused by vandalism and theft to vacant homes, and the effect these have on communities and home price stabilization. D4L allows qualifying borrowers of properties transferred through deed-in-lieu of foreclosure (DIL) to remain in their home by executing a lease of up to 12 months in conjunction with a DIL. Investment properties that are tenant-occupied may also be considered as long as the borrower is cooperative in providing information from the tenant to facilitate the D4L. Fannie Mae Announces “Deed for Lease” Program With the D4L program, loan servicers are expected to follow their regular process in considering a borrower for a DIL in accordance with Fannie Mae’s existing rules. Once the servicer determines a borrower is eligible for a DIL through its normal course of business, the servicer will notify Fannie Mae that the borrower may also be eligible for D4L. Fannie Mae will take the steps necessary to further verify property and borrower eligibility, determine the rental rate, and, if appropriate, execute the lease agreement. To qualify for D4L, the occupant of the property must have the ability to pay market rent not to exceed 31% of his or her monthly gross income. The lease agreement will be contingent on successful completion of the DIL. Fannie Mae Announces “Deed for Lease” Program One area in which the program might be used in the relocation industry could be in the case of properties employees are occupying as renters. Though not a common occurrence, there are cases in which these workers find the house which they are legitimately renting is foreclosed upon. While there may be other short-term remedies, the D4L, which specifically applies to renters, may be an option. The downside, however, is the personal financial information which Fannie Mae will apparently require from the renter. Tenants also have protection under the Federal Protecting Tenants at Foreclosure Act of 2009, which requires the bank to take the property in foreclosure subject to an existing lease, or to give 90 days’ notice in the event that the lease expires within that period, or in the event of an “at will” lease. HUD Released Additional FAQs on New RESPA Rule HUD released a total of nineteen additional FAQs concerning the rule, the Good Faith Estimate, and HUD-1 forms. The new FAQs include discussions of the Good Faith Estimate (GFE), defining the “written list of providers” more specifically, further discussion of the “changed circumstances” exemption, "right to cure and tolerance violations," and additional technical points regarding the form. One of the new FAQ’s deals with a problem concerning deductible origination fees Origination Fees Origination fees are deductible as interest, like points, but only if calculated and stated as a percentage of the loan amount. Such origination fees were easily identifiable on the old HUD-1, companies who reimbursed them ordinarily did not gross up because fee was deductible by transferee New HUD-1 lumps such origination fees with numerous other charges to initiate the mortgage. Consequently, amount in Line 801 can no longer be assumed to be deductible Origination Fees FAQ says loan originator may designate any origination point paid on page 2 of HUD-1 in line 801. “The designation should follow ‘Our Origination Charge’ either by adding the language ‘Includes Origination Point’ (_% or _$) or by placing an asterisk (*) and adding the language at the bottom of the page.” Companies will need to work with lenders to identify what part, if any, of line 801 is a deductible origination fee, and whether the amount stated on line 801 consists entirely of amounts company is willing to reimburse HUD Released Additional FAQs on New RESPA Rule The bottom line regarding the RESPA rule remains unchanged: all settlement service providers need to be fully aware of the complex requirements mandated and which became effective January 1st. – The ambiguities, and changes in procedure, such as the amalgamation of mortgage service costs have been discussed, and others are likely to be discovered. HUD and FHA Suspend the Anti-Flipping Timing Regulations in the General Market HUD announced a temporary policy to expand access to FHA mortgage insurance and allow for the quick resale of foreclosed properties. With certain exceptions, such as the relocation property exemption which Worldwide ERC® successfully lobbied for over 10 years ago, FHA currently prohibits insuring a mortgage on a home owned by the seller for less than 90 days. The temporary exemption came about because FHA research discovered that acquiring, rehabilitating and the reselling foreclosure properties to prospective homeowners often takes less than 90 days (usually the bank). HUD and FHA Suspend the Anti-Flipping Regulations in the General Market The policy change will permit buyers to use FHA-insured financing to purchase HUD-owned properties, bank-owned properties, or properties resold through private sales. The waiver will take effect on February 1, 2010 and is effective for one year, unless otherwise extended or withdrawn To protect FHA borrowers against predatory practices of "flipping" where properties are quickly resold at inflated prices to unsuspecting borrowers, the waiver is limited to those sales meeting the following general conditions: – – All transactions must be arms-length, with no identity of interest between the buyer and seller or other parties participating in the sales transaction. In cases in which the sales price of the property is 20 percent or more above the seller's acquisition cost, the waiver will only apply if the lender meets specific conditions. HUD and FHA Suspend the Anti-Flipping Regulations in the General Market This waiver does not affect the relocation property exemption, which remains in place. It is designed to increase the rate of sale of foreclosed properties, where a house is purchased at foreclosure and resold. It also apparently does not, unfortunately, affect the application of the “owner of record” requirement in the anti-flipping rules. – – – Rules require that the seller be the owner of record With increased underwriting scrutiny, this rule is now often invoked by FHA lenders to prevent use of “one deed” in relocation transactions It has become common for two deeds to be used in any relocation transaction in which FHA financing is sought Mileage Rates New optional standard mileage rates for use of a car in business or moving announced December 3 – – 50 cents per mile for business, down from 55 16.5 cents per mile for moving, down from 24 Rate for moving lowest since 2005 Companies that reimburse transferees for auto use at higher than 16.5 cents per mile must include the excess in income Imported Corrosive Drywall Letter from some influential members of Congress to IRS Nov. 24 includes data from the Consumer Product Safety Commission as to damages caused, urges formal ruling by year end that losses are deductible as casualty losses. IRS has not ruled, but seems receptive to argument A bill has been introduced in the House to exclude from income any remediation payments received from Federal, State or local governments relating to defective drywall installed after September 1, 2006. H.R. 4362 (Cao, R-LA). Prospects are unclear. Legislative Outlook Healthcare reform on life support, various tax items in House/Senate bills may not occur. These include: – – – – – – 40% nondeductible excise tax on “high cost” insurance plans (Senate) 5.4% surtax on income over $500,000 (1 million joint) (House) Increase Medicare tax to 2.35% for those earning $200,000 ($250,000 joint) (Senate) Penalties for those without insurance (Both) Penalties for employers not offering insurance (Both) Small business tax credits for providing insurance (Both) Legislative Outlook But given the dire budget situation, and recent passage by Congress of statutory “paygo” rules, search will intensify for revenue raisers One revenue raiser in both House and Senate health care bills is likely to re-emerge Legislative Outlook Extend information reporting to corporations, and to payments for property – – – – Currently, Forms 1099 not required if payment is to a corporation, or for property other than real estate Revenue raiser in health care legislation would end both exceptions Likely to be used as a revenue raiser elsewhere Would take effect in 2012 Information Reporting Unless IRS writes regulations carefully, will be very burdensome. – – – All payments by businesses to anyone aggregating $600 during the year will have to be reported, whether or not the recipient is a corporation, and whether or not the payment is for services or property (for example, supplies, inventory, etc) Will greatly enlarge the number of required information reports Worldwide ERC will watch this carefully and look at whether there are opportunities to narrow the rules for relocation Questions Rules: – – – Has to be one I can answer (but not necessarily on the subjects we covered) Questioner cannot be on permanent “banned” list (you know who you are) No “stump the tax nerd” Relevance of recent study of audience attention to tax presentations