Unit 2 A Topics - mrrobinson.org

advertisement

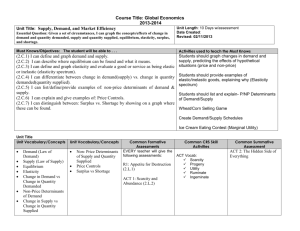

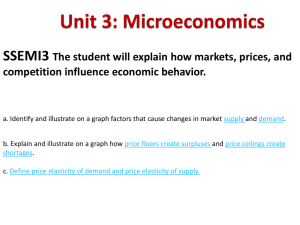

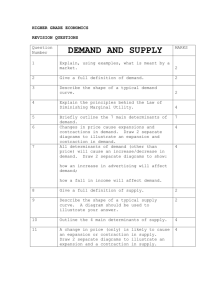

UNIT II: THE MARKET ECONOMY AP Content Summary II. The nature and functions of product markets (55-65%) A. Supply and demand 1. Market equilibrium 2. Determinants of supply and demand 3. Price and quantity controls 4. Elasticity a. Price, income, and cross-price elasticities of demand b. Price elasticity of supply 5. Consumer surplus, producer surplus, and market efficiency 6. Tax incidence and deadweight loss Straight from the horse’s mouth: “A well-planned AP course requires an analysis of the determinants of supply and demand and the ways in which changes in these determinants affect equilibrium price and output. In particular, the course helps students make the important distinction between movements along the curves and shifts in the curves. The course also emphasizes the impact of government policies such as price floors and ceilings, excise taxes, tariffs, and quotas on the free market price and quantity exchanged. The concepts of consumer surplus and producer surplus should also be introduced. Students are expected to comprehend and apply the concepts of price, cross-price, income elasticities of demand, and the price elasticity of supply.” Primary and Supporting Concepts: Module (Krugman) 5 Chapter (McConnell) 3 Concepts Demand (D) - 6 3 6, 7, 8, 9 3 46, 47, 48 6 49, 50 3 50 4, 17 Determinants of Demand Change in Demand versus Change in Quantity Demanded (QD) Law of Demand Supply (S) - Determinants of Supply - Change in Supply versus Change in Quantity Supplied (QS) - Law of Supply Equilibrium (E) - Laws of Supply and Demand (relationships) - Shortages and Surplus (Law of Market Forces) - Ceilings and Floors Elasticity - Price, income, and cross-price elasticities of demand - Price elasticity of Supply Market Efficiency - Consumer Surplus, Producer Surplus - Market Efficiency Tax Incidence - Deadweight loss Topic 1: Demand: Read Krugman’s module 5 & 7 Objectives: 1. Explain the role of price in a market economy 2. Define and illustrate demand through schedules and graphs. 3. Distinguish between change in demand and change in quantity demanded. 4. Explain the inverse relationship between price and quantity demanded. 5. Identify and explain the variable which causes a change in demand. 6. Illustrate and explain the changes in quantity demanded given a price change. Concepts to memorize: Market Law of Demand Diminishing Marginal Utility Substitution Effect Normal Goods Substitute Goods Change in D versus Change in QD Demand Schedule Demand Income Effect Demand Curve Inferior Goods Complimentary Goods Key Conceptual Questions: 1. What is the difference between demand and quantity demanded? 2. What is the difference between change in demand and change in quantity demanded? (use graphs to aid you) 3. What determinants cause a change in demand? Topic 2: Supply Read Krugman’s module 6 & 7 Objectives: 1. Explain the role of price in a market economy. 2. Define and illustrate supply through schedules and graphs. 3. Distinguish between change(s) in supply and change(s) in quantity supplied. 4. Explain the direct relationship between price and quantity supplied. 5. Identify and explain the variables that cause a change in supply. 6. Illustrate and explain the changes in quantity supplied given a price change. Concepts to memorize: Quantity Supplied Supply Schedule Substitution Change in Price of a Substitute Productivity Law of Supply Supply Supply Curve Market Supply Complement in Production Change in Price of a Complement Key Conceptual Questions: 1. What is the difference between supply and quantity supplied? 2. What is the difference between change in supply and change in quantity supplied? (use graphs to aid you) 3. What determinants cause a change in supply? Topic 3: Equilibrium and Market Efficiency Read Krugman’s module 6, 7, 8, 9 Objectives: 1. Explain the role of price in a market economy. 2. Explain the concept of equilibrium price and quantity. 3. Illustrate graphically equilibrium price and quantity. 4. Explain and graph the effects of changes in demand and supply on equilibrium price and quantity, including simultaneous changes in demand and supply. 5. Define and illustrate surpluses and shortages. 6. Define affects of surpluses and shortages on prices and quantities. 7. Interpret and/or compute equilibrium price and quantities from graphs, mathematics equations, and/or data. 8. Define price ceilings and price floors, and provide examples. 9. Graph and explain the consequences of government-set prices. Concepts to memorize: Market Equilibrium Surplus/Excessive Supply Marginal benefit Market Efficiency Price Ceiling Rent Ceiling Black Market Equilibrium Price Shortage/Excessive Demand Marginal Cost Obstacles to Efficiency Price Floor Production Quota Search Activity Equilibrium Quantity Subsidies Minimum Wage Law Key Conceptual Questions: 1. Why will the market-clearing (equilibrium) price be set at the intersection of supply and demand-- and not at a higher or lower price? 2. How do market prices and equilibrium quantities respond to a. change in demand? b. change in supply? c. simultaneous increases in supply and demand? d. simultaneous decreases in supply and demand? e. an increase in demand and a decrease in supply? f. decrease in demand and an increase in supply? 3. What is the function of price and to what extent does it provide those functions in an efficient and equitable manner? 4. What is an effective price ceiling? What is an effective price floor? Why are they created and what are the effects of each? 5. Assume the fast food industry is an example of a competitive market currently in equilibrium. (i) Draw a market supply and demand graph to show the current equilibrium and; (2) illustrate and explain the immediate results of imposing a price ceiling on fast food good 6. What are black markets? Why do these occur? 7. How can wage rates, interest rates and exchanges rates be analyzed within the supply and demand framework? 8. What happens when prices are set by law above or below the market equilibrium level? Topic 4: Elasticity Read Krugman’s module 46, 47, 48 Objectives: 1. Define, explain, calculate, and interpret the price elasticity of demand. 2. Explain the meaning of elastic, inelastic, and unitary price elasticity of demand. 3. Recognize graphs of perfectly elastic and perfectly inelastic demand. 4. Use the total revenue test to determine whether elasticity of demand is elastic, inelastic, or unit elastic. 5. List four major determinants of price elasticity of demand. 6. Explain cross elasticity of demand and how it is used to determine substitute or complementary products. 7. Define income elasticity and its relationship to normal and inferior goods. 8. Calculate and explain the price elasticity of supply. Concepts to memorize: Elastic Total Revenue Income Elasticity Mid-Point Method Inelastic Total Revenue Test Normal Goods Unit elastic Cross Elasticity Inferior Goods Key Conceptual Questions: 1. What is price elasticity of demand and what factors determine its size? 2. How is total revenue related to the price elasticity of demand? 3. What is the income elasticity of demand? 4. What is the price elasticity of supply? 5. Assume that the short run demand for cigarettes is relatively, but not perfectly, inelastic. The Indiana legislature often debates whether to place a per unit tax on cigarettes in order to both increase the states tax revenues and to decrease cigarette smoking. Use supply and demand analysis to describe the impact of a proposed per unit tax on: (i) the price paid by consumers for cigarettes; (ii) the quantity sold. Evaluate the short run goals of the Indiana legislature. Now if the demand for cigarettes became more elastic, explain how each of the following will differ from your previous answers: (i) the price and quantity sold of cigarettes and (ii) the government’s tax revenues. Topic 5: Tax incidence and deadweight loss Read Krugman’s module 50 Objectives: 1. Identify and explain tax burdens and deadweight loss 2. Describe the effects of taxes, who pays the taxes, and why they create inefficiencies. 3. Differentiate between the benefits-received and ability-to-pay principles of taxation. 4. Explain the relationship between the elasticities of demand and supply and the efficiency loss of a particular tax. Concepts to memorize: Deadweight Loss Taxable income Progressive Tax Benefits Principle Producer Surplus Tax Incidence Marginal Tax Rate Proportional Tax Ability-to-pay Excess Burden Average Tax Rate Regressive Tax Consumer Surplus Key Conceptual Questions: 1. How does the imposition of a tax affect a market? What determines the distribution of the tax burden between buyers and sellers? 2. Explain the burden of taxation given elasticity information.