McGraw-Hill/Irwin

1-1

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

6–1

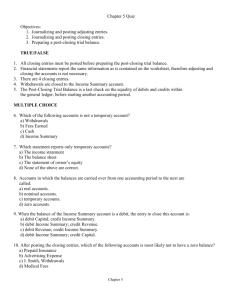

Chapter

6

Closing Entries

and the Postclosing

Trial Balance

Section 1: Closing Entries

Section Objectives

1.

Journalize and post closing

entries.

6–2

The Accounting Cycle

Step 1

Analyze

transactions

Step 2

Journalize the

data about

transactions

Step 3

Post the

data about

transactions

Step 4

Prepare

a

worksheet

Step 5

Prepare

financial

statements

Step 9

Interpret

the financial

information

Step 8

Prepare a

postclosing

trial balance

Step 7

Journalize and

post closing

entries

Step 6

Journalize and

post adjusting

entries

The seventh step in the accounting cycle is to journalize and post

closing entries

6–3

QUESTION:

What is the Income Summary account?

ANSWER:

The Income Summary account is a

special owner’s equity account that

is used only in the closing process

to summarize the results of

operations.

6–4

Income Summary Account

Classified as a temporary owner’s equity account.

Does not have a normal balance.

Has a zero balance after the closing process and remains with

a zero balance until after the closing procedure for the next

period.

6–5

Objective 1 Journalize and post closing entries

There are four steps in the closing

process:

1. Transfer the balance of revenue account

balances to the Income Summary account.

2. Transfer the expense account balances to the

Income Summary account.

3. Transfer the balance of the Income Summary

account to the owner’s capital account.

4. Transfer the balance of the drawing account to the

owner’s capital account.

6–6

Wells’ Consulting Services

Worksheet

Month Ended December 31, 2013

ACCOUNT NAME

TRIAL BALANCE

ADJUSTMENTS

ADJ. TRIAL BAL.

INCOME STMT.

BALANCE SHEET

DEBIT

DEBIT

DEBIT

DEBIT

DEBIT

CREDIT

111,350

Cash

5,000

Accounts Receivable

1,500

Supplies

Prepaid Rent

8,000

Equipment

11,000

Accum. Depr.—Equip.

3,500

Accounts Payable

Carolyn Wells, Cap.

100,000

5,000

Carolyn Wells, Draw.

Fees Income

47,000

Salaries Expense

8,000

Utilities Expense

650

(a) 500

Supplies Expense

Rent Expense

(b) 4,000

Depr. Exp.—Equip.

(c)

183

Totals

150,500 150,500

4,683

Net Income

CREDIT

111,350

5,000

(a) 500

1,000

4,000

(b) 4,000

11,000

(c) 183

CREDIT

CREDIT

CREDIT

111,350

5,000

1,000

4,000

11,000

183

3,500

100,000

183

3,500

100,000

5,000

5,000

47,000

8,000

8,000

650

650

500

500

4,000

4,000

183

183

4,683 150,683 150,683 13,333

33,667

47,000

Fees Income has a credit

balance of $47,000

47,000

47,000 137,350 103,683

33,667

47,000 137,350 137,350

6–7

Step 1: Close Revenue

Fees Income

Balance 47,000

Income Summary

Closing 47,000

Closing 47,000

6–8

Step 1: Close Revenue

GENERAL JOURNAL

DATE

2013

DESCRIPTION

POST.

REF.

4

PAGE

DEBIT

CREDIT

Closing Entries

Dec. 31 Fees Income

47,000

Income Summary

47,000

The words “Closing Entries” are written in the

Description column of the general journal

6–9

Step 2: Close Expenses

The Income Statement section of the worksheet for

Wells’ Consulting Services lists five expense accounts.

Since expense accounts have debit balances, enter a

credit in each account to reduce its balance to zero.

This closing entry transfers total expenses to the

Income Summary account.

6–10

Step 2: Close Expenses

The five expense account balances are reduced to

zero.

The total, $13,333

of

expenses are transferred to

the temporary owner’s equity

account, Income Summary.

6–11

Income Summary

Bal 47,000

Closing

Salaries Expense

Balance 8,000

Closing 8,000

13,333

Utilities Expense

Balance

650

Supplies Expense

Balance

500

Closing 650

Rent Expense

Closing 500

Depr. Expense – Equip.

Balance

Balance 4,000

Closing 4,000

183

Closing 183

6–12

Step 2: Close Expenses

GENERAL JOURNAL

DATE

2013

Dec. 31

DESCRIPTION

Closing Entries

Income Summary

Salaries Expense

Utilities Expense

Supplies Expense

Rent Expense

Depreciation Exp.-Equip.

POST.

REF.

4

PAGE

DEBIT

CREDIT

13,333.00

8,000.00

650.00

500.00

4,000.00

183.00

6–13

The Income Summary account reflects all

entries in the Income Statement section of

the worksheet.

Income Summary

Dr.

Cr.

Closing 13,333

Closing 47,000

Balance 33,667

Net Income

6–14

Step 3: Close Net Income to Capital

The journal entry to transfer net income to owner’s

equity is a debit to Income Summary, and a credit

to Carolyn Wells, Capital.

The balance of Income Summary is reduced to

zero; the owner’s capital account is increased by

the amount of net income.

The Income Summary account is reduced to zero.

The net income amount, $33,667, is transferred to the

owner’s capital account. Carolyn Wells, Capital is

increased by $33,667.

6–15

Step 3: Close Net Income to Capital

Income Summary

Balance 33,667

Closing 33,667

Carolyn Wells, Capital

Balance 100,000

Closing 33,667

6–16

Step 3: Close Net Income to Capital

GENERAL JOURNAL

DATE

DESCRIPTION

Closing Entries

Dec. 31 Income Summary

Carolyn Wells, Capital

POST.

REF.

PAGE

DEBIT

4

CREDIT

33,667.00

33,667.00

6–17

Step 4: Close Drawing to Capital

•Withdrawals appear in the statement of owner’s

equity as a deduction from capital.

•The drawing account is closed directly to the capital

account.

•The drawing account balance is reduced to zero.

•The balance of the drawing account, $5,000, is

transferred to the owner’s capital account.

6–18

Step 4: Close Drawing to Capital

Carolyn Wells, Capital

Balance 133,667

Closing 5,000

Carolyn Wells, Drawing

Balance 5,000

Closing 5,000

6–19

Step 4: Close Drawing to Capital

GENERAL JOURNAL

DATE

DESCRIPTION

Closing Entries

Dec. 31 Carolyn Wells, Capital

Carolyn Wells, Drawing

POST.

REF.

4

PAGE

DEBIT

CREDIT

5,000.00

5,000.00

6–20

The new balance of the Carolyn Wells,

Capital account agrees with the amount

listed on the balance sheet.

Carolyn Wells, Drawing

Dr.

Cr.

Balance

5,000

Balance

0

Carolyn Wells, Capital

Dr.

Cr.

Balance 100,000

Closing 5,000

Drawing 5,000

Net Inc.

33,667

Balance 128,667

Carolyn Wells, Capital

6–21

Summary of Closing Entries

GENERAL JOURNAL

STEPS

1. Close

Revenue

Account

DATE

2013

Dec. 31

2. Close

Expense

Accounts

31

3. Close

Income

Summary

31

4. Close

Drawing

Account

31

DESCRIPTION

Closing Entries

POST.

REF.

PAGE

DEBIT

Fees Income

Income Summary

401

309

47,000.00

Income Summary

Salaries Expense

Utilities Expense

Supplies Expense

Rent Expense

Depr. Expense-Equip.

Income Summary

Carolyn Wells, Capital

309

511

514

517

520

523

309

301

13,333.00

Carolyn Wells, Capital

Carolyn Wells, Draw.

301

302

4

CREDIT

47,000.00

8,000.00

650.00

500.00

4,000.00

183.00

33,667.00

33,667.00

5,000.00

5,000.00

6–22

Posting the Closing Entries

All journal entries are posted to the general

ledger accounts.

“Closing” is entered in the Description column of

the ledger accounts.

The ending balances of the drawing, revenue,

and expense accounts are zero.

6–23

GENERAL JOURNAL

STEPS

DATE

2013

1. CLOSE

REVENUE

Dec. 31

ACCOUNT

Fees Income

DATE

2013

Dec. 31

Dec. 31

Dec. 31

DESCRIPTION

Closing

DESCRIPTION

Closing Entries

Fees Income

Income Summary

POST.

REF.

401

309

ACCOUNT NO.

POST.

REF.

J2

J2

J4

DEBIT

CREDIT

36,000.00

11,000.00

47,000.00

DEBIT

PAGE

4

CREDIT

47,000.00

47,000.00

401

BALANCE

DEBIT

CREDIT

36,000.00

47,000.00

–0–

6–24

GENERAL JOURNAL

DATE

2013

STEPS

1. CLOSE

REVENUE

ACCOUNT

DATE

2013

Dec. 31

Dec. 31

DESCRIPTION

Closing Entries

Fees Income

Income Summary

Income Summary

DESCRIPTION

Closing

POST.

REF.

DEBIT

401

309

ACCOUNT NO.

POST.

REF.

J4

DEBIT

CREDIT

47,000.00

PAGE

4

CREDIT

47,000.00

47,000.00

309

BALANCE

DEBIT

CREDIT

47,000.00

6–25

Chapter

6

Closing Entries

and the Postclosing

Trial Balance

Section 2: Using Accounting

Information

2.

Prepare a postclosing trial

balance.

3.

Interpret financial statements.

4.

Review the steps in the

accounting cycle.

6–26

The Accounting Cycle

Step 1

Analyze

transactions

Step 2

Journalize the

data about

transactions

Step 3

Post the

data about

transactions

Step 4

Prepare

a

worksheet

Step 5

Prepare

financial

statements

Step 9

Interpret

the financial

information

Step 8

Prepare a

postclosing

trial balance

Step 7

Journalize and

post closing

entries

Step 6

Journalize and

post adjusting

entries

6–27

QUESTION:

What is the postclosing trial balance

ANSWER:

A postclosing trial balance is report that

is prepared to prove the equality of total

debits and credits after the closing

process is completed. It verifies that

revenue, expense, and drawing accounts

have zero balances.

6–28

Wells’ Consulting Services

Postclosing Trial Balance

December 31, 2013

ACCOUNT NAME

Cash

Accounts Receivable

Supplies

Prepaid Rent

Equipment

Accumulated Depreciation–Equipment

Accounts Payable

Carolyn Wells, Capital

Totals

DEBIT

CREDIT

111,350.00

5,000.00

1,000.00

4,000.00

11,000.00

132,350.00

183.00

3,500.00

128,667.00

132,350.00

6–29

Finding and Correcting Errors

If the postclosing trial balance does not

balance, the accounting records contain

errors.

Use the audit trail to trace data through

the accounting records.

6–30

Objective 3

Interpret financial

statements

6–31

Wells’ Consulting Services

Partial Balance Sheet

December 31, 2013

Assets

Cash

Accounts Receivable

Supplies

Prepaid Rent

Equipment

Less Accumulated Depreciation

Total Assets

$111,350.00

5,000.00

1,000.00

4,000.00

$ 11,000.00

183.00

10,817.00

$ 132,167.00

What is the

cash balance?

How much do the customers

owe the business?

6–32

Wells’ Consulting Services

Balance Sheet

December 31, 2013

Assets

Cash

Accounts Receivable

Supplies

Prepaid Rent

Equipment

Less Accumulated Depreciation

Total Assets

$111,350.00

5,000.00

1,000.00

4,000.00

$ 11,000.00

183.00

10,817.00

$ 132,167.00

Liabilities and Owner’s Equity

Liabilities

Accounts Payable

Owner’s Equity

Carolyn Wells, Capital

Total Liabilities and Owner’s Equity

$ 3,500.00

128,667.00

$132,167.00

How much does the business owe its suppliers?

6–33

Wells’ Consulting Services

Income Statement

Month Ended December 31, 2013

Revenue

Fees Income

Expenses

Salaries Expense

Utilities Expense

Supplies Expense

Rent Expense

Depr. Expense--Equipment

Total Expenses

Net Income for the Month

47,000.00

8,000.00

650.00

500.00

4,000.00

183.00

13,333.00

33,667.00

What is the profit?

6–34

Objective 4 Review the steps in the accounting cycle

The Accounting Cycle

Step 1

Analyze

transactions

Step 2

Journalize the

data about

transactions

Step 3

Post the

data about

transactions

Prepare financial statements

Income Statement

Statement of Owner’s Equity

Balance Sheet

Step 4

Prepare

a

worksheet

Step 5

Prepare

financial

statements

6–35

The Accounting Cycle

Step 1

Analyze

transactions

Step 2

Journalize the

data about

transactions

Step 3

Post the

data about

transactions

Transfer net income or net loss

to owner’s equity.

Reduce the balances of the

temporary accounts to zero.

Step 7

Journalize and

post closing

entries

Step 4

Prepare

a

worksheet

Step 5

Prepare

financial

statements

Step 6

Journalize and

post adjusting

entries

6–36

The Accounting Cycle

Step 1

Analyze

transactions

Step 2

Journalize the

data about

transactions

Step 3

Post the

data about

transactions

Step 4

Prepare

a

worksheet

Step 5

Prepare

financial

statements

Step 9

Interpret

the financial

information

Step 8

Prepare a

postclosing

trial balance

Step 7

Journalize and

post closing

entries

Step 6

Journalize and

post adjusting

entries

6–37

Flow of Data Through a Simple

Accounting System

Source

Documents

General

journal

General

ledger

Worksheet

Financial

statements

Source documents are analyzed

6–38

Thank You

for using

College Accounting:

A Contemporary Approach, 2nd Edition

Haddock • Price • Farina

6–39