Price Floors - IB Economics

advertisement

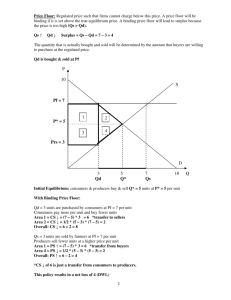

Government Intervention – Pink line class 1.3 Taxes – (on separate word document) Subsidies Price floors Price ceilings 1.3 Government Intervention: Subsidies Government Intervention (Subsidies) A subsidy is effectively an opposite tax. Governments place subsidies to encourage the production or consumption of goods, in result, gaining a greater quantity demanded. Subsidies are usually given in the form of cash payment (most commonly attained through taxation of other areas) or a tax reduction. Government Intervention (Subsidies) Why governments give out subsidies: Supports a desirable activity (eg; exports) Essentially reduces costs of production Keeps prices of staples/necessities low Maintains employment levels by increasing revenues of producers Raises availability for a greater portion of the population Improve allocation of resources Government Intervention (Subsidies) The Consequences of Subsidies in the Market (Who benefits?): Consumers: Consumers benefit from the fall in price of the good Producers: Producers benefit as firm revenues increase because #cashmoney from the #abbott Government: Governments are negatively impacted as they pay the subsidy, which is a burden on their budget Workers: Workers benefit as supply increases, firms hire more workers to tackle the new output Foreign producers: Domestic producers benefit as the lowered prices increase exports, but foreign producers may not be able to compete with the subsidised prices. They are negatively affected Society as a Society as a whole is WORSE OFF as there is an over allocation of resources to the production of that particular good. whole: Government Intervention (Subsidies) Example of subsidies: Solar panels, vaccinations, childcare, public transport. Government Intervention (Subsidies) There are several types of subsidies, some of these include… Grants and other direct payments Tax concessions In-kind subsidies Cross subsidies Credit subsidies and government guarantees Direct aid Government Intervention (Subsidies) • Producer Subsidy causes firm’s supply curve to shift to the right. http://beta.tutor2u.net/economics/reference/governmentintervention-producer-subsidies • A direct subsidy TO THE CONSUMER has the effect on increasing demand shift of demand curve to the right. Government Intervention (Subsidies) So… It shifts supply curve to the right There is more supplied at each price Decrease on the market equilibrium price Increase in quantity demanded Government Intervention (Subsidies) http://beta.tutor2u.net/economics/reference/governmentintervention-producer-subsidies Government Intervention (Subsidies) • In an economy where resources are allocated efficiently, a subsidy introduces allocative inefficiency and welfare losses • In an economy where resources are allocated inefficiently (due to market imperfections), then a subsidy can improve the allocation of resources if it is designed to correct the source of the inefficiency. 1.3 Government Intervention Price Floors Price Controls- Price Floors • Price controls- cases where for some reason the government considers the market-determined (equilibrium) price unsatisfactory and, as a result, intervenes and sets the price either below or above it • Price floor- price set above • Designed to protect producers • Examples: agriculture, minimum wage Equilibrium Demand Schedule P Qd P S $5 P Qs 4 $5 10 $5 50 Equilibrium Price = $3 (Qd=Qs) $4 40 3 $4 20 $3 30 $2 50 $1 80 Supply Schedule 2 $3 30 1 o 10 D 20 30 40 50 60 70 Equilibrium Quantity is 30 80 Q $2 20 $1 10 14 Price Floor Demand Schedule P Qd P Supply Schedule S $5 Price Floor 4 $5 10 P Qs $5 50 3 $4 20 $3 30 $2 50 $1 80 $4 40 2 $3 30 1 o 10 D 20 30 40 50 60 70 80 Q $2 20 $1 10 15 Impact on Market Outcomes- Surplus Demand Schedule P Qd P $5 Supply Schedule S Surplus Price Floor 4 $5 10 P Qs $5 50 3 $4 20 $3 30 $2 50 $1 80 $4 40 2 $3 30 1 o 10 D 20 30 40 50 60 70 80 Q $2 20 $1 10 16 Government must purchase the surplus, otherwise the price collapses Consumer and Producer Surplus With Price Floor P Without Price Floor P S $5 Consumer surplus 4 $5 4 Producer surplus 3 2 S 3 2 D D 1 o 10 1 20 30 40 50 60 Q o 10 20 30 40 50 60 Q Consumer and Producer Surplus- Elastic Demand With Price Floor P 4 S Consumer surplus 3 D $5 Producer surplus 2 1 o 10 Without Price Floor P S $5 4 D 3 2 1 20 30 40 50 60 Q o 10 20 30 40 50 60 Q Impact on Market Stakeholders Consumers • Enjoy less of the product at a higher price per unit Producers • Sell more at a higher price leading to increased revenues • May be less cost conscious leading to inefficiency and wasting resources Government • Government expenditures increase because they are forced to buy the surplus and store it, destroy it or sell/donate it abroad • Taxes may eventually increase due to government spending Examples of Price Floors- Agricultural Markets • Protect the agricultural sector • Encourage existing producers to increase their levels of production and attract new firms to enter the market for certain agricultural goods • In the EU large stockpiles were created and purchased and stored by the EU • Over-production was dealt with by paying farmers to leave fields fallow (paying farmers not to produce) as well as introducing quotas Examples of Price Floors- Minimum Wage • Normally, wages are determined by supply and demand in the labor market • In sectors where the equilibrium price determined by supply and demand of labor is below the minimum wage, the level of the minimum wage acts as a price floor and the effect is to artificially raise the price of labor • Increase the supply of labour but reduce demand for labour • Supply increase, demand decreases • A minimum wage policy will benefit some workers, it will also typically create unemployment Bibliography Books Ziogas, C, 2008. Economics for the IB diploma- Study guide. 2nd ed. Oxford: Oxford University Press. Websites Econport. 2015. Price Controls. [ONLINE] Available at: http://www.econport.org/content/handbook/Equilibrium/Price-Controls.html. [Accessed 03 May 2015]. Hann P. 2015.Examples of Current Price Floors and Ceilings in Today's Economy. [ONLINE] Available at: http://www.brighthub.com/office/finance/articles/123133.aspx. [Accessed 03 May 2015]. Price Floors - Economics. 2015. Price Floors - Economics. [ONLINE] Available at: http://economics.fundamentalfinance.com/micro_price-floor.php. [Accessed 03 May 2015]. Videos Hingston A. (2010). Price floors and surplus. [Online Video]. Available from: https://www.youtube.com/watch?v=zjXwvQz7f2o. [Accessed: 29 March 2015]. Khan Academy. (2009). Minimum wage and price floors | Deadweight loss. [Online Video]. Available from: https://www.khanacademy.org/economics-finance-domain/microeconomics/consumer-producersurplus/deadweight-loss-tutorial/v/minimum-wage-and-price-floors. [Accessed: 29 March 2015]. Jakka, Han, Nick, Jiwon, Mengfei Group 3 Price Ceilings What is a price ceiling? A government-imposed price control or limit on how high a price is charged for a product. Explain why governments impose price ceilings, and describe examples of price ceilings, including food price controls and rent controls. Example 1. Rent control in New York City To protect low income Rent control is a price ceiling on rent. individuals from not being able to afford important resources. Example 2. Food price controls Food price control: by setting a price ceiling on food means that producers aren’t able to charge more for certain essential goods. Impacts on market outcomes Draw a diagram to show a price ceiling, and analyse the impacts of a price ceiling on market outcomes. Price ceiling (maximum price) and market outcomes Through imposing a price that is lower than the equilibrium price, a price ceiling results in a lower quantity supplied and sold than at the equilibrium price. This is displayed in the diagram above, where the price ceiling, Pc, corresponds to quantity Qs that firms supply, which is less than the equilibrium quantity Qe that suppliers would supply at Pe. Furthermore, the price ceiling, Pc, gives rise to a greater quantity demanded than at the equilibrium price: the quantity consumers want to purchase at price Pc is given by Qd, which is larger than quantity Qe that they would purchase at price Pe. A price ceiling does not allow the market to clear; it creates a state of disequilibrium where there is a shortage (excess demand). Definition of ‘consumer expenditure’: The amount of money spent by households in an economy. The spending includes durables, such as washing machines, and nondurables, such as food. It is also known as consumption, and is measured monthly. The change in consumer expenditure is equal to the change in firm revenue, which is the amount of money that a company actually receives during a specific period, including discounts and deductions for returned merchandise. Consequences for the economy Examine the possible consequences of a price ceiling, including shortages, inefficient resource allocation, welfare impacts, underground parallel markets and nonprice rationing mechanisms. Shortage If a price ceiling has been set, the product can only be sold at a maximum price, which is often below the equilibrium selling price. This causes a shortage for the product as at a lower price, the quantity demanded by consumers is more than the quantity the producers are willing to sell. This is due to the law of demand and supply. Inefficient resource allocations Resources are often wasted due to a price ceiling, these resources are the time, effort and money consumers spend in order to deal with the shortages created by the price ceiling. These resources are wasted as people will need to spend more time and effort to find the goods they want while they could be using the resources to do something else. Welfare Impacts Producer surplus is the amount that producers benefit by selling at a market price that is higher than the least they would be willing to sell for. Consumer surplus is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest that they are willing to pay. Deadweight loss A deadweight loss is a loss of economic efficiency that can occur when equilibrium for a good or service is not achieved or is not achievable. When a price ceiling is set, a shortage occurs. For the price that the ceiling is set at, there is more demand than there is at the equilibrium price. There is also less supply than there is at the equilibrium price, thus there is more quantity demanded than quantity supplied. An inefficiency occurs since at the price ceiling quantity supplied the marginal benefit exceeds the marginal cost. This inefficiency is equal to the deadweight welfare loss. Underground Parallel Markets Underground Parallel Markets = Black Market People sell consumers as much of a controlled good as they want, but at a price higher than the price ceiling. (Generally illegally). These markets provide higher profits for producers and for consumers that people take the risk of fines or imprisonment. Non-Price Rationing Mechanisms If a price ceiling is compulsory for a long time, the government may need to ration the good to ensure availability for the greatest consumers. One way is by issuing tickets to consumers. Therefore, government is only allowed to put out as much good in the marketplace as there are the amount of available tickets. Obtaining goods would therefore require the consumer to present the ticket when purchasing. This can minimize the impact of shortage caused by price ceiling, but is usually reserved for times of war or severe economic distress. Discuss the consequences of imposing a price ceiling on the stakeholders in a market, including consumers, producers and the government. Price ceiling is defined as “a situation where the government sets a maximum price, below the equilibrium price to prevent producers from raising the price above it” (ibguides.com, 2012). • Government: • No real consequences. • Consumers: • Shortage • But cheaper • Producers: • Profit