PPT

advertisement

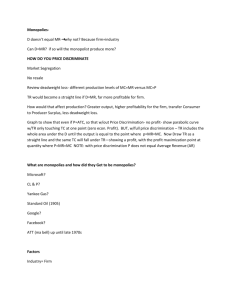

Chapter 13 Monopoly MODERN PRINCIPLES OF ECONOMICS Third Edition Outline Market Power How a Firm Uses Market Power to Maximize Profit The Costs of Monopoly: Deadweight Loss The Costs of Monopoly: Corruption and Inefficiency The Benefits of Monopoly: Incentives for Research and Development Economies of Scale and the Regulation of Monopoly Other Sources of Market Power 2 Introduction Since 1981 AIDS has killed over 36 million people. In the U.S., deaths from AIDS dropped 50% due to drugs like Combivir. A Combivir pill costs $0.50 to produce, but sells for 25 times higher - $12.50. Why? INGRAM PUBLISHING/VETTA/GETTY IMAGES 3 Definition Market power: The power to raise price above marginal cost without fear that other firms will enter the market. Monopoly: A firm with market power. Normally thought of as a single seller in a market 4 Market Power GlaxoSmithKline owns the patent on Combivir. A patent gives exclusive rights to make, use, or sell the product. GSK’s patent prevents competition. This gives GSK market power. India does not recognize the Combivir patent. In India, an equivalent drug sells for $0.50, or the marginal cost. Market Power = “lack of substitutes” 5 Definition Marginal revenue (MR): the change in total revenue from selling an additional unit. Marginal cost (MC): the change in total cost from selling an additional unit. 6 Self-Check Market power allows a firm to raise price: a. Above average cost. b. Above marginal cost. c. Above marginal revenue. Answer: b – market power allows a firm to raise price above marginal cost, without fear that other firms will enter the market. 7 Market Power To maximize profit, firms produce at the level of output where: MC = MR A firm with market power faces a downward sloping demand curve. It must lower price to sell an additional unit. The additional revenue per unit < current price, or: MR < P 8 Marginal Revenue When price ↓ from $16 to $14, quantity ↑ from 2 to 3 units Total revenue ↑ from $32 to $42. MR, or the change in total revenue, is $10. 9 Marginal Revenue Price $20 Revenue loss $2 x 2 = $4 18 16 Price ↓ $16 to $14 14 12 10 Revenue gain 14 x $1 = $14 8 6 Demand MR = $10 4 2 1 2 3 4 5 6 MR 7 Quantity 10 Short-Cut for Finding MR MR begins at same point on the vertical axis as demand. MR has twice the slope (assuming linear demand curve). Price a Demand: P = a – b x Q 2b 1 b 1 a/2b MR = a – 2b x Q Quantity a/b 11 Self-Check For a firm with market power, marginal revenue is: a. Higher than price. b. Equal to price. c. Lower than price. Answer: c – A firm with market power must drop its price to sell more units, so the marginal (additional) revenue is lower than price. 12 Profit Maximization for Monopoly Just like for firms in a competitive industry: Profit maximization consists of two steps: 1.Choosing a Quantity Rule: choose Q where MR = MC 2.Choosing a Price Choose the highest price you can get away with… which is the highest price consumers will pay for that Quantity Rule: once you’ve picked your Quantity, then follow the graph to the Demand curve, which shows you how much consumers will pay (price). 13 Using Market Power to Maximize Profit Price ($/pill) Demand Profit maximizing output: MR = MC at 80 million pills Profit maximizing price = $12.50 Profit per pill = $10.00 Total profit = $10 x 80 = $800 m $12.50 Profit 2.50 // AC MC 0.50 80 MR Quantity (millions of pills) 14 Elasticity of Demand and Markup Two effects make demand for pharmaceuticals inelastic: • The “you can’t take it with you” effect: People with serious illnesses are relatively insensitive to the price of life saving drugs. • The “other people’s money” effect: If third parties are paying for the medicine, people are less sensitive to price. The more inelastic the demand curve, the more a monopolist will raise price above MC. 15 Elasticity of Demand and Markup Price Price Relatively elastic demand → small markup Relatively inelastic demand → big markup P Demand P MC MC Demand QE MR Quantity Q MR Quantity 16 Costs of Monopoly: Deadweight Loss Monopolies charge a higher price and produce less than competitive firms. Monopolies reduce total surplus (consumer surplus + producer surplus). This implies a deadweight loss - sales that do not occur because the monopoly price is above the competitive price. The real cost of monopoly is the lost gains from trade or DWL. 17 Costs of Monopoly: Deadweight Loss P P Consumers get this Consumers get this Monopolist gets this PM PC No one gets this (deadweight loss) Supply MC = AC Demand Demand MR QC Competition: P = MC Q QM Q QC Monopoly: P > MR 18 Self-Check A monopolist’s price is: a. Lower than a competitive firm’s. b. Higher than a competitive firm’s. c. The same as a competitive firm’s. Answer: b – a monopolist’s price is higher than a competitive firm’s. 19 Costs of Monopoly: Corruption and Inefficiency Many monopolies are the result of government corruption. Tommy Suharto, the Indonesian president’s son, was given the clove monopoly. He bought the Lamborghini company with the monopoly profits. In these cases, self-interest is channeled toward social destruction through poor institutions, instead of towards social prosperity through good institutions. 20 Costs of Monopoly: Corruption and Inefficiency Monopolies are especially harmful if they control a good that is used to produce other goods. In Algeria a dozen or so army generals each control a key good • People refer to these men as General wheat, General tire…. • Each general tries to get a larger share of the economic pie. The result is greater deadweight loss, and the “pie” shrinks. 21 Benefits of Monopoly: Incentives for R&D Drug prices are lower in India and Canada. • India does not offer strong patent protection. • Canada’s government controls drug prices. It costs $1 billion to develop a new drug. Patents are one way of rewarding research and development (R&D). Without patents firms would not spend on R&D, fewer new drugs would be developed. 22 Benefits of Monopoly: Incentives for R&D Prizes can reward research and development without creating monopolies. Patent Buyouts • If the government were to compensate patent holders the value of their patents (and then allow competition), prices could be driven down - eliminating the deadweight loss without eliminating the incentive to innovate. Reduce price without reducing R&D. Must raise taxes to pay for the patent. May be difficult to determine a price. 23 Definition Economies of Scale: the advantages of large-scale production that reduce average cost as quantity increases. Natural Monopoly: when a single firm can supply the entire market at a lower cost than two or more firms. 24 Natural Monopoly Monopolies can arise naturally when economies of scale allow a single firm to produce at lower cost than many small firm. Utilities such as water, natural gas, and cable television are often natural monopolies. • The largest firm will be able to produce its goods at a lower per unit cost than smaller firms, so only one firm tends to exist. If economies of scale are large enough, price can be lower under natural monopoly than under competition. 25 Natural Monopoly P Average costs for small firms Competitive price PC It is possible for PM < PC If economies of scale are large enough Monopoly price PM AC MC Demand Competitive Quantity QC Monopoly Quantity QM MR Q 26 Self-Check Which of the following is most likely to be a natural monopoly: a. A home builder. b. A restaurant. c. A railroad company. Answer: c – a railroad company is most likely to be a natural monopoly, due to economies of scale and the high cost of duplicating tracks. 27 Price Control and Natural Monopoly A price control can increase output. Price = MC is the optimal level of output. At P = MC, P < AC. The firm is operating at a loss and will exit the industry. Price = AC is the lowest price the firm will accept. Firm is earning zero (normal) profit. Output is higher than at monopoly price. 28 Price Control and Natural Monopoly Price • PM and QM are set where MR = MC • Optimal quantity is where P = MC • At optimal Q, firm suffers a loss Monopoly price PM P = MC AC Loss (P < AC) QM Monopoly quantity Optimal quantity MC Demand Quantity MR 29 Price Control and Natural Monopoly Price • At P = AC, firm has normal profit • Results in some deadweight loss Monopoly price PM Deadweight Loss P = AC AC P = MC QM Monopoly quantity Optimal quantity MC Demand Quantity MR 30 Natural Monopoly - Regulation Government Regulation or ownership can solve the Natural Monopoly problem. California deregulated electricity prices with disastrous results. • High demand pushed generators to capacity • Utilities’ demand for electricity is inelastic when supply is critically low. • System was designed for regulation, not competition • Social cost of an outage – at least $10,000/Mwh if not higher • “Electricity is damn useful stuff” 31 Natural Monopoly - Regulation • Firms that generated electricity found a way to increase profit by shutting down some of their generators “for maintenance and repair.” When supply decreased, the price rose rapidly. Enron and others “gamed” the system for their benefit • California put wholesale price controls in place • Deregulation, ultimately caused PG&E to file for bankruptcy, and added $50,000,000,000 to total power costs in the region • Other Western States would up charging as much as $5000/Mwh (normal - $40/Mwh) 32 More On Regulation • Many assume that market failure can be corrected via regulation • Implicitly presume that regulation is done competently if not perfectly • “Nirvana” fallacy - the fallacy of comparing actual things with unrealistic, idealized alternatives. It can also refer to the tendency to assume that there is a perfect solution to a particular problem. • Example: using political, not economic criteria 33 More On Regulation Sometimes regulatory actions are hardly “solutions” (i.e. Calif electric “deregulation”) Many believe Dodd-Frank Financial Regulation bill has made things worse What matters is the effectiveness of the regulation in terms of costs/benefits, including potential opportunity costs i.e. over-regulation can stifle market forces for cost reduction and/or innovation “Power does not equate to wisdom” 34 Self-Check A monopolist will have normal profit when its price is set equal to: a. Marginal cost. b. Average cost. c. Total cost. Answer: a – a monopolist will have normal profit when P = AC. 35 Definition Barriers to entry: factors that increase the cost to new firms of entering an industry. 36 Other Sources of Monopoly Power 37 Numerical Example - Monopoly A monopolist's demand curve is described by the equation Q = 50 – 0.5P. The marginal revenue curve is described by the equation MR = 50 – Q. Marginal cost per unit is constant at $5, and there are no fixed costs to be considered here. What is the monopolist's profit-maximizing quantity and profit level? Show all your calculations. MC = 5, MR = 50 – Q, FC = 0 MC = MR is profit max Quantity so 50 – Q so Q = 45, Q = 45 Solve for P using demand equation: Q = 50 - .5P 45 = 50 - .5P (solve for P) 5/.5 yields P = 10 Profit = TR – TC (45)*(10) – ($5)*45 = 450-225 Profit = $225 38 Takeaway For a monopolist, marginal revenue is less than market price (MR < P). Monopolies: • Charge a higher price than competitive firms. • Reduce total. • Create a deadweight loss. • Use market power to earn above normal profits. The markup of price over marginal cost is larger the more inelastic the demand. 39 Takeaway Patent monopolies involve a trade-off between deadweight loss and innovation, Natural monopolies involve a trade-off between deadweight loss and economies of scale. Outcomes can be improved by: • Opening the industry up to competition. • Regulating the monopolist. 40