here - Principles of Microeconomics

advertisement

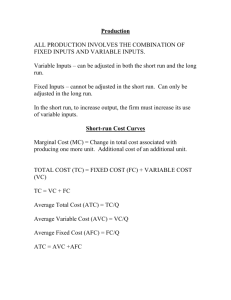

The Costs of Production Principles of Microeconomics Boris Nikolaev Brainstorming costs You run Ford Motor Company. • List three different costs you have. • List three different business decisions that are affected by your costs. In this chapter • What is a production function? What is marginal • • • product? How are they related? What are the various costs? How are they related to each other and to output? How are costs different in the short run vs. the long run? What are “economies of scale”? It’s business time. • Firms are in the business of making profits. Profit = Total Revenue (TR) – Total Cost (TC) the amount a firm receives from the sale of its output the market value of the inputs a firm uses in production Sneak Preview MR=MC Profits • Are profits bad? • What is the function of profits in a free market economy? • In a competitive market profits come not from increase in price, but from decrease in the cost of production. Why? • Fortune 500 most profitable companies [see here] The Weed Trail [read here] Profits and Insurance • Recollect risk-aversion & uncertainty. Corporate Profits after tax CP/GDP Marxist View • The stagnating wages since the 1970s – – – – – Technology World war II Outsourcing Women in the labor force Immigration • Problem of effective demand – Work more hours – Borrowing binge (mortgage debt, credit cards) • Greatest profit boom (in the history of the world) – Marginal productivity, wages, and profits Productivity vs Wages What do you do with the profits? • CEO salaries [Forbes list] • Mergers & Acquisitions • Lend to employees (e.g. GM, IBM, etc.) Costs • Resources are scarce, productive, and have alternative uses. Explicit costs are the direct cash payments you make to use resources you don’t own such as wages, rent, insurance, taxes, etc. Implicit costs is the opportunity cost of the resource you own (the benefit you could have extracted from it from its next best use). Do not require direct cast payments. Example You need $100,000 to start your business. The interest rate is 5%. • Case 1: borrow $100,000 – explicit cost = $5000 interest on loan • Case 2: use $40,000 of your savings, borrow the other $60,000 – explicit cost = $3000 (5%) interest on the loan – implicit cost = $2000 (5%) foregone interest you could have earned on your $40,000. Economic vs Accounting Profit • Accounting profit = total revenue minus total explicit costs • Economic profit = total revenue minus total costs (including explicit and implicit costs) • Accounting profit ignores implicit costs, so it’s higher than economic profit. Example 1 The equilibrium rent on office space has just increased by $500/month. Determine the effects on accounting profit and economic profit if: a. you rent your office space b. you own your office space Answers The rent on office space increases $500/month. a. You rent your office space. Explicit costs increase $500/month. Accounting profit & economic profit each fall $500/month. b.You own your office space. Explicit costs do not change, so accounting profit does not change. Implicit costs increase $500/month (opp. cost of using your space instead of renting it) so economic profit falls by $500/month. Practice Question Your current job pays $50K/year. You have $20K savings that earn you $3K interest a year. You own a garage, which you rent for $12K/ year. You decide to invest your savings and use your garage to start your own business. Did you make a good economic decision? Total Revenue Explicit Costs labor food Total Cost $105K $21K $20K $41K Implicit Costs salary interest rent Total Implicit Cost Accounting Profit _____ Economic Profit / Loss______ _____ _____ _____ _____ Production in the Short Run Q= f(L,K) A production function shows the relationship between the quantity of inputs used to produce a good and the quantity of output of that good. EXAMPLE 1: Production Function Q (no. of (bushels workers) of wheat) 3,000 Quantity of output L 2,500 0 0 1 1000 2 1800 3 2400 500 4 2800 0 5 3000 2,000 1,500 1,000 0 1 2 3 4 No. of workers 5 Marginal Product (MP) • If you hire one more worker, your output rises by the marginal product of labor. • The marginal product of any input is the increase in output arising from an additional unit of that input, holding all other inputs constant. • Notation: ∆ (delta) = “change in…” Examples: ∆Q = change in output, ∆L = change in labor • Marginal product of labor (MPL) = ∆Q ∆L EXAMPLE 1: Total & Marginal Product L Q (no. of (bushels workers) of wheat) ∆L = 1 0 1 ∆L = 1 ∆L = 1 ∆L = 1 ∆L = 1 2 3 4 5 0 MPL ∆Q = 1000 1000 ∆Q = 800 800 ∆Q = 600 600 ∆Q = 400 400 ∆Q = 200 200 1000 1800 2400 2800 3000 EXAMPLE 1: MPL = Slope of Prod Function Q (no. of (bushels MPL workers) of wheat) 0 0 1000 1 1000 800 2 1800 600 3 4 5 2400 2800 3000 400 200 MPL 3,000 Quantity of output L equals the slope of the 2,500 production function. 2,000 Notice that MPL diminishes 1,500 as L increases. 1,000 This explains why 500 production the function gets flatter 0 as L0 increases. 1 2 3 4 No. of workers 5 Why MPL Is Important • Recall one of the Ten Principles: Rational people think at the margin. • When you hire an extra worker, – your costs rise by the wage he pays the worker – your output rises by MPL • Comparing them helps you decide whether he should hire the worker. Class demonstration The Law of Diminishing Marginal Returns • Diminishing marginal product: The marginal product of an input declines as the quantity of the input increases (other things equal). • Why does it decline? Practice Question # fishermen Fish caught 1 15 2 35 3 58 4 80 5 95 6 105 7 108 8 105 Input (L) TP = f(L) MP of labor Assume that only one input (L) is relevant in production. The wage / worker = $175 and one pound of fish is selling for $10 MRP Let’s go back to our farm example… • You must pay $1000 per month for the land, regardless of how much wheat you grow. • The market wage for a farm worker is $2000 per month. • Your cots are related to how much wheat you produce… EXAMPLE 1: Your Costs L Q Cost of (no. of (bushels land workers) of wheat) Cost of labor Total cost 0 0 $1,000 $0 $1,000 1 1000 $1,000 $2,000 $3,000 2 1800 $1,000 $4,000 $5,000 3 2400 $1,000 $6,000 $7,000 4 2800 $1,000 $8,000 $9,000 5 3000 $1,000 $10,000 $11,000 EXAMPLE 1: Total Cost Curve $12,000 Total Cost 0 $1,000 1000 $3,000 1800 $5,000 2400 $7,000 2800 $9,000 3000 $11,000 $10,000 Total cost Q (bushels of wheat) $8,000 $6,000 $4,000 $2,000 $0 0 1000 2000 3000 Quantity of wheat Marginal Cost • Marginal Cost (MC) is the increase in Total Cost from ∆TC producing one more unit: MC = ∆Q EXAMPLE 1: Total and Marginal Cost Q (bushels of wheat) 0 Total Cost $1,000 ∆Q = 1000 1000 $3,000 ∆Q = 800 ∆Q = 600 ∆Q = 400 ∆Q = 200 1800 Marginal Cost (MC) $5,000 2400 $7,000 2800 $9,000 3000 $11,000 ∆TC = $2000 $2.00 ∆TC = $2000 $2.50 ∆TC = $2000 $3.33 ∆TC = $2000 $5.00 ∆TC = $2000 $10.00 EXAMPLE 1: The Marginal Cost Curve 0 TC MC $1,000 $2.00 1000 $3,000 $2.50 1800 $5,000 $3.33 2400 $7,000 $10 Marginal Cost ($) Q (bushels of wheat) $12 $8 MC usually rises as Q rises, as in this example. $6 $4 $2 $5.00 2800 $9,000 3000 $11,000 $10.00 $0 0 1,000 2,000 Q 3,000 Why MC Is Important • You are rational and want to maximize your profits. To increase profit, should you produce more or less wheat? • To find the answer, you need to “think at the margin.” • If MC > MR then producing one more unit will decrease profits. Fixed and Variable Costs • Fixed costs (FC) do not vary with the quantity of output produced. – In our example, FC = $1000 for land – Other examples: cost of equipment, loan payments, rent • Variable costs (VC) vary with the quantity produced. – In our example, VC = wages you pay workers – Other example: cost of materials • Total cost (TC) = FC + VC EXAMPLE 2: Costs FC VC TC 0 $100 $0 $100 1 100 70 170 2 100 120 220 3 100 160 260 4 100 210 310 5 100 280 380 FC $700 VC TC $600 $500 Costs Q $800 $400 $300 $200 $100 6 7 100 380 100 520 480 620 $0 0 1 2 3 4 Q 5 6 7 EXAMPLE 2: Marginal Cost TC MC 0 $100 1 2 3 4 5 6 7 170 220 260 310 380 480 620 $70 50 40 50 70 100 140 $200 Marginal Cost (MC) Recall, is $175 the change in total cost from producing one more unit: $150 ∆TC MC = ∆Q $100 Usually, MC rises as Q rises, due $75 to diminishing marginal product. Costs Q $125 $50 Sometimes (as here), MC falls $25 before rising. $0 (In other0 examples, 1 2 3 MC 4 may 5 6be 7 constant.) Q EXAMPLE 2: Average Fixed Cost FC 0 $100 1 2 100 100 AFC n/a $100 50 3 100 33.33 4 100 25 5 100 20 6 100 16.67 7 100 14.29 $200 Average fixed cost (AFC) is$175 fixed cost divided by the quantity of output: $150 Costs Q AFC $125 = FC/Q $100 Notice $75 that AFC falls as Q rises: The firm is spreading its fixed $50 costs over a larger and larger $25 number of units. $0 0 1 2 3 4 Q 5 6 7 EXAMPLE 2: Average Variable Cost VC AVC 0 $0 n/a 1 70 $70 2 120 60 3 160 53.33 4 210 52.50 5 280 56.00 6 380 63.33 7 520 74.29 $200 Average variable cost (AVC) is$175 variable cost divided by the quantity of output: $150 Costs Q AVC $125 = VC/Q $100 As$75 Q rises, AVC may fall initially. In most cases, AVC will $50 eventually rise as output rises. $25 $0 0 1 2 3 4 Q 5 6 7 EXAMPLE 2: Average Total Cost Q TC 0 $100 ATC AFC AVC n/a n/a n/a 1 170 $170 $100 $70 2 220 110 50 60 3 260 86.67 33.33 53.33 4 310 77.50 25 52.50 5 380 76 20 56.00 6 480 80 16.67 63.33 7 620 88.57 14.29 74.29 Average total cost (ATC) equals total cost divided by the quantity of output: ATC = TC/Q Also, ATC = AFC + AVC EXAMPLE 2: Average Total Cost TC 0 $100 1 2 170 220 ATC $200 Usually, as in this example, $175 the ATC curve is U-shaped. n/a $150 $170 110 Costs Q $125 $100 3 260 86.67 4 310 77.50 5 380 76 $25 6 480 80 $0 7 620 88.57 $75 $50 0 1 2 3 4 Q 5 6 7 EXAMPLE 2: The Various Cost Curves Together $200 $175 ATC AVC AFC MC Costs $150 $125 $100 $75 $50 $25 $0 0 1 2 3 4 Q 5 6 7 Calculating costs Fill in the blank spaces of this table. Q VC 0 1 10 2 30 TC AFC AVC ATC $50 n/a n/a n/a $10 $60.00 80 3 16.67 4 100 5 150 6 210 150 20 12.50 36.67 8.33 $10 30 37.50 30 260 MC 35 43.33 60 Answers Use AFC FC/Q ATC AVC = TC/Q VC/Q MC and First,relationship deduce FC between = $50 and use FCTC + VC = TC. Q VC TC AFC AVC ATC 0 $0 $50 n/a n/a n/a 1 10 60 $50.00 $10 $60.00 2 30 80 25.00 15 40.00 3 60 110 16.67 20 36.67 4 100 150 12.50 25 37.50 5 150 200 10.00 30 40.00 6 210 260 8.33 35 43.33 MC $10 20 30 40 50 60 EXAMPLE 2: ATC and MC $200 ATC is falling. $175 When MC > ATC, $150 ATC is rising. $125 The MC curve crosses the ATC curve at the ATC curve’s minimum. Costs When MC < ATC, ATC MC $100 $75 $50 $25 $0 0 1 2 3 4 Q 5 6 7 Cost in the Long Run • Short run: Some inputs are fixed (e.g., factories, land). The costs of these inputs are FC. • Long run: All inputs are variable (e.g., firms can build more factories or sell existing ones). EXAMPLE 3: LRATC with 3 factory sizes Firm can choose from three factory Avg Total sizes: S, M, L. Cost Each size has its own SRATC curve. The firm can change to a different factory size in the long run, but not in the short run. ATCS ATCM ATCL Q A Typical LRATC Curve In the real world, factories come in many sizes, each with its own SRATC curve. ATC LRATC So a typical LRATC curve looks like this: Q How ATC Changes as the Scale of Production Changes Economies of scale: ATC falls as Q increases. ATC LRATC Constant returns to scale: ATC stays the same as Q increases. Diseconomies of scale: ATC rises as Q increases. Q Sources of Economies of Scale • Spread of “overhead,” fixed cost over bigger production. • Labor specialization. • Technology. • Learning by doing. • Agglomeration economies. Note on International Trade • What goods are produced and where? • David Ricardo (1800’s) – comparative advantage. • Heckscher & Ohlin (1920-30’s) – differences in factor endowments. Example: Developed countries export more capital intensive goods (cars, airplanes, etc…) and import from developing countries more labor intensive goods (clothing, agricultural products, etc…) • Empirical studies. Krugman’s Model Uses economies of scale to explain international trade. 1. Mass production decreases average cost (ES) 2. Consumers prefer diversity of products Each country specializes and then trades. This is how countries with similar factor endowments engage in trade (e.g. Japan sells Toyota to US, US sells GM to Germany, etc…)