Macro 2.3- Inflation

advertisement

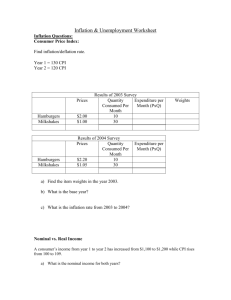

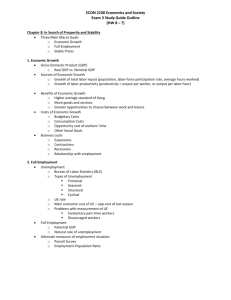

Unit 2: Macro Measures Copyright ACDC Leadership 2015 1 REVIEW ACTIVITY Name That Concept Rules: 1. Cannot use the word(s) 2. Focus on the concept not word Ex: Price Maker Copyright ACDC Leadership 2015 2 NAME THAT CONCEPT 1.Macroeconomics 2.Inflation 3.Nominal GDP 4.Structural Unemp. 5.C+I+G+Xn Copyright ACDC Leadership 2015 NAME THAT CONCEPT 1.REAL GDP 2.FULL EMPLOYM. 3.CYCLICAL UNEMP. 4.NATURAL RATE 5.FRICTIONAL UNEMPLOYMENT Copyright ACDC Leadership 2015 Goal #3 LIMIT INFLATION Country and TimeZimbabwe, 2008 Annual Inflation Rate79,600,000,000% Time for Prices to Double24.7 hours Copyright ACDC Leadership 2015 What is Inflation? Inflation is rising general level of prices and it reduces the “purchasing power” of money Examples: •It takes $2 to buy what $1 bought in 1987 •It takes $6 to buy what $1 bought in 1970 •It takes $24 to buy what $1 bought in 1913 When inflation occurs, each dollar of income will buy fewer goods than before Copyright ACDC Leadership 2015 Is Inflation Good or Bad? Copyright ACDC Leadership 2015 Good or Bad? In general, ramped inflation is bad because banks don’t lend and people don’t save. This decreases investment and GDP. What about deflation? Deflation- Decrease in general prices or a negative inflation rate. Deflation is bad because people will hoard money (financial assets) This decreases consumer spending and GDP. Disinflation- Prices increasing at slower rates Copyright ACDC Leadership 2015 But inflation doesn’t effect everyone equally. Identify which people are helped and which are hurt by unanticipated inflation 1. A man who lent out $500 to his friend in 1960 and gets paid back in 2015. 2. A tenant who is charged $850 rent each year. 3. An elderly couple living off fixed retirement payments of $2000 a month 4. A man that borrowed $1,000 in 1995 and paid it back in 2014. 5. A women who saved $500 in 1950 by putting it under her mattress Copyright ACDC Leadership 2015 Effects of Unanticipated Inflation Hurt by Inflation • Lenders-People who lend money (at fixed interest rates) • People with fixed incomes • Savers Helped by Inflation • Borrowers-People who borrow money • A business where the price of the product increases faster than the price of resources Nominal Wage- Wage measured by dollars rather than purchasing power Real Wage- Wage adjusted for inflation If there is inflation, you must ask your boss for a raise Copyright ACDC Leadership 2015 Historic Inflation Rates Copyright ACDC Leadership 2015 Copyright ACDC Leadership 2015 Measuring Inflation Copyright ACDC Leadership 2015 How is inflation measured? The government tracks the prices of specific “market baskets” that included the same goods and services. There are two ways to look at inflation over time: The Inflation Rate- The percent change in prices from year to year Price Indices- Index numbers assigned to each year that show how prices have changed relative to a specific base year. Examples: • The U.S. inflation rate in 2014 was 0.8%. • The Consumer Price Index for 2014 was 235 (base year 1982). This means that prices have increased 135% since 1982. Copyright ACDC Leadership 2015 Consumer Price Index (CPI) The most commonly used measurement of inflation for consumers is the Consumer Price Index (CPI) Here is how it works: • The base year is given an index of 100 • To compare, each year is given an index # as well CPI = Price of market basket Price of market basket in base year x 100 1997 Market Basket: Movie is $6 & Pizza is $14 Total = $20 (Index of Base Year = 100) 2009 Market Basket: Movie is $8 & Pizza is $17 Total = $25 (Index of 125) •This means inflation increased 25% b/w ’97 & ‘09 •Items that cost $100 in ’97 cost $125 in ‘09 Copyright ACDC Leadership 2015 Copyright ACDC Leadership 2015 Problems with the CPI 1. Substitution Bias- As prices increase for the fixed market basket, consumers buy less of these products and more substitutes that may not be part of the market basket. (Result: CPI may be higher than what consumers are really paying) 2. New Products- The CPI market basket may not include the newest consumer products. (Result: CPI measures prices but not the increase in choices) 3. Product Quality- The CPI ignores both improvements and decline in product quality. (Result: CPI may suggest that prices stay the same though the economic well being has improved significantly) Copyright ACDC Leadership 2015 Calculating Nominal GDP, Real GDP, and Inflation Copyright ACDC Leadership 2015 Calculating CPI Year 1 2 3 4 5 Nominal, Units of Price GDP Output Per Unit 10 10 15 20 25 Real, GDP CPI/ GDP Deflator (Year 1 as Base Year) $4 5 6 8 4 Make year one the base year CPI= Copyright ACDC Leadership 2015 Price of market basket in the particular year x 100 Price of the same market basket in base year Inflation Rate Calculating CPI Year 1 2 3 4 5 Nominal, Units of Price GDP Output Per Unit 10 10 15 20 25 $40 50 90 160 100 $4 5 6 8 4 Real, GDP CPI/ GDP Deflator (Year 1 as Base Year) $40 40 60 80 100 100 125 150 200 100 Inflation Rate N/A 25% 20% 33.33% -50% Inflation Rate % Change in Prices Copyright ACDC Leadership 2015 = Year 2 - Year 1 Year 1 X 100 Practice Year Nominal, Units of Price GDP Output Per Unit 1 2 3 4 5 5 10 20 40 50 $6 8 10 12 14 $30 80 200 480 700 Real, GDP $50 100 200 400 500 Consumer Price Index (Year 3 as Base Year) 60 80 100 120 140 Make year three the base year CPI = Copyright ACDC Leadership 2015 Price of market basket in the particular year Price of the same market basket in base year x 100 CPI vs. GDP Deflator The GDP deflator measures the prices of all goods produced, whereas the CPI measures prices of only the goods and services bought by consumers. An increase in the price of goods bought by firms or the government will show up in the GDP deflator but not in the CPI. The GDP deflator includes only those goods and services produced domestically. Imported goods are not a part of GDP and therefore don’t show up in the GDP deflator. GDP Deflator = Nominal GDP x 100 Real GDP If the nominal GDP in ’09 was 25 and the real GDP (compared to a base year) was 20 how much is the GDP Deflator? Copyright ACDC Leadership 2015 Calculating GDP Deflator GDP Deflator Nominal GDP Copyright ACDC Leadership 2015 = = Nominal GDP Real GDP x 100 (Deflator) x (Real GDP) 100 Calculations 1. In an economy, Real GDP (base year = 1996) is $100 billion and the Nominal GDP is $150 billion. Calculate the GDP deflator. 2. In an economy, Real GDP (base year = 1996) is $125 billion and the Nominal GDP is $150 billion. Calculate the GDP deflator. 3. In an economy, Real GDP for year 2002 (base year = 1996) is $200 billion and the GDP deflator 2002 (base year = 1996) is 120. Calculate the Nominal GDP for 2002. 4. In an economy, Nominal GDP for year 2005 (base year = 1996) is $60 billion and the GDP deflator 2005 (base year = 1996) is 120. Calculate the Real GDP for 2005. Copyright ACDC Leadership 2015 2008 Audit Exam 2012 Audit Exam Copyright ACDC Leadership 2015 Copyright ACDC Leadership 2015 Review 1. 2. 3. 4. 5. Identify the 3 goals of all economies Define Natural Rate of Unemployment Define inflation rate What is a market basket? Explain the difference between nominal and real interest rates 6. How do you calculate CPI? 7. What does a CPI of 130 mean? 8. Who is helped and hurt by inflation? 9. Why did Bolivia experience hyperinflation? 10.List 10 old-school Nintendo games Three Causes of Inflation 1. If everyone suddenly had a million dollars, what would happen? 2. What two things cause prices to increase? Use Supply and Demand Copyright ACDC Leadership 2015 3 Causes of Inflation 1. The Government Prints TOO MUCH Money (The Quantity Theory) • Governments that keep printing money to pay debts end up with hyperinflation. • Result: Banks refuse to lend so investment falls and people don’t save up to buy things. Examples: • Bolivia, Peru, Brazil • Germany after WWI Copyright ACDC Leadership 2015 Quantity Theory of Money If the real GDP in a year is $400 billion but the amount of money in the economy is only $100 billion, how are we paying for things? The velocity of money is the average times a dollar is spent and re-spent in a year. How much is the velocity of money in the above example? Quantity Theory of Money Equation: MxV=PxY M = money supply V = velocity P = price level Y = quantity of output Notice that P x Y is Nominal GDP Copyright ACDC Leadership 2015 MxV=PxY Why does printing money lead to inflation? •Assume the velocity is relatively constant because people's spending habits are not quick to change. •Also assume that output (Y) is not affected by the amount of money because it is based on production, not the value of the stuff produced. If the govenment increases the amount of money (M) what will happen to prices (P)? Ex: Assume money supply is $5 and it is being used to buy 10 products with a price of $2 each. 1. How much is the velocity of money? 2. If the velocity and output stay the same, what will happen if the amount of money is increase to $10? Notice, doubling the money supply doubles prices 33 2012 Audit Exam 3 Causes of Inflation 2. Demand- Pull Inflation DEMAND PULLS UP PRICES!!! “Too many dollars chasing too few goods” An overheated economy with excessive spending but same amount of goods. 3. Cost-Push Inflation Higher production costs increase prices A negative supply shock increases the costs of production and forces producers to increase prices. Copyright ACDC Leadership 2015 The Wage-Price Spiral A Perpetual Process: 1.Workers demand raises 2.Owners increase prices to pay for raises 3. High prices cause workers to demand higher raises 4. Owners increase prices to pay for higher raises 5. High prices cause workers to demand higher raises 6. Owners increase prices to pay for higher raises Nominal vs. Real Interest Rates Copyright ACDC Leadership 2015 Interest Rates and Inflation What are interest rates? Why do lenders charge them? Who is willing to lend me $100 if I will pay a total interest rate of 100%? (I plan to pay you back in 2050) If the nominal interest rate is 10% and the inflation rate is 15%, how much is the REAL interest rate? Real Interest RatesThe percentage increase in purchasing power that a borrower pays. (adjusted for inflation) Real = nominal interest rate - expected inflation Nominal Interest Ratesthe percentage increase in money that the borrower pays not adjusting for inflation. Nominal = Real interest rate + expected inflation Copyright ACDC Leadership 2015 Nominal vs. Real Interest Rates Example #1: You lend out $100 with 20% interest. Inflation is 15%. A year later you get paid back $120. What is the nominal and what is the real interest rate? Nominal interest rate is 20%. Real interest rate was 5% In reality, you get paid back an amount with less purchasing power. Example #2: You lend out $100 with 10% interest. Prices are expected to increased 20%. In a year you get paid back $110. What is the nominal and what is the real interest rate? Nominal interest rate is 10%. Real rate was –10% In reality, you get paid back an amount with less purchasing power. Copyright ACDC Leadership 2015 Achieving the Three Goals The governments role is to prevent unemployment and prevent inflation at the same time. •If the government focuses too much on preventing inflation and slows down the economy we will have unemployment. •If the government focuses too much on limiting unemployment and overheats the economy we will have inflation Unemployment Inflation GDP Growth Good 6% or less 1%-4% 2.5%-5% Worry 6.5%-8% 5%-8% 1%-2% Bad 8.5 % or more 9% or more .5% or less