Retailer Boot Camp - Wisconsin Housing Alliance

advertisement

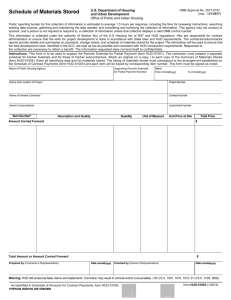

Retailer Boot Camp May 12, 2015 Sponsored by: Presenters O Ross Kinzler, Executive Director O ross@housingalliance.us O Amy Bliss, Deputy Director O amy@housingalliance.us WI HOUSING ALLIANCE 258 Corporate Drive Madison, WI 53714 (608) 255-3131 Phone (608) 255-5595 Fax Welcome O Please shut off cell phones O Feel free to ask questions, tell stories, participate fully. O Evaluations forms – please fill them out and note ideas for future events as we go throughout the day O Most materials are in your binder, available on our website or on the DSPS website THANK YOU O Use Home Dues O Thank you to Bryan Folz for the challenge to all members to donate $75/used home sold O Thank you to all of the people in this room that contribute this funding VOLUNTARILY! O For those businesses that do not participate, please consider this very important source of funding the Alliance. O In 2014, this contributed $18,000 and in 2013, $14,000 Please call it by it’s real name O HUD Code Home is built to a federal code which is preemptive. –Manufactured Home O The Code requires that the home be “habitable” when it leaves the factory. O There is 3rd party design approval and 3rd party in plant inspectors (DAPIA and IPIA) HUD Code Dealer Responsibilities O Can’t sell a HUD Code home without seals O Can’t sell a home out of conformance O Don’t alter a home to take it out of conformance – make no changes unless authorized by the manufacturer O Complete the information card O Refer to the manufacturer information/complaints about defects to the manufacturer. If not satisfied refer to the SAA HUD Code Licenses O Manufacturer O Dealer O Salesperson O Installer O Community 2 Types of Dealer LicensesAll cost $215 / 4 years O Non-Broker – (Full dealer license) O Sales lot O Inventory O Ownership interest in some homes sold O Broker – (limited dealer license) O No sales lot O No inventory O No ownership interest O Lists homes Net Worth Requirements O Non-Broker O New initial dealer license - $50,000 O Succeeding licenses O 1-50 $50,000 O 51+ $100,000 O Provide: O Financial statement O Purchase a bond Brokers O New initial broker license - $25,000 O Succeeding licenses O 1-50 $25,000 O 51+ $50,000 O Provide: O Financial statement O Purchase a bond Other Requirements O There must be at least one licensed salesperson. O Establish a permanent business location. O Establish an office in which the business records are kept. O If you carry and display inventory, display a sign with business name. O Display lots are not required for manufactured home dealers, but if provided, must be within the same block or directly across the street from the main business location. O Establish a repair service facility to service manufactured homes offered for sale. If a repair service facility is not provided, a Service Agreement Form must be submitted. Other Requirements O If the business property is not owned, a copy of the four-year lease must be submitted. O Maintain Records O Title for each used home O Certificate of origin for each new home O Factory invoices O Sales contracts O Listing agreements O Detailed records of each sale Signage O When a retailer carries and displays inventory an exterior business sign is required that names the business and doesn’t misrepresent the business. Additional Issues O See your resource guide for O Relocating your dealership O Zoning O Temporary sales locations like fairs Modular Homes O Homes built to Wisconsin One- and Two- Family Dwelling Code (UDC) O Homes built to Wisconsin One- and TwoFamily Dwelling Code (UDC) O Home designs are submitted to DSPS O Wisconsin seals are issued Modular Home Sales O No state license for selling just the home O Real estate license if land is included Building Permits O Can be “pulled” by the homebuyer O Can be “pulled” by a Dwelling Contractor Qualifier O Building permit application is included in your packet. Staying Out of Trouble O Most violations are process violations O Get the paperwork right and most things fall into place. O If you see the HUD logo, the slide only applies to HUD Code home sales Fair Trade O The Department of Agriculture, Trade & Consumer Affairs; O The Department of Safety & Professional Service and O The Federal Trade Commission have rules. Fair Trade - Advertising O All business ads must include the business name. O You cannot run a classified ad that appears to be a private party sale. O This applies, even on craigslist! Fair Trade - Advertising O Advertising statements must be truthful and the dealer must be able to prove the statements. False Advertising O False advertising can ruin a business. O False advertising can be proven if ALL of the following are present: O A false or misleading statement of fact O The false statement either deceived or had the capacity to deceive a substantial segment of potential customers O The deception is material to the purchasing decision O The product is in interstate commerce O The plaintiff has been or is likely to be injured Puffery O A defense to false advertising is that a statement is mere puffery O Puffery is O An exaggerated claim or boasting statement that no reasonable person would rely on O A general claim of superiority that is vague O Outrageous claims that cannot be backed up but appear to be performance guarantees rather than statements of opinion can lead to trouble Fair Trade - Advertising O Credit Advertising - NEW - You cannot advertise a home at a monthly payment cost unless you as a creditor can actually provide the credit and are licensed by DFI to do so. Fair Trade - Advertising O It is illegal in Wisconsin to sell merchandise or advertise to do so below its cost. O Certain exceptions apply to bona fide clearance sales, imperfect items or final liquidation sales. Fair Trade – All In Pricing O When a price of a home is included in an ad, a written statement or representation of the price must include all of the charges that are necessary to acquire ownership O Exceptions: O taxes, registration fees, permit fees and charges by lenders or others. Selling Below Cost O Wisconsin has a minimum mark up law (6%) that affects personal property sales. New vs. Used O A new home means a home that has never been occupied, used or sold for personal or business use. O A model home is not “used” unless it has been put into a business use other than for display for sale Purchase Contract O You must use the State Forms for HUD Code home sales O A copy must be given at the time the purchaser signs AND again after the offer has been accepted by the retailer. O A contract must be signed in order to accept a downpayment, or a title for a trade in. Termination of Offers O Contract is void if the contract has not been accepted by the close of the retailer’s next business day. (Unless the contract provides for a different time.) O Once a contract is signed for a specific home, the retailer cannot sell that home to a different buyer until the first offer is rejected or the first buyer cancels. Termination of Offers O If the retailer rejects an offer, then any downpayment, deposit or title must be returned within 2 hours. If the buyer is not present, then return in person or by mail at the close of the next business day. Cancellation Penalties O Cancellation within 24 hours has a penalty limit of 1% of the cash price. O After 24 hours the penalty is the amount stated in the contract. O DON’T LEAVE IT BLANK, other wise the penalty is ZERO Price Changes O Only 3 legal reasons for a price change O Addition of new equipment required by federal or state law. O State or federal tax changes O Reappraisal of the trade-in which suffered damage or is missing parts. O Manufacturer price changes cannot be passed on! 3 Day Right to Cancel O If a sale occurs away from the sale center a 3 day cooling off period applies under the Uniform Commercial Code. O The buyer can back out without penalty O Seller must provide a 3 Day Right to Cancel Notice. O Watch out – don’t complete sales away from your office. Legal Signatures or X E-Sign O Electronic documents are legal in all 50 states O They are not common in manufactured housing transactions O There are several requirements to use them so consult your legal counsel Referral Selling O NO NO O OK O Can’t offer $$ to a O Give $$ to a past buyer if they refer another person and that person buys O We will take $$ off your home purchase if 6 people you refer buy from us. customer for a referral and that person buys. Interference in Contracts O Any intentional actions taken to induce or otherwise cause a buyer not to enter into or continue with a contract with a competitor can result in liability for money damages suffered by the other retailer. Warranty O A one-year written warranty is required for each HUD Code home sold. O Joint & Several Liability O Each has 30 days to make repairs after notice of any defects. If the retailer makes the repair, the manufacturer must fully reimburse the retailer. Warranty O If the repair is inadequate and it is discovered before OR after expiration of the warranty the same condition must be repaired again it must be repaired at no cost to the homeowner. Magnuson Moss Warranty Act O Generally creates warranty rights for consumers but 2 provisions are favorable: O Consumer has right to recover attorney fees but the seller must be given an opportunity to cure the defect (no gotcha’s) O A written warranty can limit coverage. That’s why almost all warranties are titled Limited Warranty Warranty Tips O Read the warranty – they are not all the same O Joint & several liability for HUD Code means the dealer must not sit on their hands during the 30 day repair period. O Consider adding mediation/arbitration clauses to contracts. Waivers O A purchase contract or other agreement cannot waive the consumer’s rights. (Wis Stats. 101.953(3)) Liens O Anyone who performs work on real property is entitled to a lien. O Proper contract language and notices is required. O Doing liens right is a full day seminar Contracts for Builders Contracts Address Risks What are your risks? O You will order a home for big $ from a manufacturer based on What? O A promise or a contract O You will do work on property owned by others based on What? O A promise or a contract O You will arrange for others to do work on a home based on What? O A promise or a contract Three Contracts to Discuss O Modular Home Purchase Contract O MH Purchase Agreement O Sub Contractor Agreement What we are NOT going to cover O Agreements between builder and manufacturer O Agreements between “owner/buyer” and others O There are particular risks here since they are likely to directly affect you but you have little control How to Complete the Manufactured Home Sales Contract Some Contract Basics O Nothing happens until a contract is signed O A contract to be valid must have these elements: O Signatures of all parties O Sufficient detail to represent a “meeting of the minds” O Financial commitment that ties the customer to the contract – not vague language Purchase Contracts O Is the contract current? O Real vs. Personal property O Security interests protected? O Real meeting of the minds? O Changes dated and initialed? O Customer signing first? O Use Change Orders – Don’t Re-write the Contract !!! The State Form Leave No Blanks The following Schedules apply: ___ A Home Options ___ B Warranties & Representations; ___ C Personal Property Placement: ___ D Real Property Placement; ___ E Additional Representations; ___ F Notice of Manufactured Home Community Lease/Rules; ___ Others Attached. A. Base Price of Home Sold $ ____________ B. Total Options from Schedule A, Part A $______ C. Total from Schedule C $ ____________ 1. Sub Total (Sum lines A + B+C) $___________ 2. Trade Allowance $ ________ 3. Trade Difference (1 Less 2) $ ___________ 4. ____ % Wisc. Sales Tax x line 1 $___________ (Includes 35% exemption if applicable) □ Sales Tax Computed on line 4 □ Line 1 Price includes Sales Tax, if applicable □ No Sales Tax imposed on purchaser because of realty improvement □ No Sales Tax imposed due to other exemption: ____________________________ (include ES # if applicable) (Note: Trade allowance may not be used in calculating tax. No Tax on used homes exceeding 45 ft.) 5. Title, Lien, UCC-1, Other fees $______ 6. Physical Damage Insurance $_______ 7. Total from Schedule D $_____________ 8. Total from Schedule A, Part B $__________ 9. Balance Due to (below) On Trade in$_____ (_________________________________) 10. Sub-Total (3+4+5+6+7+8+9) $ ________ 11. Less Down Payment $ ________ 12. Sub-Total (10 less 11) $ ______ 13. Additional Down Payment Due $________ 14. Amount Due on Closing $______________ Don’t forget the Cancellation % Personal Property Sale O New Home O Purchase Contract O Used Home from Inventory O Schedule A O Purchase Contract O Schedule B O Schedule B O Schedule C O Schedule C O Schedule E if there O Schedule E if trade in is a trade in O Schedule F O Schedule F Real Property Sale O Purchase Contract (assuming new home) O Schedule A O Schedule B O Schedule D plus worksheet Modular Contract - Risks Addressed O Buyer backing out O Builder wanting out if buyer doesn’t perform O The buyer really owns the land – dah! O Lot is build-able O Scope of work – just what you are doing and not doing O Liability limitations O Possession and control of the property Risks Addressed - continued O Owner responsibilities O Lien Notices – more later on this O Security agreement for property O Insurance for property O Price changes during contract O Default remedies Modular Contract O Is a simpler document than the MH Contract because the MH contract is dictated by many provisions of WI law O However, we’ve found that mistakes people make are often the same. How to Use the Modular Contract O Pick the Version O Standard O Trade-in # 1 Top Mistake O No Blanks O Don’t give the other party a chance to add things you did not agree to # 2 Top Mistakes O Messing up the financing condition – this is NOT OPTIONAL if contract is conditioned on getting financing! a. Minimum amount: $________________ b. Minimum term: ___________ months c. Maximum interest rate: If checked here □, a fixed rate not more than _______% per year. If checked here □, a variable rate loan in which the initial interest rate is not more than ____% per year, which may change not earlier than ________ months and thereafter not more frequently than every _______ months, and will not change by more than ____% per year at any change and not more than _____% per year in total. d. Maximum monthly payments: $___________ e. Maximum “points” or origination fees of any description ________________________ f. Other special terms apply if checked here □ and a schedule is attached. Cash Deal? O Make sure to check the box at the end of finance section #3 - Top Mistakes O Scope of Work – What are you doing? SCOPE OF THE WORK: _____ HOME ONLY - Attach the Home on a foundation provided by Owner, in accordance with Builder’s procedures. Owner understands that the Home is a modular home which will be constructed by __________________________________________ designated as model __________________________________ and delivered to and installed on the Owner’s property as described in this Contract. _____ HOME PLUS – Attach the Home on the foundation and perform other Work and services as described on the Addenda. #4 - Top Mistakes O Failure to identify who is in charge of project PRIME (GENERAL) CONTRACTOR: _____If checked here, Builder is acting as Owner’s general contractor. General Contractor’s License # ___________ _____If checked here, Builder is not acting as general contractor and Owner is either acting as the general contractor or has chosen to hire a general contractor. As a condition to Builder’s obligation to perform under this Contact, Owner will provide to Builder originals of all permits that are the responsibility of Owner to obtain under this Contract. Owner acknowledges the construction and legal risks in assuming the role of general contractor. So You Don’t Want to be the General Contractor? O You generally will not escape liability by not being the general contractor. O Example – Putting home on basement homeowner provided. If basement fails, it is likely you will be held responsible anyway # 5 - Top Mistakes O Changing the contract by re-writing it. # 5 - Top Mistakes O Don’t do it. Use Change Order #6 – Top Mistakes O Get enough detail in plans and specs O Attach all relevant documents! ADDENDUM A Plans and Specifications Included In Scope of Work [The following become a part of this contract once completed and signed or initialed by the Owner – base model spec sheet, factory order form, floor plan print, foundation print, plot plan and any other documents required by lenders or other similar 3rd parties. ] #7 – Top Mistakes O Other Construction - Getting enough detail in Addendum B including pricing if appropriate #8 – Top Mistakes O Addendum C - Included items or Allowance O Select one or the other or cross out! #9 – Top Mistakes O Get Initials on non-signature pages _______________Initials Page 2 of 9 #10 – Top Mistakes O If you use an arbitration clause you may want to delete the Jury Trial Waiver Listing Agreement O Protects you so you get paid for trying to sell the home. O Commission can be % of final price, a fixed fee or the greater or a or b. O Commission is due if you bring a buyer at the agreed price whether the seller goes through or not. Offer to Purchase O Modeled on standard real estate offer contract. Offer and Acceptance O Read the form carefully. O Don’t use the MH Purchase Contract if you don’t own the home, use this form instead O The form has a mistake – 4 lines for buyers to sign, change 2 to seller. Used Home Disclosure O This used to be a “dealer’s disclosure” O We change the law to a “seller/owner’s disclosure O If you take in a trade, have the seller complete the form Used Home Disclosure O Lead, mold, lead-based paint, asbestos and radon gas – Get owner to sign on back page O Purchaser acknowledgement on back page Selling Used MH O Who owns the home determines which contract to use O Listed home – Offer to Purchase O This is an offer/acceptance contract O Contract is between selling homeowner and buyer O You are the agent O Inventory home – MH purchase agreement O Dealer is the seller Special Issues in Used Sales O Contract must have name of current owner if listed home O Contract must name prior owner/address if inventory sale Special Issues in Used Sales O If on-site in MH community and sold by dealer O Clearly state whether home may have to be removed from site O Clearly state that the sale is voidable if purchaser or home is not acceptable to the community owner O If home is to remain, dealer must inform customer prior to executing the contract that the lease may be obtained from the community. Special Issues in Used Sales O Used home inspection must be completed and given to buyer prior to execution of the contract O Used home inspection is a seller’s disclosure like in real estate so get one from any you acquire a home from O Dealer cannot charge for doing the used home inspection Special Issue in Used Sales O Net Sales are prohibited. O A net sale occurs when the dealer and seller agree on a price and the selling commission is whatever amount is received over the set selling price. Special Issue in Used Sales O Is it a Listing or a Consignment? O Listing – Seller remains owner of property and retains the title until a closing occurs O Consignment – Dealer receives the title and gives it to buyer and remits money to seller. O In a bankruptcy of the dealer, a consigned home is considered an asset of the dealer. The seller could lose their home. Special Issues in Used Sales O A Lead Paint Disclosure is required for all home constructed before Sept. 1, 1978. Special Issues in New Home Sales O Notices required O Formaldehyde (FTC) O Temporary notice usually affixed to kitchen counter top or cabinet O Insulation (FTC) O The type, thickness and R-Value of insulation O Dispute Resolution (HUD) O Let’s consumers know of a federal dispute system O Installation (HUD) O Federal law requires notice about the installation standards applicable to the home Special Issues in New Home Sales O Wheels and Axles O Are a part of the home and bank’s collateral O If the dealer is to keep the wheels and axles the sales contract in advance must specify that. Special Issues in New Home Sales O Title or No Title O If the home is or is intended to be located on land owned by the homebuyer, no title is issued. Sub Contractor Agreement O It is a template! O Take to your attorney to square up with your business practices O One size probably doesn’t fit all O This is a member benefit and will be revised from time to time based upon member input Sub Contractor Agreements O Why? O You don’t want the ‘tail’ wagging the dog O You don’t want sub’s employees deemed to be yours O You want to establish standards O This contract is between businesses O You as builder and your sub contractor O Not between you and your customer’s subcontractors Comments O As you read this contract you realize all of the areas where your customer’s sub can get you in trouble. Why not control those issues? Agreement Basic Theory O One General Agreement that might go on for years O One Scope of Work/Project Schedule for each job. O Acceptance Report to Verify end of each job job Job Job Agreement job job Topics Covered O Who provides/protects materials O Payments and liens O Payments subject to Scope of Work O Completion – When is a job done? O Job changes – builder must approve O Clean up O Performance to industry standards Topics Covered O Safety and OSHA compliance O Extensive provision on default O Builder can step in O If builder takes over sub shall give permits and materials to builder O Permits and Laws O Sub is responsible for their own compliance O Insurance O General Liability – builder to be additional insured Topics O Sub warrants their work O All work to be done to meet/exceed UDC O Mutual Indemnification O Tools O Availability for meetings O Confidentiality O Sub won’t solicit project owner O Conduct & Appearance Topics O Independent contractor relationship – not employer/employee O Builder owns plans & specs O Governing law O Dispute resolution - options O Courts O Arbitration Items You Might Add O Insurance – consult with your insurance O O O O agent for additional coverage they might want. Severability Clause Compliance with Immigration Laws Modify Scope of Work/Project Schedule to add more information Modify Acceptance Report Sales & Use Tax O Real verses Personal Property O Sales tax on personal property O Use tax on real property construction O Who is the taxable entity? O What is the rate? O What is the taxable base? O Is there a partial tax exemption? O Do you deduct the trade in? O How are used homes taxed? Tax Issues O Interstate off-sets O Modular manufacturers generally collect the tax O To get the exemption on add-ons they have to be on the home purchase agreement O Tax audits hurt O Sales to Native Americans and religious groups Overview of Right to Cure O Homeowner can’t sue before exhausting other remedies first O Builder given chance to fix home Installer Contract Buyer Seller Atty Home Law Complaint s Overview of Right to Cure O This law is designed to resolve construction disputes before they land in court. O The law became effective 9/1/2006. O The builder has two specific duties under the law at the time the home is sold (contracted for). Right to Cure O Builder must: O give a notice and O a brochure to all buyers before the contract is completed. Right to Cure Resources O Copy of Notice – See Alliance Website under Retailer Resources ►Modular page O Copy of Brochure – See Alliance Website or Commerce website (UDC) O Copies available in your packet Definitions O “Action” (lawsuit) means a civil action or an arbitration under ch. 788. O Working Days – This law talks about working days in many places. A working day does not include weekends and holidays Definitions O “Contractor” means a person that enters into a written or oral contract with a consumer to construct or remodel a dwelling. O “Dwelling” means any premises or portion of a premises that is used as a home or a place of residence and that part of the lot or site on which the dwelling is situated that is devoted to residential use. “Dwelling” includes other existing structures on the immediate residential premises such as driveways, sidewalks, swimming pools, terraces, patios, fences, porches, garages, and basements. Definitions O “Construction defect,” if there is a warranty then defect means the definition of “defect” in the warranty. In all other cases, “construction defect” means a deficiency in the construction or remodeling of a dwelling that results from any of the following: 1. Defective material. 2. Violation of applicable codes. 3. Failure to follow accepted trade standards for workmanlike construction. NAHB Standards Right to Cure Claims O Step One: Notice of Claim At least 90 working days before commencing an action against a contractor, a claimant must deliver a written notice of the alleged defect to the contractor. Right to Cure Claims Builder Response O Step Two: Contractor’s Response - You have 15 working days to provide the claimant with a written: O (1) offer to repair or remedy the defect; O (2) offer to settle the claim with a monetary payment; Right to Cure Builder Response (3) offer of a combination of (1) and (2); (4) rejection of the claim and the reasons for rejecting the claim; or (5) proposal to inspect the alleged defect or perform any necessary testing. Right to Cure Claims Customer’s Response O Step Three: Claimant’s Response - If you reject the claim, the claimant may proceed to a lawsuit. The claimant must serve written notice on the contractor within 15 working days if he or she either accepts any offer or rejects an offer. Right to Cure Claims O Step Four: Contractor’s Supplemental Response - If the claimant rejects the offer, the contractor has 5 working days to provide a written supplemental offer or a notice that no additional offer will be made. Right to Cure Claims O Step Five: Claimant’s Response - If you send a written notice that no additional offer will be made, the claimant may commence a lawsuit or other action against you. If the claimant has received a supplemental offer from the contractor, the claimant must respond within 15 working days. Right to Cure – Other Aspects O Claimants may: 1. accept settlement offers, 2. accept them in part, or 3. reject offers, doing so via detailed written notice. Other Aspects O Remedies to claims may involve: O repairs O monetary payment, or O a combination of repairs and payments. Other Aspects O You have the right to: 1. inspect and, as appropriate, 2. test alleged defects. Access must be provided in a timely fashion for inspections, tests, and repairs. Notice from Consumer 15 Days Offer to Repair Offer to Settle Offer to Settle & Repair Customer Rejects Offers 5 Days 15 days Supplemental Offer Customer Responds Customer Sues No Offer Reject Claim Fair Housing Hot Buttons O Anti-discriminatory ads O Steering O Refusal to sell Federal Law – Fair Housing Act 1968 Title VIII - Civil Rights Act (THE ACT) --prohibits discrimination in the sale, rental, and financing of dwellings, and in other housing-related transactions, based on: O O O O O O O race color national origin religion sex familial status handicap (disability). Wisconsin has additions O Marital Status O Ancestry O Check for additional ordinances made by: O Lawful Source of Income O Sexual Orientation O Age O Status as a victim of Domestic or Sexual abuse or stalking O Counties O Municipalities Wisconsin Law – Enacted 1982 O Refusing to sell, rent, insure, construct, and/or finance housing. O Refusing to discuss the terms of the sale, rental, insurance, construction and/or financing of housing. O Refusing to allow inspection of housing. O Refusing to renew a lease or causing the eviction of a tenant. O Misrepresenting the availability of housing for sale, rent or inspection. O Applying different terms or conditions for the sale, rental, insurance and construction and/or financing of housing. O Printing, publishing or displaying advertisements or notices that state or indicate a preference based on a protected class. O Engaging in harassment, coercion or intimidation. O Blockbusting, which consists of efforts to induce or attempt to induce a person to sell or rent a dwelling by representations regarding the presence or entry of a person or persons of a protected class or economic status. O Steering, which is restricting or attempting to restrict, by word or action, an individual’s housing choices. O Segregation by floor, building, development, or community based on membership in a protected class. Beware of your advertisements CHECK YOUR ADVERTISING!!! O “Perfect home for married couple” O “Home is near the Catholic Church” O “Quiet section perfect for seniors.” Is this a good photo for your advertisement? Steering O Steering occurs when you base your housing recommendation using one of the protected classes. O Suggesting a elderly couple would be happier located away from families with kids. Quiz question: Can you advertise an Easter Bunny Sale or a St. Nick special pricing or is that religious discrimination? Refusal to Sell O Watch out for bias from homeowners using you as a listing agent. O Stay away from anyone who says – Don’t sell my home to __________ (ethnic) (age) (etc). O $10,000 minimum fine Testers O We are not talking about the people at stores that spray perfume on you O HUD and the Justice Department use testers. So do advocacy groups. American’s with Disabilities Act O Does NOT apply to single family homes or your models, but if you don’t want to eliminate potential buyers…. http://www.modular-wheelchairramps.com/?gclid=CPztpL34yK4CFQzGKgod62OzBg O Does apply to your office Ramps can be utilized for an open house application O $100-$140 per linear foot (Sample Price) Compliance Issues For your Sales Center O Ramps O Wide doorways for entry and bathroom O Handrails for bathroom Exemptions O When making the changes is impractical. O Don’t count on any exemptions for your office. O Using a HUD Code home as an office doesn’t exempt you. Renting verses Selling O O O O O O O O Renting Monthly revenue stream Low cost entry to industry Can always sell the home later Can use as a trial period More management needed You need more cash to fund homes Potential damage to your home Increased insurance costs Selling O One and done transaction on the home O Higher entry threshold O Your funds are not tied up O Need to find finance source for buyers Appraisal Rule • Effective July 18,2015 • New and Pre-Owned home and land transactions will require a full USPAP (Uniform Standards of Professional Appraisal Practices) Appraisal. New Homes will not require a physical inspection of the interior of the home. • Higher Priced Mortgage Loans (HPMLs) that are not Qualified Mortgage Loans (QM) are subject to regulatory requirements. Generally, HPMLs are loans with an APOR of more than 1.5% over the APOR • Loans less than $25,000 are exempt from the following requirements. • Qualified Mortgages are exempt. • Lenders are required to provide appraisals to the borrower 3 days in advance of closing! Business Impact of new Appraisal Rules on Land Home transactions • None of the national lenders have given any indication that this new rule will change their internal lending guidelines with respect to their maximum allowable loan advance. - Conforming loans - those sold to Fannie, Freddie or Title II FHA all required appraisals before…so no change. – Loans held in portfolio that allowed the tax value of the real estate to be used; or land in lieu transactions also using tax values can still be done but will now require a full USPAP Appraisal. – Rural locations where comps are not easily found on average have about a 30% fail rate…so if more land home transactions are subject to full appraisals more loans will fail the appraisal requirement. – The question is if the appraised value is less than the selling price of the home, will the borrower go through with the purchase even if the lender is still willing to make the loan? What is the industry doing to prepare for these new rules? • The rules are clear on land home transactions that a full USPAP appraisal is required on new and preowned real estate transactions so not much can be done at this point. The industry will be monitoring the impact and if a significant negative impact is determined then we will be going back to the CFPB. Appraisal Rule • New and Pre-Owned home loans without land will be exempt from USPAP appraisals if the creditor provides the borrower one of the following three types of information or valuations about the home. • The Manufacturer’s Invoice • An Independent Cost Service Unit Cost (Value) (NADAguides.com) • A valuation conducted by an individual or company who has no financial interest in the property or credit transaction and has training in valuing manufactured housing. (DATAComp) NADAguides NADAguides will continue to provide a “cost based valuation” but with significant additional data to influence their algorithms. – Requesting 5 years of sales data from lenders and other key stakeholders. – Requiring a commitment from the industry for 50% of the new home business. – Cost estimated between $30-$10 per valuation, based on volume. DATACOMP DATACOMP is prepared to provide a “market valuation” – DATACOMP is happy to have the last 5 years of sales data from the lenders too but believes that the most accurate valuation is based on sales within the last 12 months. – Additionally they are asking for the “industry” (communities, retailers, lenders) to provide the manufacturer’s invoice, and the Purchase Agreement on all sales including cash sales beginning in August 2014. That will provide a year’s history of sales data on which to base valuations beginning in 7/15. On the MHICAS.org web page, Datacomp has prepared an instruction page and a page where cash sales and sales financed by “other lenders” can be recorded. – Believe they can get the cost of a new home valuation to less than $50 Other Future Topics O Dealing with building O O O O O inspectors Liens Deed restrictions FEMA 185 installation standards Understanding the UDC Dispute resolution O Dodd-Frank & SAFE O O O O Act How to sell Energy Star Homes Fair Dealership Act FTC Privacy Safeguarding Rule Energy Rule impact on housing costs Upcoming Events July 23 – Community Management Boot Camp I – Cranberry Creek, Tomah August 13 – Community Management Boot Camp II – Holiday Inn, Wausau September 17 – IL, IA, WI Golf Outing – Eagle Ridge Resort, Galena, IL November 11/12 – Annual Convention / Ross Retirement Party – Chula Vista Resort, WI Dells Thank You For Coming O Fill out the evaluation form-If you would like a Bootcamp II, let us know and don’t be shy about listing future topics. O Consider becoming a Certified Housing Consultant (CHC)-Discounts, Professionalism, Plaque to prove it.