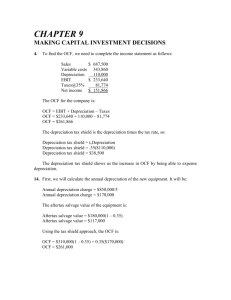

Project evaluation

advertisement

Chapter 10 Making Capital Investment Decisions •Homework: 23, 24, 31, 32 & 34 Lecture Organization Identify relevant cash flows Construct forecasted financial statements Alternative definitions of OCF CCA versus straight-line deprecation Capital budgeting examples Fundamental Principles of Project Evaluation Fundamental Principles of Project Evaluation: Project evaluation - the application of one or more capital budgeting decision rules to estimated relevant project cash flows in order to make the investment decision. Relevant cash flows - the incremental cash flows associated with the decision to invest in a project. The incremental cash flows for project evaluation consist of any and all changes in the firm’s future cash flows that are a direct consequence of taking the project. Stand-alone principle - evaluation of a project based on the project’s incremental cash flows. Relevant Cash Flows Honda Corp. is considering a new car model to replace the Accord which earns 340,000 million yen a year in Accord sales Estimates it will sell 2 million units of the new model and earn 210,000 yen on each unit (420,000 million yen in revenues) Incremental cash flows = Cash Flow(With new car model) - Cash Flows(Without new car model) 420,000 - 340,000 = 80,000 million yen Stand-Alone Principle Evaluate project on the basis of its incremental cash flows Project = "Mini-firm" Allows us to evaluate the investment project separately from other activities of the firm Cash Flows from the Project = Cash Flows from Assets Aspects of Incremental Cash Flows Sunk Costs Opportunity Costs Side Effects (Erosion) Net Working Capital Financing Costs All Cash Flows should be after-tax cash flows Sunk Costs The Limited hires The Boston Consulting Group (BCG) to evaluate whether a new product line should be launched. The consulting fees are paid no matter what. Opportunity Costs Firm paid $300,000 land to be used for a warehouse. The current market value of the land is $450,000. Opportunity Cost = Sunk Cost = Side Effects and Erosion A drop in Big Mac revenues when McDonald's introduced the Arch Deluxe. Net Working Capital Investment in inventories and receivables. This investment is recovered at the end of project. Financing Costs Interest, principal on debt and dividends. Pro Forma Financial Statements and DCF Valuation Pro forma financial statements Best current estimate of future cash flows Exclude interest expenses and other financing costs Use statements to obtain Project cash flow If stand-alone principle holds: Project Cash Flow = Cash Flow from Assets = Operating Cash Flow - Net Capital Spending - Additions to Net Working Capital Depreciation Economic and future market value are ignored. Depreciation expense uses the cost of asset. Care about depreciation because it affects tax bill Use tax accounting rules for depreciation. CCA Straight-line Additions to Net Working Capital Will start with a NWC number (date 0) NWC will change during project life (e.g. grow at a rate of 3% per period) NWC(year 2) = NWC(year1)*1.03 Or, NWC will equal Y% of sales each period (e.g. 15%) NWC(year 2) = 0.15*Sales(year 2) All NWC is recovered at the end of the project. Inventories are run down Unpaid bills are paid. Bring NWC account to zero. Ways to Capital Budgeting Problem Date 0: Buy the fixed asset -- Cash Outflow Date T: Sell the fixed asset -- Cash Inflow If no more assets of the same class: Record after-tax gain or loss Example: Preparing Pro Forma Statements Suppose we want to prepare a set of pro forma financial statements for a project for Norma Desmond Enterprises. In order to do so, we must have some background information. In this case, assume: 1. Sales of 10,000 units/year @ $5/unit. 2. Variable cost/unit is $3. Fixed costs are $5,000/year. Project has no salvage value. Project life is 3 years. 3. Project cost is $21,000. Depreciation is $7,000/year. 4. Net working capital is $10,000. 5. The firm’s required return is 20%. The tax rate is 34%. Example: Preparing Pro Forma Statements (continued) Pro Forma Financial Statements Projected Income Statements Sales Var. costs $______ ______ $20,000 Fixed costs 5,000 Depreciation 7,000 “EBIT” Taxes (34%) Net income $______ 2,720 $______ Example: Preparing Pro Forma Statements (concluded) Projected Balance Sheets 0 1 2 3 $______ $10,000 $10,000 $10,000 NFA 21,000 ______ ______ 0 Total $31,000 NWC Example: Using Pro Formas for Project Evaluation Let’s use the information from the previous example to do a capital budgeting Project operating cash flow (OCF): EBIT Depreciation Taxes OCF $____ Example: Using Pro Formas for Project Evaluation (continued) Project Cash Flows 0 1 2 3 OCF NWC Sp. ______ Cap. Sp. -21,000 Total ______ ______ ______ Example: Using Pro Formas for Project Evaluation (concluded) Capital Budgeting Evaluation: NPV = PB = AAR = Should the firm invest in this project? Why or why not? Alternative Definitions of OCF Let: OCF = operating cash flow S = sales C = operating costs D = depreciation Tc = corporate tax rate Alternative Definitions of OCF (concluded) The Tax-Shield Approach OCF = (S - C - D) + D - (S - C - D) x Tc = (S - C) x ( 1 - Tc) + (D x Tc) = (S - C) x (1 - Tc) + depreciation tax shield The Bottom-Up Approach OCF = (S - C - D) + D - (S - C - D) x Tc = (S - C - D) x (1 - Tc) + D = Net income + depreciation The Top-Down Approach OCF = (S - C - D) + D - (S - C - D) x Tc = (S - C) - (S - C - D) x Tc = Sales - costs - taxes Chapter 10 Quick Quiz Assume we have the following background information for a project being considered by Gillis, Inc. Calculate the project’s NPV and payback period. 1. Required NWC investment = $40; initial capital spending = $60; 3 year life 2. Annual sales = $100; annual costs = 50; straight line depreciation to $0 3. Salvage value = $10; tax rate = 34%, required return = 12% The after-tax salvage is $10 - ($___ - ___ )(.34) = $6.6 OCF = (100 - 50 - 20) + 20 - (100 - 50 - 20)(.34) = $_____ Chapter 10 Quick Quiz (concluded) Project cash flows are thus: 0 OCF Add. NWC 1 2 3 $39.8 $39.8 $39.8 _____ _____ -60 _____ Cap. Sp. _____ $39.8 NPV = $ ______ Payback period = 2.24 years $39.8 $86.4 Example: Fairways Equipment and Operating Costs Equipment requirements: Ball dispensing machine Ball pick-up vehicle Tractor and accessories $ 2,000 7,000 9,000 $18,000 all depreciable equipment is Class 10, 30% all equipment is expected to have a salvage value of 10% of cost after 6 years. Assume there are no more class 10 assets after the project ends. Balls and buckets $ 3,000 expenditures for balls and baskets are expected to grow to 5% per year Corporate tax rate is 15% Example: Fairways Equipment and Operating Costs (concluded) Operating Costs (annual) Land lease $ 12,000 Water 1,500 Electricity 3,000 Labor 30,000 Seed & fertilizer 2,000 Gasoline 1,500 Maintenance 1,000 Insurance 1,000 Misc. 1,000 $53,000 Working Capital Initial requirement = $3,000 Working capital requirements are expected to grow at 5% per year for the life of the project Example: Fairways Revenues, Depreciation, and Other Costs Projected Revenues Year Buckets Revenues 1 20,000 $60,000 2 20,750 62,250 3 21,500 64,500 4 22,250 66,750 5 23,000 69,000 6 23,750 71,250 Example: Fairways Revenues, Depreciation, and Other Costs (continued) Cost of balls and buckets Year Cost 1 $3,000 2 3,150 3 3,308 4 3,473 5 3,647 6 3,829 Example: Fairways Revenues, Depreciation, and Other Costs (concluded) CCA for the six year life of the project Year Beg. UCC CCA Ending UCC 1 9000 2700 6300 2 15300 4590 10710 3 10710 3213 7497 4 7497 2249 5248 5 5248 1574 3674 6 3674 1102 2572 Example: Fairways Pro Forma Income Statement Year 1 2 3 4 5 6 $60,000 62,250 64,500 66,750 69,000 71,250 3,000 3,150 3,308 3,473 3,647 3,829 Fixed costs 53,000 53,000 53,000 53,000 53,000 53,000 Depreciation 2,700 4,590 3,213 2,249 1,574 EBIT 1,300 1,510 4,979 8,028 10,779 195 227 747 1,204 1,617 1105 1,283 4,232 6,824 9,162 Revenues Variable costs Taxes Net income $ Example: Fairways Projected Increases in NWC Projected increases in net working capital Year Net working capital Increase in NWC 0 3,000 ____ 1 3,150 150 2 3,308 158 3 3,473 165 4 3,647 174 5 3,829 182 6 4,020 ____ Example: Fairways Cash Flows Operating cash flows: Year 0 EBIT $ 0 + Depreciation $ 0 - Taxes $ 0 Operating = cash flow $ 0 1 1,300 2,700 195 3,805 2 1,510 4,590 227 5,873 3 4,979 3,213 747 7,445 4 8,028 2,249 1,204 9,073 5 10,779 1,574 1,617 10,736 6 ______ _____ ______ _______ Example: Fairways Cash Flows (concluded) Total cash flow from assets: - Increases in NWC Capital - spending Total = cash flow 0 $ ______ $18,000 -$_____ 1 3,805 150 0 3,655 2 5,873 158 0 5,715 3 7,445 165 0 7,280 4 9,073 174 0 8,899 5 10,736 182 0 10,554 6 ______ _____ ______ ______ Year 0 Operating cash flow $ Present Value of the Tax Shield on CCA Let: C = total capital cost added to the pool (initial UCC) d = CCA rate for the asset class k = discount rate S = salvage value of asset Tc = corporate tax rate n = asset life in years Notes for Present Value of CCA Tax Shield (CCATS) Example 1: Using CCATS to Evaluate a Cost-Cutting Proposal Consider a $10,000 machine that will reduce pretax operating costs by $3,000 per year over a 5-year period. Assume no changes in net working capital and a scrap value of $1,000 after five years. The equipment is in class 8 with a CCA rate of 20%. The marginal tax rate is 34% and the appropriate discount rate is 10%. (Assume there are other class 8 assets in use after 5 years.) Example 1: Using CCATS to Evaluate a Cost-Cutting Proposal (concluded) Example 2: Straight-line Depreciation and Cost-Cutting Proposal Redo the previous example with straight-one deprecation. Consider a $10,000 machine that will reduce pretax operating costs by $3,000 per year over a 5-year period. Assume no changes in net working capital and a scrap value of $1,000 after five years. For simplicity, assume straight-line depreciation. The marginal tax rate is 34% and the appropriate discount rate is 10%. Example 2: Straight-line Depreciation and Cost-Cutting Proposal (concluded) Example: Setting the Bid Price The Army is seeking bids on Multiple Use Digitizing Devices (MUDDs). The contract calls for 4 units per year for 3 years. Labour and material costs are estimated at $10,000 per MUDD. Production space can be leased for $12,000 per year. The project will require $50,000 in new equipment which is expected to have a salvage value of $10,000 after 3 years. Making MUDDs will require a $10,000 increase in net working capital. Assume a 34% tax rate and a required return of 15%. Use straight-line depreciation. Increases in NWC Capital spending Total = cash flow 0 ______ ______ _______ 1 OCF 0 0 OCF 2 OCF 0 0 OCF 3 OCF ______ ______ OCF + ______ Year 0 Operating cash flow $ Example: Setting the Bid Price (concluded) Evaluating equipment with different economic lives Machine A Machine B Costs $100 $140 Annual Operating Costs $10 $8 Replace Every 2 years Every 3 years Equivalent Annul Cost (EAC) PV(Costs) = EAC*(Annuity Factor) EAC = PV(Costs)/Annuity Factor Example: Equivalent Annual Cost Analysis Two types of batteries are being considered for use in electric golf carts at City Country Club. Burnout brand batteries cost $36, have a useful life of 3 years, will cost $100 per year to keep charged, and have a salvage value of $5. Longlasting brand batteries cost $60 each, have a life of 5 years, will cost $88 per year to keep charged, and have a salvage value of $5. Assume straight-line depreciation. Example: Equivalent Annual Cost Analysis (concluded)