Macro Economics Analysis

advertisement

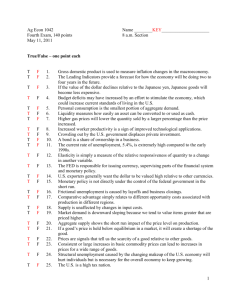

Graph- Essay Section. The business cycle occurs when aggregate demand and aggregate supply fluctuate. In graph 1, the aggregate demand (AD2) and short-run aggregate supply (SAS2) fluctuate but the money wage rate does not adjust quickly enough to keep real GDP at potential GDP. In this case, real GDP is less than potential GDP so this graph´s equilibrium is below full-employment equilibrium. Causing what is called a recessionary gap. Economist has analyze this situation and concluded that to restore real GDP back to potential GDP we may use the help of fiscal and monetary policies. When inflation is low and real GDP is below potential GDP, the Fed takes actions that are designed to help restore full employment. Graph 2, 3 & 4 shows the effects of the Fed’s actions. Graph 2 shows the market for bank reserves, the FOMC lowers the target federal funds rate from 5 percent to 4 percent a year. To achieve the new target, the New York Fed buys securities and increases the supply of reserves of the banking system from RS0 to RS1. With the increased reserves, the banks create deposits by making loans and the supply of money increases. The short-term interest rate falls and the quantity of money demanded increases. In Graph 3, the supply of money increases from MS0 to MS1, the interest rate falls from 5 percent to 4 percent a year, and the quantity of money increases from $3 trillion to $3.1 trillion. The interest rate in the money market and the federal funds rate are kept close to each other by the powerful substitution effect. Graph 4 shows the demand for and supply of real GDP. Potential GDP is $14 trillion, where LAS is located. The short-run aggregate supply curve is SAS, and initially, the aggregate demand curve is AD0. Real GDP is $13 trillion, which is less than potential GDP, so there is a recessionary gap. The Fed is reacting to this recessionary gap. The increase in the supply of loans and the decrease in the real interest rate increase aggregate planned expenditure. A fall in the interest rate lowers the exchange rate, which increases net exports and aggregate planned expenditure. The increase in aggregate government expenditure, "E, increases aggregate demand and shifts the aggregate demand curve rightward to AD0 + "E. A multiplier process begins. The increase in expenditure increases income, which induces an increase in consumption expenditure. Aggregate demand increases further, and the aggregate demand curve eventually shifts rightward to AD1. The new equilibrium is at full employment. Real GDP is equal to potential GDP. The price level rises from 105 to 115 and then becomes stable at that level. So after a one-time adjustment, there is price stability. In this example, the Fed made a perfect hit at achieving full employment and keeping the price level stable. It is unlikely that the Fed would be able to achieve the precision of this example. If the Fed stimulated demand by too little and too late, the economy would experience a recession. And if the Fed hit the gas pedal too hard, it would push the economy from recession to inflation. Documentary Section. Should high level of debt be concern for the U.S. and other developed countries? Why or why not? Even as a first world country, the high level of debt should be a great concern for the United States and all the countries. The governments collects money from income taxes, social security taxes, corporate income taxes and indirect taxes. When the government spends more than it collects, there is a deficit. The U.S. has accumulated all this debt by trade deficits, budget deficits, and savings deficits. Economist know that to help the country lower their debt, they need to make use of fiscal and monetary policies. By imposing fiscal policies such as increasing government expenditures and tax revenues, the country can better the economy by being closer to potential GDP. But sometimes it is not so easy. While implementing monetary policies as the open market operation, sometimes is hard. We know that for us to implement the monetary policies there must be fiscal policies. A country experiencing a high level of debt is a risk because a growing portion of savings would go towards purchases of government debt leading to lower output and incomes and lowering real GDP. If higher marginal tax rates were used to pay rising interest costs, savings would be reduced and work would be discouraged such as the situation in North Korea. Rising interest costs would force reductions in government programs as 100 para los 70 and scholarships. Restrictions to the ability of policymakers to use fiscal policy to respond to economic challenges and an increased risk of a sudden financial crisis such as in Greece.