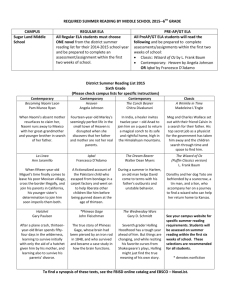

2015-16 Budget Workshop - February 9

advertisement

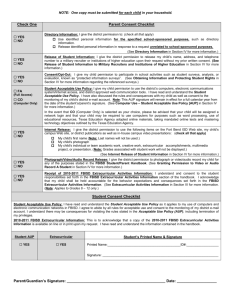

Update on 2014-15 Finances & 2015-2016 Budget Process February 9, 2015 1 BCC Email Legislative/Economic Update Governor’s spending plan Significant revenue growth with competing demands School funding lawsuit Oil prices - Texas likely to grow at slower pace than USA. 2015-16 – need to budget conservatively BCC call for funding improvements: We are always in this mode. 2 Budget and Financial Update Property Value by Year 8.5% Local Value Growth Billions $B $35.0 $30.8 $30.0 $28.3 $24.4 $23.9 $22.9 $23.3 $23.4 $25.0 $26.1 $20.5 $20.0 $18.6 $17.0 $14.3 $15.0 $10.0 $6.9 $8.3 $7.6 $7.8 $9.3 $10.5 $11.8 $15.5 $12.9 $5.0 $0.0 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015E Source: FBISD Finance & Appraisal District 3 FBISD Property Value 2014-15 Total Tax Year 2014 CPTD Value $28.3 Billion Industrial, 4.9% Utilities & Other, 3.2% Commercial, 13.9% Residential, 78.0% Source: Texas Comptroller of Public Accounts 4 State Revenue Estimate-Early Thoughts New Comptroller Hegar presented initial revenue estimate on January 12 The estimate can be modified at any time General revenue above current biennium spending levels of about $18 billion Increased property value provides effective new revenue Estimated price of crude oil ($58.44/BBL - Brent) may influence revisions—average in BRE of $64.50 & $69.27 in 2016 & 2017 © 2015 Moak Casey and Associates 5 State Revenue Estimate Sales Tax biennial growth 8.9% 2014-15 biennium growth estimated at 12.1% Other Major Tax Revenue Natural gas tax down: -8% Oil tax down: -14.3% Motor vehicle sales up: +14.6% Franchise tax down: -1.6% Property Values (Combs projection) 8.64% for 2014 5.71% for 2015 5.30% for 2016 © 2015 Moak Casey and Associates 6 Rainy Day Fund Economic Stabilization Fund (Rainy Day Fund) Allocation may be superseded by 2/3 vote in each house Estimated balance of $8.5 billion ending the current biennium Projected $11 billion balance at end of 2017, after transfers to transportation © 2015 Moak Casey and Associates 7 State Revenue Sources 2014-15 Biennium Severance Taxes 4.6% Franchise Tax 4.5% Motor Vehicle Sales and Rental Taxes 3.9% Motor Fuel 3.1% Other Taxes 5.1% Federal Funds 35.5% Other Receipts 16.0% Interest and Investments 1.0% Sales Taxes 26.2% Source: LBB & FBISD Finance 8 State Appropriations – All Funds Public Safety/Criminal Justice 5.8% The Judiciary .4% Natural Resources 3.4% Regulatory .6% Business & Econ Dvlp / Transportation 13.1% The Legislature .2% Agencies of Education 37.0% General Provisions .2% General Government 2.4% Health and Human Services 36.9% Source: LBB & FBISD Finance 9 Reaction to Proposed State Budgets Appropriations for schools would have declined from current biennium due to property value growth Not a good position when arguing the state’s case in Supreme Court Continues state’s reliance on property tax to fuel the education funding structure Significant formula improvement without increased state cost is a re-run of 2013, just cheaper Still quite a bit of room under the spending limit, and lots of money available © 2015 Moak Casey and Associates 10 Factors that influence State Revenue Enrollment Average Daily Attendance (ADA) Special Services / Weights (WADA) Property Values Free and Reduced Percentages Prior Year Comptroller Values Central Appraisal Dist. Values ARB – Appraisal Review Board Collection Rate Frozen Values Special Education population Career & Technology teacher utilization Source: FBISD Finance 11 Budget and Financial Update Average Student Enrollment 72,317 Projected (0.19% diff) 75,000 73,082 73,000 72,183 70,857 71,000 69,000 67,780 68,507 69,066 68,710 68,964 69,588 66,792 67,000 65,927 65,000 62,657 63,000 61,000 61,011 59,000 57,000 55,000 2004 2006 2008 2010 Source: FBISD Finance & District Demographer Earliest Estimates/Least Likely Scenario 2012 2014 2016E 12 Budget and Financial Update General Fund Revenue Sources Projected 60% 55.3% 54.4% 50% 43.2% 54.1% 52.7% 44.4% 45.7% 44.6% Local 40% State 30% Federal 20% 10% 1.6% 1.2% 1.5% 1.3% 0% 2011-12 Source: FBISD Finance 2012-13 2013-14 2014-15 13 Budget and Financial Update Timing of Budget Development • Essential Campus & Non-Campus Staffing Requests Phase 1 • February • Other Staffing Changes Based on Staffing Guidelines Phase 2 • March • Compensation & Other Requests Based on Session Phase 3 • May/June Source: FBISD Finance 14 Budget and Financial Update 2015-16 Initial Position Request Summary Classification FTEs Salary Elementary 46 12 $638,432 Career and Technical Education 32 $2,024,000 Departments 10 $740,102 Non-General Funded Positions 11 $924,279 Total Position Requests 64 $4,326,813 Source: FBISD Finance 15 Budget Committees Collaborative Budget Process Budget & Compensation Committee Nominated delegates Participation from all campuses and departments Document ideas and set priorities Principals & Directors Teacher Forum Benefits Committee Source: FBISD Finance 16 Critical Dates February 16 Consider Approval of Critical Staffing Recommendations Regular Board Meeting March 23 Review of Compensation and Additional Staffing Changes Board Workshop March 30 Consider Approval of Additional Staffing Recommendations Regular Board Meeting April 13 Board Workshop Source: FBISD Finance Budget and Legislative Update; Review Contract Recommendations; Initial Discussion on Non-staffing Enhancements; Debt Service Update 17 Critical Dates April 20 Consider Approval of Contract Recommendations (Renewals, Non- Regular Board Meeting Renewals, Terminations) May 11 Discussion of Additional Staffing, Compensation, Non-Staffing Enhancements; Action to Call Meeting for the Purpose of Discussing the Proposed Tax Rate and Adoption of the 2015/2016 Budget Board Workshop May 18 Regular Board Meeting Consider Approval of Additional Staffing, Compensation, NonStaffing Enhancements; Review Proposed Budget June 1 Board Workshop June 15 Regular Board Meeting Source: FBISD Finance Public Hearing on Budget and Proposed Tax Rate Budget Adoption 18 Do we need this slide??? Questions??? State Funding Elements Total Cost of Tier I Less: Local Fund Assignment State Share of Tier I Tier II and Other Programs TRS on behalf Total 2013-14 State Allocation Source: FBISD Finance Projected 2013-14 Budget $449,710,824 ($240,390,472) $209,320,352 $12,848,237 $22,100,000 $244,268,589 19