s9w

advertisement

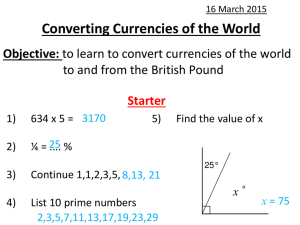

EXCHANGE RATES Examples Floating, creeping, and sinking exchange rates Asian Currency Crisis began in July 1997 with Thai Baht. Jan 1 1997 =100 EXCHANGE RATES Calculation corner Purchasing Power Parity (PPP): is a measure of the relative purchasing power of different currencies. It is measured by the price of the same goods in different countries, translated by the FX rate (or exchange rate) of that country's currency against a "base currency". How to read this table: In this case, the goods is the Big Mac. For example, if a BigMac costs €2.75 in the countries that use Euro and costs $2.65 in US, then the PPP exchange rate would be 2.75/2.65 = 1.0377. If the actual exchange rate is lower, then the BigMac theory says that you should expect the value of the Euro to go up until it reaches the PPP exchange rate. If the actual exchange rate is higher, then the BigMac theory says that you should expect the value of the Euro to go down until it reaches the PPP exchange rate. The Over/Under valuation against the dollar is calculated as: (PPP - Exchange Rate) ---------------------------------Exchange Rate BigMac Price Country United States Argentina Australia Brazil Britain Canada China Euro area in Local Currency $3.10 Peso 7.00 A$3.25 Real6.40 £1.94 C$3.52 Yuan10.50 €2.94 Hong Kong HK$12.00 x 100 Over(+) / Under(-) Valuation against the dollar, % Purchasing Power Price in US dollars Actual Exchange Rate 1 USD = 3.10 2.2562 2.4454 2.9745 3.6446 3.1451 1.3197 3.7225 1.00 3.1026 1.329 2.1516 1.8786‡ 1.1192 7.9566 0.7898 -27.1579 -20.9932 -4.2573 17.415 1.8585 -57.3939 20.5851 2.26 1.05 2.06 0.625 1.14 3.39 0.9524 1.5415 7.7845 -50.2858 3.87 Market vs various parity exchange rates EXCHANGE RATE MANAGEMENT Management of foreign exchange risk arose as a result of the abandonment of fixed exchange rates in 1973 Does not apply to all currencies equally: SOME CURRENCIES IN MANAGED FLOATING MODE, PEGGED TO THE US$ (E.G. Hong Kong$; also until 1997, Singapore$, Thai Baht, Indonesia Rupiah, Malaysia Ringgit) BENEFITS OF FLEXIBLE EXCHANGE RATES AT THE MACRO ECONOMIC LEVEL - better adjustment in trade balance (automatic adjustment of wages) - independent monetary (money supply) policy for each nation PROBLEMS WITH FLEXIBLE EXCHANGE RATES: - introduces major uncertainty (like inflation) into firms' and households' decision processes - causes destabilizing speculation - firms' investment decisions for plant expansion based on export demand and exchange rate in January ---> may not be valid in November when expansion is complete and exchange rate has changed - several ways to cope with these problems (HOWEVER, NO PERFECT SOLUTION EXISTS!) COPING WITH FLUCTUATING EXCHANGE RATES (A) THE SELLER (YOU) ASKS THE BUYER TO PAY IN YOUR HOME CURRENCY many Japanese firms ask for payments in yen ---> not always acceptable to the buyer (Question: who absorbs what kind of risk by doing so?) (B) USE OF FWD FOREIGN EXCHANGE MARKET The exporter (you, a U.S. firm) and a bank agree to exchange set amounts of two currencies at a prescribed rate on a particular future date The bank's profit from a bid-ask spread: (E.g. it will pay US$1.00 to obtain DM2.5 but it will require you to pay DM2.5002 to buy US$1.00) You assume a new risk: if the buyer (in Germany) defaults, the forward contract still forces you to supply the set foreign currency amount to the bank (You may have to buy it in the future spot ex. market at an unknown price) ---> Also, forward markets typically limited to up to 1 year and the currencies in large circulation (C) SPOT-FORWARD SWAPS (A TYPE OF FWD) The trader (you) buys (sells) foreign currency on the spot market while simultaneously selling (buying) foreign currency on the forward market, hence reversing the original exchange NOW---> YOU MUST PAY X POUNDS TO SUPPLIERS IN U.K. IN 90 DAYS---> YOU GET PAID Y POUNDS FOR FINAL PRODUCTS -----> BUY POUNDS NOW ON THE SPOT USING C$ SELL POUNDS FOR C$ IN THE FORWARD -you also assume default risk (D) OTHER METHODS: currency futures, currency options,.. Generally contract length limited (less than a year) (E) Foreign Direct Investment (FDI) -reduces daily exposure to foreign exchange risk -exchange rate problem remains at consolidation -opportunity for tax maneuvering (manipulate transfer prices) EXCHANGE RATE: THEORIES FOR FORECASTING THE DEMAND (+) FOR AND SUPPLY (-) OF C$ RELATIVE TO US$ DETERMINE THE EXCHANGE RATE: C$ PER US$ FUNDAMENTAL FACTORS AFFECTING THE DEMAND FOR AND THE SUPPLY OF CANADIAN DOLLARS: CANADIAN EXPORTS TO U.S. ----> D (+) CANADIAN IMPORTS FROM U.S. ---> S (+) CANADA'S FDI IN U.S. -----> D (?) S(?) U.S. FDI IN CANADA -------> D (?) S(?) SPECULATION ---------------> D (?) S (?) OTHER FACTORS GIVEN BY THEORIES: (1)PURCHASING POWER PARITY (PPP) The law of one price ----> Price of a basket of goods and services P(US)=100 US$, P(CAN)=140 CAN$ P(US) = EXCHANGE RATE (US$ / CAN$ ) P(CAN) ------> EX(US$ / CAN$ ) = (100/140) (2)INTEREST RATE EFFECTS Recall that a country's nominal interest rate is the sum of real interest rate and inflation rate. (Fisher Effect.) International Fisher Effect predicts that: if nominal interest rates are higher in the U.S. than in Japan, the value of US$ in terms of Japanese Yen will fall in the future by that interest-rate differential. Low inflation in Japan relative to the U.S. -->US$ is expected to be weaker against the Japanese yen.