Factors Effecting Students and Credit Cards

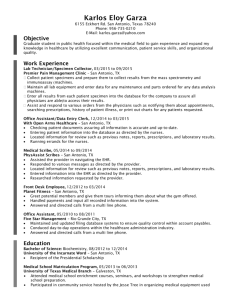

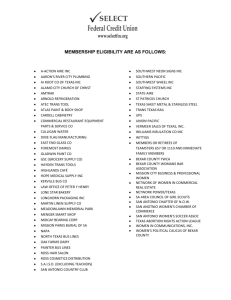

advertisement

Factors Influencing Students’ Selection of Credit Cards: Some Initial Results Charles Blankson University of North Texas, Denton, Texas Sylvia J. Long-Tolbert University of Toledo, Toledo, Ohio 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Presentation • • • • • Rationale for the study Research aim Methodology: 5 steps in scale development Results and Discussion Managerial contributions 2006 AMS Annual Conference, May 24-27, San Antonio, Texas American students 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Rationale for the study • Importance of consumers’ selection/choice criteria in the changing competitive financial services (banking) sector (Lewis, 1982; Thwaites and Verre, 1995; Devlin, 2002). 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Rationale for the study contd. • Difficulties in attracting and maintaining college students and the youth population (Lewis, 1982a). • Bank advertising and promotions have little effect upon college students’ choice criteria (Lewis, 1982b). 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Rationale for the study contd. • Some 82% of US college students own at least one credit card (Roberts and Jones, 2001). • The subject of the criteria/factors used by college students in selecting credits card brands is important in the banking services sector. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Rationale for the study contd. • “…it is of little use for an organization to attempt to position and differentiate an offering by emphasizing particular attribute(s) that do not constitute significant choice/selection criteria in the target market…” (Devlin, 2002, pp.276). 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Research Aim • To develop a scale that measures college students’ decision criteria (selection) when evaluating and/or choosing a credit card brand. • Note: This study does not deal with the debate about (a) students’ credit card debt and (b) credit card companies’ ethical behavior on college campuses. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Research Objectives • To generate a pool of items or statements which college students employ in their evaluation and/or selection of credit card brands and • To synthesize and then reduce these statements/items into key determining factors explaining or underpinning college students’ selection of credit card brands. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Methodology: Initial generation of statements (step 1) • Pre-notification announcements in class rooms. • Focus group sessions: – Involving a convenience sample of 70 undergraduate and graduate business students (4 batches of 15 undergrads and one batch of 10 evening MBA students at GVSU) – vocabulary about the descriptions of their evaluation criteria and rationale for their selection of their credit card brands. • Qualitative analysis was conducted via the inductive reasoning approach (Brady and Cronin, 2001): – 80 statements/items were identified. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Deletion of duplicate statements (step 2) • Examination of the 80 statements was via the inductive reasoning – resulted in the retention of 43 statements/items. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Initial collection of perceptions (step 3) • The 43 items formed the questionnaire and was pre-tested among a convenience sample of 40 undergrad and 14 MBA students from GVSU (Parasuraman, Zeithaml, Berry, 1988). • Finally, a self-administered survey was carried out in class rooms using a convenience sample of 600 students from GVSU, Cornerstone university and Drexel university. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Initial collection of perceptions (step 3 contd.) • The 43 statements (questionnaire) were measured on a 7 – point Likert scale (1 = not important at all and 7 = very important). • Out of the 600 questionnaires distributed in class rooms, a total of 338 were received, yielding a 56% response rate. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Scale development (step 4) • The underlying structure of the data was explored via EFA (DeVellis, 1991; Churchill, 1997; Fabrigar et al., 1999). • Considerable degree of inter-factor correlation. • The Bartlett test of Sphericity (Approx. Chi-square = 18063.571; df = 1275; sig. 0.000) and • KMO measure of Sampling Adequacy Index (0.917) confirmed the appropriateness of the data for EFA. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Scale development (step 4 contd.) • Principal component analysis was employed to reduce the number of factors using the 50% cut-off criteria. • 9 factors were extracted and accounted for 61% of the variance. • Examination of the communality column further showed evidence of the overall significance of the solution extracted. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Scale development (step 4 contd.) • The oblique (Oblimin) rotation was applied to the data. • The factor loading for the common factors was subjected to the 0.5 absolute value (Hair et al., 1998). • Internal reliability was assessed via the Cronbach Alpha ά. • All factors exceeded the adopted criteria. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Identification of the main factors (step 5) • Following: – Examination of the EFA results, – Analysis of the internal reliability, – Conceptual coherency of the indicated factors…. Four factors emerged and were named (Parasuraman, Zeithaml, Berry, 1988; Spector, 1992). 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Internal consistency of revised structure • Factor 1 (Buying power) – – – – – Good when traveling For shopping To order from catalogs Easier than writing checks Gives extra buying power ά Value = 0.8467 • Factor 2 (Incentives) – Cash back bonuses – Cash back at the end of th year – Gain points for using card – Pays you to use it – Receive discounts on purchases ά Value = 0.8570 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Internal consistency of revised structure contd. • Factor 3 (Firm’s Reputation) – – – – – Friendly staff Competence Good customer service Good service provision Reputation of the organization – Quick service Consistency • Factor 4 (Enhance good credit) – To establish good credit – To obtain credit – ά Value = 0.7574 ά Value = 0.8603 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Results and Discussion • This study has attempted the development of a scale measuring factors influencing students’ selection of credit cards. • Buying power = confidence in purchases that the usage of the card and/or affiliation with the card organization brings to the consumer. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Discussion contd. • Incentives = issues about enticement and “perks” used by organizations to woo or attract customers to obtain and use a card. • Firms’ reputation = a card organization’s reputation regarding good service provision, consistency, competence and friendly staff. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Discussion contd. • Enhance good credit = the benefits of establishing credit history from the usage of the card. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Managerial contributions • The results could be useful for managers and advertising executives involved with students’/youth credit card accounts. • Employ the four factors to reflect marketing strategies or tactics (e.g., services marketing mix, relationship marketing): – To change consumers’ attitudes about a card brand, – To change the card brand’s image and – Pursue these strategies in proactive manner to preempt the competition. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Managerial contributions contd. • While “financial security” and “enhance good credit” may be pursued by all card organizations, • we infer that “incentives” and “firm’s reputation” are crucial factors/strategies capable of differentiating and/or positioning a card brand. 2006 AMS Annual Conference, May 24-27, San Antonio, Texas Thank you 2006 AMS Annual Conference, May 24-27, San Antonio, Texas