to the Year End Processing Guide Review for

advertisement

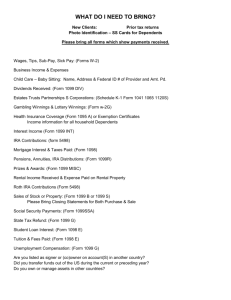

Welcome! to the Year End Processing Guide Review for Online Credit Unions Presented by the Client Service & Education Team Host: Ellie Barton Harding ~ Education Coordinator Year End Processing Guide Review Year End Processing Guide Review For your convenience, our detailed 2014 Year End Processing guide is available on our website. To access the guide: http://cunorthwest.com/end-ofyear/ Reference tab End of Year What’s New for 2014? IRS has announced new HSA limits for 2015. If your statement print vendor is not The Masters Touch and you would like to use substitute 1099-INT forms, call your vendor to verify whether they can process substitute 1099-INTs. Private Mortgage Insurance (PMI) premiums are no longer reported and will not appear on the 1098 form. See Page 27 for more information. Due to year-end dates, Beginning-of-Year/Tax File Verification reports should be reviewed on January 2 to ensure all deadlines are met. See Page 39. When generating 1099-INT/substitute 1099-INT forms, we will now ignore the “Report dividends to IRS” flag on IRA and HSA products since those dividends are not reportable. When closing the general ledger for year-end, you are no longer required to move the “Current processing year/month” back to Dec 2014 from Jan 2015 in order to post the year-end journal entry generated during Step 4. See page 43 for more information. Page 4 Other Reminders Verify dividend rate changes Important – Assign year-end tasks as soon as possible so deadlines on pages 6 and 7 of this booklet are met. Don’t forget to enter Mortgage Insurance Premium data prior to year end!! Deadlines refer to 8 p.m. EST on the deadline day. Ascensus-administered IRA programs – Credit Union’s must notify Ascensus with instructions. Page 4-5 Other Reminders cont’d No need to call!! CU*Base Alerts will be sent when transmission of data is completed. IRA/HSA balance file verification – Set aside time during the first week in January. Don’t wait until after year end! We recommend monthly or at least quarterly verifications. In-house eDOC server – Please review the detailed instructions on page 5 for archival of your tax forms. Page 5 2014 Task Checklist Remember this checklist is for many teams in your organization! We recommend sharing this timeline with the everyone involved in any of these processes. Page 6 -7 Tax Form Information Tax form quick reference section Alternate Addresses – printed on tax forms/member names come from Master record DBA Names – never printed on tax forms Tax form pricing See pricing information in booklet. Blank forms – www.irs.gov. Archival forms on CD – pricing in booklet. Page 8-9 When Using Member Statements as Substitute 1099-INTs Deadline! Complete CU*Base Tax Instructions Screen – Deadline passed 11/21/14 Statement Message Instructions – 12/5/2014 Page 10 Statement Message Instructions –When Using Member Statements as Substitute 1099-INTs Printing Costs - detailed information regarding the printing of substitute 1099-INT information on member statements can be found on the bottom of page 10 Page 10 Statement Message Instructions –When Using Member Statements as Substitute 1099-INTs Points to remember Remember that IRS regulations prohibit the use of any marketing-related messages on the statements. Either clear all messages or insert generic text ONLY about the substitute 1099-INT. See page 13 for more details. If using a Statement Printer other than The Masters Touch– verify they can process substitute 1099-INT forms. Page 11 Envelope Requirements – When Using Member Statements as Substitute 1099-INT’s Must be marked “Important Tax Information Enclosed”. The Masters Touch Clients – instruction insert and envelope notation will be handled for you. Pricing can be found on Page 9. CU’s that use a different statement processor will need to contact the statement vendor directly. Page 11 Statements – When Using Member Statements as Substitute 1099-INT’s 1099’s are generated by Account Number. Members with two separate memberships using the same SSN will receive a separate 1099 for each membership. Generated for “Active Accounts” and accounts that were closed accounts during the final statement period. Will be printed for every member even those with $0.00. Page 11 Information on the statement– When Using Member Statements as Substitute 1099-INT’s Substitute 1099’s - applies to substitute 1099–INTs only! (Not 1098 or any other 1099 information) Information must all print on the same page of the statement If the entire form does not fit on the last page of the statement, another page will be generated for that membership. Page11 For Credit Unions Offering E-Statements – When Using Member Statements as substitute 1099-INT’s You will need to make sure that members understand: They will not receive any forms in the mail. They must view their year-end statement through online banking in order to see the 1099-INT information. See page 14 for details. Page 11-12 2014 Conversions If your credit union “converted” to CU*Base during 2014, you may NOT use your year-end statements as substitute 1099-INTs. Page 12 Need More Information? Please refer to the IRS Publication 1179 “General Rules and Specifications For Substitute Forms 1096, 1098, 1099, 5498, W2-G and 1042-S.” www.irs.gov Page 12 Special Instructions for CU’s Offering E-Statements Deadline! Preliminary Alert Message – November or December Modify e-statement notification message for December during December Page 14-15 Messages – For CU’s Offering E-Statements If your Credit union offers E-Statements Suggested messages and detailed information An Alert Message should also be added to your website. Modify e-statement notification messages before month-end Page 14-15 Information for recipient – taken from the back of a standard 1099-INT form This sample PDF was taken from: http://irs.gov/pub/irspdf/f1099int.pdf The Masters Touch uses this same text for the instructions that will be inserted with your statements Page 16 End of Year Statement Audits If your credit union uses The Masters Touch for your statements and has an Audit Run planned Special envelopes must be ordered Contact the Masters Touch no later than 12/12/14 509-326-7475 Insert Due Date is earlier than normal – 12/27/14 Page 19 Setting 2015 Holidays Configure your credit union business days Using the standard Federal Holidays or Update/Customize your business days Updates are performed MNCNFD #23 Please do not change the processing days without contacting CU*Answers Page 20 Verifying Loan Categories Deadline! Before December 12th Page 21 Verifying Loan Categories Loan Category Configuration! Mortgage and equity loan categories must have the “Send 1098 tax form” field checked Before changing loan category configurations – contact the Client Service Team Page 21-24 Verifying Loan Categories 1098 forms are not generated for less than $600.00 Your CU can choose to send a form for amounts under $600.00 – operations@cuanswers.com Exception: Student Loan Categories Do not check the 1098 flag on these categories Student Loan Categories have a Process Type of “P” which will cause a 1098-E to generate. Page 21-24 Verifying Loan Categories cont. Run the Loan Category Configuration Report – MNCNFX #18 1098 Reporting for Rewritten loans Must report interest & points paid on mortgages totaling greater than $600.00 To combine your YTD Interest Paid you need to update the loan(s) using MNUPDT #2 For Mortgage Points and More – see page 27 Page 22-24 Updating Tax File Data Deadline! If using Substitute 1099-INTs – 12/31/14 If not – 01/06/15 Page 25 Updating Tax File Data – cont. Print a final copy of the 1099/1098 Tax Information Report after all changes are made - MNRPTF #1 If you make changes after your tax file deadlines corrected paper forms must be generated by the credit union and sent to the member Updates to the member’s tax file are performed using MNUPDT #18 Refer to page 53 to learn more about the tax file Page 25-29 Updating Tax File Data cont Page 26 – Screen shots detailing the property tax paid field Page 27 - Special Note – IRS Regulations for 2014 result in removing PMI premiums from the 1098 forms We have changed the 1098 vendor print file so vendors can choose to print ‘Property Tax Paid’ – Included for Sage Direct forms. If using other vendors, updated files have been sent, please contact those vendors for details on their plans. Page 25-29 Verifying Share & Certificates Products – for 1099-INT Reporting Deadline! 12/12/2014 Page 30 Verifying Share & Certificates Products - cont. Printing reports for this process can be done on MNCNFX # 16 & 17 You will be verifying the flag ‘Report Dividends to IRS’ Important! – If settings are incorrect, an additional fee will be charged for additional runs of your forms! For Credit Union memberships – update the Foreign Citizen Flag and Dividend Post Code Page 30-32 Verifying A/P Vendors – for IRS Reporting Deadline! Perform before 12/12/2014 – Verify the setting of the ‘Create a form 1099-MISC year end’ flag. Between 1/1/2015 – 1/6/2015 – Verify the amount shown in the Pageyear 33 - 34 ‘Previous 1099-MISC amount’ field Verifying A/P Vendors - cont. Verify the Account Payable vendor records Verify the setting of the ‘Create a form 1099MISC year end’ flag. Verify the amount shown in the ‘Previous year 1099-MISC amount’ Page 33-35 Month-End Verifications Deadline! After End-of-Year Processing for 12/31/2014 Perform your monthly verification of member data for share and certificate dividends, loan interest, fee postings and other misc. monthly verifications Refer to the separate Month-End Processing Verification Booklet Page 36 Month-End Verifications - if your rates will change at Year-End Making changes to your Savings or Checking rates? Plan to review any changes made the morning after they are scheduled Run the Share Dividend Configuration Report from MNCNFX #17 Rate changes occur during end-of-day processing Page 36 Annual Statement Preparation Deadline! 12/5/14 – update your statement message! 12/27/14 – inserts delivered to The Masters Touch Page 37 Annual Statement Preparations – cont. Remember that ALL member will receive a statement regardless of activity! As a result, your total page count for statements will be higher at year-end Page 37-38 Beginning of Year – Tax File Verification Reports Important! Review your Beginning of Year Tax File reports on January 2 Reports are generated on January 1 and archived in CU*SPY under ‘End of Month’ category Page 39 - 40 Fair Market Value for IRA’s to Members & the IRS If your credit union is Ascensus-Administered and has also made arrangements for Ascensus to provide duplicate Fair Market Value to your members, CU*Answers will send this file after January 6, 2015 If your CU is self-administered, the Fair Market Value will be reported on your Y/E members statements Page 41 Updating the IRA and HSA Balance File Limits If your member has an existing IRA or HSA at end of this year, CU*NorthWest will automatically create the 2014 balance file and set limits as published by the IRS If you have members with special limits, you can maintain them anytime during January New limits for HSA’s for 2014 Manual adjustments for special circumstances can be done after Year-end. Page 42 General Ledger Year-End Closing Instructions If your CU wishes to perform this process, steps are detailed on pages 43-48 If your CU would like CU*Answers to close your books for you, contact SRS Bookkeeping Services at ext. 277 Page 43 - 48 Verify the IRA/HSA Balance File Deadline! 1099 Distributions 1/6/2015 5498 Contributions 4/15 – 4/18 Page 49-53 Verifying the IRA/HSA Balance File – cont. Verification should already be taking place – Monthly or Quarterly Verify using reports generated in MNRPTF #9 Update records: In MNUPDT #16 – ‘Update IRA/HSA Trans Post Codes’ Or #17 –’ Update IRA Balance Information’ And #19 ‘Update IRA Beneficiary Info’, > F15 Distributions. Page 49-53 Verifying the IRA/HSA Balance File – cont. Please review this section as some information will need manual input. Run another report for your records after all updates Special note to Credit Unions Converted During 2014 IRA Balance File is what is reported for members Page 49-53 Verify the Tax file and printing the 1099/1098 Tax Info Report Deadline! Prior to Printing1/6/2015 Prior to reporting 02/7/2015 Page 54 - 56 The Tax file and printing the 1099/1098 Tax info Reports Your credit union is responsible for reviewing the accuracy of the data that will be used to produce forms and report to the IRS. Print the 1099/1098 Tax Info Reports from MNRPTF #1 & #2 Page 54-56 Ascensus Administered – 1099-R/1099-SA and 5498/5498-SA, ESA Deadline! 1099-R/1099-SA reported after 1/6/2015 5498/5498-SA final changes between 4/15 – 4/18 All 5498 reporting to IRS by 6/2/2015 Page 57 - 58 Ascensus Administered – 1099-R/1099-SA -cont. 1099-R and 1099-SA Instructions are on page 57 If your CU’s IRA or HSA programs are administered by Ascensus, you can choose to have CU*NorthWest report the 1099-R distribution data 1099-Q information for **(Coverdell Education IRA’s cannot be submitted to Ascensus via a file!) Run the 1099/1098 Tax Information Report using MNRPTF #1 Page 57 Ascensus Administered – 5498/5498SA, ESA – cont. 5498/5498-SA page 58 Run the ‘IRA Govt./ Report / 5498 – MNRPTF #7’ Updates are performed MNUPDT #16 and #17 Final adjustments for IRA and HSA Balance Files must be done before 04/18/2015 Page 58 Self Administered 5498/5498 SA, ESA Deadline! 5498/5498-SA final changes between 4/15 – 4/18 All 5498 reporting to IRS by 6/2/2015 Page 59 Self Administered 5498/5498SA, ESA– cont. Verify IRA contributions using MNRPTF #7 Updates are performed using MNUPDT # 16 and #17 Remember members have until April 15th. 2014 to make contributions for 2014! Final adjustments to the IRA and HSA Balance file must be done before April 18th, 2015 Page 59 Questions? 2014 Year-End Processing Guide – for Online Credit Unions http://cunorthwest.com/end-of-year/ Thank you for attending our Year-End Guide Review! Presented by: Client Service and Education Team