on How To Do Business in the Philippines

advertisement

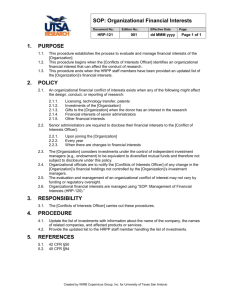

Frequently Asked Questions (FAQs) on How To Do Business in the Philippines 1. What are the possible modes of entry in setting up business operations in the Philippines? You may choose to set up your business under the following options: 2. single proprietorship partnership corporation branch office representative office regional headquarters and regional operating headquarters Where does one apply for registration of investments? You may go online at http://www.bnrs.dti.gov.ph to know the requirements and register your business name. http://www.bnrs.dti.gov.ph For additional info, you may log on to www.dti.gov.ph or www.business.gov.ph a. For Corporations/Partnerships, Branch and Representative Offices – You may log on to www.sec.gov.ph for details. b. For Regional Headquarters and Regional Operating Headquarters - Submit application form together with required documents at the Board of Investments (see contact details below). Board of Investments (BOI) Project Evaluation and Registration Department Industry and Investments Building 385 Sen. Gil Puyat Avenue Makati City Metro Manila Tel. : (632)895-3997 E-mail: perd@boi.gov.ph 3. Can a foreign investor be allowed to invest up to 100% of its capital in a domestic enterprise? Yes, foreign investors are allowed to invest 100% in a domestic enterprise under the following conditions: Investments are made in areas listed under the Foreign Investments Act (FIA) except those marked in the Regular Foreign Investment Negative List (FINL); If the investor has a paid-up capital of at least US$200,000.00, which may be trimmed down to US$100,000 provided the venture introduces cutting-edge technology or employs at least 50 direct personnel; If product/service being engaged is earmarked for exports. What are the areas of investments covered by the Foreign Investments Act (FIA)? The FIA covers all investment areas, except banking and other financial institutions, which are governed and regulated by the Bangko Sentral ng Pilipinas (BSP). The Foreign Investment Negative List covers areas of economic activity whose foreign ownership is limited to a maximum of forty percent (40%) of the outstanding capital stock in the case of a corporation or capital in the case of partnership. For detailed listing, you may access the FIA at www.gov.ph/laws/ra8179.pdf. 4. How can my business avail of tax incentives from government? To avail of tax incentives, enterprises must be registered with the appropriate Investment Promotion Agency (IPA) depending upon the location of the project. a. For projects outside the Economic or Freeport Zones Board of Investments (BOI) b. For projects located in Economic or Freeport Zones, these are the options: Cagayan Economic Zone Authority (CEZA) Clark Development Authority (CDC) Phividec (Philippine Veterans Investment Development Corp.) Industrial Authority (PIA) PHIVIDEC Philippine Economic Zone Authority (PEZA) Subic Bay Metropolitan Authority (SBMA) Zamboanga Economic Zone Authority (ZEZA) 5. I would like to know more about the Board of Investments (BOI) and Philippine Economic Zone Authority (PEZA) and its respective criteria for registration? Board of Investments (BOI) The BOI is the lead agency of the Department of Trade and Industry (DTI) in promoting investments in the Philippines. It offers total investments solutions as it supplies knowledgebased market information and analyzes business feasibilities. The BOI handholds business concerns and links them to essential chains of service where it matches prospective investors with local and foreign business entities. When it profiles industries for up-to-date developments, it also ensures that registered enterprises are nurtured for their prospective expansion and diversification. To qualify for registration with the BOI, the proposed activity is listed among preferred sectors in the current Investments Priorities Plan (IPP). For more details, you may log on to www.boi.gov.ph. Philippine Economic Zone Authority (PEZA) PEZA, an investment promotion agency attached to the Department of Trade and Industry, manages areas declared as economic zones to foreign investors. In addition, PEZA grants fiscal and non-fiscal incentives to locators, producers, service providers and developers within these economic zones as mandated by the Special Economic Zone Act of 1995. Specifically, enterprises that could qualify for registration with PEZA are those that will manufacture and export 100% of their production/services. Permission has to be sought if the enterprise located within the zone will export below the prescribed 100% level. In feasible instances, PEZA has allowed entry of 30% of total production into the domestic market. For additional information, you may log on to www.peza.gov.ph. 6. What incentives are available to registered enterprises? The composition of incentives offered is both fiscal or non-fiscal such as income tax holidays, wage-based deductions from taxable income and/or infrastructure, exemption from duties or grant of tax credits from certain importation, easement from wharf dues and export taxes, employment of foreign nationals, etc. For details, you may log on to www.boi.gov.ph or www.peza.gov.ph Other Incentives Programs offered by other IPAs Also, there are varied site-specific incentives extended by other investment-related governing agencies. For additional details you may log on to these sites: www.sbma.com www.clark.com.ph www.ceza.gov.ph www.zambofreeport.com.ph 7. What activities do Regional Headquarters (RHQ))/Regional Operating Headquarters (ROHQ) engage in and its list of incentives? The activities of the RHQ are limited to acting as a supervisory, communications and coordinating center for its subsidiaries affiliates and branches in the region. It is neither allowed to derive any income from sources in the Philippines and to participate in any manner in the management of any subsidiary or branch office it might have in the Philippines nor to solicit or market goods and services whether on behalf of its mother company or its branches, affiliates, subsidiaries or any other company. The law that governs this industry is Republic Act 8756. For full text of this law, you may log on to: http://www.congress.gov.ph/download/ra_11/RA08756.pdf 8. What are the basic rights and guarantees given for the safety of foreign investments? All investors and enterprises are entitled to the basic rights and guarantees provided in the Philippine Constitution, such as the right to repatriation of investments, remittance of earnings, foreign loans and contracts, freedom from expropriation and non-requisition of investment. 9. How does a company remit its profits and dividends and repatriate capital abroad? Enterprises may remit profits and dividends or repatriate its capital abroad thru remittances with the Bangko Sentral ng Pilipinas (BSP) after registration with the SEC or BTRCP. For this purpose, BSP rules and regulations covering procedures for registration of foreign investments are observed. 10. What are the investment rights of a former natural born Filipino? The Foreign Investments Act (FIA) recognizes the rights of former natural born Filipinos. They are granted same investment rights as Filipino citizens in activities such as cooperatives, thrifts banks and private development banks, rural banks and financing companies. In addition, under Section 1 of the FIA as amended by RA 8179 provides that any natural born citizen who has lost his citizenship, and who has legal capacity to enter into a contract under Philippine laws may be a transferee of a private land to be used by him for business or other purposes up to a maximum area of five thousand (5,000) square meters in the case of urban land or three (3) hectares in the case of rural land. See the Foreign Investments Act (FIA) for details: www.gov.ph/laws/ra8179.pdf 11. As an investor, what visa can be issued to me? The Special Investor Resident Visa (SIRV) entitles the holder to reside in the Philippines for an indefinite period as long as his investment continues to operate. The SIRV is issued in coordination with the BOI (www.boi.gov.ph) and the Bureau of Immigration (www.immigration.gov.ph). For more details on the allowable forms of investments, criteria for granting SIRV, log on to their respective websites. Entry Visa Foreign nationals come to the Philippines for reasons of business, pleasure or health with a temporary visitor’s visa. This visa allows them to stay for a period of 59 days, extendable for a maximum of one year. Visitors who may wish to extend their stay must register with the Bureau of Immigration or with the office of the municipal or city treasurer in areas outside Manila. Executive Order No. 408 allows for foreign nationals, except those of specifically restricted nationalities, to stay in the Philippines for up to 21 days without a visa. Work Permits In general, a foreign national seeking employment in the Philippines, whether resident or nonresident, needs to an Alien Employment Permit (AEP) from the Department of Labor and Employment (DOLE). For more details, you may log on to www.ble.dole.gov.ph. Special Resident Retiree Visa (SRRV) The SRRV is issued by the Philippine Retirement Authority (PRA). Its primary role is to promote and grant the SRRVs to would-be retirees, and to offer a range of services, benefits, and comfort that would make their stay worthwhile. For more details, you may log on to www.pra.gov.ph. Treaty Traders Visa (applicable only to Japanese, Germans and Americans) This visa is issued to abovementioned nationalities based on certain criteria. For more information, you may log on to www.immigration.gov.ph. .