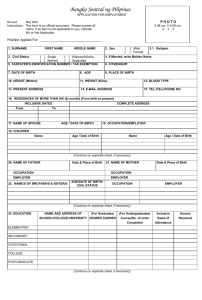

Nacpil-english

advertisement

The Government of the Bangko Sentral ng Philippines Pilipinas Republic of the PHILIPPINE EXTERNAL DEBT: An Update DIWA C. GUINIGUNDO Assistant Governor Monetary Policy Sub-Sector Bangko Sentral ng Pilipinas 25 April 2005 Bangko Sentral ng Pilipinas What is the general policy on foreign borrowings? BSP Circular No. 1389 (1993) provides that all foreign currency loans shall be regulated by the BSP with the view to manage debt service requirements.* *Pursuant to Philippine Constitution and Foreign Borrowings Act (R.A. 4860) 2 Bangko Sentral ng Pilipinas What loans are covered by the BSP approval system? All foreign borrowings of the public sector Private sector loans if: Guaranteed by government corporations and/or government financial institutions, and covered by foreign exchange guarantees issued by local commercial banks; Intended for relending to public or private sector enterprise for loans obtained by private commercial banks with maturities of more than 1 year; and Foreign exchange to service the debt will be purchased from the banking system. 3 Bangko Sentral ng Pilipinas What mechanism does the BSP employ to manage the level of external debt? Regulatory issues (e.g., circular, circular letters) Administrative mechanism (approval and registration process, reporting and monitoring system) Approve debt reduction schemes Debt refinancing/restructuring 4 Bangko Sentral ng Pilipinas RECENT DEVELOPMENTS 5 Bangko Sentral ng Pilipinas Total external debt remains manageable As of endDecember 2004, total external debt has declined. 2001 2002 2003 2004 Total Debt (US$ billion) 51.90 53.65 57.40 54.85 Growth (%) 1.35 3.37 6.99 -4.44 in US$ billion 70.00 On average, short-term debt accounts for only about 10% of total debt. Medium-term Short-term 60.00 50.00 6.18 5.05 48.09 51.22 49.80 2002 2003 2004 6.00 5.56 45.90 2001 40.00 30.00 20.00 10.00 0.00 6 Bangko Sentral ng Pilipinas No bunching of external debt maturities MLT debt is well spread out based on original maturity. MLT debt of the public sector even longer. Weighted Average Maturity for Medium- to Long-term Debt (in years) 2002 2003 2004 Total 16.5 17.2 17.4 Public 19.1 19.4 19.6 Private 10.5 11.0 10.9 7 Bangko Sentral ng Pilipinas Interest Rate Profile of MLT/ST Debt (% share to Total External Debt) (as of end-2004) Variable Rate 31.9% Short-Term Rate 9.2% Fixed Rate 55.6% Non-Interest Bearing 3.3% Note: Variable, Fixed and Non-Interest bearing rate profile refer to MLT debt 8 Bangko Sentral ng Pilipinas External Debt By Borrower Public sector accounts for bulk of total external debt. Percent Share to Total (%) 2001 2002 2003 2004 Public 64.35 66.24 68.82 69.10 38.55 41.71 45.49 46.85 35.65 33.76 31.18 30.90 of w/c: NG Private in US$ billion 70.00 60.00 Public Sector 50.00 40.00 Private Sector 17.90 16.95 35.54 39.50 37.90 2002 2003 2004 18.50 18.11 33.40 2001 30.00 20.00 10.00 0.00 9 Bangko Sentral ng Pilipinas External Debt By Borrower and Creditor (as of end-December 2004) Levels (in US$ million) Total Total Public Sector Of w/c: NG Percent share to total (%) Private Sector Total Public Sector Private Sector 54,846 37,895 25,693 16,951 100.0 69.1 30.9 8,440 7,939 4,790 501 15.4 14.5 0.9 Bilateral 16,800 13,900 9,935 2,901 30.6 25.3 5.3 Banks & Fis 11,175 3,627 940 7,548 20.4 6.6 13.8 2,041 47 9 1,993 3.7 0.1 3.6 15,839 12,374 10,019 3,465 28.9 22.6 6.3 551 8 - 543 1.0 0.0 1.0 Multilateral Suppliers/ Exporters Bondholders/ Noteholders Others 10 Bangko Sentral ng Pilipinas External Debt by Currency On average, more than half of the country’s external debt is in US dollars External debt of the public sector is denominated largely in Japanese yen and in US dollars. In US$ billion 2001 2002 2003 2004 US dollar 29.6 29.2 30.9 28.1 Japanese yen 12.7 14.5 15.9 16.4 Euro 1.0 2.0 2.7 3.2 Others 8.6 8.0 7.9 7.1 Debt By Currency (percent share to total) as of end-Dec 2004 Japanese yen 30.0% Euro 5.9% Others 12.9% US dollars 51.2% 11 Bangko Sentral ng Pilipinas External Debt by Creditor Country Japan and the US are the country’s major creditors In US$ billion 2001 2002 2003 2004 Japan 12.0 12.9 14.5 14.5 US 6.0 6.3 6.2 3.9 Germany 3.5 3.2 2.7 2.7 France 0.7 0.9 0.9 1.4 29.7 30.4 33.1 32.3 Others 1/ 1/ Includes multilateral agencies and bondholders/noteholders Others 59.0% France 2.5% Germany 4.9% Japan 26.5% US 7.1% 12 Bangko Sentral ng Pilipinas Selected Philippine External Debt Ratios In Percent (%) 2001 2002 2003 2004 External debt to GNP 68.27 65.55 67.36 59.15 External debt to GDP 72.88 69.91 72.35 63.46 DSB to exports of goods, receipts from services & Income 15.80 16.41 16.93 a/ 13.82 DSB to GNP 8.63 9.10 9.35 7.79 DSB to GDP 9.22 9.70 10.04 8.35 GIR to Short-term Debt (Residual) 1.44 1.44 1.41 1.57 Starting 2003, income includes cash remittances of OFWs which are reflected under the income account and workers’ remittances of current transfers account. Note: Debt Service Burden (DSB) refer to principal and interest payments a/ 13 Bangko Sentral ng Pilipinas Philippines: External Debt to GDP In percent 80.0 > 70.0 70.0 60.0 63.9 63.5 50.0 40.0 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 14 Bangko Sentral ng Pilipinas Philippines: Debt Service Burden to External Revenue In percent 40.0 30.0 27.2 >25.0 20.0 10.0 13.8 0.0 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 15 Bangko Sentral ng Pilipinas Philippines: GIR to ST debt (remaining maturity) In percent 250.0 200.0 156.5 150.0 > 100.0 100.0 50.0 48.0 0.0 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 16 Bangko Sentral ng Pilipinas EXTERNAL DEBT INDICATORS OF SELECTED COUNTRIES 2004 (in percent) ST/EDT PED/EDT EDT/GNI GIR/ST Philippines 9.2 69.1 59.2 321.6 Indonesia 5.6 60.2 (2003) 77.3 (2003) 463.6 Malaysia 28.0 51.9 (2003) 51.0 (2003) 419.2 Thailand 22.4 32.8 (2003) 38.1 (2003) 435.8 Argentina 38.6 67.6 (2003) 104.9 (2003) 30.9 Brazil 10.8 40.2 (2003) 49.3 (2003) 223.3 Chile 17.6 22.6 51.7 (2003) 207.8 Mexico 13.9 60.7 22.2 (2003) 355.1 EDT – Total External Debt ST – Short- term debt (Orig. Maturity) PED – Public External Debt Sources:National Websites GDP – Gross Domestic Product GNI – Gross National Income GIR – Gross International Reserves 17 Bangko Sentral ng Pilipinas Impact of an increase in global interest rate A 1 percentage point increase in global interest rate would result in: Short-term Medium- & long-term Total Increase in total debt service 50 175 225 Increase in public sector debt service 10 105 115 in US$ million 18 Bangko Sentral ng Pilipinas Website: www.bsp.gov.ph E-mail: bspmail@bsp.gov.ph 19