Tax Facts - O'Grady's Solicitors

advertisement

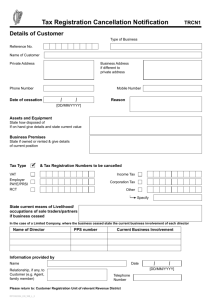

O’GRADYS SOLICITORS Tax Facts 2012 Republic of Ireland O’Gradys, Solicitors, 4th Floor, 8-34 Percy Place, Dublin 4. 1 O’GRADYS SOLICITORS INCOME TAX € € € PERSONAL TAX CREDITS 2011 Change 2012 Single persons 1,650 - 1,650 Married persons/ Civil Partners 3,300 - 3,300 Additional one-parent family 1,650 - 1,650 PAYE 1,830 - 1,650 Age Credit - Single 245 - 245 Age Credit - Married 490 - 490 Home Carer (Max) 810 - 810 Rent tax credit <55/ 55+ Single 320/640 80/160 240/480 <55/55+ Widowed 640/1,280 160/320 480/960 <55/55+ Married 640/1,280 160/320 480/960 - Nil/Nil <55/55+ Available at Top Rate Nil/Nil Blind persons: 1 spouse blind 1,650 - 1,650 Married (both blind) 3,300 - 3,300 825 - 825 Blind persons guide dog allowance Widowed parent: 1st year after year of bereavement 3,600 - 3,600 2nd year after year of bereavement 3,100 - 3,100 3rd year after year of bereavement 2,700 - 2,700 4th year after year of bereavement 2,250 - 2,250 5th year after year of bereavement 1,800 - 1,800 Widowed person without dependent child: 2,190 - 2,190 EXEMPTION LIMITS - 65 YEARS AND OVER: Single/widowed 18,000 - 18,000 Married 36,000 - 36,000 Single/widowed persons 32,800 - 32,800 Married couples, one income 41,800 - 41,800 Married couples, two incomes 65,600 - 65,600 One parent/widowed parent 36,800 - 36,800 STANDARD RATE BANDS 2 O’GRADYS SOLICITORS Contents Chapter Pages 1) Personal Taxes 4-6 2) Employment Taxes 7-9 3) Pension Matters 9 - 10 4) Business Tax 11 - 12 5) Financial Services 13 - 16 6) Property & Construction 17 - 18 7) VAT 19 - 20 8) Capital Taxes 21- 22 9) Research & Development 23 - 24 10) Revenue Powers 25 - 26 11) Stamp Duty 27 - 28 12) Tax Rates & Credits 2012 (Chart) 29 - 30 3 O’GRADYS SOLICITORS 1. Personal Taxes Rent relief Relief for rent credit will be withdrawn on a phased basis over 7 years. DIRT and Deposit Interest Rate of DIRT increased by 3% from 1/Jan/2012. Rates 30% (Deposit accounts) 33% (Certain Life Assurance Policies & Investment Funds) Mortgage Interest Increase to 30% in mortgage interest relief for first time buyer who took out their first mortgage in 2004-2008. For first time buyers who purchase in 2012, mortgage interest relief will be: Years 1 & 2 25% Years 3 - 5 22.5% Years 6 – 7 20% Relief ends after year 7. Non first time buyers: 15% for first 7 years only. No mortgage interest relief will be allowed on mortgages taken out after 31 December 2012. Limits on relievable interest: First Time Buyers Non First Time Buyers Single Married €10,000 €20,000 Single Married €3,000 €6,000 4 O’GRADYS SOLICITORS PRSI contribution, Universal Social Charge Increase in the exemption threshold from €4,004 to €10,036. Employer * Employee** PRSI Universal Social Charge * ** *** **** % 10.75% 4.25% Income No limit If income is €365 p/w or less 4% 2% 4% 7% No limit** Up to €10,037*** €10,037 to €16,016 > €16,016**** Employer PRSI relief on employee pension contributions will be removed from 1January 2012. Employees earning €352 or less p/w are exempt from PRSI. In any week in which an employee is subject to full rate PRSI, the first €127 of weekly earnings is disregarded. Individuals with total income up to €10,036 are not subject to the Universal Social Charge. Reduced rate (4%) applies for persons over 70 and/or with a full medical card. Self-employed PRSI contribution, Universal Social Charge PRSI Universal Social Charge * ** *** % 4% 2% 4% 7% 10% Income No limit* Up to €10,036** €10,037 to €16,016 €16,017 to €100,000 *** > €100,000*** Minimum annual PRSI contribution is €253 Individuals with total income up to €10,036 are not subject to the Universal Social Charge Reduced rates (4% and 7%) apply for persons over 70 and/or with a full medical card. Illness & Injury Benefit The income tax exemption that applied to the first 36 days of annual Illness Benefit and Occupational Injury Benefit has now been removed. Such payments are now taxable from 2012 onwards. Domicile Levy Citizenship has been removed as a requirement for the payment of the domicile levy. The domicile levy will be payable by Irish domiciled individuals: Whose qualifying Irish assets exceed €5m; Whose worldwide income exceeds €1m; and Whose liability to income tax for the relevant year is less than €200,000. 5 O’GRADYS SOLICITORS PRSI on non-employment income of employees From the 1st of January 2013 employees/pensioners will suffer a 4% PRSI liability on nonemployment income. Other Matters Civil Partnerships The Act introduces some minor changes in regard to maintenance relief. Civil Partners will now be placed on the same footing as married persons in certain break-up situations, where both partners continue to live under the same roof. Tax relief on third level fees The tax relief for fees paid for third-level education remains, but the amount to be disregarded in any such claim has increased from €2,000 to €2,250, with pro rata changes for part-time courses. Artist’s exemption The current general Revenue practice of publishing information is placed on a statutory footing in respect of beneficiaries of this tax exemption. Income tax relief for significant buildings and gardens The Act contains a new provision requiring such buildings to be open for public visits during National Heritage week. Age related income tax credit for health insurance premiums No relief is available for those > 60 years old, with graduated amounts of relief for various bands thereafter up to full relief at age 85. Tax relief for charitable donations Rate of tax relief on charitable donations of ‘around 30%’ will replace existing higher and standard rates. The benefit will go to the charity. PAYE and self-assessed taxpayers will no longer be distinguished. Currently a charity is only entitled to this refund for donations by PAYE taxpayers. Self- assessed taxpayers must claim a deduction on their personal tax returns for qualifying donations. An annual limit of €1 million per individual can be taxed relieved. It is anticipated that the specific changes will be formally announced in Budget 2013 and will be effective from the 1st of January 2013. 6 O’GRADYS SOLICITORS 2. Employment Taxes Special Assignee Relief Programme (‘SARP’) A Special Assignee Relief Programme (SARP) is being introduced to reduce the cost to employers of assigning skilled employees from abroad. Its aim is to encourage the relocation of key talent within organisations to Ireland. The new relief is complex. An exemption from income tax on 30% of salary between €75,000 and €500,000 will be provided for employees that are assigned for a minimum of 1 year and a maximum of 5 years. The new SARP regime will only apply for individuals arriving in Ireland in any of the three tax years 2012, 2013, 2014, with effect from 1 January 2012. If an individual qualified under the previous regime in 2011, they cannot qualify for the new regime as it is only applicable to those who arrive in Ireland from 2012. The following criteria have to be met: Must be employees of companies incorporated and tax-resident in a double tax treaty country, or a company resident in a country with which Ireland has a tax information exchange agreement. Does not apply to unincorporated businesses. Employee must have been employed by the employer for 12 months before coming to Ireland and must substantially perform all their duties in Ireland. Employee cannot have been tax-resident in Ireland for 5 years before arriving in Ireland. Employer must certify that the conditions have been met. Employees can recover the cost of a return trip for their family to their home country from their employer tax-free and can have school fee (up to €5,000/child) paid by their employer tax-free. Minimum base salary of €75,000. Foreign Earnings Deduction The Foreign Earnings Deduction (FED) supports Irish employers in managing the cost of sourcing business in emerging business. It applies to Brazil, Russia, India, China and South Africa (BRICS). Deductions are capped at €35,000.It applies to: An Irish resident who has 60 qualifying days working outside Ireland in the BRICS countries in a continuous 12 month period 7 O’GRADYS SOLICITORS Share-based remuneration The Finance Act includes a number of measures designed to clarify the application of PAYE, USC, and PRSI withholdings to share-based remuneration. These include the following: The repayment of the income levy and Universal Social Charge (USC) where shares are forfeited. Removal of the technical double charge to USC on the grant and exercise of SAYE options and former Revenue-approached share options. Confirmation that gains made on the exercise, release, or assignment of a share option are not charged to USC at the additional 3% rate (maximum 10%) where relevant income exceeds €100,000. Where an individual exercises a share option they must pay income tax within 30 days of the date of exercise. Where an individual is due to pay income tax on exercise at the marginal rate of 41%, they must also pay USC at the 7% rate. The current position around the application of tax and PRSI to share-based rewards can be summarised in the following table: Scheme Type Share awards Share option gains Approved Profit Sharing Scheme (APSS) Save As You Earn (SAYE) share option scheme Income tax (41%) Liable under PAYE Liable under selfassessment within 30 days of exercise USC (7%) None Liable under PAYE Employee social security/PRSI (4%) Liable under PAYE Liable under PAYE, unless no longer in employment in which case selfassessment applies Liable under PAYE None Liable under PAYE, unless no longer in employment in which case selfassessment applies Liable under PAYE, unless no longer in employment in which case selfassessment applies Liable under PAYE Liable under selfassessment within 30 days of exercise Revenue Job Assist The Revenue Job Assist scheme provides incentives to both employers and employees in relation to long term unemployed individuals. The scheme allows employers to obtain a deduction for a 3 year period for salaries paid in relation to qualifying employments and also to claim additional tax allowances for a 3 year period. The employee is also entitled to medical card and fuel allowance benefits for a 3 year period. This scheme has now been amended such that individuals signing on for PRSI credits are also eligible to participate in the scheme. 8 O’GRADYS SOLICITORS 3. Pension Matters Deemed Distribution Fund The amount of the deemed distribution fund from an Approved Retirement Fund (‘ARF’) has been increased from 5% to 6% in respect of ARFs held by individuals with asset values over €2m at 30 November in a tax year. A 5% deemed distribution applies to a vested Personal Retirement Savings Account (PRSA) with effect from 1 January 2012 onwards (where the value is less than €2m on 30 November in that tax year). Where the value of vested PRSAs on 30th November in a year is greater than €2m, the 6% rate applies. Employer PRSI relief Employer PRSI relief has been withdrawn from 1 January 2012. Payments and transfers Any payment from an ARF is regarded as a distribution and is therefore taxable as such. The event of the death of an ARF holder is regarded as a distribution. The Finance Act 2012 amends the tax rate that applies on an ARF transfer to a child over 21 years of age from 20% to 30%. Relief on chargeable excess Measures have been introduced to reduce the immediate tax burden arising where an individual retires and their pension fund is in excess of The Standard Fund Threshold of €2.3m. These measures apply to public sector pensions only. At present, a scheme administrator must account for the tax arising on the ‘chargeable excess’ upfront and then seek recompense out of the scheme member’s entitlements. The new proposals will work as follows: The recompense which the scheme administrator can obtain from a pension lump sum is capped at a maximum of 50% of the value of the net lump sum Then the balance if any may be recovered from (i) the annual pension entitlement over a period agreed with the individual up to a 10-year maximum, or (ii) a payment of any outstanding balance by the individual within 3 months from the date that the ‘chargeable excess’ arose to the scheme administrator. A distribution from an ARF or vested PRSA of the individual to fund same shall not be liable to tax as a distribution under ARF rules. Relief has been introduced to allow scheme administrators to claim a credit for some of the tax due on the ‘chargeable excess’ (e.g. where the SFT/PFT is exceeded at retirement). Scheme administrators must now offset the tax charged at the standard rate of income tax on the lump sum against the tax on the ‘chargeable excess’. Where tax (on the lump sum) is unused, it may be carried forward for offset against tax on a future ‘chargeable excess’. 9 O’GRADYS SOLICITORS A credit does not appear to be available for any tax payable at the marginal income tax rate on a pension lump sum (such marginal tax rate applies to the element of a lump sum amount in excess of €575,000). Amendments are effective from 8 February 2012. Private and public sector pensions An opportunity is now being provided to individuals who have a private and public sector pension entitlement to ‘cash in’ their private sector entitlement on a once-off basis. They may encash their private pension rights in whole or in part from age 60 with a view to minimising any ‘chargeable excess’ on retirement. Tax will apply to the encashment of the private pension at the marginal rate of income tax plus the Universal Social Charge at the rate of 4%. The encashment is not then taken into account in calculating the value of the public sector employee’s pension on retirement. Other Matters Employee pension contributions are no longer deductible in computing employee PRSI and the Universal Social Charge liability. The annual earnings cap which determines the maximum tax-deductible pension contribution by employees and self-employed individuals has been reduced to €115,000. An overall lifetime limit of €200,000 has been introduced on the amount of taxfree retirement lump sum that an individual can draw from all pension arrangements. The first €375,000 of such lump sums will be taxed at the standard rate (currently 20%). Any excess over the aggregate amount of €575,000 will be taxed at the marginal rate. The SFT has been reduced to €2.3m. Excess value over this threshold can suffer effective tax rates of up to 69%. An annual pension levy of 0.6% has been introduced in 2011 on the value of private pension funds (effective for 4 years). 10 O’GRADYS SOLICITORS 4. Business Tax Corporation Tax Rates – 12.5% Trading Income V’s 25% Passive Income Group relief for tax losses A loss group will now include companies which are tax-resident in an EU or tax treaty country as well as any company which has its principal class of shares substantially and regularly traded on a recognised stock exchange. Tax on dividends A relief may apply where a company receives dividends out of the trading profits of a company which is tax-resident in the EU, or a country with which Ireland has a double tax treaty. Under this relief, the rate of tax on the dividend is capped at 12.5% (with a credit available for underlying foreign tax). The relief also provides for an exemption from tax on dividends received by share dealers from portfolio shareholdings. This also includes dividends from companies located in countries with which Ireland has ratified the OECD Convention on Mutual Assistance in Tax Matters but with whom Ireland does not have a treaty or they are not part of the EU (e.g. Brazil). Unilateral relief for foreign tax on royalties and interest The Act provides that any foreign tax suffered in respect of royalties (derived from certain types of intellectual property – e.g. copyrights, patents, and trademarks) which cannot be used to reduce the income because there is insufficient income to do so, can be used to reduce other foreign source royalty income which is taxed as trading income. The Act also states that, where royalties of the type described above or interest income are received in the course of a trade, the amount of income from those royalties or interest may be reduced by the amount of foreign tax borne on the royalties or interest. Relevant Contracts Tax (RCT) The current paper-based RCT system has been replaced by an electronic system. Principles engaged in the construction, forestry and meat-processing sectors are now obliged to submit information, data, payments and returns to the Revenue electronically. The Finance Act contains a number of amendments requiring additional information regarding the contract in place and the subcontractor. It also provides for a waiver for principals from their online filing obligations in the event of a “technology systems failure”. Repair or alteration of systems installed in buildings as well as the installation, repair or alteration of telecommunication systems will fall within the RCT provisions. The list of principal contractors who are obliged to operate RCT is being extended to include certain telecom companies and others in the sector. Furthermore, the definition of construction operations is extended to include the installation, alteration or repair of systems of telecommunications 11 O’GRADYS SOLICITORS Corporation tax relief for start-up companies New companies which start to trade will be exempt from corporation tax on their first three years of trading income. The Finance Act extends this relief to companies commencing trade up to 31 December 2014. The maximum annual tax liability for which the shelter is available under this scheme is €40,000. Professional Services Withholding Tax The list of persons who are required to operate Professional Services Withholding Tax has been amended to delete certain bodies such as the Commission for Taxi Regulation, and to add a new body, the Health and Social Care Professional Council. Company Mergers The Act introduces an exemption from capital gains tax to ensure that a merger between an EU company and its EU parent, without the need for the company to go into liquidation, will be a tax-free event for the company. 12 O’GRADYS SOLICITORS 5. Financial Services Investment Management Rates of exit tax The rates of exit tax applicable to investment undertakings have increased by 3% for chargeable events occurring on or after 1 January 2012. The rates of exit tax applicable to Personal Portfolio Investment Undertakings have also increased by 3%. The rate of exit tax is reduced to 25% for Irish corporate investors in an investment undertaking. Reorganisation Relief – Anti Avoidance A new anti-avoidance measure has been introduced in relation to certain transactions carried out with investment undertakings. There are relieving provisions which treat reorganisations, amalgamations or reductions of share capital and certain conversions of securities as not giving rise to a disposal for Irish capital gains tax purposes in certain circumstances. The new measure prevents this relief from applying where a company (which is not an investment undertaking) is involved in any of the above transactions with an investment undertaking. Domestic fund under old regime A number of domestic Irish funds continue to be taxed under the old regime for funds. Under that regime, such funds continue to pay tax on income and gains. The taxable income and gains of such funds were taxed at the standard rate of income tax (i.e. 20%). This rate of tax has been increased to 30%. Inward migrating funds A new provision has been introduced which relaxes the tax administration burden for certain investment funds redomiciling into Ireland. It relieves the redomiciling fund from the usual requirement to obtain declarations of non-Irish tax residence from investors who held shares or units in the fund on the date of redomiciliation. The provision applies to funds redomiciling into Ireland from certain specified territories (including Bermuda, the British Virgin Islands, the Cayman Islands, Guernsey, the Isle of Man and Jersey). The investment undertaking is also required to apply exit tax where an investor who was non-Irish tax-resident at the date of the redomiciliation subsequently becomes Irish taxresident. Technical charge to Irish tax for ETF holders Where non-Irish tax-resident investors hold shares or units in an Irish investment undertaking they should not suffer exit tax on distributions or gains on disposal of their shares or units. In addition, such investors are excluded from the technical charge to Irish tax on a self-assessment basis in respect of payments received from the investment undertaking. 13 O’GRADYS SOLICITORS Outbound migration of an Irish fund A number of changes have been introduced to facilitate the provisions of the UCITS IV Directive. One of the new provisions deals with the situation where the assets of an Irish investment undertaking are transferred to a ‘good’ offshore fund. In such circumstances, the transfer will not be considered to give rise to a chargeable event for the Irish investment undertaking. Umbrella offshore funds The Act includes an amendment which will apply the same treatment to the exchange of units in an Irish investment undertaking with that of an equivalent ‘good’ offshore fund. Master-feeder funds A further change introduced to facilitate the UCITS IV Directive extends an existing relief for the reorganisation of a non-Irish investment fund into an Irish investment undertaking. The new provision will allow relief where the units of the Irish fund are issued to the non-Irish fund (rather than to the investors in the non-Irish fund). Information reporting for investment undertakings A revised approach to obtaining information reporting for investment undertakings has been included in the act. The main changes are, firstly, that the effective date is updated for payments occurring on or after January 2012, and secondly, a focus on reporting the value of units and other information that is more readily available to investment undertakings. Cash pooling To facilitate cash pooling and group treasury operations, the Act states that, in the context of a lending trade, interest paid on short term deposits and loans to non-treaty resident connected companies will be deductible to the extent that the recipient jurisdiction levies a tax on such interest. Foreign tax credit relief for equipment leasing income The Finance Act includes a new unilateral relief for foreign tax suffered on equipment leasing rental income. The relief will allow companies which are carrying on an equipment leasing trade with lessees based in non-treaty countries to take a credit against their corporation tax for foreign tax suffered on their rental income. There is also a provision for lessors to choose how they wish to allocate certain tax deductions (such as charges on income and certain losses) when computing the available tax credit. 14 O’GRADYS SOLICITORS Encashment tax In an effort to modernise the encashment tax regime, the following amendments have been made: Payment and collection agents will be obliged to submit an encashment tax return along with the tax deducted without the necessity to have first received a notification to do so from the Revenue. Payment and collection agents will be obliged to file a return of the encashment tax collected and pay over that tax within 20 days of the end of the year assessment. Unpaid encashment tax will now attract interest at the same rates as other unpaid taxes. Payment and collection agents will no longer be entitled to receive remuneration from the Revenue for operating encashment tax. A longstanding provision, which appointed the Governor and directors of the Bank of Ireland as commissioners for the purpose of assessing tax on interest, annuities and public revenue and other dividends, has been abolished as it is now obsolete. The implementation of the encashment tax amendments is subject to the issue of a Ministerial Order to allow an opportunity for consultation. Levies on general insurance A return for the insurance levy and the insurance compensation levy must be filed and paid over within 25 days of each quarter end. Previously the deadline was 30 days from each quarter end. Life Assurance The Finance Act contains provisions which will increase the rate of exit tax for life assurance products by 3%. The list of entities to which life assurance exit tax does not apply has been extended to include Approved Retirement Funds (‘ARFs’) and Approved Minimum Retirement Funds (‘AMRFs’) as well as pension schemes. Technical charge on interest arising to a non-resident Currently the technical charge to Irish income tax on interest quoted eurobonds and qualifying wholesale debt instruments does not apply to such interest received by a resident of a tax treaty partner or EU jurisdiction. This exemption is to be extended to interest received by a company resident in a non-treaty jurisdiction where: The company is directly or indirectly controlled by treaty residents who are not, themselves, controlled directly or indirectly by non-treaty residents or Irish residents, or 15 O’GRADYS SOLICITORS The principal class of the shares of the company, or its 75% parent company, is substantially and regularly traded on a recognised stock exchange in a treaty country. Reporting interest payments Under the existing legislation, interest payments on certain domestic and international bonds and other negotiable debt securities are exempt from the reporting requirement to the Revenue. The Act includes the removal of this exemption from 31 December 2011. Islamic Finance Ireland has been keen to support and grow its Islamic industry and in 2010 introduced a legislative regime to allow companies that provide certain types of Shari’a compliant finance (‘Islamic finance’) to be taxed in an equivalent manner to parties in a comparable conventional finance transaction. Under the current legislation a finance company or a sukuk (Islamic bond) issuer can only elect into the regime. The Act now allows either party in the transaction to make the election. 16 O’GRADYS SOLICITORS 6. Property and Construction Overview The following measures, taken by the government, are likely to have significant benefit over the medium term: 1. The decision not to implement retrospective legislation concerning contracts with upward-only rent reviews. 2. A more considered, and less severe, scheme for reducing legacy property reliefs. 3. A reduction in all non-residential stamp duty from 6% to 2%. 4. The creation of a new CGT exemption for property to be held for seven years. Stamp Duty There will be a reduction of stamp duty on all non-residential property from 6% to 2% for transactions after Budget Day. This reduction will also apply to other stampable items such as goodwill, loans and other property to the extent that it is not already exempt from duty. Intra-family transfers of non-residential property are entitled to 50% stamp duty abatement, known as consanguinity relief. This relief is to be maintained until the end of 2014. Legacy property reliefs The majority of the most severe retrospective impacts of the legacy property reliefs have been withdrawn and replaced with more targeted measures, namely; A 5% property relief surcharge imposed on investors with an annual gross income of over €100,000 which will apply to the amount of income sheltered by property reliefs in a given year. Investors in accelerated capital allowances schemes will no longer be able to use capital allowances beyond the original tax life of the particular scheme where that tax life ends after 1 January 2015. Where the tax life of the related scheme ends before 1 January 2015, no carry-forward of allowances will be permitted into 2015 and beyond. Incentive CGT relief A special incentive CGT measure is being introduced for property purchased between midnight on 6 December 2011 and the end of 2013. If a property is bought during this period and held for at least seven years, the capital gain relating to that seven-year holding period will be fully relieved from capital gains tax. 17 O’GRADYS SOLICITORS Annual property tax The minister has formed an inter-departmental group aimed at replacing the €100 household charge with a full valuation-based property tax. The group is expected to report by April 2012. 18 O’GRADYS SOLICITORS 7. VAT VAT rate increase The standard rate of VAT has increased by 2% to 23% in Ireland. This measure came into effect on the 1ST January 2012. Other VAT measures VAT on property Extension of the ‘reverse charge’: Under existing VAT law, a supplier of construction services is responsible for paying the VAT unless those services come within the scope of Relevant Contracts Tax (‘RCT’), in which case the recipient of the service becomes liable for the VAT (the so-called ‘reverse-charge’ VAT regime). The Act contains provisions to extend the ‘reverse-charge’ to cases where both the supplier and the recipient of the construction services are connected parties (and where the supply is not already caught by the ‘reverse-charge’ for supplies within the regime). The definition of ‘connected persons’ is wide and includes persons or bodies of persons connected by family or other close personal ties, management, ownership, control, common purpose and certain legal ties. The measure will take effect on 1 May 2012. Capital Goods Scheme: The current VAT on property rules contains provisions (known as the Capital Goods Scheme) which require a property owner to review and, if necessary, adjust the VAT deducted on property. Usually, the review must be carried out annually over the course of an ‘adjustment period’ of typically 20 years. The Act contains measures to clarify the duration of the adjustment period where development work has been undertaken. The Act also confirms existing Revenue practice that development of an already completed transitional property (referred to as a ‘refurbishment’) will not restart the adjustment period applying to that property or leasehold interest. Recovery of VAT on accommodation provided under the Travel Agents Margin Scheme: The Travel Agents Margin Scheme (‘TAMS’) is a special VAT collection regime that operates in the travel agent sector. The Act contains measures to remove the ability for businesses to recover VAT incurred on “qualifying” conference accommodation in Ireland when it is supplied under TAMS. 19 O’GRADYS SOLICITORS Record-keeping for liquidated companies: The Act contains measures to extend the VAT record-keeping period (6 years) to liquidated companies. VAT repayments received under a refund order: Existing Orders allow for repayments of VAT on certain expenditure by farmers, sea fishermen, disabled persons, and medical and philanthropic organisations. The Act includes measures relating to the payment of interest and penalties on incorrect claims and the raising of assessments to claw back repayments made under an Order where the conditions attaching are no longer met by the claimant. 20 O’GRADYS SOLICITORS 8. Capital Taxes Capital Gains Tax Tax Rate The capital gains tax rate has increased from 25% to 30%. This applies to disposals of assets made on or after 7 December 2011. Retirement relief An individual over 55 years of age continues to be exempt from capital gains tax on disposals of certain ‘qualifying assets’ (broadly, a business or shares in certain family companies) to his or her child. However, where the individual has reached 66, this exemption has been restricted to qualifying assets with a market value of up to €3m and no relief for the excess. This incentivises the handing-over of family businesses, including farms, where an individual reaches 55 years of age but removes the incentive for more valuable businesses where the owner has reached 66. There is a related change in the exemption which previously applied to an individual over 55 selling qualifying assets where the sale or transfer is not to their children. Previously, where the proceeds did not exceed €750,000 the gain was exempt from capital gains tax. This exemption is now restricted where the individual has reached the age of 66. For such persons, a full exemption is only available where the proceeds do not exceed €500,000, with marginal relief applying thereafter. All of these restrictions apply only to disposals made on or after 1 January 2014. This means that persons who are approaching 66 or are already 66 or over have almost two years’ lead time to transfer or sell assets and avail of the old regime. Non-resident trusts The Act makes a technical amendment to rules which charge Irish-resident or ordinarily resident individuals to capital gains tax, where non-resident trusts of which they are beneficiaries make a capital gain. Prior to the publication of the Act, the rules did not apply where the trust was settled by a person domiciled outside Ireland, and the settler continued to be domiciled outside Ireland when the gain was made. This exception will no longer apply. A charge will now arise to beneficiaries in respect of gains made by the trust during a period when those persons were excluded from benefit. Non-Euro bank deposits held by non-trading companies The Act introduces relieving measures for certain holding companies in respect of foreign currency deposits. Firstly, non-Euro currency is not within the Irish capital gains tax net, where: It is held in a bank, and It is held by a “relevant holding company”, that is a company with at least one wholly owned trading subsidiary, or a company which acquires or sets up a wholly owned trading subsidiary within one year of a foreign exchange gain being realised and credited to its accounts. 21 O’GRADYS SOLICITORS Secondly, only foreign currency gains credited to the profit and loss account (under Irish GAAP or IFRS) of a relevant holding company will be taxable (at an available effective rate of 30% as reduced by any foreign currency losses forward or realised in the same period). Other The Act contains certain other amendments to the capital gains tax rules, including: Previously, a tax deduction was available for contingent liabilities when the contingency arose. The Finance Act introduces a new rule that the deduction is available only when a payment is actually made as a result of the contingency. Compensation for turf cutters for giving up rights to cut turf in special areas of conservation under a scheme administered by the Minister for Arts, Heritage and the Gaeltacht is exempt. A new relief has been introduced providing for a CGT exemption on the proceeds from disposals by certain sports bodies where the proceeds are reinvested within a five year period. The relief also applies if the proceeds of the disposal are donated for charitable purposes. Capital Acquisitions Tax Tax-free thresholds Group A Group B Group C €250,000 €33,500 €16,750 Tax rate The Capital Acquisitions tax rate has increased from 25% to 30%. Discretionary trusts The 6% once-off and 1% annual Discretionary Trust Tax, have specifically been extended to cover entities ‘similar in their effect’ to a discretionary trust. Agricultural relief The Act amends the definition of ‘farmer’ for the purposes of agricultural relief. Modernisation of CAT Solicitors will be held liable for the CAT of non-resident beneficiaries in cases of probate on which they act. A further important change brings CAT in line with other tax heads by providing that payments are to be treated as being applied first against capital, and not against interest outstanding. CAT pay and file The Act moves the CAT pay and file deadline from 30 September to 31 October. 22 O’GRADYS SOLICITORS 9. Research and Development Employee remuneration A new reward mechanism for key employees involved in R&D activities of a company will allow them to effectively receive part of their remuneration tax-free. “Key” employees have been carefully defined as follows: The employee must not be, or have been, a director of the company and must not be connected to a director of the company. The employee must not have, or have had, a material interest in the company or be connected to a person who has a material interest. The employee must perform 75% or more of their activities “in the conception or creation of new knowledge, products, processes, methods and systems”. 75% or more of the emoluments of the individual must qualify for the R&D tax credit in order for that person to be considered a “key” employee. Other important conditions and anti-avoidance provisions include: The company must be paying tax to avail of this reward mechanism. It is up to the company to decide who receives the benefit of the reward mechanism. The employee must make a claim to Revenue for a tax refund. The effective rate of tax payable by the individual cannot be reduced below 23%. Unused tax credits which the employee has been allocated can be carried forward indefinitely until they are used (or until the employee leaves the company). To the extent that some or all of the R&D tax credit is denied (i.e. following a Revenue audit) there will be a clawback of the overclaim. Revenue will seek to levy the clawback on the company in priority to the employee. Base year relaxation Allowing a larger portion of the total expenditure incurred on R&D to be claimed by including the first €100,000 of expenditure without reference to a base year threshold – in effect, a volume-based approach, albeit that the base year applies for expenditure in excess of €100,000. Companies engaged in R&D activities and claiming the R&D tax credit will therefore have up to an additional €25,000 per annum of tax credit available to reinvest. Outsourcing Currently many SMES rely heavily on an “outsourced” model. While the Finance Act does not increase the rate of credit, the increase in the outsourced cap will assist SMES in conducted their R&D activities by providing more relief for companies relying on 23 O’GRADYS SOLICITORS outsourcing. The legislation requires the company to notify in writing the third-party provider that I cannot also claim the R&D tax credit. This will no doubt impact on commercial arrangements between company and the third-party provider. 24 O’GRADYS SOLICITORS 10. Revenue Powers Assessing Tax The rules governing how taxpayers are assessed to tax have been substantially rewritten. It is intended to move to a system of full electronic self- assessment for income tax, corporate tax and capital gains tax for all taxpayers. The currently system is a “pay and file” system. Under the new system of full self-assessment, taxpayers will be required to submit an additional “self-assessment”. Notices of assessment will no longer issue from Revenue. Impact of new self-assessment on taxpayer protections There is at present no provision in the electronic environment for a taxpayer to disagree with the indicative tax calculation generated by ROS. This is likely to cause difficulties. Disagreement with a published Revenue interpretation will no longer be treated as a genuine doubt. The ability to make an expression of doubt becomes dependent on making a tax return on time. The new procedures will apply to companies whose accounting periods start on or after 1 January 2012 and to individuals for the tax years 2012. New legislation has been introduced to enable Revenue to issue and assessment to tax without time limit in the event a s. 811 challenge is upheld. Prior to the Finance Act, it was arguable that there was a prohibition on the issuing of assessments- even where a challenge was upheld. Obligation to maintain records for liquidated or struck-off companies The liquidator or in the case of a company otherwise struck off the register, the last director must maintain the various tax records for a period of 6 years following the demise of the company. Power to require submission of a statement of affairs Revenue are given additional powers to require a person, or a spouse-civil partner who is jointly assessed with that person, who has failed to discharge tax that is due to provide a statement of affairs in a prescribed form. Power to demand security The Act provides that, where Revenue have a concern fiduciary taxes (PAYE, VAT, Relevant Contracts Tax and the Universal Social Charge) will not be paid, and those taxes are not paid within 30 days of the date due, Revenue may require the taxpayers to provide security on foot of a written request. This provision makes it an offence for the taxpayers to 25 O’GRADYS SOLICITORS continue to engage in business until the required security is provided, subject to a right of appeal to the Appeal Commissioners. Requirement to produce documents and information For any matter that constitutes an offence, Revenue may apply to the District Court to compel any person to make available documents or information that might be relevant to an investigation being carried out by Revenue. Time limit for Revenue to make assessments extended Where Revenue form an opinion that a transaction is a tax avoidance transaction, and that option become final and conclusive the Act includes a provision that in such circumstances the normal 4 year time limit on Revenue making an assessment does not apply. As there is also not time limit on Revenue forming an opinion, this means that from 28 February 2012 there is no time limit on Revenue’s ability to take action in a tax avoidance case. This is the case even where the transaction in question took place before 28 February 2012. 26 O’GRADYS SOLICITORS 11. Stamp Duty Residential Rates Consideration 1% = < 1 Million 2% = > 1 Million Commercial Rates 2% on full amount of consideration Modernisation of Stamp duty The changes include: i) The removal of the adjudication procedure ii) Revenue will have the power to make assessment and iii) Audit and appeal procedures will be introduced. Other aspects to note are: A fine of €3,000 has been introduced if a return is not filed within 30 days. The “expression of doubt” facility has been revamped. More detailed information is now required to be submitted when expressing doubt. A valid expression is only made if the return and expression of doubt are delivered within 30 days. Provision is made for an appeal to the Appeal Commissioners if a person is aggrieved by the decision of the Revenue. The penalty system for later payment of stamp duty has been amended to provide for a surcharge (similar to that for the late filing of a corporation tax return). Other surcharge provisions are to be deleted. A refund claim must be made within 4 years from the date the instrument was stamped (previously 6 years after executing the instrument). On submitting a return, it will be necessary to include an assessment of the stamp duty chargeable and pay the relevant tax. Records must be kept for 6 years. Revenue powers of inspection have been introduced. Mergers of Companies The Finance Act includes a stamp duty exemption for the transfer of assets pursuant to a merger, cross-border merger or Societas Europaea (SE) merger effected in accordance with the relevant EU regulations. The aim of the directive is to facilitate mergers between various types of limited liability companies governed by the laws of different countries within the EU/EEA. 3 types of mergers exist: 1) A merger by acquisition 2) A merger by formation of a new company 3) A merger by absorption. 27 O’GRADYS SOLICITORS In each case, the transferee company is dissolved without going into liquidation. Other changes A range of measures relating to the financial services sector and some property specific measures have been introduced. A “young trained farmer” to whom land is transferred must have a specified qualification. The FETAC Level 6 Specific Purpose Certificate in Farm Administration is now included in the list of qualifications that a young trained farmer can hold in order to obtain relief from stamp duty on the purchase of farmland. 28 O’GRADYS SOLICITORS 12. Rates & Credits 2012 Personal Income Tax Rates (rates and bands unchanged) Single person Married couple (one income) * Married coupe (two incomes) * & ** One parent/ widowed parent At 20% first €32,800 At 41% Balance €41,800 Balance €65,600 Balance €36,800 Balance PRSI contribution, Universal Social Charge Employer * Single person Married couple * Additional one-parent family credit Additional credit for certain widowed persons * Employee credit Home carer credit Rent credit - single and under 55 years (reduced) €1,650 €3,300 €1,650 €1,650 €1,650 €810 €240** *Applies to civil partnership/ surviving civil partner also. ** Rent credit phasing out over 7 years, €80 reduction in 2012. Home loan interest relief granted at source on principal private residence* Income No limit If income is €365 p/w or less Employee ** (Class A1) PRSI Universal Social Charge *Applies to civil partnership/ surviving civil partner also. ** €41,800 with an increase of €23,800 maximum. Personal Tax Credits (unchanged) % 10.75% 4.25% 4% No limit ** 2% 4% 7% Up to €10,036 *** €10,037 to €16,016 > €16, 016**** * Employer PRSI relief on employee pension contributions will be removed from 1 January 2012 ** Employees earning €352 or less p/w are exempt from PRSI. In any week in which an employee is subject to full rate PRSI, the first €127 of weekly earnings are disregarded *** Individuals with total income up to €10,036 are not subject to the Universal Social Charge **** Reduced rate (4%) applies for persons over 70 and/or with a full medical card Self-employed PRSI contribution, Universal Social Charge PRSI Universal Social Charge % 4% Income No limit * 2% 4% 7% 10% Up to €10, 036** €10,037 to €16,016 €16,017 to €100,000 *** > €100,000 *** First time buyers loans taken out from 2009 to 2012 Years 1-2 Married/ widowed ** Single Years 3-5 Married/ widowed ** Single Lower of €5,000 or 25% of interest paid * Minimum annual PRSI contribution is €253 ** Individuals with total income up to €10,036 are not subject to the Universal Social Charge *** Reduced rates (4% and 8%) apply for persons over 70 and/or with a full medical card Lower of €2,500 or 25% of interest paid Lower of €4,500 or 22.5% of interest paid Lower of €2,250 or 22.5% of interest paid Years 6-7 Married/ widowed ** Lower of €4,000 or 20% of interest paid Single Lower of €2,000 or 20% of interest paid Capital Gains Tax (rate increase) Rate Annual exemption 30% * €1,270 * Effective for disposals made on or after 7 December 2011 29 O’GRADYS SOLICITORS After year 7 (where applicable up to and including 2017) Married/ widowed ** Single Lower of €900 or 15% of interest paid Lower of €450 or 15% of interest paid Other mortgages, loans taken out from 2004 to 2012 Married/ widowed ** Single Capital Acquisitions Tax (rate increase & threshold A reduction) Rate 30% * Thresholds Group A Group B Group C €250,000 * €33,500 €16,750 * Effective for gifts and inheritances taken on or after 7 December 2011 Lower of €900 or 15% of interest paid Lower of €450 or 15% of interest paid Corporation Tax Rates (no change) First time buyers, loans taken out from 2004 to 2008 Standard rate Residential land, not fully developed Non-trading income rate 12.5% 25% 25% Remainder of the first 7 years of mortgage Married/ widowed ** Single Lower of €6,000 or 30% of interest paid Lower of €3,000 or 30% of interest paid After year 7 and up to and including 2017 Married/ widowed ** Single Lower of €1,800 or 30% of interest paid Lower of €900 or 30% of interest paid Value Added Tax (rate increase) Standard rate* / Lower rate/ Second lower rate Flat rate for unregistered farmers 23%*/ 13.5%/ 9% 5.2% * Effective from 1 January 2012 * Loans taken out on or after 1 January 2013 will not qualify for Mortgage Interest Relief. The relief will be abolished completely from 2018 and subsequent tax years. ** Applies to civil partnerships/ surviving civil partner also. Household Charge (new) Household charge of €100 to apply to owners* of residential property** Stamp Duty – commercial and other property (reduction) * Owners include tenancies of greater than 20 years ** Does not apply to individuals entitled to mortgage interest supplement or to properties in unfinished estates. 2%* on commercial (not residential) properties and other forms of property, not otherwise exempt from duty * Effective for transfers of property on or after 7 December 2011 Stamp Duty – residential property (unchanged) 1% on properties valued up to €1,000,000 2% on balance of consideration in excess of €1,000,000 30 O’GRADYS SOLICITORS O’Gradys, Solicitors, 4th Floor, 8-34 Percy Place, Dublin 4. 31