Speaking of Money: Students Share What They Need To

advertisement

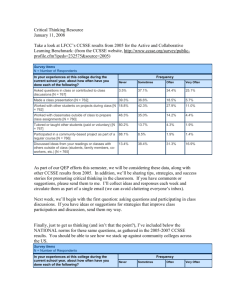

By EVELYN WAIWAIOLE and ARLEEN ARNSPARGER / 2015 January 19 - 07:28 pm Speaking of Money: Students Share What They Need To Earn and Learn More Than Two Million Community College Students have Expressed Their Hopes for a Better Life Through Education “The reason I’m coming back to school is that I’m tired of being poor. I want to make my parents proud. I’m getting older and I want my life to change. I’m determined, no matter what. I’d like a certificate or a piece of paper that I can show someone and get a decent job.” - ANONYMOUS STUDENT Community colleges enroll disproportionately high numbers of students who exhibit characteristics that put them statistically at risk of not completing college. This group includes those who attend part time, are first-generation college students, did not enter college directly after high school, are single parents, are students of color, or come from low-income families. And for many of these students, financial challenges are nothing new. For more than a decade at the Center for Community College Student Engagement (CCCSE), through both student engagement surveys and focus group discussions, more than two million community college students have expressed their hopes for a better life through education. They have also described the struggles they face as they try to balance college with their need to earn enough money to take care of themselves and their families. “My biggest worry is just maintaining the cost of living and then still going to school and doing really well in school. It’s hard working a full-time job and going to school because school itself can be a fulltime job, so just finding a good balance between the two.” “I’m in my class, and every time I’m thinking, ‘Oh, I have to pay this bill. Oh, man, how are my little brothers doing?’ It goes beyond just thinking about, ‘Concentrate on this,’ because you’ve got the financial problem going on, too, that your parents on depending on you to help them.” “I have a second job on top of the work-study. It’s usually 50 to 60 hours on top of going to school. I haven’t stopped [going to school] yet, but it’s come close.” In the 2014 Community College Survey of Student Engagement (CCSSE) more than 70 percent of students responding said a lack of finances could cause them to withdraw. (These data represent findings from about 500,000 students from 684 community colleges that are part of the 2014 CCSSE cohort.) For far too many students, the concerns reflected in the CCSSE survey results are, unfortunately, predictive. In a survey conducted by and reported on by Public Agenda, “With Their Whole Lives Ahead of Them,” most young adults who started college but didn’t finish said they left because they needed to work more to make ends meet. According to the National Center for Education Statistics, the percentage of students in two-year institutions receiving any financial aid increased from 67 percent in 2006-07 to 79 percent in 2011-12. In the 2014 “College Hopes and Worries Survey” conducted by Princeton Review Inc. last March, concerns about paying for college reached an all-time high; 89 percent of respondents reported that financial aid would be “very necessary” to pay college expenses. Among those respondents, 65 percent said it would be “extremely necessary.” A ten-year analysis of CCSSE survey data confirms the picture these studies and countless other reports paint: students’ reliance on grants and loans to pay for their education continues to increase; fewer are using their own income and/or their parent’s income as a source to pay for college. Notably, African-American students show the greatest increases in use of loans as a source; Latino students show the least increase in use of grants and loans. The data also show that students perceive that community colleges are doing more than in past years to help them financially. Yet student perspectives reflected in both survey data and in focus groups point out that the gaps between what students need and what colleges are providing are still wide. “I got financial aid. That’s the main thing that’s been keeping me in school, because if I had to pay for school, I wouldn’t be in school. I can’t support myself like that just yet.” “I’m using student loans right now to get by and I’m very grateful for that. Otherwise I couldn’t go to college.” “The access to a payment plan. That helped a ton. It’s flexible as well and that really took a load off my shoulders.” As the financial burden increases for students, many community colleges are making progress in their efforts to streamline a cumbersome financial aid process and to reach more students who need financial support. Still, it is not enough. Students frequently are frustrated by the financial aid process or do not understand the requirements that come with the financial aid they receive. “It’s been really hard for me here. It’s like every quarter it is something different with the financial aid, meeting their criteria and they change things and they don’t tell you until it’s time to start class, and then you can’t start class because nobody told you about this other thing you had to have.” “Being that I’m single I make too much money to qualify for grants, so I have to get loans. When I needed the money to help, I applied for an outside loan and that probably at the time was OK, but now the interest has like doubled what I borrowed…I didn’t know the consequences.” Talking about their financial challenges, students participating in CCCSE focus groups describe what they believe they need to learn and point to college services and programs that are helping them gain the skills they need. “I think financial literacy is a huge, huge thing and I don’t think students get it unless they ask for it. It’s not something that’s just presented to them in orientations or anything like that, so if you’re not inquisitive about what’s going on with your money and your financial aid, it kind of blows by you, you kind of don’t learn about it.” “A lot of places that help you with budgeting are places like the Resource Center or the Career Development Center. They’re often putting on workshops. Their services are free of charge for students, of course. They do everything from budgeting to resume-building, mock interviews, to help you be more professional or [achieve] independent status… I’ve been to the resumebuilding and the mock interviews and they’re a godsend.” “… a lot of things that I’ve learned in [the student success class], I did not think about before she asked me to do the assignment…I never thought of professional goals or smart goals, I just thought about work, making money, so for me it’s like a light, it shines… I know [now] what I am capable of doing…” In focus group discussions, students also recommend steps community colleges should take that will help students who face financial challenges: “I personally think that during orientation they should have a set requirement…like they have requirements for scholarships that you have to attend workshops….So like making it a for-sure thing that they have to attend a workshop or talk to a financial aid advisor first — just talk to someone in financial aid to say, ‘do you know what you’re doing, what you’re getting yourself into, that you’re going to have to pay,’ just so that they’re aware of everything.” Helping students confront the financial challenges they face requires more than a much-needed focus on improving college practices and processes. Talking about streamlining financial aid is one conversation; talking about poverty and how to help students move beyond it is quite another. Both discussions are necessary. There are questions for community college leaders to consider. Are we engaging in honest conver sations about students’ financial vulnerability? Are there community partnerships we need to explore in order to help students access additional financial support and services? Are there additional educational experiences that can be required inside and outside the classroom that will increase students’ financial literacy and build bridges to careers and financial security? And, of equal importance, are we listening to our own students, students who are working to create a better life tell their own stories? “I’ve been kind of resourceful. I’ve been good with temp labor, day labor, show up in the morning and see if there’s work for the day, then you get cash at the end of the day and you can buy some food. Cutting back on things, selling my artwork when I can, selling my possessions when I can, or going to second-hand stores and finding something that’s worth more money than that and flipping it pretty quickly. I can be resourceful with it. It just takes up so much of my time. I’ve been homeless and going to school at the same time, so it’s just what you have to do.” Community college students are speaking. Let’s listen and let’s act. Evelyn Waiwaiole is director of the Center for Community College Student Engagement (CCCSE) at the University of Texas at Austin. Arleen Arnsparger is Program Manager of the Initiative on Student Success at CCCSE. Since 2002, with support from MetLife Foundation, the cCenter has conducted focus groups with students to bring student voices and perspectives into discussions about community college practices that lead to improved student success.