MA360 MS 2013 - Activating your university user account

advertisement

MA360 EXAM – MAY/JUNE 2013

SOLUTIONS

Question 1.

Answer

Maximum

Marks

a)

i.

K=

ii.

TOTAL QUALITY COST

(Tolerance allowed)2

= £2,000 = £3,200,000

(0.025)2

2

Two possible solution methods to this problem.

Rewriting the equation for estimating the value of k:

Total quality cost = k x (Tolerance)2

= £3,200,000 x (Tolerance)2

£30 = £3,200,000 (Tolerance)2

Solving:

Tolerance = 0.0031

5

{Alternatively, the tolerance could be computed as:

Tolerance = To √ ͞C1/C2}

Where To = current (or customer tolerance)

C1 = Cost of reworking or scrapping the unit before shipping

C2 = Cost of quality due to failure to meet customer’s expectation

iii.)

0.5 +/- 0.03 i.e. √0.0009

3

b. Y = The learning curve can be expressed as follows

Yx = aXb

Where, Yx = the cumulative average time to produce x units

a is the time to produce the first unit

X is the number of units under consideration

b is the index of learning ,defined as the ratio of the logarithm of the learning

improvement rate divided by the logarithm of 2.

Hence given a learning curve of 80%

b=

log 0.8

log 2

= -0.3219

2

Maximum

Marks

Question 1 Answer contd.

So in order to produce 40 units the average cumulative hours per unit

would be Y = 12(40) -0.3219

= 3.660 hours

Cumulative units

1

Average time per unit total time

40

hours

hours

3.660

146.40

Cost of producing 40 units =

£

Direct materials £40 x 40

1,600.00

Direct labour 146.40 hours x £8

1,171.20

Variable overhead 146.40 hours @ £5

732.00

Total variable cost of production

£3,503.20

Cost per unit = £3,503.20 ÷40 = £87.58

ii.

3

Since learning reaches a steady state at the 50 cumulative units mark one needs to ascertain the

time taken to produce the 50th unit.

For 49 cumulative units a = 12 hours; X = 49 hours and b = -0.3219

•

• • Y = 12(49) -0.3219 = 3.4285

To produce 50 units on average would take 12(50)- 0.3219

= 3.4063 hours

Cumulative units

3

Average time per unit Total time

49

3.4285

167.9965

50

3.4063

170.315

Incremental time for 50th unit =

• The variable cost of a unit would be as follows:

2.3185

3

Question 1 answer contd.

Direct materials

£40.00

Direct labour 2.3185 hours @ £8 per hour

£18.55

Variable overhead 2.3185 @ £5 per hour

£11.59

Total variable cost per unit

£70.14

3

Total 25 marks

_____________________________________________________________________________________

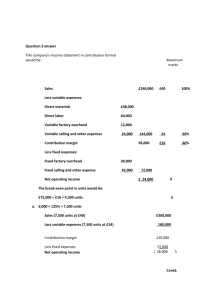

Question 2

Answer:

a. I

£

Direct materials

19.60

Direct labour

16.10

Variable manufacturing overhead

2.10

Fixed manufacturing overhead

Unit product cost

12.40

£ 50.20

2

Mark up on absorption cost =

Required return on Investment (8% x £285,000 ) +

Variable SG&A expenses £3.40 x 23,000) +

Fixed SG&A expenses £473,000

= £22,800 + £78,200 + £473,000 = £574,000 ÷ (£50.20 x 23,000)

4

(Unit cost of production x no of units produced)

= £574,000 / £1,154,600

= 49.71 %

Target Selling Price =

2

£50.20 + (49.71 % x £50.20) = £75.15

ϵd Price elasticity of demand = Ln(1 + % change in quantity sold)

4

1

Ln(1 + % change in price)

= Ln (1 +(- 16%))/Ln (1 + 10%) =- -1.83

The profit maximizing price =

ϵd

1 + ϵd

= ( -1.83/1 + -1.83 ) x £41.20 = £90.8306

2

x Variable cost per unit

1

Question 2 answer contd.

Maximum

Marks

b. i. Revenue - R = PQ =

Marginal revenue

Costs

= dR 100 -0.0002Q

dQ

C = £20Q

Marginal cost MC =

(£100 – .0001Q)Q = 100Q – 0.0001Q2

dC

dQ

2

+ £1,100,000

=

20

Profit is maximized when marginal cost = marginal revenue

100 – 0.0002Q = 20;

80

Q

=

0.0002Q

= 400,000 units

Price in £’s = 100 – 0.0001Q = £100 – 40 = £60

Hence the profit –maximising price is £60.

1

At this price the annual profit would be:

Sales 400,000 x £60

=

Costs £1,100,000 + ( 400,000 x £20)

Profit

£24.0 million

£ 9.1 million

£14.9 million

(c )

Report to: Board of Directors Chammal Co. Ltd.

From : A. Accountant

Date…….

Re: Your Concerns lily Rose and Azalea

Introduction

Findings

2

Question 2 contd.

Concerns may include:

1.

Assumption that demand curve and total costs can be identified with certainty. This is

not likely to be the case.

2.

It may have ignored the market research costs of acquiring the knowledge of demand

3.

It assumes that the firm has no production constraint which could mean that the

equilibrium point between supply and demand cannot be reached.

4.

It assumes the objective is to maximize profits. There may be other objectives

5.

It assumes that price is the only influence on quantity demanded. This may not be the

case.

6.

Absorption costing does not consider demand

Maximum of I mark for each valid comment (total 4) + 1 mark for presentation

5

______________________________________________________________________________

Question 3

(a)

i.

Maximum

Marks

Computation of Sales Margin Volume Variances

Blackberry

Budgeted sales

Actual sales

Sales volume variance

4,000

3,960

40 A

x standard margin per box

£20

4,000

5,040

1,040 F

£24

£800 A

Total sales volume variance

Strawberry

£24,960 F

£24,160 F

3

ii. Computation of contribution margin Sales Mix Variance

Blackberry

Strawberry

Actual mix

of sales

boxes

Standard

mix

boxes

3,960

5,040

4,500

4,500

mix variance

boxes

TOTAL £ 2,160 F

540 A

540 F

std margin Mix

per box Variance

£20 £10,800 A

£24 £12,960 F

1.5

Question 3 contd.

Maximum

Marks

ii

Computation of sales quantity variance

Actual sales in Budgeted

Budgeted

Difference Standard Sales

Sales

Proportions

margin quantity

Quantity

(Boxes)

per box

variance

Boxes

Blackberry

4,500

4,000

500 F

£20

£10,000 F

Strawberry

4,500

4,000

500 F

£24

£12,000 F

TOTAL £ 22,000 F

iii

1.5

Computation of market share variance

= Budgeted weighted average

unit contribution margin unit x

Actual

Market share Proportion

Budgeted

Market share x

Proportion

Actual

market

unit sales

1.5

The budget weighted average unit contribution margin is as follows:

Blackberry

4,000

x £20

=

£80,000

Strawberry

4,000

x £24

=

£96,000

Total

8,000

£176,000

Budget weighted average = £176,000 ÷8,000 = £22 per box

£22 x

Iv

(12 % - 10%) x 75,000

=

£33,000 F

1.5

Computation of market size variance =

Budgeted weighted average Actual

unit contribution margin x Total market unit sales

volume

Budgeted

Total market x

unit sales

volume

Budgeted

Market

Share

Proportion

=

£22 x [ 75,000- 80,000] x 10%

Question 3 contd.

=

£11,000 A

Check Factors:

Market share Variance + Market size variance = Sales Quantity variance

£33,000 F + £11,000 A = £22,000

Sales Quantity Variance + Sales Mix Variance = Sales volume variance

3

£22,000 F + £2,160 F = £24,160 F

Maximum

Marks `

b.

i.

Financial Partial Productivity:

(1) Output

2012

2013

39,500

48,600

Direct materials:

i

Quantity

160

Unit cost

x £34

180

x £31

Total direct materials cost

5,400

5,580

DM financial partial productivity ½ =

7.3148

8.7097

Hours spent

1,010

1,350

Hourly wage

X £25

X £24

Total direct labour cost

£25,250

£32,400

1.5644

1.5000

39,500

48,600

Direct materials cost

£5,580

£2,500

Direct labour cost

25,250

32,400

£30,830

£34,900

1.2812

1.3926

2

Direct labour:

X

DL financial partial productivity

ii.

2

Total productivity:

Output

Total cost:

Total direct (prime) cost

Total productivity

iii.

4

The direct labour productivity per direct labour hour per £ decreased from

1.5644 units of output in 2012 ot 1.5000 in 2013. The direct materials

productivity, however, improved from manufacturing 7.3148 units of output

per £ in 2012 to 8.7097 in 2013.

The decision to increase direct materials productivity (reduce direct materials

waste) at the expense of direct labour productivity is the correct decision. The

total productivity improved from 1.2812 units of output for each £ or prime

cost in 2012 increased to 1.3926 units per £ in 2013.

5

Total 25 marks

SECTION B:

Question 4 (Case Study)

(a) SWOT Analysis: (Not exclusive; other valid points will be accepted).

Strengths:

Competent and experienced founding partners

Competent and experienced partners and professional consultants

Established relationships with existing client base

An established capability to grow the business

Established technical competencies in industrial manufacturing

Weaknesses:

Inadequate management control systems / Certain questionable control practices e.g. nature of

incentive scheme

Organisational culture not consistent across all four offices

Narrow technical competencies – industrial manufacturing only

Too much dependency on founding partners?

Incentives for competent staff dependent on continually growing the business

Opportunities:

Expansion/diversification into service industries with technological needs

Expansion into geographic regions with rapid growth in industrial manufacturing, e.g. China

Threats:

Industrial manufacturing market in USA could be shrinking (e.g. moving manufacturing to China)

Poor economic conditions after global economic crisis could slow, halt, or reverse growth

Poor economic conditions being experienced in potential expansion area (Europe)

Heavy reliance on motor industry in Detroit

(Two valid points in each area x 0.5 = 4 Marks)

(b) Results Controls: Profit Sharing Scheme

Results controls are those controls which are intended to reward employees for achieving the desired

results. [1]

Functioning of Profit sharing Scheme (PSS):

Ordinary partners and managing partners (including the founding partners) receive a share of the firm’s

total profits, in proportion to their office’s share of the total revenue generated. [1]

Managing partners (excluding the founding partners) receive an additional bonus, linked to the revenue

growth achieved by their specific offices. The founding partners receive an additional bonus based on

firm-wide revenue growth. [1]

Weaknesses of the PSS and suggested Improvements.

Because profit is shared in proportion to total revenue rather than total profit, partners at

Philadelphia get a greater share of the profit than they should, while those at Boston are in an

equal position, and those at the other two offices get less than they should. To illustrate: the

ratio of total revenue earned between the four branches is: (B, P, D, & SJ): 44.7%; 24.2%;

16.7%; 14.4%. The Ratio of profit earned is: 44.8%; 21.3%; 18.9%; 14.9%.

[2]

Partners therefore get no credit for managing costs, and would in fact be better off if they

incurred higher costs to generate higher revenues. Profit shares should be based on profits

earned, not on revenues earned. [2]

Additional bonuses awarded to managing partners are based on the revenue growth of their

offices; this should also be based on the profit growth of their offices. [1]

The founding partners get an additional bonus based on firm-wide revenue growth. They are

therefore being rewarded on the basis of revenue growth in branches other than their own,

for which they were not responsible. This is not fair, and could cause resentment among the

other partners. Managing partners should only be rewarded for the specific additional

benefits they have brought to the firm as a whole. Perhaps the managing partners should

receive higher salaries to reflect their management role, and should then forego this

additional bonus. [3]

The profit sharing scheme is restricted to partners. There are no incentives for any of the

other professional consultants, who must wait for a promotion to partner before they benefit

from the profit sharing scheme. This is likely to be de-motivating, as their actions can lead to

more business, revenues and profits for the firm. There should be an incentive scheme for

these employees as well, with Principals, Senior Associates and Associates receiving a specified

percentage of their office’s profits (The percentages could be based on seniority as well as an

annual performance review) As mentioned in the case study, certain capable senior associates

have left the firm because they have not received promotion. [3]

(c) The Form of Control being Practiced in the San Jose Office

It appears that a clan culture has developed in the San Jose office among the principals and

associates, aided by the managing partner and other partners. The word ‘clan’ refers to a group of

people who hold similar values, such as doctors or nurses or accountants. However, a group of

people working in an organisation can also hold certain common beliefs and values. This results in a

culture which influences group members to control their own behaviour (i.e. without supervision)

so as to achieve organisational goals (Ouchi, 1979, 1980). [2]

Wilkins and Ouchi (1983) have identified five conditions necessary for clan formation:

-

A reasonably long history and a reasonably stable membership (citing Schein, 1981).

-

The telling of ‘shared stories’ among the group that illustrate and legitimise a common

management philosophy.

-

Considerable effort by management to screen applicants, to improve the likelihood that

new members would possess values in common with those promoted by the organisation.

-

A strong and shared claim of uniqueness

-

An atmosphere where all team members are encouraged to offer opinions on decisions,

rather than having decision-making dominated by single individuals.

It appears that four of the five requirements are probably being met at the San Jose office, with the

screening of applicants by management being the only unknown factor. As the team does not

appear to have changed for some years, this factor may not be relevant at this stage. [5]

It is possible that clan control could be achieved in the other offices, but the profit-sharing scheme

might need to be changed to provide group incentives. Managing partners and other partners

would also need to create the environment, and adopt the practices, necessary for clan formation

(as described above). [1]

_____________________________________________________________________________________

Question 5

Control Effects of the Different Levels of Organisational Culture:

Management control functions by focusing on worker behaviour, output, and/or the minds of

employees (Alvesson and Kärreman, 2004). Controls intended to influence output and

behaviour have been referred to variously as mechanistic, formal, technocratic etc. (Chenhall,

2003; Collier, 2005; Alvesson and Kärreman, 2004) , whereas controls intended to influence

employees’ minds have been variously referred to as normative (Kunda, 1992), social

(Merchant, 1985b), informal (Collier, 2005) and socio-ideological (Alvesson and Kärreman,

2004).

Cultural control is a form of the latter types of control, intended to exert an influence on

employees’ minds by enabling and reinforcing a shared set of beliefs and values.

Definition of organisational culture, e.g. “a pattern of shared basic assumptions that was

learned by a group as it solved its problems of external adaptation and internal integration, that

has worked well enough to be considered valid and, therefore, to be taught to new members as

the correct way to perceive, think, and feel in relation to those problems.” (Schein, 2004)

Various social science writers have noted that culture manifests itself at various levels, ranging

from ‘shallow’ to ‘deep.’ (Hofstede, 1990).

Schein (2004) states that culture can be analysed at several different levels, ranging from

tangible, overt manifestations to deeply imbedded, unconscious, basic assumptions which

constitute the essence of culture. Schein (2004) refers to the tangible overt manifestations of

culture as ‘artefacts’, while values are acknowledged to be the deeply imbedded, unconscious,

basic assumptions which constitute the essence of culture.

The control effects (if any) and roles in culture formation of the various levels of culture should

now be discussed, with reference to the appropriate literature. Specifically, the roles and

control effects of artefacts and values (both espoused values and shared basic assumptions)

should be addressed. The cultural paradigm and control systems as artefacts (Johnson, 1992)

may also be mentioned.

There is a strong relationship between personnel controls and cultural control. (Brief

explanation of how personnel controls can support cultural control should be provided).

The existence of a particular form of cultural control, i.e. clan control, could also be mentioned

and briefly explained.

(25 Marks)

_____________________________________________________________________________________

Question 6

EVA and VBM

Candidates should clearly explain the EVA concept and its link with value creation.

Although metrics such as EVA provide a single measure upon which management can focus, it is

not possible to act directly on EVA; improved EVA is the end result of other processes and

activities.

While Pitman realised that multiple activities are required within the organisation to create

value, he did not appear to appreciate that frameworks such as the BSC facilitate the

organisation of activities for the purpose of value creation. Multiple subsidiary objectives, if

properly aligned in cause-and-effect linkages, can therefore help to achieve an overall objective

of increased EVA, for example.

To achieve higher levels of EVA it will be necessary for organisations to conceive and implement

a value-adding strategy. Because, as Otley (1999) has pointed out, the processes and activities

necessary to implement a value-adding strategy using EVA are not clear, it will be necessary to

employ a strategic management system in support of EVA.

The generic VBM framework identified by Ittner and Larcker (2001) is in effect a strategic

management system.

The use of EVA within this framework should now be discussed, in the context of the six steps

set out by I&L (2001):

Ittner and Larcker (2001) note that, while VBM systems vary slightly from firm to firm, they all

include the following six steps:

(1) Choosing specific internal objectives that lead to shareholder enhancement;

(2) Selecting strategies and organizational designs consistent with the achievement of the chosen

objectives;

(3) Identifying the specific performance variables, or “value drivers”, that actually create value in

the business, given the organization’s strategies and organizational design;

(4) Developing action plans, selecting performance measures, and setting targets based on the

priorities identified in the value driver analysis;

(5) Evaluating the success of action plans and conducting organizational and managerial

performance evaluations;

(6) Assessing the ongoing validity of the organization’s internal objectives, strategies, plans, and

control systems in light of current results, and modifying them as required.

(25 Marks)

_____________________________________________________________________________________

Question 7

Anthony and Govindarajan’s (2007) management control framework:

Anthony and Govindarajan (A & G) define management control as follows:

Management control is the process by which managers at all levels ensure that the people they

supervise implement their intended strategies.

Although this appears to be a broad and potentially inclusive view of management control (i.e.

incorporating both formal and informal control methods), A&G in reality place a greater emphasis on

the formal control process. A & G believe furthermore that the management control process is a

systematic one, involving a series of steps that occur in a predictable sequence according to a more-orless fixed timetable, and with reliable estimates. This would include:

Planning what the organisation should do

Coordinating the activities of several parts of the organisation

Communicating information

Evaluating information

Deciding what, if any, action should be taken

Influencing people to change their behaviour

Although A&G define management control as the process by which managers implement strategy, they

exclude from their framework certain means of strategy implementation, i.e. organisational structure,

human resource management, and organisational culture.

In essence, A&G seem to take the view that employee behaviour can be controlled by way of formal

control systems, and by trying to achieve goal congruence, i.e. aligning employees’ personal goals with

those of the organisation. They see this as being achieved via rewards linked to formal control systems.

Other writers on management control (such as Merchant and Van Der Stede, 2007) focus on directly

and indirectly controlling employees’ behaviours in order to achieve the organisation’s strategic

objectives, and as such see human resource management (‘personnel controls’) and culture (‘cultural

controls’) as part of a broad package of controls (which could also include, but not be restricted to,

formal control systems such as budgets).

(10 Marks)

Reasons why A&G’s framework may no longer be valid in the 21st century

Discussion could consider and elaborate upon a number of the following themes (referring, where

appropriate, to relevant academic research) which have severely tested A&G’s control paradigm:

Changes in the control environment

A change in the nature of change – now discontinuous, abrupt and seditious

The diffusion of new technologies (e.g. the internet)

The need to build and maintain the trust of a broad set of stakeholders

The need to establish a better balance between ‘hard’ and ‘soft’ control methods

Shorter product lifecycles and new product positioning strategies

The spread of modular design from the computer industry to a diverse range of industries

The widening gap between current management control literature and management practice

The gap between the management control literature and conceptual developments in broader,

control-related literatures

The scope for closer links between the management control literature and the burgeoning

literature on performance measurement and management

(15 Marks)

Total:

(25 Marks)

_____________________________________________________________________________________