Question 3 answer

advertisement

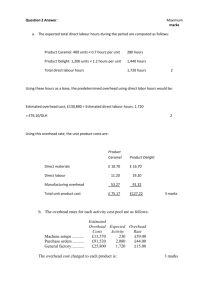

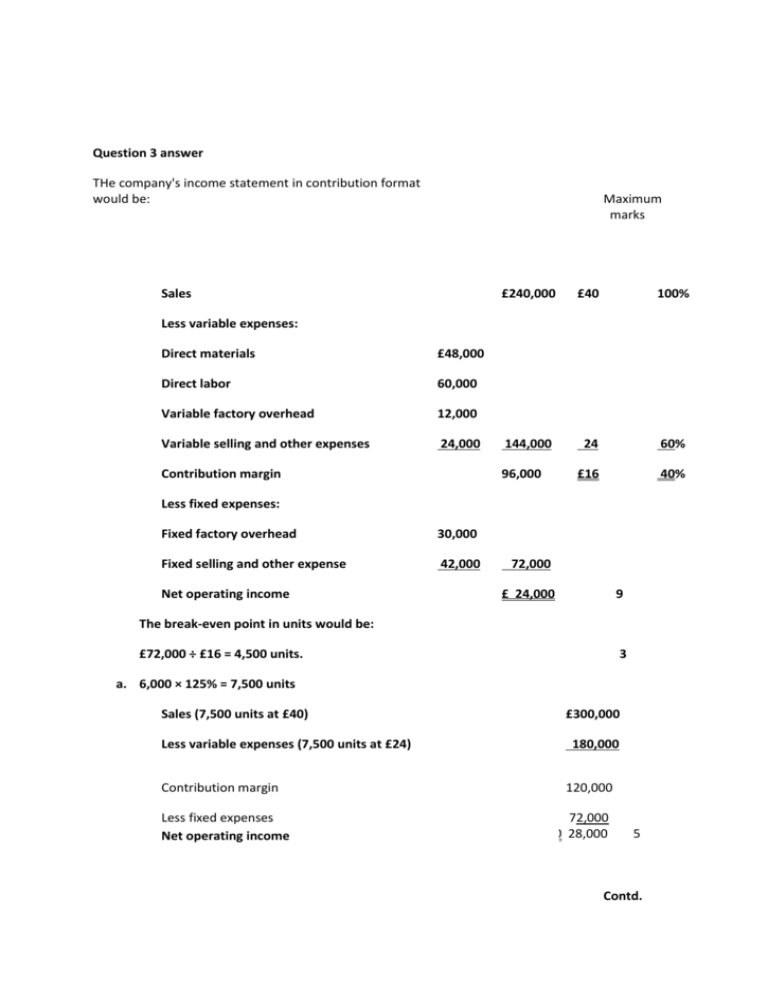

Question 3 answer THe company's income statement in contribution format would be: Maximum marks Sales £240,000 £40 100% 144,000 24 60% £16 40% Less variable expenses: Direct materials £48,000 Direct labor 60,000 Variable factory overhead 12,000 Variable selling and other expenses 24,000 Contribution margin 96,000 Less fixed expenses: Fixed factory overhead 30,000 Fixed selling and other expense 42,000 Net operating income 72,000 £ 24,000 9 The break-even point in units would be: £72,000 ÷ £16 = 4,500 units. 3 a. 6,000 × 125% = 7,500 units Sales (7,500 units at £40) Less variable expenses (7,500 units at £24) Contribution margin Less fixed expenses Net operating income £300,000 180,000 120,000 72,000 £ £ 48,000 28,000 5 5 Contd. Question 3 answer contd. Maximum marks c. (£72,000 + £50,000) ÷ 0.40 = £305,000 3 d. Direct labor costs are presently £10 per unit (£60,000 ÷ 6,000 units) and will decrease by £4 per unit (£10 × 40%). Therefore, the company’s new cost structure will be: Selling price Less variable expenses (£24 – £4) Contribution margin £40 100% 20 50% £20 50% (2 × £30,000 + £42,000) ÷ £20 per unit = 5,100 units 5 Total marks 25 Question 4 Answer Maximum Marks a. i. Total material variance = £140 U 1 ii. = Materials price variance = AQ(AP - SP) (2.1 x 400) x (£1.60 - £1.50) = £84 U 2 iii Materials quantity variance = SP(AQ - SQ) = £1.50(2.1 x 400 - 2.0 x 400) = £60 U 2 iv. Direct labor rate variance = AH(AR - SR) = (1.4 x 400) x (£6.50 - £6.00) = £280 U 2 v. Direct labor efficiency variance = SR(AH - SH) = £6.00(1.4 x 400 - 1.5 x 400) = £240 F 2 vi . Variable overhead rate variance = AH(AR - SR) = (1.4 x 400) x (£3.10 - £3.40) = £168 F 2 vii Variable overhead efficiency variance = SR(AH - SH) = £3.40(1.4 x 400 - 1.5 x 400) = £136 F 2 b. The total materials variance is divided into a price variance and a quantity variance for two basic reasons. First, the difference between the standard materials cost for the actual output and the actual materials cost is due to two different factors. One factor is the price that was paid for the materials. 6 The second factor is the efficiency with which the materials were used. Breaking down the total variance allows managers to isolate these two factors. Second, different people are usually responsible for purchasing and for using materials in production. The price variance is generally the responsibility of the individual in charge of purchasing. The quantity variance is generally the responsibility of the individual in charge of production. 6 Total 25 marks Question 5 Answer a. Sales, April: £300,000 × 0.26 Maximum marks £ 78,000 Sales, May: £500,000 × 0.70 350,000 Total Collections b. £428,000 3 Budgeted cost of goods sold for May: £500,000 × 60% = £300,000 Required inventory level at the end of April: £300,000 × 25% = £75,000 c. 2 May June July Budgeted sales £500,000 £700,000 £400,000 Budgeted cost of goods sold (60%) 300,000 420,000 240,000 Desired ending inventory, at cost* Total needs 105,000 405,000 Less beginning inventory, at cost** Required purchases, at cost 60,000 480,000 75,000 105,000 £330,000 £375,000 6 *Following month’s cost of goods sold × 25% **Current month’s cost of goods sold × 25% d. Payments for May purchases: £330,000 × 0.50 £165,000 Payments for June purchases: £375,000 × 0.50 187,500 £352,500 2 October production = 8,000 + (7,000 × 10%) - (8,000 × 10%) = 7,900; November production = 7,000 + (11,000 × 10%) - (7,000 × 10%) = 7,400; October production resin needs = 7,900 × 7 = 55,300 ounces 6 Contd. Question 5 answer contd. November production resin needs = 7,400 × 7 = 51,800 ounces October resin purchases = 55,300 + (51,800 × 25%) - (55,300 × 25%) = 54,425 ounces 6 Total 25 marks