Products Liability in the United States

advertisement

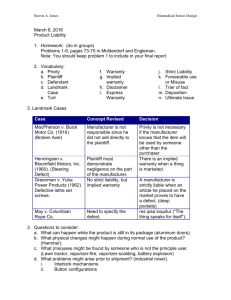

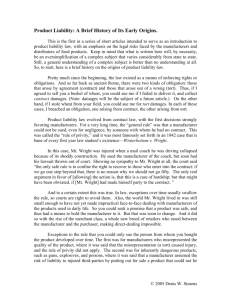

Products Liability in the United States BRUCE DOMAZLICKY PROFESSOR OF ECONOMICS SOUTHEAST MISSOURI STATE UNIVERSITY Outline of Presentation Historical Background Strict Liability v. Negligence 3 Ways that products can be defective Defenses in products liability cases Computation of damages The Liability “Crisis” in the United States Possible Reforms Historical Background Privity of Contract-protected manufacturers Escola v. Coca-Cola Bottling Co. (1944) (negligence standard applied, res ipsa loquitur) Greenman v. Yuba Power Products, Inc. (1963) (strict liability applied by Supreme Court of California) Why Strict Liability? Manufacturer in best position to prevent defects Manufacturer best understands the risk of using the product Manufacturer can spread risk of loss over all units sold through increase in price Proving negligence by manufacturer difficult for consumer Gives manufacturer incentive to adopt cost-justified improvements Deep pockets?? Three Ways a Product Is Defective Manufacturing Defect-usually the easiest to prove Design Defect Dueling Experts Jeopardizes manufacturer’s entire product line Failure to Give Adequate Warning Warning: Cape does not allow person to fly. Cape does not give person Superhuman powers. Warning: Product contains eggs. Warning: Product may cause drowsiness. Economics of Hazard Warnings Provide consumer with information on risk of using product Consumer then decides if the expected utility of his use of product exceeds the expected cost of using the product, including risk Role of Warnings Influence the Decision to Purchase a Product Influence the level of care of consumer when using the product Problems with Current Warning Regime Information Overload-to be effective, warnings need to be selective Label Clutter Excessive Warnings-warnings should provide new information, no need to warn of obvious risks Defenses in Products Liability Cases Unforeseeable Misuse Daniell v. Ford Motor Co. (1984) Cryts v. Ford Motor Co. (1978) Unreasonable Assumption of Risk Product has obvious defect and consumer chooses to use it anyway State of the Art Defense (Design Defect Cases) Calculating Damages: Some Issues Some Damages easy to Compute: Lost Earnings, Medical Expenses Other damages More difficult: Value of Life, Pain & Suffering, Loss of Consortium Collateral Source Rule-allows recovery even when third party covers costs Medical Insurance-subrogation clauses Life Insurance Joint and Several Liability Punitive Damages Liability “Crisis” 1975-89: Products Liability Cases Increased Sixfold 1984-1987: Liability Premiums Increased from $6.5B to $20B 1985: Premiums Increased 78% 1986: Premiums Increased another 68% Contributors to Crisis Mass Toxic Torts: Asbestos Cases Design Defect Doctrine Hazard Warning Cases Manufacturers’ Concerns Stock Market Loss Retroactive Losses: Cannot go back and raise price to spread cost of lawsuits Liability for not warning about hazard that was unknowable at the time of manufacture (asbestos) Possible Reforms Allow state of the art defense (Problem: Reduces incentive to improve product) Shorten the statute of limitations (Problem: Some risks take a long time to appear) Change collateral source rules so can only collect up to amount of loss (Problem: manufacturer may not get correct signals) Possible Reforms, Continued Joint and Several Liability-defendants are only responsible for their share of loss (Problem: Plaintiffs may not get full compensation) Limit Pain & Suffering Awards (Problem: Plaintiffs may not get full compensation) Loser Pays Court Costs, Lawyers’ Fees (Problem: Consumers afraid to sue)