Lecture 8 - Brian's Financial Accounting 111 Page

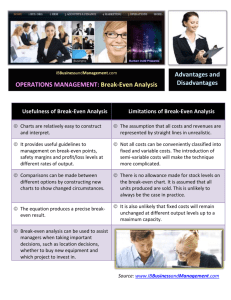

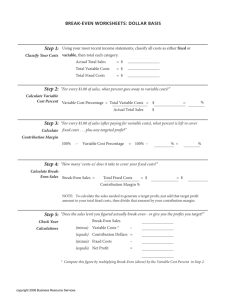

advertisement

Accounting & Financial Analysis 111 Lecture 8 Ratio Analysis, Break-even point Ratio analysis Ratio analysis provides the manager with the tools necessary to analyse the performance of the business. The business can then compare its current performance with its past performance to establish whether it is doing better or worse than previous years. It can also compare its performance with that of similar types of business by extracting the relevant ratios from business statistical publications. Ratio analysis 2 Ratios are use to measure different aspects of the business namely: The trading performance - (P & L) The trading performance in relation to assets, liabilities and shareholder's equity - (P & L / BS) An analysis of the company's worth (BS) Ratio analysis 3 Ratios are viewed under the following headings: 1) Profitability 2) Activity 3) Liquidity 4) Leverage 5) Valuation Ratio analysis e.g. In your notes are the Profit & Loss and Balance Sheet of Pizza Delight Ltd for the years 2003 & 2004. We will use these figures in the ratios that follow. Measuring Profitability The ratios used to measure profitability are usually: 1. Gross profit margin % 2. Net profit margin % 3. Return on total assets % 4. Return on shareholder's funds % 5. Return per employee $ Gross profit margin = Gross profit * 100 Sales $880,000 * 100 $2,200,000 = 40% Net profit margin = Net profit * 100 Sales $218,500 * 100 = $2,200,000 6.95% Return on net assets = Net profit after tax * 100 Total assets - current liabilities $152,950 . * 100 $1,064,300 = 14.37% Return on shareholder's funds = Net profit after tax Shareholder's equity *100 = $152,950 * 100 = 36.92% $414,300 Return per employee Net profit after tax Number of employees $152,950 20 = $7,648 Measuring Activity The ratios used to measure activity are: 1. Average inventory 2. Stock turnover 3. Average accounts receivable turnover 4. Average daily credit sales 5. Average collection period 6. Asset / employee ratio Average inventory Opening stock + closinq stock 2 $32,000+$29,000 = 2 $30,500 Stock turnover Cost of qoods sold Average inventory = $1,320,000 $30,500 = 43.28 times Average accounts receivable turnover Annual Credit sales Accounts receivable = $2,200,000 $78,200 = 28 times Average daily credit sales Annual credit sales Number of working days =$2,200,000 = $6,027 365 Average collection period Accounts receivable Average daily credit sales = $78,200 $6,027 = 13 days Asset/ Employee ratio Total assets Number of employees = $1,182,650 = $59,133 20 Measuring Liquidity Liquidity ratios are a means of calculating the working capital available to meet the short term debts of the company. It is an expression of how cash liquid the company is. The higher the number the stronger the company position. Current ratio Current assets Current liabilities $345,000 = $118,350 2.92 times Quick ratio Current assets - inventory Current liabilities- bank overdraft $316,000 $118,350 = 2.67 times Measuring leverage - gearing Debt to equity (Gearing) Long-term debts Shareholder's equity = $650,000 = 1.57 times $414,300 Total debt to total assets Total debt Total assets = $768,350 $1,182,650 = 0.65 times Interest coverage Profit before Interest* & Tax Interest = $218,500 + $68,000 $68,000 =4.21 times * Shown as “Finance Costs” in P&L Fixed charge coverage PBIT* + Lease payments Interest + lease payments $286,500 + $130,000 $68,000 + $130,000 = 2.1 times * Profit Before Interest & Tax Measuring valuation Earnings per share Profit after tax No. of Ordinary shares issued = $152,950 200,000 = $0.76 p.s. Dividend per share Ordinary dividends paid No. of Ordinary shares issued = $50,000 200,000 = $0.25 p.s. Earnings yield % per share Earnings per share * 100 Market price per share =$0.76 * 100 = 18.09% $4.20 Dividend yield % per share Annual dividend paid per share * 100 Market price per share $0.25 * 100 $4.20 = 5.95% Price / earnings ratio Market price per share Earnings per share = $4.20 $0.76 = 5.5 times Break-even Point Selling price - Variable costs = Contribution margin Contribution margin - Fixed costs = Profit Selling price is the price per unit sold. Total number of units sold * selling price per unit = Total revenue E.G. sale of 15,000 meals *$25 per meal =$375,000 revenue Variable costs are costs that increase/decrease according to the level of activity. (Sales, production) They relate to PER UNIT COST E.G. If each meal cost $9 to purchase the ingredients. The cost of the meals will change depending on the number of meals produced. 10,000 =$90,000 and 15,000 = $135,000. If the kitchen staff are paid by the number of meals produced and sold, their wages would be variable costs otherwise they are fixed costs. Semi-variable costs are costs that change slightly as the level of production increases but not in proportion to the increase in production. A semi-variable cost has an element of fixed costs in it. E.G. Telephone account has a fixed service charge, only the call charge increases as the calls increase. Electricity/gas charges in a kitchen will not change too much as the number of meals increase. Semi-variable costs are not normally classified within small to medium sized industry. It is only the very large corporations that may apply semi-variable costs in management applications. Most companies consider semivariable costs as part of the fixed costs. Fixed costs are costs that remain the same irrespective of the level of sales or production. E.g. Occupancy costs - (Rent, rates, electricity, telephone, insurance), long-term finance costs, Depreciation, Administration costs, Marketing costs. Break-even point It is in the interest of every business to calculate the amount of sales required at a given profit margin that will equal the fixed costs. That number of sales is the break-even point for the business. If the business cannot finance its fixed costs within a short time of commencement and has no alternate funding its chances of success are limited. Break-even point 2 1. 2. 3. The break-even point is influenced by three components. An adjustment to any of the components will change the breakeven number. Change in the selling price per unit Change in variable costs Change in fixed costs Break-even point e.g. A manufacturing company producing one product has the following data: Sale price $52 Variable costs $31 Fixed costs $325,500 Before the company starts to make any profit it must produce enough contribution equal to the fixed costs ($325,000). Therefore it must sell 15,500 units. Break-even point e.g. ctd. $52 - $31 = $21 contribution $325,500 / $21 = 15,500 units At this stage the company has not made any profits it has only made sufficient contribution to cover its costs. Every unit sold in excess of 15,500 will produce a profit of $21. Therefore if the company sells 18,000 units it should make a profit of $52,500. (18,000 - 15,500) * $21 Break-even point e.g. ctd The company may decide that $52,500 is not sufficient return on assets employed and it is not likely to increase sales beyond 18,000 units. Therefore an adjustment to any of the three components could improve the profit margin. Break-even point e.g. ctd E.g. If selling price was to be increased to $54 the break-even point would be reduced to 14,152 units. The outcome will be a profit of $88,504. (18,000 - 14,152) * $23 = 88,504 OR:((18,000 * $54) - (18,000 * $31)) $325,500 = $88,500 Break-even equation The equation to calculate the breakeven point is: Break-even point = Fixed costs Contribution PRACTICE ACTIVITY! Class Exercise 8A & 8B Do it manually or use Excel