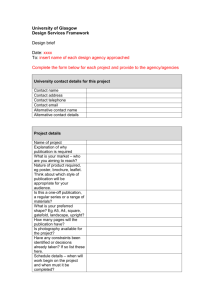

Scenario 6 PowerPoint

EKS Training

Scenario Six

Ground

Rules

o Don’t work ahead – stay on the current task o Turn off your cell phone o Question/Comments – raise your hand, stay in your seat o No side conversations - don’t even ask your neighbor for help o Returning volunteers sit next to new volunteers o Bring your materials every day o At least try to do your homework – bring your questions

Class

Structure

4 Steps:

1.

As a class, we will review Interview Notes, Intake

& Interview Sheet (13614-C) & supporting documents for each scenario.

2.

Instructor will teach Tax Law – referencing

Publication 4012 and 13614-C

3.

Instructor will show you how to enter information into TaxWise. WATCH!

4.

Now DO! Students will enter information on

TaxWise

Scenario #6

Scenario #6

What you will learn in this scenario:

1.

Capital Gains

What you will review in this scenario:

1.

Filing Status

2.

Personal Exemptions

3.

Income – W-2, Social Security, 1099-DIV, 1099-INT

4.

Business Income with expenses

5.

Simplified Method for 1099-R

6.

Itemized Deductions versus Standard Deduction

7.

ACA – Full coverage

8.

Form 8888

Scenario #6

Let’s review Timothy and Nicole’s

Information:

Interview Notes

Intake & Interview sheet - 13614-C

Tax Documents

Interview

Notes Review

What did you learn about Timothy and Nicole?

Intake &

Interview

Deep Dive with the 13614-C

Did they bring all the required documents?

Everything accurate?

What’s missing/wrong/mismatched that needs to be changed?

Compare tax documents and interview notes

Make any corrections needed on 13614-C

Fill out greyed out boxes (dependency and ACA)

Publication 4012, Tabs K-3 and K-4

Who should file?

Does this taxpayer need to file their return?

Or should they?

Publication 4012, Tab A

In Scope?

Is client eligible for VITA services?

What certification level is needed to prepare this return?

Publication 4012, pages 8-10

Scope of Services Chart

Scenario #6

You Got This!

Determine filing status and personal exemption

Publication 4012, Tab B-1 and Tab C-1

TaxWise

You Got This!

Enter Timothy and Nicole’s:

Personal information on Main Information

Sheet

Everything on page one of 13614-C goes on

Main Info

Publication 4012, K-6 to K-11 for Main Info

TaxWise

You Got This!

Enter Timothy and Nicole’s:

Income documents:

W-2, 1099-INT, 1099-DIV, 1099-R, SSA-1099, 1099-MISC

Publication 4012, Tab D for Income

Tax Law

Topic #1

Capital Gain or Loss

Capital gains are proceeds from the sale of stock, mutual funds or a personal residence

Sale of any other asset is out of scope

Sale of stock is reported on a 1099-B

Stock held for one year or less is short term

Stock held for more than one year is long term

A taxpayer cannot take net losses of more than

$3,000 per year - unused losses can be carried over to later years until they are completely used up

Publication 4012, Tab D-16 to D-19

Tax Law

Topic #1

Capital Gain or Loss

The taxpayer will need to report:

Date of sale

Date of purchase/acquisition

Short term or long term

Sale price/proceeds of the sale

Cost or other basis

Federal income tax withheld

Wash sale loss disallowed

Description (Rust Corp 100 SH; Rio Motors 150

SH)

Publication 4012, Tab D-16 to D-19

Tax Law

Topic #1

Capital Gain or Loss - Basis

The basis of property is usually the cost

The cost or basis should be reported on the

1099-B

Taxpayers should go to their broker if they need help determining the basis

If a taxpayer cannot provide the basis, the IRS will deem it to be zero

Publication 4012, Tab D-16 to D-19

TaxWise

Students: WATCH instructor

Enter Timothy and Nicole’s capital gains

(1099-B) on the Capital Gains Worksheet

Publication 4012, Tab D-16 to D-19

TaxWise

Students:

Enter Timothy and Nicole’s capital gains

(1099-B) on the Capital Gains Worksheet

Publication 4012, Tab D-16 to D-19

TaxWise

You got this!

Enter Timothy and Nicole’s itemized deductions on Schedule A

Publication 4012, Tab F

TaxWise

You got this!

Enter health coverage information for Timothy and Nicole on the ACA worksheet

Publication 4012, Tab ACA

Completing the

CA return

1.

Get the red out! Most information will automatically populate from the federal return

2.

State EITC Form – 3514*

3.

If you have entered more than one W-2 on the 1040, you will have to manually add the additional W-2’s. The first W-2 will carry over, but the rest won’t.

4.

Make sure to complete the direct deposit or balance due portion of the return

5.

Complete the CA Renters Credit Worksheet when applicable.

*At the time of this ppt creation, details on what TaxWise will auto populate are not available

TaxWise

You got this!

Complete the Sterlings’ CA return (540)

Balance Due

Timothy and Nicole have a balance due

What are their payment options?

How can they avoid this in the future?

Publication 4012, Tab K-16 through K-18

TaxWise

Students: WATCH instructor

Direct debit question on 1040 page 2:

No – 1040V appears in tree & prints

Yes – fill out ACH 1040 Form

Publication 4012, Tab K-16 to K-18

TaxWise

Students:

Direct debit question on 1040 page 2:

No – 1040V appears in tree & prints

Yes – fill out ACH 1040 Form

Publication 4012, Tab K-16 to K-18

Finishing the return

THINGS YOU NEED TO KNOW ABOUT FINISHING A RETURN

1.

Ask the questions in the Prep Use Fields

2.

All returns must be Quality Reviewed (checklist on 13614-C) Tab,

K-25

3.

Run Diagnostics to check for errors

4.

Print returns (Federal and State) for Taxpayer

5.

Review return with taxpayer (Formula 1040 activity)

6.

Have Taxpayer and Spouse sign 8879s for Federal and State and remind them they are responsible for their return and by signing, they are agreeing it is accurate:

One copy for the taxpayer

One copy for the VITA Site

Publication 4012, Tab K

Check our work

Do we have matching AGI, refund?

Let’s review:

Income documents

Schedule C/Schedule C-EZ

Capital Gains Worksheet

Schedule A

ACA worksheet

Look it up!

What are a taxpayer’s options in figuring out the basis of their stock transaction?

Publication 17, Part 3

Put it as zero, find it on their 1099-B or call up their broker!

True or False: Stock shares purchased on June 25, 2011 and sold October 8,

2015 are long term

Publication 17, Part 3

True

Where do I report the stock transactions?

Publication 4012, Tab D-16

Capital Gain or Loss Transactions Worksheet. TaxWise will automatically populate the copies of form 8949 and Schedule D.

Look it up!

How much loss can a taxpayer take in a given tax year?

Publication 17, Part 3

$3,000

True or False: The gain from the sale of a taxpayer’s main home cannot be excluded from the taxpayer’s income

Publication 17, Part 3

False– it can be excluded (up to $250,000) as long as it meets the ownership and use tests, the taxpayer has not excluded income from the gain of a sale on another home, did not receive a 1099-S or does not qualify to exclude it or chooses not to

But guess what – you never see this – talk to your site coordinator if you do!