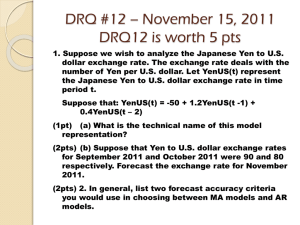

Exchange Rate Moves in the Current Japan Crisis US Dollar hits

advertisement

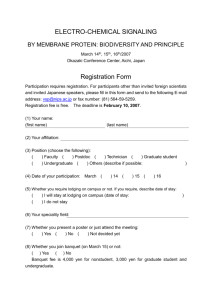

Event Study: Exchange Rate Moves in the Current Japan Crisis US Dollar hits fresh highs against EUR, GBP, But Falls against the Yen and Swiss Franc FXStreet.com Wednesday Mar 16 2011 The Dollar rose further against the British Pound (GBP) and the Euro (EUR) in the last hours amid risk aversion. The Japanese Yen (JPY) , the Swiss Franc(CHF) and the U.S. Dollar (USD) are once again rising as investors fly from riskier assets amid ongoing worries about a nuclear crisis in Japan and arrest in the Middle East. The Yen has continued rising throughout today's session on the back of the Japanese crisis and risk aversion. The Swiss Franc rose further across the board as risk aversion intensifies. The Swissy (nickname for Swiss Franc) is trading at 2-month highs against the Euro and the Pound Japanese Yen Hits Highest Against Dollar since 1995 on Radiation Concern Bloomberg.com March 16, 2011 The yen reached its strongest level since 1995 versus the dollar as increased risk in Japan of radiation leaks from crippled nuclear power plants boosted speculation investors there will bring home overseas assets. The four-day rally in the yen prompted speculation the Bank of Japan may intervene for the first time since September in an effort to counter repatriation flows and shore up the competitiveness of Japanese companies. The euro fell for the first time in four days after a Portugal credit downgrade revived concern about the region’s debt crisis. The Swiss franc gained as violence in the Middle East and concern in Japan prompted haven-asset buying. “It’s a mix of risk aversion and repatriation that’s driving the yen to strengthen,” said Brian Kim, a currency strategist at UBS AG in Stamford, Connecticut. “If there is repatriation coming back to Japan, the stronger yen is making it even more expensive to purchase yen.” “The more macabre headlines you see pertaining to the nuclear reactors, the more speculation you are going to see over repatriation,” said Jessica Hoversen, a Chicago-based analyst at the futures broker MF Global Holdings Ltd. “I think 80 is a line in the sand for the central bank.” The yen rose 0.6 percent to 80.20 at 12:55 p.m. in New York, from 80.71 yesterday. It gained as much as 0.9 percent to 79.98 per dollar, the strongest since April 1995, when it touched a post-World War II high of 79.75. Next Move Page | 1 “There are real concerns that if it’s a disorderly move down in dollar-yen, the Bank of Japan may start to intervene,” said Paresh Upadhyaya, head of Americas G-10 currency strategy at Bank of America Corp. in New York. “This time around there will be support for unilateral intervention. In order for Japan to regain competitiveness, they need a weaker yen. They can now build an economic case for that.” In an attempt to slow the yen’s 15 percent appreciation last year, the Bank of Japan sold 2 trillion yen ($25 billion) in September in the nation’s first currency market intervention since 2004. Governments and central banks intervene by selling or buying currencies to influence prices. “A surge in the yen could be a destabilizing event, said Robert Sinche, global head of foreign exchange strategy at Royal Bank of Scotland Group Plc’s RBS Securities unit in Stamford, Connecticut. “I would expect that they would intervene and that U.S. And European authorities would be fine with them intervening here. If there’s activity required now, it would be the Federal Reserve acting on behalf of the Bank of Japan.” The euro dropped after Portugal was cut two steps by Moody’s yesterday to A3, four levels from socalled junk status. The company cited the nation’s “less supportive” economic environment and said its outlook remained negative given Portugal’s “subdued growth prospects” and risks that the government won’t be able to implement deficit-reduction plans. Swiss Franc Record The Swiss franc advanced to a record against the U.S. dollar on investor demand for a refuge amid turmoil in the Middle East and Japan. Bahrain closed its stock exchange as clashes between security forces and anti-government protesters intensified. Concern that violence may spread to neighboring Saudi Arabia, the world’s biggest oil producer, damped demand for higher-yielding assets and increased commodity prices. The Thomson Reuters/Jefferies CRB Index of raw materials rose 1.1 percent after falling 3.6 percent yesterday. “The focus will remain on Bahrain as well as Japan,” Kathy Lien, director of currency research with online currency trader GFT Forex in New York. “For the time being, risk aversion will still be something that’s more dominant in the market right now.” The Swiss franc appreciated 0.8 percent to 90.92 centimes per dollar after touching 90.73, the strongest level since at least 1971, when Bloomberg records begin. The yen has strengthened 3.5 percent since Japan’s strongest earthquake on record last week caused a 7-meter (23 foot) tsunami that engulfed the northeast coast and damaged nuclear reactors. The yen reached its postwar high three months after Japan’s 6.9-magnitude Kobe earthquake. Page | 2 Japanese Redemptions May Quicken South African Rand’s Drop, Push Turkish Lira and Australian Dollar Lower Bloomberg.com March 16, 2011 Emerging-market currencies from South Africa to Turkey are falling on concern Japanese families will sell developing-country local bonds to fund the rebuilding of homes wrecked by the nation’s strongest earthquake. South Africa’s rand, the worst-performing emerging-market currency this year, will decline another 5 percent against the dollar following its biggest slump in 10 months yesterday as the Japanese unload their Eurobond holdings, Societe Generale SA says. The Turkish lira will slide to the weakest level since May, according to Guillaume Salomon, an emerging-market strategist at the Paris-based bank. Japanese investors own about $3.9 billion of South African rand-based Eurobonds, known as uridashi, more than the $3 billion of Brazilian real and $765 million in Turkish lira, according to data compiled by Bloomberg. Japan’s mutual funds held 2.8 trillion yen ($34.6 billion) in Brazilian stocks and bonds as their fourth-largest foreign assets, leaving the real among the most “vulnerable” during the selloff, HSBC Holdings Plc said. “When you’ve got a crisis like this, the initial reaction is shock, then people have got to access their cash and start rebuilding their homes,” Guillaume Salomon, an emerging-market strategist at Paris-based Societe General, said in a phone interview yesterday. “What we’re going to see is a reduction of emerging-market portfolios as people are putting money back into Japan.” Repatriation Japanese investors will repatriate funds from other countries to finance the recovery, Pacific Investment Management Co. Chief Executive Officer Mohamed El-Erian said in an interview with Bloomberg Radio yesterday. The nation’s holdings include at least $50 billion of debt in real issued by the World Bank, European Bank for Reconstruction & Development and Goldman Sachs Group Inc., according to Guggenheim Securities LLC, a New-York based brokerage. Investors in Japan have been buying bonds issued in the higher-yielding emerging-market currencies for the past five years lured by yields as high as 9 percent, Salomon said. Japan’s main central bank rate is between zero and 0.1 percent, compared with 11.75 in Brazil and 6.25 percent in Turkey. South Africa cut its main borrowing rate to 5.5 percent last year from 12 percent in 2008. The Brazilian real and the Australian dollar are the “most vulnerable” currencies and are likely to fall against the Swiss franc and Norwegian krone, David Bloom, global head of foreign- exchange strategy at HSBC in London, wrote in a note to clients, citing data from Japan’s Investment Trust Association. “The flow could be most dramatic for the Australian dollar and Brazilian real,” Bloom wrote. Page | 3 Japanese Yen Exchange Rate (Yen per USD): March 5 – March 16, 2011 Swiss Franc Exchange Rate (USD per Swiss Franc): March 5 - - March 16, 2011 Page | 4