Lease Agreement-Real Property

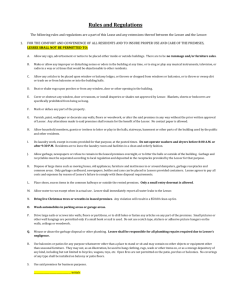

advertisement