Theory of Production and Cost

advertisement

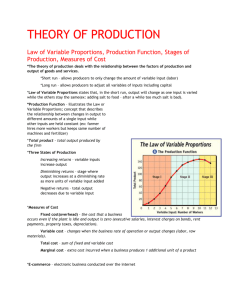

Economic cost: total cost of choosing one action over another. (Explicit + Implicit costs) Accounting costs: the actual expenses incurred in the production process (explicit costs). Explicit costs: the monetary payments for the factors of production and other inputs bought or hired by the firm. Eg. – rent, raw materials, wages, electricity. Implicit costs: those opportunity costs which are not reflected in monetary payments. Eg. – salary that could have been earned. A quick story to explain accounting and economic costs… Bob is a teacher who earns R100 000 a year (this includes his salary, medical aid and pension benefits). He also has R50 000 in a savings account. Bob decides to retire from teaching and start his own business making bean bags. He uses R50 000 from his savings account to purchase the machinery and equipment required to start his business. What are the accounting (explicit) costs involved in this decision? What are the economic (explicit + implicit) costs involved in this decision? Profit: revenue – cost of producing it. Total (accounting) profit: total revenue – total explicit costs Normal profit: equal to the best return that the firm’s resources could earn elsewhere Economic profit: total revenue - total explicit and implicit costs (including normal profit). Total revenue R320 000 Raw material costs R30 000 Wages and salaries R85 000 Interest paid on bank loan R30 000 Salary that the owner could have earned elsewhere R32 000 Interest forgone on capital invested in the business R20 000 Calculate… a) Normal Profit b) Economic Profit Production: the physical transformation of inputs into output. Short run production: a period of time when there is at least one fixed factor input. Fixed factor usually quantity of plant / machinery Long run production: a time period in which all of the factors of production can change. Fixed input: input whose quantity cannot be altered in the short run. Variable input: input whose quantity can be changed in the short run (as well as the long run). • The firm produces only one product. • units of input are identical/homogeneous. • Inputs can be used in infinitely divisible amounts. • Prices of the product and of inputs are given. • Firm uses fixed inputs and one variable input. Length of time between the short and the long run will vary from industry to industry. Fixed quantity of land = 20 units Variable input = labour Units of land Units of Labour 20 20 20 20 20 20 20 20 20 20 20 0 1 2 3 4 5 6 7 8 9 10 Total Product (tons of maize) 0 5 16 30 56 85 114 140 160 171 180 Units of labour ACTIVITY: investigate relationship between output (total product) and quantities of variable factors of production used. • By the end of this simulation you must understand… • The law of diminishing returns • The difference between total, average and marginal concepts • The difference between 'production' and 'productivity' • The difference between short run and long run • You have an imaginary factory. You have to move hockey balls from one bucket to another. • On successful transfer of a ball from one bucket to the other, your firm generates one unit of output. • Fixed factors (capital) - 2 buckets, batch of hockey balls & land. • Variable factor – labour (that’s where you come in!) • At the end of each production run, the firm will add an extra unit of labour to production. • Production levels will be recorded at the end of each production run. • Your must monitor the output levels with each different combination of inputs. • You may not throw the balls. • Balls must not be dropped into the bucket - if they are, they are counted as damaged goods and do not count towards final output. • Any balls dropped between the buckets also become damaged goods. • Each production run lasts for 30 seconds - you must keep strictly to this time limit. Can you explain the law of diminishing returns using our maize farmer example? Marginal product: the number of additional units of output produced by adding one additional unit of the variable input. Average product: the average number of total output produced by each unit of variable input. thproduct nd st product Total Highest of marginal first 2units labour Once Marginal 9maximum unitproduct of labour MP ofreached 21adds unit nothing -of of it keeps labouron unit of labour 113200 –1678 =16 =200 44 35 tons tons (N = 4) 44 ––declining. = = 28 0 tons tons 0 = 16 tons AP of Highest 1st unit of APlabour 16 ÷÷15==16 145 29tons tons AP increases zero when TP MP reaches >long AP asitsMP TPMP willequals continue towhere increase as AP & MP shaped like inverted “U”s MP equals AP at its maximum point. rise at declining rates reach max decrease at increasing AP decreases maximum. when MP < AP rates is positive BOX 6-1 TOTAL, AVERAGE AND MARGINAL MAGNITUDES Costs: expenses faced by a business when producing a good or service for a market. Short run - fixed and variable costs. Fixed Costs Fixed costs: cost that remains constant irrespective of the quantity of output produced. Examples of fixed costs include: • Rent • Insurance charges. • Salaries • Interest charges on borrowed money. • The costs of purchasing new capital equipment. • Marketing and advertising costs. Variable Costs Variable costs: costs that vary directly with output. As production rises - higher total variable costs as extra resources purchased. Examples of variable costs for a business include: • The costs of raw materials • Labour costs • Consumables and components used directly in the production process. Total product MC equals AC lies AVC above AC AFC and theirAVC respective AFC is L-shaped AVC, AC &and MC areatU-shaped minimum it-ratesdeclines includes points both start high - decline at decreasing - reach minimum points - increase at increasing rates starts because very high tillthem max TP reached The shape of the unit cost curves is determined by the shape of the unit product curves. OutputQ2 Q1isisthe thetotal totaloutput outputproduced producedby byN2 N1units unitsofoflabour labour. Output Long run: a time period where there are no fixed inputs – all the inputs (including all the factors of production) are variable. Enough time to build a new factory, install new machines, use new techniques of production etc… Law of diminishing returns does not apply - all the costs are variable. Marginal product has no meaning - can only be calculated if all the other inputs are held constant. Returns to scale: long-run relationship between inputs and output. Measured by varying all inputs by a certain % and comparing resulting percentage in production. Three possible situations can result… Constant returns to scale Given % increase in inputs = same % increase in output Increasing returns to scale Given % increase in inputs = larger % increase in output Decreasing returns to scale Given % increase in inputs = smaller % increase in output Decreasing returns to scale (long run concept) – ALL inputs increase by the same proportion. Diminishing marginal returns (short-run concept) - only the variable input increases. Economies of scale: occur when costs per unit of output fall as the scale of production increases. Diseconomies of scale: occur when unit costs rise as output increases. Both can be internal and external Internal: specific to a firm –can be controlled. External: outside the firm’s control – affects entire industry/economy. Technical economies: modern technology suited to mass production Managerial, organisational or administrative economies: specialisation and division of labour Marketing economies: bulk discounts & CPT decreases Financial economies: easier/cheaper to raise. Average fixed charges decline. Spreading overheads: Average fixed costs lower as firm grows. Internal diseconomies of scale Managerial diseconomies: longer lines of communication, management less directly involved. Worker alienation: specialised, boring and repetitive jobs – motivation & productivity affected. Deteriorating industrial relations: increased work stoppages and strikes. Industry economies: Specialised markets – benefits raw materials, selling finished product; specialised labour skills General economies: general infrastructural development & better workers and may lower the effective cost of labour. Shortage: raw materials, skilled labour – unit costs rise Congestion: land prices, traffic, pollution. Economies of scope: the cost savings achieved by producing related goods in one firm rather than in two. All inputs variable in long run therefore no total or average fixed costs. The long run can be seen as a set of alternative short-run situations between which the firm can choose.