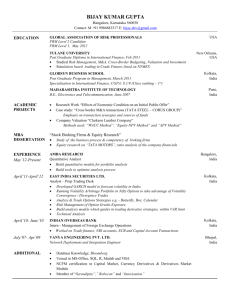

Volatility - The International Securities Exchange (ISE)

advertisement

International Securities Exchange

Alex Jacobson

Vice President, Education

www.iseoptions.com

Volatility And Its Importance To

Options Traders

ISE EDUCATION WEBINAR

FEBRUARY 2006

For the sake of simplicity, the examples that follow do not take into consideration

commissions and other transaction fees, tax considerations, or margin

requirements, which are factors that may significantly affect the economic

consequences of a given strategy. An investor should review transaction costs,

margin requirements and tax considerations with a broker and tax advisor before

entering

into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling

an option, a person must receive a copy of CHARACTERISTICS AND RISKS OF

STANDARDIZED OPTIONS. Copies have been provided for you today and may

be obtained from your broker, one of the exchanges or The Options Clearing

Corporation. A prospectus, which discusses the role of The Options Clearing

Corporation, is also available, without charge, upon request at 1-888-OPTIONS

or www.888options.com.

Any strategies discussed, including examples using actual securities

price data, are strictly for illustrative and educational purposes and are not to be

construed as an endorsement, recommendation or solicitation to buy or sell

securities.

www.iseoptions.com

» Free volatility data on all ISE listed options

» Updates on ISE broad market index products

» Updates on ISE sector options

» education@iseoptions.com

Bullish Stock Investor

Long Stock

One Strategy: buy stock

Some Bullish Option Choices

Long Call

Short Put

Spread

Short Put

Call Volatility

Spread

Long Call Spread

Split Strike

Synthetic

Many Strategies!

OPTIONS GIVE YOU OPTIONS

Fact

» All options strategies work

» They each describe a specific set of expected

outcomes -- Price action --Volatility -- Time

» No strategy works all the time

Options Myths

»

»

»

»

90% Expire Worthless {10 - 30 - 60}

Sellers Smarter Than Buyers

Zero Sum Game Between Buyer/Seller

Raw Option Data Has Sentiment

Volatility Importance

» If you are right about direction but wrong about

volatility, your trade may not make money

» If you are right about volatility but wrong about

direction, your trade may not lose money

Option Pricing

To calculate an option’s theoretical value, you need:

»

»

»

»

The Price of the underlying

The Strike Price of the option

The Time until the option expires

The Cost of Money (Interest Rates less dividends, if

any)

» The Volatility

= Theoretical Value of the Option

Options Pricing

» Volatility is really the only unknown for short

dated options

» Longer dated options also have interest rate

uncertainty

The Reality of Pricing

Options Have Value For Two Core Reasons

1. The Time Value of Money

For Calls The Cost of Carry Less

Dividends

For Puts The Short Stock Rebate

Plus Dividends

2. The Probability of Price Change

Volatility

Price Movements

Theoretical Values Change because Options Exist in

a dynamic environment…

»

»

»

»

Stock Prices Change

Time Goes By

Interest Rates are Adjusted

Volatility Increases and Decreases

Price Movements

» Volatility and price are generally inversely related

– Volatility generally goes up when prices decline

Price Movements

» If a stock moved 1% daily it would be a 16%

volatility

» Daily % move X 16 is the annual volatility

» Why 16 ?

» All volatility is quoted is annual

Types of Volatility

» Historical

Based on the PAST price action of the

underlying instrument

» Implied

Reverse engineered from the trading

activity in the options

» Actual

What you will experience over the life of

your trade

» OOB/COB Be Careful (Especially on down days in

puts)

» Mine

Your expectation

Volatility Comparisons

» Historical vs. Implied

» Implied vs. Expected

» Implied vs. Actual

Expectations

» Options Buyers Volatility Expand

» Options Sellers Volatility Contract or Stay Constant

Some Comments On Volatility

» About as low as it’s been (in many stocks and

indexes) for almost 30 years

» Is not right or wrong, but does represent a

current consensus

» Is considered by some to be forward looking

» Represents a lot more information than “just”

price distribution

Volatility And Hedging

» With volatility near 30 year lows hedging costs are

also near 30 year lows

» Hedges involving buying options may feel

inexpensive

» Hedges involving the selling of options may feel

cheap to employ – premiums received provide little

protection net of transaction costs

Why Volatility Is Low

» Flood of liquidity in options trading

» Dealer consolidation

» Lowered transaction costs

» Crash premium left market post-9/11

» Lack of downside gaps

» Stable market

Low Volatility

» Many major market events have come off of what

was (in hindsight) a volatility low

» Volatility resources: www.iseoptions.com

Volatility’s Impact On Option Prices

» Volatility changes have an impact on options

prices:

» ATM:

» OTM:

» ITM:

Largest nominal change

Largest percentage change

Smallest nominal/percentage

Volatility

» QQQQ @ $37.98

Implied Volatility at about 16.50%

What if I changed it to 32% ?

Volatility

» 60 Day $35 Call 3.30 – 3.40

3.85

» 60 Day $38 Call 1.05 – 1.10

2.00

» 60 Day $41 Call

.10 - .15

.90

Bullish Declining Volatility

» Trades that benefit from a price advance and a

decline in volatility

» Put Selling

Debit call spreads

OTM covered writes

ITM calls vs. ATM/OTM calls

Bearish Declining Volatility

» Trades that benefit from a price decline and a

decline in volatility

–

–

–

–

Selling calls

Debit put Spreads

ITM puts vs. ATM/OTM puts

ITM covered writes

Benefits Of Trading At ISE

» Largest equity options market

» First and proven all-electronic platform in the

US

» Spreads traded as spreads

» Electronic buy/write capability

www.iseoptions.com

» Free volatility data on all ISE-listed options

» Updates on ISE broad market index products

» Updates on ISE sector index options

International Securities Exchange

![[These nine clues] are noteworthy not so much because they foretell](http://s3.studylib.net/store/data/007474937_1-e53aa8c533cc905a5dc2eeb5aef2d7bb-300x300.png)