Marketing auditing

advertisement

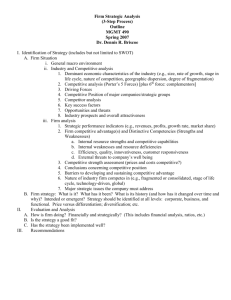

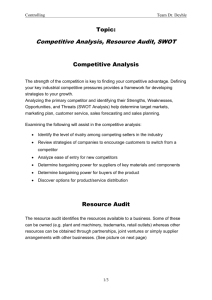

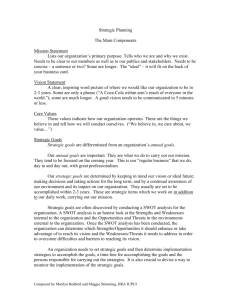

1 An audit plays a vital role in imparting knowledge about the market and its environment. It is a tool for recording and analyzing information. The audit for recording, analyzing, and measuring the performance of the company's marketing activities is called marketing audit. 2 Marketing audit has two variables namely the external audit and the internal audit. The marketing performance of an organization is gauged in terms of its market share, profitability, and growth of sales. The marketing effectiveness depends on the customer philosophy, marketing orientation, marketing information, strategic orientation, and operational efficiency. 3 An effective audit should be systematic, comprehensive, independent, and periodic. A marketing audit has six components: 1. Marketing environment audit 2. Marketing strategy audit 3. Marketing organization audit 4. Marketing systems audit 5. 6. Marketing productivity audit Marketing function audit 4 Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis is the most commonly used tool in organizations. Strengths and Weaknesses pertain to the internal environment. Opportunities and Threats pertain to the external environment. After SWOT analysis, the strategy has to be formulated based on the insights from the analysis. Some of the reasons for the failure of SWOT analysis are lack of proper focus during the analysis and lack of in-depth information. 5 THE NATURE, STRUCTURE AND PURPOSE 6 Where is the company now? 1. The organization’s current market position 2. The nature of environmental Where does the company want to go? opportunities and threats 3. The organization’s ability to cope with environmental demands. How should the company organize its resources to get there? The audit is the means by which the first of these questions is answered 7 An audit is a systematic, critical and unbiased review and appraisal of the environment and of the company’s operations. A marketing audit is part of the larger management audit and is concerned (specifically) with the marketing environment and marketing operations. “The means by which a company can identify its own strengths and weaknesses as they relate to external opportunities and threats. It is thus a way of helping management to select a position in that environment based on known factors.” 8 1. The detailed analysis of the external environment and internal situation 2. The objective evaluation of past performance and present activities 3. The clearer identification of future opportunities and threats. 9 “Irrespective of the size of the organization, corporate decisions have to be made within the constraint of a limited total resource.” (Ansoff, 1968) The marketing audit can therefore be seen in terms of providing a sound basis for process of resource allocation. Any strategy that is developed should be far more consistent both with the demands of the environment and the organization’s true capabilities and strengths. 10 11 STRUCTURE 1. The organization’s environment (opportunities and threats) . 2. Its marketing systems (strengths and weaknesses). 3. Its marketing activities. External Audit Internal Audit FOCUS 1. Environmental or Market Variables : macro-environmental forces (political/ legal, economic/ demographic, social/cultural, and technological) 2. Operational Variables: microenvironmental actors (customers, competitors, distributors and suppliers) 12 1. Pre-audit activities in which the auditor decides upon the precise breadth and focus of the audit. 2. The assembly of information on the areas which affect the organization’s marketing performance – these would typically include the industry, the market, the firm and each of the elements of the marketing mix. 3. Information analysis 4. The formulation of recommendations 5. The development of an implementation program. 13 Step 1 Define the market Develop: ➡ Statement of purpose in terms of benefits ➡ Product scope ➡ Size, growth rate, maturity state, need for primary versus selective strategies ➡ Requirements of success ➡ Divergent definitions of the above by competitors ➡ Definition to be used by the company 14 Step 2 Determine performance differentials ➡ Evaluate industry performance and company differences ➡ Determine differences in products, applications, geography and distribution channels ➡ Determine differences by customer set Step 3 Determine differences in competitive programs Identify and evaluate individual companies for their: ➡ Market development strategies ➡ Product development strategies ➡ Financing and administrative strategies and support 15 Step 4 Profile the strategies of competitors ➡ Profile each significant competitor and/or distinct type of competitive strategy ➡ Compare own and competitive strategies Step 5 Determine the strategic planning structure When size and complexity are adequate: ➡ Establish planning units or cells and designate prime and subordinate dimensions ➡ Make organizational assignments to product managers, industry managers and others 16 17 Marketing effectiveness is, to a very large extent, determined by the extent to which the organization reflects the five major attributes of a marketing orientation, namely: 1. A customer-oriented philosophy 2. An integrated marketing organization 3. Adequate marketing information 4. A strategic orientation 5. Operational efficiency 18 Each of these dimensions can be measured relatively easily by means of a checklist and an overall rating then arrived at for the organization: an example of this appears in figure 2.2 (text book) 19 20 21 To separate meaningful data from that which is merely interesting To discover what management must do to exploit its distinctive competencies of the market segments both now and in the longer term. 22 23 Organizational advantages • Economies of scope and /or scale • Flexibility • Competitive stance • Size • Speed of response • Past performance • Financial strengths • Patterns of ownership • Reputation 24 Departmental and functional advantages Production • Technology • Process efficiency • Economies of scale • Experience • Product quality • Manufacturing flexibility Personnel • Good management–work • Workforce flexibility Research and development • Product technology • Patents Marketing • Customer base Customer knowledge • New product skills • Pricing • Communication and advertising • Distribution • Sales force • Service support • Reputation 25 Advantages based on relationships with external bodies • Customer loyalty • Channel control • Preferential political and legislative treatment • Government assistance • Beneficial tariff and non-tariff trade barriers • Cartels • Intra-organizational relationships • Access to preferential and flexible financial resources 26 Sources of competitive advantage (adapted from McDonald, 1990) 27 The threats matrix 28 1. An ideal business that is characterized by numerous opportunities but few, if any , threats 2. A speculative business that is high both in opportunities and threats 3. A mature business that is low both in opportunities and threats 4. A troubled business that is low in opportunities but high in threats. 29 A firm's strengths are its resources and capabilities that can be used for developing a competitive advantage. Examples of such strengths include: Patents Strong brand names Good reputation among customers Cost advantages from proprietary know-how Exclusive access to natural resources Good access to distribution networks The absence of certain strengths are a weakness. For example, the following may be considered weaknesses: Lack of patent protection A weak brand name Poor reputation among customers High cost structure Lack of access to best natural resources Lack of access to key distribution channels In some cases, a weakness may be the flip side of a strength. For example, a firm has a large amount of manufacturing capacity. While this capacity may be considered a strength that competitors do not share, it also may be a considered a weakness if the large investment in manufacturing capacity prevents the firm from reacting quickly to changes in the strategic environment. To develop strategies that take into account the SWOT profile, a matrix of these factors can be constructed. The SWOT matrix, can be changed into what is known as the TOWS Matrix that is shown on the next slide: Strengths TOWS Analysis Opportunities S-O Weaknesses W-O Strategies Strategies Threats S-T W-T Strategies Strategies S-O strategies pursue opportunities that fit well the company's strengths. W-O strategies overcome weaknesses to pursue opportunities. S-T strategies identify ways that the firm can use its strengths to reduce its vulnerability to external threats. W-T strategies make a defensive plan to prevent the firm's weaknesses from making it susceptible to external threats. 37 38