PPT

advertisement

Securitization of IP

DR. Prabuddha Ganguli [PhD]

CEO

“VISION-IPR”

FLAT NO. 101/201, SUNVIEW HEIGHTS

SHER – E- PUNJAB SOCIETY , ANDHERI EAST , Mumbai 4001093

e-mail: ramugang@vsnl.com

Presentation at the WIPO-Italy International Symposium on

IPR and Competitiveness of SMEs in Textile and Clothing

Caserta, Italy, November 30-December 1, 2005

IPR Enabled Knowledge Incubation and

Realisable Value of IP to Potential Value of IP

Wealth Realisation

Product Lifecycle

Competitive sustenance

Market acceptability

IPR

Marketable Products/Processes

Management

Alignment with market

Idea into product/process

Ideas Actionable

Ideas demonstrable

Idea Feasibility

Freezing of options

Position in the protected

Technology grid

idea stage ..Technology

development

pganguli©2005

p.ganguli©2003

time

Value addition

to Organisation

& Market

Value of IP

• Dow Chemical Company lowered maintenance taxes

paid by aligning its intellectual assets with

business strategies reduced its annual costs for

obtaining and maintaining patents by $1.5 million.

By reducing its patent portfolio

from 12000 patents to 8500 patents from 1993 to 1999,

Dow saved $ 40 million in maintenance tax savings.

• IBM increased patent licensing royalty revenues 3,300%

from $30 million in 1990 to $1B today.

This recurring revenue stream is mostly

unrestricted cash that represents 1/9 of IBM’s

pretax profits and equates to $20B in product sales reve

pganguli©2005

Value of IP

• Philips Electronics, enhanced licensing

revenue by 45% and obtained 35%

more patents in 2000 as

compared to their performance in 1999.

• British Telecommunications generated ~

$14 million in new licensing revenue by

data mining its patent portfolio and

unlocking new sources of revenue

pganguli©2005

Traditional financing methods

•

Royalty recipients turn future receivables into cash

by selling the intellectual property outright.

-- the owner receives a lump sum

but loses all control over the assets.

•

Method of cashing in on royalty payments

has been to borrow against them.

This type of loan provides a fairly low amount

of proceeds

-- about 70% of the value of the receivables.

-- the term of these loan is < five years,

resulting in fairly high installment payments.

pganguli©2005

Loans using intellectual property rights as collateral

Venture companies lacking sufficient physical collateral,

such as land, buildings and other real estate,

and credit strength find it difficult to obtain loans

from financial institutions.

In these cases, Banks use loans secured by IPR,

such as patents and copyrights with market value.

Examples of intellectual property rights serving as collateral

•Patents that have been approved, patents that have been

filed (in principle, patents cannot be used as collateral before

they have been filed for approval) ;

Program copyrights (computer programs),

copyrights applying to content ; Other IPRs

pganguli©2005

Securitisations based on

royalties

2500

2000

1500

US $ million

1000

500

0

1992

1994

1996

2000

Source: www.dechert.com article by Malcolm S Dorris

pganguli©2005

IP Securitization by Industry

Industry

Issuance

$MM

% of total

issuance

Number of

transactions

Film

865

42

2

10

Music

446

22

14

70

Sport

315

15

1

5

Fast Food

290

14

1

5

Pharma

100

5

1

5

Apparel

24

1

1

5

Source: David Edwards in “From Ideas to Assets”, p. 605;

pganguli©2005

% number of

transactions

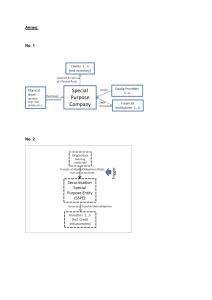

Securitization

Securitization is the pooling of revenue - generating assets,

and issuing securities backed by them.

The owner of the assets receives payment

based on the discounted present value

of the transferred assets,

and

the investors obtain a return on their investment

derived

pganguli©2005

from the assets' revenue stream.

Securitization

Securitization means “a company, etc.

transfers specified assets that it owns

to a vehicle that is newly established

for the purpose of

holding assets (called “special purpose vehicle; SPV”)

and

raising funds backed up by

cash flows arising from transferred assets through the SPV.

It is financial means of raising funds by taking

only specific assets as reserves

instead of the entire asset base of the fund-raiser.

pganguli©2005

IP Securitization

Known Securitization Approaches

•issuance of publicly-offered corporate bonds

(typical securitization);

• issuance of privately-offered corporate bonds;

• privately-offered bonds that are practically

IP - backed loans

(e.g., privately-offered bonds underwritten

by a single institutional investor);

and non - recourse loans collateralized by IP (IPR)

pganguli©2005

IP Securitization

Known Securitization Approaches

•a scheme of securitizing rights in small portions

could also be added

since this scheme does not sufficiently secure

bankruptcy

remoteness of the assets at all and the investors

would

directly bear any risk concerning the assets,

it would be better to distinguish

this scheme from securitization.

pganguli©2005

IPR Securitization

•the characteristics of the assets to be securitized

•the transfer of assets to be securitized

i.e. transferability; true sales; effectiveness

against third parties; risk of cancellation of a

license contract ; evaluation of the IP concerned.

•credit enhancement

•issue of securities

•handling after the implementation of the securitization.

pganguli©2005

Securitization in USA

Asset-backed securities issued : 2.9 trillion $

Compare with straight corporate bonds issued 880 billion $

Diversification of Assets for securitization include

Lease credit claims and mortgages,

intellectual property (IP)

In January 1997, David Bowie, a U.K. rock star, issued

Bonds backed by the royalty claims for his music works,

and raised 55 million dollars in the U.S. financial markets.

This case is recognized as the first IP securitization.

pganguli©2005

Securitization of IP… Japan

Securitization of the ground-based broadcasting right

(a type of copyright) in 2002,

and

The first attempt of securitization of a patent right

was made in 2003.

pganguli©2005

IP Securitization

Use of System Supporting Business with Effective Use of Intellectual Property Rights

(SPC method)

pganguli©2005

Source:Dev.Bank of Japan)

DBJ cooperated with the Bank of Tokyo-Mitsubishi, Ltd.,

in providing loans to GONZO K.K. to produce a new animated film.

In this project, GONZO transferred the intellectual property rights

to a special purpose company (SPC).

The SPC raised funds from DBJ and others, and

GONZO used the money it received from transferring the copyright

to produce a new work.

This new fund-raising method - distinct from

the “production committee method,” which involves equity – enables

the consolidated management and use of the copyright by the SPC

as well as the introduction of non-recourse loans and

outside investors, paving the way for the development of

content businesses that can compete on a global stage.

The key factors behind the success of this project were

GONZO's digital technology for animated productions and

the motivation to find a new form for the licensing business

run by GDH K.K.,

GONZO's parent company and an investor in the project.

pganguli©2005

Copyright securitized

Shochiku Co., Ltd., a film company,

granted TV Tokyo Corp.

the ground-based broadcasting right for 34 films

that had yet to be aired from among a total

of 48 of the popular serial films “It’s Tough Being a Man.”

The SPC, having obtained this content copyright

from Shochiku, raised funds from the Industrial Bank of Japan,

by offering the royalties for

the ground-based broadcasting right from TV Tokyo as backing.

pganguli©2005

Patents Securitized

Scalar Co., a venture company holding multiple patents

relating to optical technology and engaged

in the development of optical lenses,

had granted an exclusive license for four patent rights

that it owned to Pin Change, Co., Ltd.,

a venture company within Matsushita Electric Group.

Scalar transferred these patent rights to the SPC and then

SPC issued corporate bonds and raised funds backed up

by the royalties for the patent rights.

pganguli©2005

Examples… Securitization

Music industry : David Bowie's securitisation, others based

on receivables from music tapes.

Iron Lady's music receivables have been securitised.

Others:Scorpion, Ron Isley, etc

Fashion designers: In 1993, US fashion company Calvin Klein

raised US$58 million with the securitization

of royalties on perfume brands,

arising from the exclusive right

to use the Calvin Klein trade mark

on existing and future products.

Source: http://www.vinodkothari.com/index.htm

pganguli©2005

Chrysalis deal structured by Bank of Scotland{March 2001}

Source: http://www.vinodkothari.com/index.htm

GBP 60 million deal

The transaction uses a loan structure and

not a true sale structure.

The 15-year transaction includes a three-year revolving

period followed by a 12-year amortisation

period to a substantial residual amount

Funded by MUSIC Finance Corp and

the collateral was the Chyrsalis Group’s International

music catalogue and the revenues derived from the Catalogue

– the Net Publishers Share (NPS)

- via the US Commercial Paper market.

pganguli©2005

Chrysalis deal structured by Bank of Scotland

GBP 60 million ~ 40% of the estimated current value of the

catalogue and is non-recourse to the

rest of the Chrysalis Group.

Chrysalis is allowed to maintain control over

the administration and management of its

various music-publishing subsidiaries.

Effective interest rate after amortising all fees and costs

compared well to the Group’s then-prevailing

cost of borrowing.

pganguli©2005

Securitization… newer

approaches

• Monaco Records

– cash flows from Intellectual Property rights owned or

administered by the record label will go to repay

investors who can exercise their right to 'buy into'

profits when they reach a pre-determined level

– investors can realise their profit and a higher interest

rate in a much shorter time frame than with a traditional

Asset-Backed Bond issue, which will normally take

between 10 to 15 years to mature.

– the product will be offered to retail investors in the

capital market while earlier IP securitisation products

have been lapped up mostly by insurance companies on

private placement

pganguli©2005