SGLV 8286 & sglv 8286a

advertisement

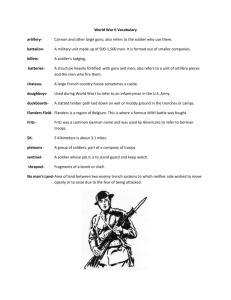

SGLV 8286 & sglv 8286a TASK, CONDITIONS, STANDARDS: • TASK: • Conduct class on SGLV 8286 & 8286A. • CONDITIONS: • Given a classroom, PowerPoint presentation, reference material & Soldiers. • STANDARDS: • IAW AR 600-8-1, MILPER MESSAGE 08274 & 08-227, complete SGLV 8286 & 8286A RISK ASSESSMENT: • LOW • Possible hazards: • Falling asleep and hitting your head on table • Paper cuts • Tripping over wires or chairs REFERENCES: • AR 600-8-1, Chapter 12 dated 30 April 2007 • www.va.gov • MILPER MESSAGE 08-274 & 08-227 SGLV 8286 & SGLV 8286A forms can be found on eMILPO (https://emilpo.ahrs.army.mil/), DBIW and www.va.gov DEFINITIONS: • Surety bond: a bond given to protect the recipient against loss in case the terms of a contract are not filled. • Term insurance: an insurance policy that provides coverage for a limited period, the value payable only if a loss occurs within the term, with nothing payable upon its expiration. • UGMA: Uniform Gifts to Minors Act. • UTMA: Uniform Transfer to Minors Act. SOLDIER RESPONSIBILITIES: • Soldiers will ensure the amount of insurance coverage and beneficiary designations on their SGLV 8286 are current. • Soldiers will promptly inform the personnel office of any • Election to increase or decrease coverage. • Election not to have coverage. • Change or addition to beneficiaries. • Legal name change. *para 12-2 • At a minimum, comply with AR 600-8-1, Chapter 12, Section III for other changes. SGLI INFORMATION: • SGLI is a term life insurance. • As of 1 SEP 05, all Soldiers are automatically insured under SGLI for the maximum $400,000 unless they elect IN WRITING to be covered for a lesser amount, or not to be covered at all. They may purchase lesser amounts in increments of $50,000. • The SGLI coverage does not affect the right to retain any other Government or private insurance except VGLI. • It will affect the FSGLI coverage. *para 12-3 • See AR 600-8-1, Chapter 12, paragraph 12-4 for information on Soldiers eligible to be insured. TERMINATION OF COVERAGE: • Absent without leave. • Court-martial sentence. • Arrest or confinement by military authorities. • Civilian confinement. *para 12-5 FORFEITURE OF COVERAGE: • Those guilty of mutiny, treason, spying, or desertion. • Those who, because of conscientious objections, refuse to perform service in, or wear the uniform of, the Armed Forces of the United States. • No insurance will be payable for the death inflicted as a lawful punishment for crime, or for military or naval offenses. However, it will be paid for death inflicted by an enemy of the United States. *para 12-7 BENEFICIARY DESIGNATIONS: • All Soldiers electing SGLI coverage are required to designate each principal and contingent beneficiary by name. • A Soldier may designate as beneficiary any person, firm, corporation, or legal entity, including a charitable organization or trust. The Soldier may designate a principal and a contingent beneficiary. When a Soldier designates more than 1 beneficiary, the SGLV 8286 must clearly show each beneficiary designated as either “principal” or “contingent”. When the Soldier designates 2 or more beneficiaries as principal or contingent, the Soldier should specify in fractions, percentages, or monetary amounts the share to be paid to each beneficiary shown on the form. *para 1217 COUNSELING ON BENEFICIARY DESIGNATIONS: • The installation AG will appoint an officer, warrant officer, senior NCO (E7-E9), or civilian (GS-5 or higher) employee or contract employee to counsel Soldiers who name some person or organization other than family members or parents as a beneficiary. The appointed officer will sign the SGLV 8286 in the “Witnessed and Received By” block. If an appointed Federal contract employee signs, enter the word “Contractor” in the “Rank, Title, or Grade” block of the SGLV 8286. At a minimum, the counselor will advise the Soldier that SGLI is intended to provide some form of financial security for family members or parents. *para 12-18c. CONT… COUNSELING ON BENEFICIARY DESIGNATIONS: • Additionally, inform the Soldier that election of beneficiaries is a personal choice requiring careful consideration. If the Soldier insists on an unusual designation, the person providing the counseling to the Soldier will insert the following notation near the bottom of the SGLV 8286: “On (date) this Soldier was counseled regarding this unusual beneficiary designation.” The person who counseled the Soldier will sign and date the form. MILPER MESSAGE 08-274: • 1. This message reinforces guidance to personnel work centers when assisting married Soldiers who make changes to their SGLI designation. • 2. References A & B require the Army to make a good faith attempt to notify the Soldier’s spouse anytime a married Soldier names someone other than his/her spouse or children as their beneficiary. These references also require that the Army make a good faith attempt to notify the Soldier’s spouse anytime a married Soldier who has named his/her spouse as the SGLI beneficiary purchases less than the maximum coverage of $400,000. Cont…MILPER MESSAGE 08-274: • 3. Under the current procedure, if a married Soldier changes his/her SGLI designation as described in paragraph 2, the electronic military personnel office (EMILPO) will not print the new SGLV 8286 election and certification, until the spouse notification letter is first printed. • 4. To ensure the Army complies with the statutory requirements of references A & B to notify spouses about these SGLI designations, this message reminds personnel work centers to mail the spouse notification letter to the spouse’s last known address. In cases where there is no current address for the spouse in EMILPO, the system will generate a message notifying the operator to enter an address for the spouse using the family member function. • 5. POC for any policy questions is LTC Mike Worth, Army Casualty and Mortuary Affairs Operations Center, (703) 3255309. SPOUSAL NOTIFICATION LETTER: • 13 July 2008 • • • Mrs. Mary Jones 1N211 Park Ridge Rd. Somewhere, IL 88888 • Dear Mrs Mary Jones : • As the current lawful spouse of MAJ JOHN JONES, the law provides for spouse notification whenever a service member elects a beneficiary designation for SGLI other than the current lawful spouse. This letter is to inform you that on 13 July 2008 your spouse has elected: A beneficiary other than current lawful spouse or child Your spouse is entitled to make the above election. While we are not authorized to identify the names of any other beneficiaries (if elected), we are required to notify you of your spouses decision. • • • • SSG JOE SMITH MILPER MESSAGE 08-227: • Paragraph 4. (3) Where possible, keep spousal notification letters associated with the completed form when web uploading document batches to iperms. When that is not possible, annotate the Soldier’s name and ssn at the top of the spousal notification letter of any follow-on submissions. DESIGNATION OF MINORS DIRECTLY BY NAME: • Counsel a Soldier who wishes to name a minor as a principal or contingent beneficiary directly by name that SGLI proceeds cannot be directly paid to a minor. Further advise the Soldier of the following: • Advantages are• The probate of a will is not required in order to pay SGLI proceeds. If the SGLI proceeds are the only major asset in the Soldier’s estate, the delay and expense involved in probate may be avoided altogether. • A court will determine the person best qualified to serve as a guardian of the SGLI proceeds for the benefit of the minor. *para 12-18e. CONT…DESIGNATION OF MINORS DIRECTLY BY NAME: • Disadvantages are• Before the SGLI proceeds may be released and used for the benefit of a minor (other than a minor spouse), an adult acting on behalf of the minor (or appointed by a court to do so) must petition a court to appoint the guardian for the SGLI proceeds. Since the appointment of a guardian takes place after the Soldiers death, the Soldier has no input about the person selected to act for the minor. In many cases, the person appointed guardian for a child who is designated as an SGLI beneficiary may be the Soldier’s spouse or former spouse. *para 12-18e. CONT…DESIGNATION OF MINORS DIRECTLY BY NAME: • Most courts will require the guardian to pay for a surety bond to ensure payment of the SGLI proceeds. • Under some state laws, only a certain amount of money may be spent on behalf of a minor each month or year, despite the Soldier’s election. If more is needed, a judge must approve. • Certain bond, court, and legal expenses are paid out of the SGLI proceeds, initially, as well as while the designated beneficiary remains a minor. • The distribution of SGLI proceeds are delayed pending the appointment of a guardian. • All SGLI proceeds must be paid to the minor at age 18, regardless of the minor’s maturity, or lack thereof. *para 12-18e. DESIGNATING A CUSTODIAN: • Advise a Soldier who desires to name a custodian for a minor as the principal or contingent beneficiary under the UGMA or the UTMA that before completing the SGLV 8286, they should obtain the approval of the friend, relative, or financial or other institution they want to serve as the UGMA/UTMA custodian for distribution of the SGLI proceeds. Transfer of SGLI benefits under the UGMA/UTMA may be for the benefit of a minor child or children, regardless of their relationship to the Soldier. *para 12-18g. CONT…DESIGNATING A CUSTODIAN: • Further advise the Soldier that• Advantages are• There is no requirement for court involvement. The court appointment of a custodian and the probate of a will is not required in order to pay SGLI proceeds. If the SGLI proceeds are the only major asset in the Soldier’s estate, the delay and expense involved in probate may be avoided altogether. • The Soldier, not a court, determines who will act in the minor’s best interest with regard to the use of SGLI proceeds. *para 12-18g. • For more information regarding designating a custodian, refer to AR 600-8-1, Chapter 12, paragraph 12-18. CONT…DESIGNATING A CUSTODIAN: • The UGMA/UTMA custodian can use the SGLI proceeds, as the UGMA/UTMA custodian determines is appropriate, for the benefit of the children during the time the children remain minors. • Ordinarily the UGMA/UTMA custodian will not be required to pay for a surety bond to receive the SGLI proceeds. • There ordinarily will be no delay in the distribution of SGLI proceeds to the designated UGMA/UTMA custodian. *para 1218g. CONT…DESIGNATING A CUSTODIAN: • Disadvantages are• All SGLI proceeds must be paid to the minor at age 18, regardless of the minor’s maturity, or lack thereof. • There is no automatic court supervision of the UGMA/UTMA custodian. • There is no surety bond required that could protect the minor’s funds from theft, fraud, waste, and other such acts by the UGMA/UTMA custodian. *para 12-18g. FAILURE TO PROPERLY NAME BENEFICIARY: • Advise Soldier that if they do not designate beneficiaries, or their designation fails, (for example, the designated beneficiary dies before the Soldier dies; a trustee is designated, but no trust was established) 38 USC 1970 determines the payment of SGLI proceeds in the following order• Widow or widower; if none, to• Child or children in equal shares with the share of any deceased child distributed among the descendants of that child; if none, to• Parents in equal shares; if none, to• The executor or administrator of the Soldier’s estate; if none, to• Other NOK. *para 12-18j. • Please refer to JAG for further guidance pertaining to SGLV 8286 & 8286A. FAMILY SERVICEMEMBERS’ GROUP LIFE INSURANCE • The FSGLI is a program extended to the spouses and dependent children of Soldiers insured under the SGLI program. The FSGLI program provides up to a maximum of $100,000 of insurance coverage for a spouse, not to exceed the amount of SGLI the insured Soldier has in force, and $10,000 for dependent children. Spousal coverage is issued in increments of $10,000. *para 12-23. Cont… FAMILY SERVICEMEMBERS’ GROUP LIFE INSURANCE • If an insured Soldier declines FSGLI coverage for a spouse or elects an amount less than the maximum amount available, the Soldier may later apply for coverage or an increase in coverage up to the $100,000 maximum, or the amount of SGLI held by the insured Soldier, whichever is less. • The Soldier is the beneficiary of the FSGLI coverage, so no beneficiary need be named. A Soldier is not entitled as beneficiary if he/she is convicted or pleads guilty to involvement in the death of the spouse or the dependent child. • A Soldier married to another Soldier can be insured under both the FSGLI and SGLI programs at the same time for a maximum coverage amount of $500,000. *para 12-23. ELIGIBLE PERSONS TO BE INSURED: • Dependent children are defined as follows• All natural born children and legally adopted children under the age of 18. • All stepchildren under the age of 18 who are members of the Soldier’s household. • Any dependent child between the ages of 18 and 23 who is a full-time student. • Any dependent child who has been declared legally incompetent before the age of 18. *para 12-24b. EFFECTIVE DATE OF COVERAGE: • The FSGLI coverage begins automatically when the Soldier• Enters service and is married/has dependent children, or • Gets married or gains a dependent child during service, and • Has full-time SGLI coverage. • Spousal coverage is automatically at the maximum level of $100,000 or the Soldier’s SGLI coverage level, if it is less than $100,000. *para 12-26. PREMIUMS: • The Soldier pays premiums for the spousal coverage. The dependent child coverage is free. • For all Soldiers entitled to SGLI coverage, DFAS will deduct the premium amount from the Soldiers pay, or otherwise collect from the Soldier. • Spousal premiums are based on 7 age brackets. Premiums increase as the spouse reaches each successive age bracket. The increase is effective the month of the spouse’s birthday. *para 12-27. TERMINATION OF INSURANCE: • The following events end FSGLI spousal coverage• • • • • Soldier declines SGLI coverage. Soldier declines FSGLI coverage. The marriage ends due to divorce. The Soldier dies. The Soldier is discharged or released from active duty. • During mobilization, a Soldier that has FSGLI will still pay the premium. *para 12-28. FSGLI UPDATE: • Soldiers going onto Title 10 from Title 32 status are incurring a debt for FSGLI when they are mobilized on Title 10. This is happening even if the Soldier previously declined FSGLI. Information provided by DEERS creates a debt to the Soldier retroactive to the most recent of the following dates: • Inception of the policy (1 NOVEMBER 2001) • Date initially Entered Military Service • Date of Marriage • During SRP process at MOB Sites be sure to inform the Soldiers that a FSGLI (declination SGLV 8286A) will be required for a 2nd time during SRP process at the MOB site to avoid debt created by the system. • Soldiers who incur debt should immediately fill out a DD 2789 to request a refund. CONCLUSION: •QUESTIONS? QUIZ: • • Q: Who is considered an unusual beneficiary? A: Anyone other than family members or parents (AR 600-8-1, CH 12, para 12-18c) • • Q: What kind of insurance is SGLI? A: Term • • Q: What is the statement for declining coverage? A: “I do not want insurance at this time” • • Q: How much coverage is available for a dependent child? A: $10,000 • • Q: What is the cost of coverage for a dependent child? A: Free; no cost • • Q: Who will be appointed to counsel Soldiers regarding their SGLI? A: officer, warrant officer, senior NCO (E7-E9), or civilian (GS-5 or higher) or Federal contract employee • • Q: How much coverage is available for a dependent on the SGLV 8286? A: NONE, coverage for dependents is on the SGLV 8286A