Floating exchange rates

advertisement

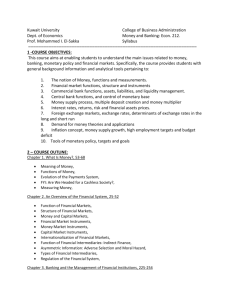

Thorvaldur Gylfason Despite Africa’s great diversity of culture and languages, many Africans identify themselves as Africans first, then as Congolese, Kenyans, Nigerians, South Africans, etc. Most Europeans, North Americans, and Asians have it the other way round: country first, then continent Yet, national boundaries within Africa are generally less open than those within Europe Various restrictions on trade and migration Restrictions need to be relaxed to spur growth National currencies constitute a trade restriction In view of the success of the EU and the euro, economic and monetary unions appeal to many Africans and others with increasing force Consider four categories Existing monetary unions De facto monetary unions Planned monetary unions Previous – failed! – monetary unions CFA franc 14 African countries CFP 3 Pacific island states East franc Caribbean dollar 8 Caribbean island states Picture of Sir W. Arthur Lewis, the great Nobel-prize winning development economist, adorns the $100 note Euro, more recent 16 EU countries plus 6 or 7 others Thus far, clearly, a major success in view of old conflicts among European nation states, cultural variety, many different languages, etc. Australian dollar Indian rupee South Africa plus Lesotho, Namibia, Swaziland – and now Zimbabwe Swiss franc New Zealand plus 4 Pacific island states South African rand India plus Bhutan (plus Nepal) New Zealand dollar Australia plus 3 Pacific island states Switzerland plus Liechtenstein US dollar US plus Ecuador, El Salvador, Panama, and 6 others East Burundi, Kenya, Rwanda, Tanzania, and Uganda Eco African shilling (2009) (2009) Gambia, Ghana, Guinea, Nigeria, and Sierra Leone (plus, perhaps, Liberia) Khaleeji Bahrain, Kuwait, Qatar, Saudi-Arabia, and United Arab Emirates Other, (2010) more distant plans Caribbean, Southern Africa, South Asia, South America, Eastern and Southern Africa, Africa Danish krone 1885-1938 Denmark and Iceland 1885-1938: 1 IKR = 1 DKR 2009: 2,300 IKR = 1 DKR (due to inflation in Iceland) Scandinavian monetary union 1873-1914 East African shilling 1921-69 Mauritius and Seychelles 1870-1914 Southern African rand Kenya, Tanzania, Uganda, and 3 others Mauritius rupee Denmark, Norway, and Sweden South Africa and Botswana 1966-76 Many others Centripetal tendency to join monetary unions, thus reducing number of currencies To benefit from stable exchange rates at the expense of monetary independence Centrifugal tendency to leave monetary unions, thus increasing number of currencies To benefit from monetary independence often, but not always, at the expense of exchange rate stability With globalization, centripetal tendencies appear stronger than centrifugal ones What does this mean for Africa? FREE CAPITAL MOVEMENTS Flexible exchange rate (US, UK, Japan) Monetary Union (EU) FIXED EXCHANGE RATE Capital controls (China) MONETARY INDEPENDENCE If capital controls are ruled out in view of the proven benefits of free trade in goods, services, labor, and also capital (four freedoms), … … then long-run choice boils down to one between monetary independence (i.e., flexible exchange rates) vs. fixed rates Cannot have both! Either type of regime has advantages as well as disadvantages Let’s quickly review main benefits and costs Benefits Fixed exchange rates Floating exchange rates Costs Benefits Fixed exchange rates Floating exchange rates Stability of trade and investment Low inflation Costs Benefits Fixed exchange rates Floating exchange rates Costs Stability of trade Inefficiency and investment BOP deficits Low inflation Sacrifice of monetary independence Benefits Costs Fixed exchange rates Stability of trade Inefficiency and investment BOP deficits Low inflation Sacrifice of monetary independence Floating exchange rates Efficiency BOP equilibrium Benefits Costs Fixed exchange rates Stability of trade Inefficiency and investment BOP deficits Low inflation Sacrifice of monetary independence Floating exchange rates Efficiency BOP equilibrium Instability of trade and investment Inflation In view of benefits and costs, no single exchange rate regime is right for all countries at all times The regime of choice depends on time and circumstance If inefficiency and slow growth due to currency overvaluation are the main problem, floating rates can help If high inflation is the main problem, fixed exchange rates can help, at the risk of renewed overvaluation Ones both problems are under control, time may be ripe for monetary union The Through nominal exchange rate adjustment or price changes Even so, it does make a difference how countries set their nominal exchange rates because floating takes time real exchange rate always floats Currency misalignments can persist Hence, a wide spectrum of options, from absolutely fixed rates anchored through monetary unions to completely flexible exchange rates What do countries do? No national currency Other types of fixed rates Dollarization Currency board Crawling pegs Bilateral fixed rates Managed floating Pure floating 17% 23 5 4 3 3 26 19 100 Gradual tendency towards floating, from 10% of LDCs in 1975 to over 50% today, followed by increased interest in fixed rates through economic and monetary unions 49% 51% Governments sometimes prefer fixed exchange rates so they can try to keep their national currencies overvalued To keep foreign exchange cheap To retain power to ration scarce foreign exchange To make GNP in dollars look larger than it is Another reason for persistent overvaluation, and thereby also sluggish trade and slow growth Inflation! Show by simple numerical example Real exchange rate Suppose inflation is 10 percent per year and exchange rate adjusts with a lag 110 105 100 Average Time Real exchange rate Suppose inflation rises to 20 percent per year 120 110 Average 100 Time Many African countries’ history of inflation, overvaluation, and slow growth is stark reminder that one of the keys to successful entry into monetary union is making sure that initial exchange rate at point of entry is not too high European countries on euro zone’s doorstep – Baltic countries, Sweden, Iceland – face same challenge