US Trade Deficit - World Affairs Council of Charlotte

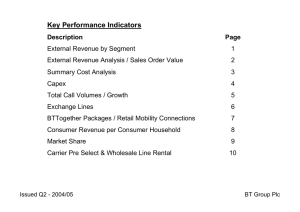

advertisement

EXTREMES BEGET EXTREMES A Balanced Approach to Global Trade and the Role of Governments Free Trade 2 Currency Manipulation “Greater scope for market forces to determine the value of the Yuan would reduce an important distortion in the Chinese economy, namely the incentive for Chinese firms to focus on exporting rather than producing for the domestic market.” Federal Reserve Chairman, Ben Bernanke, December 2006. 3 Currency Manipulation • Nations undervalue their own currency to gain an unfair advantage in global trade. RESULT: • Exports are cheap, and imports are expensive. They sell their goods, but don’t buy others’ goods. • China undervalues its currency up to 40% in relation to the U.S. Dollar to make its goods cheaper. People buy Chinese goods because they are cheaper than the same goods made in America. If China ended its currency manipulation, the U.S. economy could grow by as much as $250 billion and 2.5 million new jobs! 4 Currency Manipulation How China Does It: 1. Purchasing American Treasury Bills This creates debt for America and floods our markets with cash, which when done over time helps maintain the undervalue of the yuan. 2. “Surrender Requirements” People with dollars in China are forced to turn them in for yuan to the Central Bank, which controls the exchange rate. 3. Government Control of Business Many corporations are owned or controlled by the government, which uses profits to buy more financial instruments to control the currency value. America’s trade deficit with China is increasing by about $1 Billion per day! 5 6 U.S. Dollars per Chinese Yuan Exchange Rate (1993-2010) 0.18 0.17 0.16 0.15 0.14 0.13 0.12 0.11 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 Mar-08 Dec-07 Sep-07 Jun-07 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 Jun-97 Mar-97 Dec-96 Sep-96 Jun-96 Mar-96 Dec-95 Sep-95 Jun-95 Mar-95 Dec-94 Sep-94 Jun-94 Mar-94 Dec-93 Sep-93 Jun-93 Mar-93 0.10 U.S. Dollars per Yuan 7 Source: Pacific Exchange Rate Service U.S. Dollars per Malaysian Ringgit Exchange Rate (1993-2010) 0.45 0.40 0.35 0.30 0.25 0.20 0.15 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 Mar-08 Dec-07 Sep-07 Jun-07 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 Jun-97 Mar-97 Dec-96 Sep-96 Jun-96 Mar-96 Dec-95 Sep-95 Jun-95 Mar-95 Dec-94 Sep-94 Jun-94 Mar-94 Dec-93 Sep-93 Jun-93 Mar-93 0.10 U.S. Dollars per Ringgit 8 Source: Pacific Exchange Rate Service U.S. Dollars per Thai Baht Exchange Rate (1993-2010) 0.045 0.040 0.035 0.030 0.025 0.020 0.015 0.010 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 Mar-08 Dec-07 Sep-07 Jun-07 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 Jun-97 Mar-97 Dec-96 Sep-96 Jun-96 Mar-96 Dec-95 Sep-95 Jun-95 Mar-95 Dec-94 Sep-94 Jun-94 Mar-94 Dec-93 Sep-93 Jun-93 Mar-93 0.005 9 Source: Pacific Exchange Rate Service U.S. Dollars per Baht U.S. Dollars per Indonesian Rupiah Exchange Rate (1995-2010) 0.0005 0.0004 0.0003 0.0002 0.0001 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 Mar-08 Dec-07 Sep-07 Jun-07 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 Jun-97 Mar-97 Dec-96 Sep-96 Jun-96 Mar-96 Dec-95 0.0000 U.S. Dollars per Rupiah 10 Source: Pacific Exchange Rate Service U.S. Dollars per Japanese Yen Exchange Rate (1993-2010) 0.014 0.012 0.010 0.008 0.006 0.004 0.002 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 Mar-08 Dec-07 Sep-07 Jun-07 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 Jun-97 Mar-97 Dec-96 Sep-96 Jun-96 Mar-96 Dec-95 Sep-95 Jun-95 Mar-95 Dec-94 Sep-94 Jun-94 Mar-94 Dec-93 Sep-93 Jun-93 Mar-93 0.000 U.S. Dollars per Yen 11 Source: Pacific Exchange Rate Service U.S. Dollars per South Korean Won Exchange Rate (1993-2010) 0.0014 0.0012 0.0010 0.0008 0.0006 0.0004 0.0002 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 Mar-08 Dec-07 Sep-07 Jun-07 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 Jun-97 Mar-97 Dec-96 Sep-96 Jun-96 Mar-96 Dec-95 Sep-95 Jun-95 Mar-95 Dec-94 Sep-94 Jun-94 Mar-94 Dec-93 Sep-93 Jun-93 Mar-93 0.0000 U.S. Dollars per Won 12 Source: Pacific Exchange Rate Service U.S. Dollars per Taiwanese Dollar Exchange Rate (1993-2010) 0.045 0.040 0.035 0.030 0.025 0.020 0.015 0.010 0.005 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 Mar-08 Dec-07 Sep-07 Jun-07 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 Jun-97 Mar-97 Dec-96 Sep-96 Jun-96 Mar-96 Dec-95 Sep-95 Jun-95 Mar-95 Dec-94 Sep-94 Jun-94 Mar-94 Dec-93 Sep-93 Jun-93 Mar-93 0.000 U.S. Dollars per Dollar 13 Source: Pacific Exchange Rate Service U.S. Manufacturing Jobs (in thousands) 20,000 17,500 15,000 12,500 Jan-10 Jan-09 Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 10,000 Nearly 6 million manufacturing jobs have been lost since manufacturing last peaked in 1998 Source: U.S. Bureau of Labor Statistics, Not Seasonally Adjusted 14 14 U.S. Manufacturing As a Percentage of Gross Domestic Product % of U.S. GDP 24.0% 20.0% 16.0% 45% Drop 12.0% 2008 Source: US Department of Commerce, Bureau of Economic Analysis (BEA). Manufacturing Industry value added as a percentage of GDP (Apr. 9, 2008). 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 8.0% 15 The State Crisis: Manufacturing Jobs Lost June 1998 to September 2010 16 Wal-Mart’ing of America Employment in Manufacturing vs. Retail Sectors Manufacturing Retail Employees (Millions) 20 16 12 Less Manufacturing Jobs now than any time since 1941! 8 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 Average Manufacturing Job: $23.31 /hr 1980 1978 1976 1974 1972 1970 1968 1966 1964 1962 1960 1958 1956 1954 1952 1950 4 Average Retail Job: $15.70 /hr Source: U.S. Bureau of Labor Statistics, Current Employment Statistics Survey, Not Seasonally Adjusted; Average hourly Earnings of All Employees 17 World Exports As a Percentage of World Gross Domestic Product 25% 17.1% 20% 29.9% 20.0% 25.2% 30% 20.9% % of Global GDP 35% 27.1% 29.1% 32.6% 40% 15% 2010 2008 2006 2004 2002 2000 1998 Source: International Monetary Fund, World Economic Outlook Database, Oct. 2010 1996 1994 1992 1990 1988 1986 1984 1982 1980 10% 18 Manufacturing Jobs vs. Trade Deficit (2000-2010) 900 800 17000 Trade Deficit 700 16000 600 15000 500 400 14000 300 Manufacturing Jobs 13000 200 12000 100 11000 U.S. Trade in Goods Deficit in Billions of Dollars (Over Previous 4 Quarters) U.S. Employees in Manufacturing (in Thousands) 18000 0 Sep-10 Mar-10 Sep-09 Mar-09 Sep-08 Mar-08 Sep-07 Mar-07 Sep-06 Mar-06 Sep-05 Mar-05 Sep-04 Mar-04 Sep-03 Mar-03 Sep-02 Mar-02 Sep-01 Mar-01 Sep-00 Mar-00 Source: U.S. Census Bureau, U.S. Bureau of Labor Statistics 19 U.S. Trade Deficit (1997-2010) 900 Billions of Dollars 800 700 600 500 400 300 China will 200 Account for almost 40% of the U.S. Trade Deficit in 2010! 100 2010 2009 2008 2007 Source: U.S. Trade in Goods with World (Seasonally Adjusted) in Billions of Dollars U.S. Census Bureau 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0 20 U.S. Trade Deficit Top Trading Partners 1997-2010 255 % $640 600 500 $260 $79 100 0 $56 China Japan 94 % 200 1997 359 % 300 368 % 400 423 % Billions of Dollars 700 2010 $67 $30 EU Canada Mexico U.S. Trade in Goods with World (Seasonally Adjusted) in Billions of Dollars, estimated through Dec. 2010; U.S. Census Bureau World 21 Sept. 2010 120 100 80 60 40 Value of U.S. Dollar, Trade Weighted Index Value of U.S. Dollar (1973-2010) (as valued against currencies of major U.S. trading partners) 140 20 0 -1 ay M 09 ar M 8 0 nJa 6 -0 ov N 5 0 pSe 4 l-0 Ju 03 ay M 2 -0 ar M 1 0 nJa 9 -9 ov N 8 9 pSe 7 l-9 Ju 96 ay M 5 -9 ar M 4 9 nJa 2 -9 ov N 1 9 pSe 0 l-9 Ju 89 ay M 8 -8 ar M 7 8 nJa 85 ov N 4 8 pSe 3 l-8 Ju 82 ay M 1 -8 ar M 0 8 nJa 8 -7 ov N 7 7 pSe 6 l-7 Ju 75 ay M 74 ar 73 nM Ja 22 Source: U.S. Federal Reserve, Nominal Broad Dollar Index (Trade Weighted Index) Trade Deficit vs. Value of U.S. Dollar (2000-2010) 900 140 130 Trade Deficit 700 600 120 500 400 110 300 Value of U.S. Dollar 200 100 (Trade Weighted) Value of U.S. Dollar Trade Weighted Index U.S. Trade in Goods Deficit in Billions of Dollars (Over Previous 4 Quarters) 800 100 0 90 Sep-10 Mar-10 Sep-09 Mar-09 Sep-08 Mar-08 Sep-07 Mar-07 Sep-06 Mar-06 Sep-05 Mar-05 Sep-04 Mar-04 Sep-03 Mar-03 Sep-02 Mar-02 Sep-01 Mar-01 Sep-00 Mar-00 Source: U.S. Census Bureau, U.S. Federal Reserve, Nominal Broad Dollar Index (Trade Weighted Index) 23 Manufacturing Jobs vs. Value of U.S. Dollar (2000-2010) 140 Dollar Spikes Jobs Vanish 17000 130 16000 Value of U.S. Dollar 15000 120 (Trade Weighted) 14000 110 13000 100 Manufacturing Jobs 12000 11000 Value of U.S. Dollar Trade Weighted Index U.S. Employees in Manufacturing (in Thousands) 18000 90 Sep-10 Mar-10 Sep-09 Mar-09 Sep-08 Mar-08 Sep-07 Mar-07 Sep-06 Mar-06 Sep-05 Mar-05 Sep-04 Mar-04 Sep-03 Mar-03 Sep-02 Mar-02 Sep-01 Mar-01 Sep-00 Mar-00 Source: U.S. Federal Reserve, Nominal Broad Dollar Index (Trade Weighted Index), U.S. Bureau of Labor Statistics 24 The Dollar Goes Up – Manufacturing Profits Go Down! 140 15% 130 14% 120 Value of U.S. Dollar 13% (Trade Weighted) 12% 110 11% Manufacturing Profits 100 (As Share of National Income) 10% 9% Value of U.S. Dollar Trade Weighted Index Profit Share of National Income in Domestic Manufacturing 16% 90 Sep-10 Mar-10 Sep-09 Mar-09 Sep-08 Mar-08 Sep-07 Mar-07 Sep-06 Mar-06 Sep-05 Mar-05 Sep-04 Mar-04 Sep-03 Mar-03 Sep-02 Mar-02 Sep-01 Mar-01 Sep-00 Mar-00 Source: U.S. Federal Reserve, Nominal Broad Dollar Index (Trade Weighted Index), U.S. Bureau of Economic Analysis, Nati’ Income w/o Capital Consumption Adj. by Industry 25 Declining U.S. Industry • • • • • • • Machinery Autos Textiles Lumber/Paper Chemicals Aerospace Metals 26 70% 78% 140,000 64% Fiber, Yarn & Thread Flat Glass and Other Blown Glass Audio & Video Equipment Bare Printed Circuit Boards Light Trucks and Untility Vehicles Broadwoven Fabrics 27 Source: U.S. Bureau of Labor Statistics, Current Employment Statistics Survey, Not Seasonally Adjusted 53% 62% 58% 80,000 Manufactured and Mobile Homes Computer Storage Devices 1998 2010 0 51% 60,000 72% 100,000 Manufacturing Jobs Endangered Manufacturing Industries 120,000 40,000 20,000 United States Steel Imports Steel Imports (million metric tons) $36.6 41.1 $29.0 30.2 29 $31.3 2008 $16.8 14.7 $23.3 2007 $10.4 2002 $21.4 21 2001 $12.1 2000 $11.5 1999 $14.9 Source: U.S. Census Bureau $12.6 $16.3 1998 29.1 32.5 27.4 29.7 32.4 34.4 37.7 45 40 35 30 25 20 15 10 5 0 Value (in billions of dollars) 2003 2004 2005 2006 2009 28 Chinese Steel Production (1998-2010) 700 Estimated 630 mmt in 2010 Millions of Metric Tons 600 500 400 300 200 100 2010 2009 2008 2007 2006 2005 Total Production of Crude Steel – World Steel Association, Steel Statistical Yearbook 2010 2004 2003 2002 2001 2000 1999 1998 0 29 Chinese vs. U.S. Steel Production in Millions of Metric Tons 600 500 400 300 200 100 0 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 China Total Production of Crude Steel – World Steel Association, Steel Statistical Yearbook 2010 U.S. 30 U.S. - China Direct Investment (2000 – 2009) 60 China Direct Investment in U.S. Billions of U.S. Dollars 50 U.S. Direct Investment in China 40 30 20 10 Source: The U.S. Bureau of Economic Analysis, Direct Investment, Direct Investment Position on a Historical-Cost Basis 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 0 31 The Dollar Goes Up – Manufacturing Investments Go Down! 140 Value of U.S. Dollar 15% (Trade Weighted) 130 14% 120 13% 110 12% 100 11% 90 10% 80 9% 70 8% 60 Domestic Manufacturing Investment (As Share of Investment in Private Fixed Assets) 7% Value of U.S. Dollar Trade Weighted Index Share of Manufacturing Industry Investment in Private Fixed Assets 16% 50 6% 40 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 Source: U.S. Federal Reserve, Nominal Broad Dollar Index (Trade Weighted Index), U.S. Bureau of Economic Analysis, Investment in Private Fixed Assets by Industry 32 The Dollar Goes Up – Investments Go Overseas! 60 14% 50 12% Domestic Manufacturing Investment 10% 40 (As Share of Investment in Private Fixed Assets) 8% 30 6% 20 4% 10 U.S. Direct Investment in China (Billions of Dollars) Share of Manufacturing Industry Investment in Private Fixed Assets 16% U.S. Direct Investment in China 2% 0% 0 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 Source: U.S. Federal Reserve, Nominal Broad Dollar Index (Trade Weighted Index), U.S. Bureau of Economic Analysis, Investment in Private Fixed Assets by Industry 33 Major Issues in International Trade • Currency manipulation – China and other Asian countries keep the value of their currencies artificially low to make their exports cheaper and imports more expensive • Subsidies – China has provided billions of dollars in subsidies, directly and indirectly, to its steel industry • Attempts to weaken the trade laws – Multinational corporations that want to be able to rely on dumped and subsidized merchandise • Climate change – Some solutions would encourage U.S. manufacturing to move to China and elsewhere, leading to greater greenhouse gas emissions 34 Trade Distortions: Do More. Determining the best path forward for America is not just the responsibility of the government and major corporations. The ultimate responsibility for the future of America lies with informed American voters. Your vote is your voice, and you have the right to be heard. Speak up for your jobs, your families, your country, and your future. Know More. Do More. Nucor. 35