Current Health Plan

advertisement

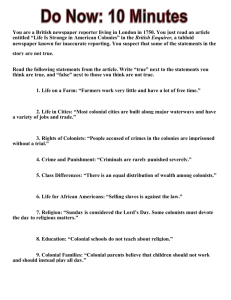

Voluntary Benefits Mainstream Market Voluntary Supplemental Benefits 1 Insurance Community University Sponsored and Presented By: Presented by: Mike McCarey President of Essential Benefits Insurance Services Our Singular Mission is to: “ Educate & Deliver Colonial Life Supplemental Benefits to Employees in a style and process that creates an excellent employee experience.” Insurance Community University 2 Class Description • By the end of this class you will understand: – – – – – – – – – the viability of the VB marketplace the buyers knowledge of “mainstream” VB plans the trends in the VB marketplace the pro’s & con’s of VB to employers, employees & brokers the use of Bridge plans combined with major medical to control premium expenses the various VB delivery methods to employees why Benefit’s Education is vital to not only a successful VB program, but to “every” benefits program why you need to be growing your revenue stream with VB why you need to be involved with VB to protect your client relationships Insurance Community University 3 Legislation Affecting Flexible Benefits • • • • • • • • Employee Retirement Income Security Act of 1974 (ERISA) Section 79: Group Term Life Insurance. Section 125: Cafeteria Plans. Section 129: Dependent Care Flexible Spending Accounts. Publication 969: HSAs, HRAs, and Health FSAs Social Security State Disability Plans Privacy Laws and Regulations Insurance Community University 4 Every day, you and your competitor can walk through your customers door Insurance Community University 5 Current Situation • The brokers world looks a little different these days: – Reduced commissions – Health Care Reform – Tough Economy • • Brokers are looking for ways to increase revenue Employers are starting to hire again – But Health Care plan premiums are continuing to rise – Employers are looking to Brokers for help • Voluntary Supplemental Benefits are a powerful solution – – – – – Brokers primary business has been major medical It’s not a new industry Gives many choices to the employer Gives many choices to the employee There are many choices of VB carriers Insurance Community University 6 Current Situation • LIMRA Study, August 2011 – “30% of US employers(10 or more) said they are considering adding new voluntary options within the next 2 years.” “Currently, 57% of US employers offer voluntary benefits and the rate rises quickly as employer size increases.” “Cancer, Life Insurance and Short Term Disability are the most commonly offered voluntary benefits” “Almost 1/3rd of all employers are considering offering new voluntary benefits to replace existing employer-paid and contributory benefits. This affects between 19 and 45 million employees in the next 2 years.” Insurance Community University 7 Current Situation • LIMRA Study, August 2011 - “The compounding health care premium increases over the last several years have forced many firms to reexamine their benefit offerings and shift costs to their employees.” • Colonial Life survey, Sept. 2011, 750 HR Managers – “Virtually all employers (99.6%) in the survey agreed their employees need guidance to make sound benefits decisions and education to help their workers understand changes in their benefits program.” • “Bonnie Brazzell, VP at Eastbridge Consulting Group, Inc., said, “However, changes have taken place in the last several years – benefit plans have gotten more expensive and companies are increasingly costsharing with employees – so we see more brokers fully incorporating voluntary benefits into their business model and proactively cross-selling these offerings.” Insurance Community University 8 Timing is Right for VB to Grow Insurance Community University 9 Timing is Right for VB to Grow Insurance Community University 10 Timing is Right for VB to Grow Insurance Community University 11 Timing is Right for VB to Grow “51% of brokers expect to make changes in the VB products they sell because of Health Care Reform. More than half expect to sell additional accident, critical illness, short term disability, cancer and term life VB benefits.” – Eastbidge Consulting, Oct. 2010 Insurance Community University 12 Typical Benefit Plan Offerings • Major Medical Plan – HMO, PPO, HSA, HRA’s, FSA’s, High Deductible Health Plan (HDHP), Mini-Med Plans, Self Funded & Fully Insured – Various methods of funding, premium splits & co-insurance • Dental & Vision Plans – Employer Paid or Employee Paid Voluntary Plans – Discount Cards • Flexible Spending Accounts (FSA’s) – Health Care, Dependent Care, Transportation, Non-Employer Sponsored Premiums • Short and/or Long Term Disability Income Protection Plans – Employer paid or Employee Paid Voluntary Plans • Employer Paid Life – Term Life, max $50k to avoid IRS issues, usually at $10k to $25k level • Section 125 Pre-Taxing of Premiums Insurance Community University 13 Additional Benefits • • • • • • • • • • • • Long Term Care Employee Credit Unions Gym Memberships 401k or 403b Retirement Plans Safety Awards Service Awards Vacation Holidays Sick Days Leaves of Absence Uniform Program Holiday Parties, Movie & Sports Event Tickets Insurance Community University 14 Mainstream VB Plans • • • • • Accident & Sickness Disability Insurance Specified Disease Insurance Hospital Confinement Indemnity Insurance Voluntary Life Insurance Supplemental Dental & Vision Insurance Also known as: • Short Term Disability • Accident Insurance • Cancer Insurance • Critical Illness Insurance (heart attack, stroke, renal failure, blindness, paralysis, coma) • Hospital Indemnity Insurance • Term Life, Universal Life, Whole Life Insurance Insurance Community University 15 Mainstream VB Plans • The Mainstream VB plans are: – – – – – – • Individually Owned Paid for by the employee Portable Guaranteed Renewable Usually do not have price increases Usually do not have minimum participation requirements Some VB plans are Group plans – – – – Master policy held by the employer May or may not be portable or convertible to individual ownership More likely to have price increases More likely to have minimum participation requirements Insurance Community University 16 Compare Two Employers • • • • Without VB Major Medical Dental Vision Employer Paid Life • • • • • • • • • • • Insurance Community University With VB Major Medical Dental Vision Employer Paid Life Short Term Disability Accident Insurance Cancer Insurance Critical Illness Insurance Hospital Indemnity Insurance Term Life, Universal Life, Whole Life Insurance Flexible Spending Account 17 Questions • Which employer is more attractive to current employees? – Why? • Which employer is more attractive to prospective employees? – Why? • Which employer has a lower overall turnover rate? – Why? • Which employer has a more expensive benefit plan offering? – Why? • In which employer would you expect to see greater levels of measureable levels of accuracy? – Why? Insurance Community University 18 Positive Influence on Key Drivers of Satisfaction Employees who receive quality benefits education report greater satisfaction.1 Highly engaged employees are 26% more productive2 1 Unum, “Employee Education and Enrollment Survey,” January 2009. 2 Watson Wyatt, “2008/2009 WorkUSA Report,” 2009. Insurance Community University Employee Benefits Choices Can Add Value Unum, “Employee Education and Enrollment Survey,” January 2009. Insurance Community University Who is the Buyer for VB? Top 5% Wage Earners Middle Wage Earners Lower Wage Earners Opportunity!!! Give VB to un-benefitted employees Unum, “Employee Education and Enrollment Survey,” January 2009. Insurance Community University Benefit Eligible Benefit Eligible Part Timers – Not Benefit Eligible VB Plan Carriers (partial list) • • • • • • • • • • • • Colonial Life Aflac ING Unum Hartford Lincoln Worksite Benefits Humana Assurant Cigna Conseco Jefferson Pilot • • • • • • • • • • • • • Insurance Community University Transamerica SSI Chimente Boston Mutual Combined Insurance American Fidelity American General Reliance Standard Allstate Trustmark Safeco Provident Life More…. 22 How Do Employees Make Choices? • • • • Different Carriers have different methods of enrollment Different Brokers employ different styles of enrollment processes Different Employers have differing requirements year-to-year that must be considered Available methods are: – – – – – – – – • One-on-One Benefit Meetings Group Meetings Co-Browsing Telephone Self Service Printed Materials Intranet HR Benefits Websites Census Enrollment There are many choices; What is the magic elixir? Insurance Community University 23 Employees Don’t Understand 64% *Watson Wyatt, “Many Workers Struggle with Basic Healthcare Terms,” July, 2007. Insurance Community University 24 Benefit Communications • Question – Give employees a list, prices and a product description of the available VB plans and have them self enroll. What should you expect as employee participation? • Question – Have employees attend a Group Meeting to receive an overview of the available plans then go back to work. Then have a flow of employees back to a VB Benefit Counselor to sit one-on-one to talk privately, ask questions, receive exact premium costs for employee spouse and dependents. What should you expect as employee participation? Insurance Community University 25 Benefit Communications: By The Numbers Companies Providing Above-Average Benefits Companies Providing Below-Average Benefits Health Care Health Care WITH Effective Communication 83.6% 76.2% WITHOUT Effective Communication 25.7% 22.1% Watson Wyatt WorkUSA 2004/2005 Study Education Meetings 1st Year Only Education Meetings Every 3rd Year Education Meetings Every Year Find the Right Partner • • Personal benefits counseling increases participation A majority of brokers (55%) agree that 1-on-1 benefit counseling sessions are very effective, but only 17% currently us them as a primary way to enroll employees. Insurance Community University 30 Benefit Communications • Question – Give employees a list, prices and a product description of the available VB plans and have them self enroll. What should you expect as employee participation? • Question – Have employees attend a Group Meeting to receive an overview of the available plans then go back to work. Then have a flow of employees back to a VB Benefit Counselor to sit one-on-one to talk privately, ask questions, receive exact premium costs for employee spouse and dependents. What should you expect as employee participation? Insurance Community University 31 - Employee Group Meeting Mainstream Supplemental Benefits *Watson Wyatt, “Many Workers Struggle with Basic Healthcare Terms,” July, 2007. Insurance Community University 32 How much does an employee usually spend? Benefit Counselors A Well-Informed Yes is just as valuable as A Well-Informed No Colonial Provides Choice Different People Different Ages Different Life Styles Just Different Different Needs Who Pays What? o Approx 2/3 of medical expenses are covered by most major medical plans o 1/3 of expenses are out of pocket. Deductibles Co-insurance Lost Wages Over the counter medications Traveling expenses Who helps you pay your co-pays and deductible payments? How do VB Plans Work? Helps pay Employee Out-of-Pocket Costs Expenses Covered by Medical Insurance Employee Out of Pocket Expenses • Co-Pays • Deductibles • Over-the-Counter • Non-Medical • Lost Wages Colonial Life The Advantage of Colonial Life plans: Most plans pay in addition to other benefits you may have with other insurance companies Benefits are paid directly to you, unless you specify otherwise With most plans, you can keep your coverage even if you change jobs or retire Most plans are guaranteed renewable Prompt and courteous customer service Colonial Life Short-Term Disability Accident Cancer Critical Illness Hospital Confinement Indemnity Universal Life Term Life Whole Life Policies have exclusions and limitations that may affect benefits payable. All plans may not be available in all states and benefits provided may also vary by state. www.coloniallife.com Disability Insurance 95% 6 Month Benefit Period Up to 40% of Income 7 day 14 day 30 day 12 Month Benefit Period Up to 40% of Income Lost Income 55% State Disability 55% of Income To $1011/week 24 Month Benefit Period Up to 40% of Income Social Security 95% of Disabilities do not happen at work 70% of first time applicants are denied Time Line 7 days 12 Months Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. 24 Months Disability Insurance – with LTD 100% 95% 6 Month Benefit Period Up to 35% of Income 7 day 14 day 30 day 12 Month Benefit Period Up to 35% of Income Lost Income 24 Month Benefit Period Up to 35% of Income 60% 55% Long Term Disability State Disability 55% of Income To $1011/week (90 Day Waiting Period) Social Security? Time Line 7 days 12 Months Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. 24 Months Disability Insurance – No SDI Lost Income 66 2/3% 7 day 14 day 6 Month Benefit Period Up to 66% of Income 12 Month Benefit Period Up to 66% of Income 24 Month Benefit Period Up to 66% of Income 30 day Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Disability Insurance - Standards You are paid regardless of any other insurance you may have with another insurance company World wide coverage Portable Benefits are paid directly to you Waiver of premium Guaranteed renewable to age 70 Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Accident Insurance Accident 1.0 Insurance FRACTURES & DISLOCATION Broken Leg Dislocated Shoulder Dislocated Ankle Broken Hip Broken Finger or Toe Broken Shoulder $825 / $1,650 $330 / $660 $880 / 1,760 $1,650 / 3,300 $110 / 220 $385 / 770 ACCIDENTAL DEATH Employee Spouse Child $25,000 $25,000 $5,000 HOSPITAL SERVICES Ambulance/ Air Emergency Room Hospital Admission Hospitalization Intensive Care Medical Imaging Lodging Rehabilitation Unit $200/ $2,000 $125 $1,000 $225 per day $450 per day $150 $125 per night $100 per day CATASTROPHIC ACCIDENT Employee Spouse Child $25,000 $25,000 $25,000 Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Accident Insurance - Options Disability rider for employee and or spouse 6,12 or 24 month benefit periods 0/7, 7/7, 0/14, 14/14, 0/30, 30/30 waiting periods Off job coverage of $400 up to 40% of monthly gross income On job coverage of $400 up to 20% of monthly income Health Screening Rider Pap smear = $50 (1 x yr) Mammogram = $50 (see plan description) 1 of 14 tests = $50 (1 x yr) Sickness Hospital Confinement Rider Pays $100 a day for a covered sickness Pays benefits for up to 30 days Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Cancer Insurance Cancer Insurance 1 in 3 Americans will be treated for cancer In the U.S. Men have a 1 in 2 life time risk of developing cancer, and for women the risk is 1 in 3 The five-year relative survival rate for screening accessible cancers is about 85% If all Americans participated in regular cancer screenings, the relative survival rate would increase $2 of every $3 dollars spent is Not Covered Cancer treatment is very expensive. Not all the costs are medical expenses and covered by medical insurance, and there are indirect or hidden costs. Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Cancer Insurance Direct Costs Most Major Medical Plans Cover 38% Hospital charges Surgeon fees Physician fees Indirect Cost You Pay 62% Loss of wages or salary Deductibles or coinsurance Medical and drug costs Travel expenses to and from treatment centers Radiological fees Lodging and meals Nursing costs Child care Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Cancer Insurance Initial Diagnosis of Internal Cancer (rider) This benefit pays a lump sum for the initial diagnosis of internal cancer that occurs after the waiting period. $ 5,000 Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Cancer Insurance Level 3 Sample Benefits Inpatient Benefits $300 per day Hospital Confinement $150 per day full time nursing services Treatment Benefits $300 per day for radiation/chemotherapy injected by medical personnel $10,000 bone marrow stem cell transplant Transportation/Lodging Benefits $75 per day for lodging Surgical Procedures Up to 5,000 per procedure Up to $3,000 for reconstructive Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Cancer Insurance Health Screening Benefit / Incentive Pap Smear = $70 annually Mammogram = $100 annually ( see plan description) 1 of 15 additional cancer screenings = $25 ~ $125 annually (2 x family) Thin Prep Pap Test Colonoscopy CA 125 Blood Test for Ovarian Cancer Virtual Colonoscopy Breast Ultrasound CA 15-3 Blood test for breast cancer PSA Test Chest X-Ray Biopsy of Skin Lesion Hemocult Stool Analysis Flexible Sigmoidoscopy CEA Blood test for colon cancer Bone Marrow Aspiration/Biopsy Thermography Serum Protein Electrophoresis Blood test for Myeloma Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Cancer Insurance - Standards No increase in premiums No cancellation after you beat Cancer Kicks in again if you have a recurrence No age bands and not smoker rated Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Critical Illness Insurance Critical Illness Insurance o With Colonials Life’s Specific Critical Illness Insurance, you’re paid a benefit that can help you cover: o Deductibles, co-pays and co-insurance of your health insurance o Home health care needs and household modifications o Travel expenses to and from treatment centers o Lost income o Rehabilitation o Child care expenses o Everyday living expenses Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Critical Illness Insurance o You choose the benefit amount o o o Employee $5,000 to $75,000 in increments of $1,000 Spouse $5,000 to $40,000 in increments of $1,000 Family Plan: o o o Employee chooses $5,000 to $75,000 in increments of $1,000 Spouse receives 50% of face amount Child receives 25% of face amount Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Critical Illness Insurance Health Screening Covered Specified Critical Illness For this illness… We will pay this percentage of the face amount Heart Attack (Myocardial Infarction) 100% Stroke 100% Major Organ Failure 100% End Stage Renal (Kidney) Failure 100% Permanent Paralysis due to a covered accident 100% Coma 100% Blindness 100% Coronary Artery Bypass Graft Surgery 25% The Maximum Benefit Amount for this policy is 100% of the face amount for each covered person. We will not pay more than 100% of the face amount for all Specific Critical Illnesses combined. The policy will terminate when the Maximum Benefit Amount for Specific Critical Illnesses has been paid. Please see the definitions, exclusions and other details in the Outline of Coverage. CI-1.0-O-CA Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Critical Illness Insurance o Health Screening Benefit o o o Cervical Cancer Screening Test = $70 annually per covered person Mammogram = $200 annually (see plan description) 1 of 21 additional cancer screenings = $50 annually per covered person Stress Test on bicycle or treadmill Breast Ultrasound Fasting Blood Glucose CA 15-3 blood test for breast cancer Blood Test for Triglycerides CA125 Blood Test for Ovarian cancer Serum Cholesterol CEA blood test for colon cancer Bone Marrow Test Chest x-ray Carotid Doppler Colonoscopy EKG & ECG Flexible Sigmoidoscopy Echocardiogram Hemocult Stool Analysis Skin Cancer Biopsy PSA Test Serum Protein Electrophoresis Thermography Virtual Colonoscopy Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Hospital Confinement Insurance Hospital Confinement Insurance As major medical plans move toward larger deductibles and higher co-payments, you may be left with more gaps to fill. Colonial Life and Accident Insurance Company’s Hospital Confinement Indemnity insurance plan can help you fill those gaps and help protect against those out – of-pocket expenses that occur when it comes to you and your family members health care More than six in ten adults who report problems paying medical bills are covered by health insurance (USA Today April 25, 2005) Based on a typical 2006 PPO plan design, the typical American family of four would pay $2,210 out of their own pocket through member cost sharing (Medical Index 2006, June 30) Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Hospital Confinement Insurance Plan 2 Hospital Confinement Benefit Choice 1 $ 1,000 Choice 2 $ 1,500 Outpatient Surgical Procedure Benefit Tier 1 $ 1,000 Tier 2 $ 1,500 Rehabilitation Unit Benefit $100 per day up to 15 days per confinement. (see plan description) Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Hospital Confinement Insurance Plan 4 Hospital Confinement Benefit Choice 1 $500 Choice 2 $1,000 Outpatient Surgical Procedure Benefit Tier 1 $500 Tier 2 $1,000 Doctor Office Visit $25 per visit. (3 x yr for single plan and 5 x yr for family) Rehabilitation Unit Benefit $100 per day up to 15 days per confinement. (see plan description) Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Hospital Confinement Insurance Wellness Benefits Health Screening Benefit / Incentive Pap Smear = $70 annually Mammogram = $150 annually ( see plan description) 1 of 14 additional cancer screenings = $50 annually (2 x family) Stress Test on bicycle or treadmill Breast Ultrasound Fasting Blood Glucose CA 15-3 blood test for breast cancer Blood Test for Triglycerides CA125 Blood Test for Ovarian cancer Serum Cholesterol CEA blood test for colon cancer Serum Protein Electrophoresis Chest x-ray PSA Test Colonoscopy or Flexible Sigmoidoscopy Virtual Colonoscopy Hemocult Stool Analysis Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Life Insurance Life Insurance Facial Response to the Purchase Price of Life Insurance Over Time Today …time passes Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Life Insurance You have 3 options Universal Life Permanent Life Insurance Builds Cash Value Whole Life Permanent Life Insurance Builds Cash Value Liberal Medical Underwriting Guidelines Term Life Available in 10, 20 or 30 year periods Does NOT build cash value Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Life Insurance Why do I need Life Insurance? Ask Yourself….. Will my family be able to meet immediate expenses such as: Funeral Costs Outstanding medical bills Will they have enough money to….. Maintain their current life style Make the Mortgage payments Provide for the Children’s education Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Section 125 Cafeteria Plan Saves Taxes for All After Tax Plan $1,000 Taxable Gross Income 250 Taxes 750 After Taxes Flex dollars or 100 Insurance premiums $650 Net Spendable Pre-Tax Plan $1,000 Taxable Gross Income Flex dollars or 100 Insurance Premiums 900 New Taxable Income 225 Taxes $675 Net Spendable Employee’s can save 15% - 45% of employee-paid benefits! Section 125 Cafeteria Plan Saves Taxes for All Governed by the IRS Allows you to pre-tax qualified premiums such as medical, dental, disability, cancer, vision, FSA’s etc. No cost to you to use this plan Certain regulations apply: Changes can only be made at reenrollment time each year unless there is a family status change: marriage, divorce, birth or adoption; death of spouse or child; or spouse changes employment. Benefit Statements Benefit Counselors will review the Benefit Statement Line-by-line with the employee www.coloniallife.com Enrollment Software + 1,057.69 + 836.36 www.coloniallife.com - Employee Group Meeting for Flexible Spending Accounts *Watson Wyatt, “Many Workers Struggle with Basic Healthcare Terms,” July, 2007. Insurance Community University 73 Flexible Spending Accounts What if you could buy your prescription and OTC drugs at a discount(if prescribed by a doctor?) Flexible Spending Accounts What if you could pay for dependent care tax free? Flexible Spending Accounts Health Care Flexible Spending Account You can use this money to be reimbursed for eligible medical expenses not covered by your major medical insurance plan • Prescriptions and over-the-counter medications prescribed by a Doctor • Deductibles, co-insurance and co-payments • Eyeglasses, contact lenses or LASIK • Dental and orthodontia expenses Effective with next years, 1/1/2011 HCR rules disallow over-the-counter meds as reimbursable items unless prescribed by a Doctor. Flexible Spending Accounts Non-Employer Sponsored Premiums You can use pay major medical plan premiums, currently paid from your home checkbook(after-tax), COBRA included, by running the premiums through your FSA account. Flexible Spending Accounts List of typical eligible medical expenses Acupuncture Alcoholism Ambulance hire Artificial limbs/teeth Birth control pills Birth prevention surgery Braces Braille - books and magazines Care for handicapped child Chiropractors Christian Science fees Co-insurance Communication equipment/deaf Contact lenses and cleaning solution Crutches Deductibles Dental fees Dentures Diagnostic fees Drug and medical supplies Education for the blind Eyeglasses, including exam fee Healing service fee Hearing devices and batteries Home improvements motivated by medical consideration Hospital bills/hospitalization insurance Insulin Laboratory fees Lasik Eye Surgery Lead base paint removal for children with lead poisoning Membership fee in association with furnishing medical services, hospitalization and clinical care Needed medical supplies, prescribed by doctor Nurses’ fees Obstetrical expenses Operations Orthodontia Orthopedic shoes Osteopaths Flexible Spending Accounts List of typical eligible medical expenses (continued) Oxygen Prescribed medicines (including over-the-counter) Psychiatric care Psychologist fees Routine physicals and other non-diagnostic services and treatments “Seeing Eye” dog and its upkeep Sterilization fees Stop Smoking Programs Surgical fees Therapeutic care for drug/alcohol addiction Therapy treatments Transportation expenses Transportation expenses primarily for rendition of medical services Tuition at special school for handicapped Wheelchair Wigs (prescribed by a physician) X-rays Flexible Spending Accounts Dependent Care Flexible Spending Account This is a valuable benefit that allows you to pay for day care to take care of your children or elderly parents while you work For qualifying dependents that are: Under the age of 13 Are mentally or physically incapable of self-care, spend at least 8 hours per day in your home For work-related dependent care expenses and are primarily for the care of the qualifying person Child care Elder care Before and after school care Care for the disabled dependents Flexible Spending Accounts Eligible Providers Child Care Centers (if more than 6 children, state and local regulations must be met) Elder Care Services In-Home Providers Care providers must report the income!!! Flexible Spending Accounts Transportation Reimbursement Transit Passes for mass transit – Max $230/mo Commuter vehicles (must have seating for 6 or more) – Max $230/mo, in conjunction with Transit Passes above. Not a separate benefit. Qualified parking – Max $230/mo You may change your elections at any time. Flexible Spending Accounts – How they work Monthly Deposit from your paycheck Open your Get Fully Reimbursed Account at Tax Savings FSA Work Fill out Reimbursement Claim Form Use Debit Card to Receive Medical or Day Care Service OR Flexible Spending Accounts The IRS Rule: “Use it or Lose it” (only set aside 50% if you are a first year user, or 70% if you are a veteran) HSA PARTICIPANTS HAVE SPECIAL RULES FOR FSA USE Annual Maximum Health Care FSA is $2,500 Annual Maximum Dependent Care FSA is $5,000 Run Out Period is 90 days Sit with your Benefits Counselor to review the worksheets & establish proper amount to set aside Decisions are fixed for plan year unless you have a qualifying event Go to www.tasconline.com for support, history & planning Enjoy the Tax Savings!!! TASC Mobile Tools Managing Benefits in the Go! MyTASC Mobile App Free download from Apple® and Android Market™ for smart phones and tablets Secure login with MyTASC username and password Check real-time account balance Request a Reimbursement wizard Submit substantiation (use embedded camera to capture receipt or form) Screen images are simulated Flexible Spending Accounts Your Plan Year is 6/1 thru 5/30 annually. That is a 12 month plan year. Do the math accordingly!!! There is no special network of providers. The FSA Debit Card is a “smart card.” It is accepted at medical providers that display the MasterCard logo. Small pharmacies may not be in the network. If this happens, call TASC and ask for assistance with that pharmacy. You will be sent one debit card. You can request a second card at no charge. Replacement cards are $10. Your card can be used for Dependent Care expenses. Your election forms for FSA are due to HR by _______. “DONE” Polling Question • Can employee FSA payroll deductions can be managed inside an employers payroll system with a TPA (Third Party Administrator)? Insurance Community University 88 IRS Incentives for Employers and Employees • Employee and employer cost savings are created from: – Section 125: Cafeteria Plans. – Section 129: Dependent Care Flexible Spending Account • • • • • • Savings allow the employee to afford more benefits Savings allow the employer to pay for benefits & services Savings help pay for an internal administrative resource to reconcile the premium payments for VB and to reconcile FSA withholdings distributions to a Third Party Administrator (TPA) These benefits pay for themselves! S Corps, LLC’s and Sole Proprietorships – owners cannot pre-tax premiums for themselves, spouses or 5%+ owners, but their employees are encouraged to pre-tax and save payroll taxes Section 125 also creates Worker’s Comp Premium Cost savings for the employer Insurance Community University 89 Other Financial Incentives for Employers • • • Lower Worker’s Comp premiums through reduced claims (can vary state-by-state depending upon the level of SDI and Worker’s Comp available to the employee) Drives down the experience mod over time Occurs because of the higher disability benefits available Insurance Community University 90 Disability Insurance – California The Monday Morning Effect Workers Comp State Disability % 66 2/3 % 55% Disability 0% 40% Total Income Level 66 2/3 % 95% Product underwritten by Colonial Life & Accident Insurance Company. Policies have exclusions and limitations that may affect benefits payable. Other Financial Incentives for Employers 100 Life Case EMPLOYER SAVINGS With FSA FICA Savings from Flexible Spending Accounts FICA Savings Premium Only Plan - No Charge Total Savings for Employer Without FSA $1,035 $ - $2,495 $2,495 $ - $ 150 $3,530 $2,645 $6,804 $6,804 $6,075 $ $12,879 $6,804 $16,409 $9,449 EMPLOYEE SAVINGS Employee VB Plan Savings Employee FSA Plan Savings Total Savings for Employees Total Combined Savings Insurance Community University - 92 Medical Bridge Plans Create New Savings Opportunities • • • • • • • • Major medical plan premium costs are rising every year Health Care Reform did not bring lower plan costs Employers are seeking relief and looking to brokers Bridge Plan are becoming more popular and help fill gaps left by rising deductible plans There are many different plan designs from several carriers First-dollar coverage is not necessarily the best plan because these plan designs promote more experience for the major medical plan Indemnity plans appear to be the best choice Simplicity and breadth of options appear to be the key – – – – Easy implementation Easy for employees to understand Easy for employees to use Simple claims process Insurance Community University 93 Employers respond to rising costs Absorb rate increase at renewal Direct impact to employer’s bottom line Shift more contributions to employees Shift more contribution to Employee Direct impact to employee’s pocket book Re-design plan and introduce HDHP solutions Increase in employee’s exposure to health care costs Employers respond to rising costs Current Health Plan New Health Plan Employee out-ofpocket costs Employer faces saves higher moneyplan with new plan costs at renewal design with current design •plan Higher annual deductible • Higher co-insurance amounts Employees face more costs Expenses covered by health plan 1 • 2X increase in employees covered by plan with a $1,000+ deductible1 • 60% of Americans do not have funds to cover unexpected costs2 Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2006-2010. National consumer study, Financial Industry Regulatory Authority Investor Education Foundation in consultation with the U.S. Department of Treasury and President’s Advisory Council on Financial Literacy, 2009. 2 The Medical BridgeSM opportunity A solution for employers and their employees Out-ofpocket costs Medical Bridge solution Expenses covered byby Expenses covered health insurance health insurance 1 • Employer saves money by redesigning the health plan • Employees receive benefits to help pay out-of-pocket costs from a hospital confinement or other covered health care event • Pays lump-sum benefits directly to employees • Benefits for Hospital Confinement, out-patient surgery, diagnostic tests and wellness visits may also be available1 Plan design and benefits vary by state. See state specific plan information for availability in each state. The Medical BridgeSM opportunity Year 1 Health Plan Year 2 Health Plan Current Health Plan Annual Deductible $500 $500 $500 Coinsurance 80/20 80/20 80/20 EE Cost $132 $151 $177 ER Cost $395 $454 $532 Total Cost $527 $605 $708 % Increase - 15% 17% Total health care cost increased by more than 30%! Based on actual Colonial Life case. The Medical BridgeSM opportunity Current Plan Proposed Health Plan Annual Deductible $500 $1,500 Coinsurance 80/20 70/30 EE Cost $177 $154 ER Cost $532 $461 Total Cost $708 $615 % Increase +17% (13%) Add Colonial Life’s Hospital Confinement Indemnity Plan MB3000 GMB 1.0 • Premiums have decreased; however, employees are now faced with more out-of-pocket exposure. • Solution… The Medical BridgeSM opportunity Proposed Health Plan Annual Deductible $1,500 Co-insurance 70/30 Total Health Cost $615 (ER Savings $72 X 100 is $532 Employees - $461 == $72/EE/Month) $7,200/month) Plus GMB 1.0 Plan 2 with Health Screening* Hospital Confinement $1,000 Outpatient Surgery Option 1 ($500 Tier 1, $1,000 Tier 2, $1,500 CY Max) Health Screening + Pap Smear + Mammography = $320/yr $7,200 $17.47 -X $1,747 100 Employees = $5,453/month = $1,747/month total savings EE Discounted Composite Rate = $17.47/month GMB 1.0 Premium Employer can use savings to purchase GMB1.0 100% for the employees.** *Plan options and benefits vary by state, and product may not be available in all states. Ask your Colonial Life contact for the plan options available in your state. **Employers who pay 100% of the premium for any Colonial Life product may not be eligible for certain complimentary employer services offered by Colonial Life. Case Results #1 Benefit Eligible Lives 109 2010 Plan Premiums $358,000 2011 Plan Renewal $390,000 New 2011 Plan (higher deductible) $285,000 Colonial GMB Plan Cost $35,000 New 2011 Plan Premiums $320,000 Net Savings to Employer $70,000 GMB Premium Split 100% Employer Paid Annual Rates Case Results #2 Benefit Eligible Lives 20 2010 Plan Premiums $78,874 2011 Plan Renewal $91,714 New 2011 Plan (higher deductible) $77,280 Colonial GMB Plan Cost $5,500 New 2011 Plan Premiums $82,780 Net Savings to Employer $8,934 GMB Premium Split 75% Employer Paid Annual Rates A solution that works in today’s marketplace Indemnity-based plans • • • • Indemnity benefits — what you see is what you get. Doesn’t coordinate with major medical or affect utilization. Rapid claims payment. Rate stability — less susceptible to trends. These are NOT “expense-based” plans • Sometimes called gap or wrap plans. • Coordinate with core health insurance. • Reliant on claims adjudication process before payment is made. Process Steps 5 P’s – Planning Prevents Panic & Precedes Perfection Insurance Community University 103 Learn Pre-Enrollment Communications Orientation Make Choices Group Meetings Individual Enrollment Methods 1-on-1 Meeting Telephonic & Paper CoBrowsing Processing Servers Data Return Other Employer Carriers Insurance Community University Planning & Communication are Essential to a Successful Program Insurance Community University Recap • • • • • • • • The Marketplace “has been” ready for VB Advantages of having VB in the plan design vs not having them It’s important to “properly educate and communicate” VB benefits You now understand the mainstream VB plans are and how they work The advantages of Section 125 pre-taxing of premiums Employers can save money on Worker’s Comp premiums Medical Bridge plans can help save BIG on major medical premiums Questions Insurance Community University 106 Key Advantages to Employers • Better management of their benefit costs – • Lower payroll taxes – • As an added bonus, offering voluntary benefits that qualify for pre-taxing can lower payroll taxes with each enrolled employee. Time and money savings – • Employers can offer lower-priced, high-deductible health plans and provide voluntary insurance to help cover the higher deductibles. Implementing a comprehensive benefits communication and enrollment program can help HR departments preserve precious time and budget resources. Employee satisfaction – – – Offering voluntary benefits also provides a great incentive for workers to stay with their employers. Employees can receive more benefits with no direct cost to the employer. By providing VB, the employer is helping employees protect their health, savings and everything they’ve worked so hard to achieve. Insurance Community University 107 Employers need benefits to drive business recovery • • • • Benefits is a vital business strategy for attracting and retaining quality workers Even after companies have recovered the competitiveness for quality employees will continue Robust & cost-effective benefit plans will continue to feed corporate strategies for maintaining a healthy company This means “Opportunity” for Brokers Insurance Community University 108 The Benefits Reality Gap • • It takes education – Brokers educating their Clients about the gap and available solutions. It takes education – Someone has to educate the employees – the proper choice of VB carrier will have Benefit Counselors equipped to handle this for you and your client. Insurance Community University 109 Key Advantages to Brokers • A reliable new revenue stream – • Stronger relationships with group benefit clients – – – – • About 40% percent of employees will purchase a VB product when enrollment included one-to-one meetings. Each employee in an account could potentially represent $60 or more in commissions; more with bonuses and renewals. Brokers can provide their clients with a way to enhance theirr existing benefits package at little or no cost while helping meet their employees’ needs. Brokers can bring more value-added services at no additional cost. This helps position the broker as a full benefits provider, which means clients won’t have to look elsewhere to meet their needs. Keep our your competition!!! Quick ramp up without additional overhead – – Brokers don’t have to become experts in VB or invest in any additional overhead if they partner with an experienced voluntary benefits carrier. A full-service VB carrier, for example, has proven enrollment systems and benefits communications processes in place. Insurance Community University 110 Developing a VB Practice is Easier Than Brokers Think Insurance Community University 111 Find the Right Partner • • • Employees say 1-on-1 meetings are important Picking the right partner is VITAL Look for Certified & Trained Benefit Counselors measured for persistency; not sales Insurance Community University 112 Find the Right Partner • Ask for References and call them – • Use Local Benefit Counselors – not imported salespeople – – – – – • • • • See what the VB agent’s customers say Better long-term strategy with lower expenses Builds a relationship with the local facility and employees Builds trust Builds in accountability for the Benefit Counselor Contributes to long term relationships Are other brokers satisfied with the carrier & responsible agent? What does their planning look like? What does their after-the-sale service look like? What does their billing process look like? Insurance Community University 113 Some Great Advice Insurance Community University 114 Wrap-Up • • • • • • Plan Year Short Plan Year Best Open Enrollment is with Core Benefits POP Plans & FSA SPD’s Guaranteed Issue Benefits Employer Contributions to employee VB plans Insurance Community University 115