Corporate Finance 2

Semester 2

2010-2011

Micha G. Keijer

HvA/HES

• Literature:

Fundamentals of Corporate Finance (8th)

Ross, Westerfield & Jordan

McGraw-Hill International edition

• Examination:

Written exam (5 ECTS)

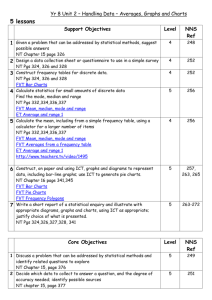

Course outline Corporate Finance 2

Week

Subject

Chapters

1&2

Future- & Present Value of Money

3&4

Bond Valuation

7

5&6

Stock Valuation

8

7&8

Capital Market History

12

9&10

Security Markets Line

13

11&12 Cost of Capital

13

Mock exam

5&6

15

Chapter

Chapter

The Slides &

Excel 5files are on

the T-drive:

•Introduction

to Valuation:

TheT:\hes\MGK\CO2

Time Value of Money

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

This week

Structure of an investment

1. Time preference

2. Risk

3. Inflation

This week

• Future- and Present Values

• DCF- method

• Discounting Annuities and EAR

1

1

t

(1 r )

PV C (1

r

2: Simple versus compound interest

First United Bank pays 4% simple interest on their savings

accounts. Second Federal Bank pays 4% interest compounded

annually on their savings accounts.

If you invest $1,000 in each bank, how much will you have in your

accounts after twenty years?

Why are the balances different?

3: Simple versus compound interest

First United Bank

$1,000 .04 $40

$40 20 $800

$1,000 $800 $1,800

Second Federal Bank

FVt PV (1 r) t

$1,000 1.04 20

$2,191.12

Difference

$2,191.12 $1,800 $391.12

4: Future value

You invest $3,000 in the stock market today.

How much will your account be worth forty years from now if you

earn a 9% rate of return?

5: Future value

FVt PV 1 r

t

$3,000 1 .09

40

$3,000 31.40942

$94,228.26

7: Present value

You want to have $7,500 three years from now to buy a car. You

can earn 6% on your savings.

How much money must you deposit today to have the $7,500 in

three years?

8: Present value

FVt

PV

t

1 r

$7,500

3

1 .06

$7,500

1.191016

$6,297.14

10: Interest rate for a single period

Last year your investments were worth $369,289. Today they are

worth $401,382. No deposits or withdrawals were made during the

year.

What rate of return did you earn on your investments this year?

11: Interest rate for a single period

FVt PV 1 r

t

$401,382 $369,289 1 r

1

1.086905 1 r

r .086905

r 8.6905%

13: Interest rate for multiple periods

The City Museum owns a rare painting currently valued at $1.2

million. The museum paid $240,000 to purchase the painting twelve

years ago.

What is the rate of appreciation on this painting?

14: Interest rate for multiple periods

FVt PV 1 r

t

$1,200,000 $240,000 1 r

12

5 1 r

12

1

12

5 1 r

5.0833333 1 r

1.1435298 1 r

r .1435298

r 14.35298%

16: Number of time periods

Tom originally started to work for Jackson Enterprises at an

annual salary of $36,500. Today, Tom earns $68,200. Tom

calculated that his average annual pay raise has been 3.4%.

How long has Tom worked for Jackson Enterprises?

17: Number of time periods

FVt PV 1 r

t

68,200 36,500 1.034

t

1.8684932 1.034t

ln 1.8684932 t ln 1.034

ln 1.8684932

t

ln 1.034

.6251323

t

.0334348

t 18.697