Document

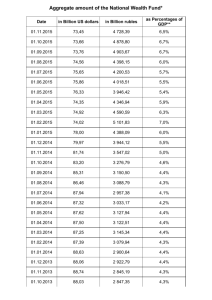

advertisement

Today’s Russian Chlor-Alkali Industry Boris Yagud Executive Director Association “RusChlor” RusChlor Membership The full members in Association “Ruschlor” Volgograd Open Joint-Stock Company "Kaustik" Sterlitamak Open Joint-Stock Company “SODA” Sayansk Open Joint-Stock Company “Sayanskkhimplast”, Sayansk, the Russian Federation; Kemerovo Limited Liability Company “Khimprom” Moscow Closed Joint-Stock Company "Russian Centre 'Chlorine Safety" Novocheboksarsk Open Joint-Stock Company "Khimprom" Berezniki Limited Liability Company “Soda-Khlorat”; Closed Joint-Stock Company "Ilimkhimprom", Bratsk, the Russian Federation; Novomoskovsk Limited Liability Company “Novomoskovskij Khlor”; Kirovo-Chepetsk Limited Liability Company “Halopolimer”, Kirovo-Chepetsk, the Russian Federation; Solikamsk Open Joint-Stock Company “Magnievyij zavod” Volgograd Open Joint-Stock Company "Khimprom" Skoropuskovsk Limited Liability Company “Sintez”, Moscow Region Open Joint-Stock Company “WTE Yugo-Vostok” Associate members in Association “RusChlor” Moscow Limited Liability Company "Sintez" Irkutsk Limited Liability Company "Giprokhlor" Izhevsk Limited Liability Company “Gidroproekt” Dzerzhinsk Limited Liability Company "Uhde" Moscow Closed Joint-Stock Company “GMZ ‘Khimmash” Moscow Limited Liability Company “Khlorkompleks” Moscow Limited Liability Company “Universal”; Dzerzhinsk Limited Liability Company “Group of Companies ‘Spetsmash”; Ekaterinburg Closed Joint-Stock Company “Scientific and Productive Enterprise ‘Mashprom”; Moscow Limited Liability Company “GLYNWED ‘Russia”; "Chemieanlagenbau Chemnitz GmbH", Germany; Descote, France "Midland Manufacturing Inc.", USA; "Uhde GmbH", Germany; “Industrie De Nora S.p.A.”, Italy Phoenix Armaturen Werke Bregel Gmbh, Germany; Thaletec GmbH, Germany “Bluestar Beijing Chemical Machinery Co., Ltd”, China; ISGEC Heavy Engineering Ltd, India Chem-Tech Engineering srl, Italy BS&B Safety Systems Ltd., Ireland RusChlor Projects 2011 – 2013 formulation of the Russian proposals for the Minamata Convention text; formulation of the National Development Strategy for the Chlor-alkali Industry for the period from the year 2014 through 2030; membership in World Chlorine Council (WCC); participation in formulation of the WCC documents on the industrial safety; participation in development by the government of the Russian Federation of the new Federal Laws and Rules on the Industrial Safety. Distribution of the production capacity of the Russian chlor-alkali industry over the production methods 18% 52% Diaphragm electrolysis Membrane electrolysis 30% Mercury-cathode electrolysis THE KEY-TASKS STEMMING FROM THE CURRENT SITUATION OF THE CHLOR-ALKALI INDUSTRY 1. MODERNIZATION OF THE INDUSTRY SECTOR, WHICH INCLUDES MODERNIZATION OF THE BASIC EQUIPMENT AT THE FACILITIES OPERATING THE DIAPHRAGM AND MERCURY-CATHODE ELECTROLYSIS. 2. PUTTING INTO COMMERCIAL OPERATION OF ONLY SUCH NEW PRODUCTION FACILITIES THAT ONLY OPERATE THE MEMBRANE ELECTROLYSIS. 3. IMPROVEMENT IN THE ENVIRONMENTAL CONDITIONS: – REDUCTION IN THE MERСURY EMISSION; – REDUCTION IN THE USE OF ASBESTOS; – REDUCTION IN THE GREENHOUSE GASES EMISSION AS A RESULT FROM THE REDUCED ENERGY CONSUMPTION. 4. GRADUAL BOTH ECONOMICALLY AND ECOLOGICALLY FEASIBLE CONVERSION OF THE STILL FUNCTIONING PRODUCTION FACILITIES OF THOSE THAT ARE STILL OPERATING THE MERCURY CATHODE ELECTROLYSIS OR THE DIAPHRAGM ONE OR BOTH INTO THE MEMBRANE ELECTROLYSIS TECHNOLOGY. RusChlor Suggestions Accepted by Federal Acts of the Russian Federation • Federal Law “On Industrial Safety of Hazardous Production Facilities” (came into the legal force on March 04, 2013); • National Standards “Safety Rules for Production of Chlorine and Chlorine-containing Substances” (approved by Federal Service for Ecological, Technological, and Nuclear Supervision and duly registered by the Ministry of Justice of the Russian Federation on December 30, 2013); • National Standards “Safety Rules for the Chemically Hazardous Production Facility” (approved by Federal Service for Ecological, Technological, and Nuclear Supervision and duly registered by the Ministry of Justice of the Russian Federation on December 30, 2013). Requirements to the Processes Federal Law No. 116-FZ “On Industrial Safety of Hazardous Production Facilities” as amended on March 04, 2013 Federal Acts of the Russian Federation Requirements to the Equipment Federal Law No. 184-FZ “On Technical Regulation” as amended on December 28, 2013 Federal Rules and Regulations for Industrial Safety (FRRIS) FRRIS “Safety Rules for Production of Chlorine and Chlorine-containing Substances” of December 30, 2013 FRRIS “Safety Rules for the Chemically Hazardous Production Facility” of December 30, 2013 Regulatory Instruments applicable on a Voluntary Basis RusChlor Technical Recommendations Instrumental Guidance provided by Federal Service for Environmental, Technological, and Nuclear Supervision (RTN Instrumental Guidance) Technical Regulations of the Custom Union (TRCU) TRCU “On safety of the machinery and equipment” No. 010/2011 TRCU “On Safety of Equipment under the Explosive Environments” No. 012/2011 TRCU “On Safety of the Gas-fired Machines” No. 016/2011 TRCU “On Safety of the Pressurized Equipment” No. 032/2013" Regulatory Instruments applicable on a Voluntary Basis The standards that should assure that all the requirements of the Technical Regulations are fulfilled Design Specifications The standards that specify all the procedures to be followed and technique to be applied in studying, testing, or measuring under the Technical Regulations. Commissioning and admission to service at the Hazardous Industrial Facility Confirmation of conformity of the device with the requirements of the Technical Regulation Only such a legal entity or self-employed entrepreneur that falls into either of the following two categories and is duly registered as a resident legal person for the Custom Union's territory can lawfully apply for the certificate: • Manufacturer or contractor fulfilling the manufacturer's obligations; • Supplier (under a certain schema). Set of documentation: • Safety Assessment Report; • Operational Requirements Documents; • The Contract (Delivery Contract) or consignment details for either a consignment or one-off item; • Management System Certificate; • Report on the Studies Undertaken; • Test reports; • Conformity Certificates for the Materials and Parts; Performance of the Expert Examination as to the Industrial Safety of the device or installation • prior to the beginning of its operational use at the hazardous production facility; • at the end of its operational lifetime as determined by the legislation or manufacturer; • in the absence of any exact endurance data in the technical documentation linked to the device or installation on the condition that the actual operational life of the device or installation has exceeded 20 years; • upon completion of the works on changing the design, replacement of the construction material for the bearing elements of the device or installation or upon completion of the works on the reconstructive maintenance that have followed such an accident at the hazardous production facility that resulted in a damage caused to the device or installation. SAFETY ASSESSMENT REPORT • Safety Assessment Report Safety Assessment Report is a single document comprising the risk analysis and certain data on the minimum essential safety measures. The data on the safety measures is supposed to have been initially excerpted from the design, operational, and process control documentation. Safety assessment report is required to be accompanying the machinery or equipment at all the stages of its lifecycle so that the risk assessment data calculated in operational stage upon completion of works on capital repair of the machinery or equipment should be added to the report. • GOST R “Safety of the Machinery and Equipment. Requirements as to the Safety Analysis Report” No. 541222010 SAFETY ASSESSMENT REPORT FOR THE TECHNICAL DEVICES CONTENTS The key parameters and records of performance The general approach to providing for safety in the design process Reliability requirements Personnel/ user skills requirements Analysis of the risk of the commercial use Safety requirements necessary to fulfill in commissioning Requirements to safety management in the commercial run Requirements to quality management in the commercial run Requirements to management over the environment protection in commissioning, commercial run, and disposal of Requirements to collection and analysis of the safety information in commissioning, commercial run, and disposal of Safety requirements to be fulfilled in decommissioning PRODUCTION OF THE CHLORORGANIC PRODUCTS IN THE RUSSIAN FEDERATION IN THE 2010–2013 TIMEFRAME • The organochlorine synthesis industry is clearly underperforming both the qualitatively and quantitatively, which should be mostly accounted for by the poor demand for the products in the market with a possible exception of PVC. • Without a considerable economic revival one can hardly expect that the chlororganic products output can rise to any substantial extent in both the short- and mid-term perspective. • The rise in the PVC output is hampered by the lack of ethylene in the domestic market. IMPORT CONTENT OF THE RUSSIAN DOMESTIC PVC MARKET 2006-2007 гг. 2010-2013 гг. 33-42% ~50% Consumers: construction, housing and public utilities,mechanical engineering, packing and wrapping materials, and some other industries. THE DEMAND FOR PVC HAS EXCEEDED 1 MILLION TONS A YEAR IN THE RUSSIAN FEDERATION The demand for PVC rose by hefty 34 percent in 2010 compared to the same indicator's previous year’s value. The demand curve has been almost flat since then. The caustic soda Consumption Segment Apparent Consumption of the caustic soda (as of 2013) Customer Share (%) Chemical industry Production of cellulose, pulp, paper, and cartonboard 405663 273337 39% 26% Metals industry, including both the extraction and downstream operations Electric-power industry Oil and gas extraction Food processing Mechanical engineering industry Other Final total 134540 83742 41972 35096 11845 47944 1034139 13% 8% 4% 3% 1% 5% 100% Apparent Consumption of the caustic soda (as of 2013) Mechanical engineering industry Food processing 1% 3% Oil and gas extraction 4% Electric-power industry 8% Metals industry, including both the extraction and downstream operations 13% Other 5% Chemical industry 39% Production of cellulose, pulp, paper, and cartonboard 27% Thank you for your listening!