Casualty Actuarial Society Seminar on Dynamic

advertisement

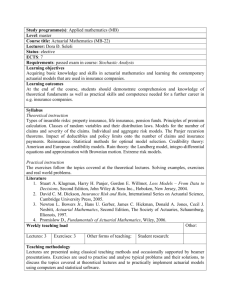

Actuarial Science and Financial Mathematics: Doing Integrals for Fun and Profit Rick Gorvett, FCAS, MAAA, ARM, Ph.D. Presentation to Math 400 Class Department of Mathematics University of Illinois at Urbana-Champaign March 5, 2001 Presentation Agenda • Actuaries -- who (or what) are they? • Actuarial exams and our actuarial science courses • Recent developments in – Actuarial practice – Academic research What is an Actuary? The Technical Definition • Someone with an actuarial designation • Property / Casualty: – FCAS: Fellow of the Casualty Actuarial Society – ACAS: Associate of the Casualty Actuarial Society • Life: – FSA: Fellow of the Society of Actuaries – ASA: Associate of the Society of Actuaries • Other: – EA: Enrolled Actuary – MAAA: Member, American Academy of Actuaries What is an Actuary? Better Definitions • “One who analyzes the current financial implications of future contingent events” - p.1, Foundations of Casualty Actuarial Science • “Actuaries put a price tag on future risks. They have been called financial architects and social mathematicians, because their unique combination of analytical and business skills is helping to solve a growing variety of financial and social problems.” - p.1, Actuaries Make a Difference Membership Statistics (Nov., 2000) • Casualty Actuarial Society: – Fellows: – Associates: – Total: 2,061 1,377 3,438 • Society of Actuaries: – Fellows: – Associates: – Total: 8,990 7,411 16,401 Casualty Actuaries • • • • • • • • Insurance companies: Consultants: Organizations serving insurance: Government: Brokers and agents: Academic: Other: Retired: 2,096 668 102 76 84 16 177 219 “Basic” Actuarial Exams • Course 1: Mathematical foundations of actuarial science – Calculus, probability, and risk • Course 2: Economics, finance, and interest theory • Course 3: Actuarial models – Life contingencies, loss distributions, stochastic processes, risk theory, simulation • Course 4: Actuarial modeling – Econometrics, credibility theory, model estimation, survival analysis U of I Actuarial Science Program: Math Courses Beyond Calculus • • • • • • • • • Math 210: Math 309: Math 361: Math 369: Math 371: Math 372: Math 376: Math 377: Math 378: Interest theory Actuarial statistics Probability theory Applied statistics Actuarial theory I Actuarial theory II Risk theory Survival analysis Actuarial modeling Exam # 2 Various 1 4 3 3 3 4 3 and 4 U of I Actuarial Science Program: Other Useful Courses • Math 270: Review for exams # 1 and 2 • Math 351: Financial Mathematics • Math 351: Actuarial Capstone course • Fin 260: Principles of insurance • Fin 321: Advanced corporate finance • Fin 343: Financial risk management • Econ 102 / 300: Microeconomics • Econ 103 / 301: Macroeconomics CAS Exams -- Advanced Topics • • • • • • • • • Insurance policies and coverages Ratemaking Loss reserving Actuarial standards Insurance accounting Reinsurance Insurance law and regulation Finance and solvency Investments and financial analysis The Actuarial Profession • Types of actuaries – Property/casualty – Life – Pension • Primary functions involve the financial implications of contingent events – Price insurance policies (“ratemaking”) – Set reserves (liabilities) for the future costs of current obligations (“loss reserving”) – Determine appropriate classification structures for insurance policyholders – Asset-liability management – Financial analyses Table of Contents From a Recent Actuarial Journal North American Actuarial Journal July 1998 • • • • • • • Economic Valuation Models for Insurers New Salary Functions for Pension Valuations Representative Interest Rate Scenarios On a Class of Renewal Risk Processes Utility Functions: From Risk Theory to Finance Pricing Perpetual Options for Jump Processes A Logical, Simple Method for Solving the Problem of Properly Indexing Social Security Benefits Actuarial Science and Finance • “Coaching is not rocket science.” - Theresa Grentz, University of Illinois Women’s Basketball Coach • Are actuarial science and finance rocket science? • Certainly, lots of quantitative Ph.D.s are on Wall Street and doing actuarial- or finance-related work • But…. Actuarial Science and Finance (cont.) • Actuarial science and finance are not rocket science -- they’re harder • Rocket science: – Test a theory or design – Learn and re-test until successful • Actuarial science and finance – Things continually change -- behaviors, attitudes,…. – Can’t hold other variables constant – Limited data with which to test theories Recent Developments in Actuarial Practice • Risk and return – Pricing insurance policies to formally reflect risk • Insurance securitization – Transfer of insurance risks to the capital markets by transforming insurance cash flows into tradable financial securities • Dynamic financial analysis – Holistic approach to modeling the interaction between insurance and financial operations Dynamic Financial Analysis • Dynamic – Stochastic or variable – Reflect uncertainty in future outcomes • Financial – Integration of insurance and financial operations and markets • Analysis – Examination of system’s interrelationships DynaMo (at www.mhlconsult.com) Catastrophe Generator U/W Inputs U/W Generator Payment Patterns U/W Cycle U/W Cashflows Tax Interest Rate Generator Investment & Economic Inputs Investment Generator Investment Cashflows Outputs & Simulation Results Key Variables • • • • • • Financial Short-Term Interest Rate Term Structure Default Premiums Equity Premium Inflation Mortgage Pre-Payment Patterns Underwriting • • • • • • • • • • • Loss Freq. / Sev. Rates and Exposures Expenses Underwriting Cycle Loss Reserve Dev. Jurisdictional Risk Aging Phenomenon Payment Patterns Catastrophes Reinsurance Taxes Sample DFA Model Output P R O B A B IL IT Y Distribution for SURPLUS / Ending/I115 0.16 0.13 0.10 0.06 0.03 0.00 6.8 13.9 21.1 28.2 35.4 Values in Hundreds 42.5 49.7 Year 2004 Surplus Distribution Original Assumptions 0.25 0.15 0.1 0.05 Millions 30 9.2 27 5.0 24 0.8 20 6.6 17 2.4 13 8.2 10 3.9 69 .7 35 .5 1.3 0 -32 .9 Probability 0.2 Year 2004 Surplus Distribution Constrained Growth Assumptions 0.25 0.15 0.1 0.05 Millions 33 4.8 30 8.1 28 1.4 25 4.7 22 8.0 20 1.3 17 4.6 14 7.8 12 1.1 94 .4 0 67 .7 Probability 0.2 Model Uses Internal • • • • • Strategic Planning Ratemaking Reinsurance Valuation / M&A Market Simulation and Competitive Analysis • Asset / Liability Management External • External Ratings • Communication with Financial Markets • Regulatory / RiskBased Capital • Capital Planning / Securitization Recent Areas of Actuarial Research • Financial mathematics • Stochastic calculus • Fuzzy set theory • Markov chain Monte Carlo • Neural networks • Chaos theory / fractals The Actuarial Science Research Triangle Mathematics Fuzzy Set Theory Markov Chain Monte Carlo Stochastic Calculus / Ito’s Lemma Financial Mathematics Theory of Risk Interest Theory Chaos Theory / Fractals Actuarial Science Dynamic Financial Analysis Portfolio Theory Interest Rate Modeling Contingent Claims Analysis Finance Financial Mathematics Interest Rate Generator Cox-Ingersoll-Ross One-Factor Model dr = a (b-r) dt + s r0.5 dZ r= a= b= s= Z= short-term interest rate speed of reversion of process to long-run mean long-run mean interest rate volatility of process standard Wiener process Financial Mathematics (cont.) Asset-Liability Management P Price-Yield Curve Duration D = -(dP / dr) / P Convexity r C = d2P / dr2 Stochastic Calculus Brownian motion (Wiener process) Dz = e (Dt)0.5 z(t) - z(s) ~ N(0, t-s) Stochastic Calculus (cont.) Ito’s Lemma Let dx = a(x,t) + b(x,t)dz Then, F(x,t) follows the process dF = [a(dF/dx) + (dF/dt) + 0.5b2(d2F/dx2)]dt + b(dF/dx)dz Stochastic Calculus (cont.) Black-Scholes(-Merton) Formula VC = S N(d1) - X e-rt N(d2) d1 = [ln(S/X)+(r+0.5s2)t] / st0.5 d2 = d1 - st0.5 Stochastic Calculus (cont.) Mathematical DFA Model • Single state variable: A / L ratio • Assume that both assets and liabilities follow geometric Brownian motion processes: dA/A = mAdt + sAdzA dL/L = mLdt + sLdzL Correlation = rAL Stochastic Calculus (cont.) Mathematical DFA Model (cont.) • In a risk-neutral valuation framework, the interest rate cancels, and x=A/L follows: dx/x = mxdt + sxdzx where mx = sL2 - sAsL rAL sx2 = sA2 + sL2 - 2sAsL rAL dzx = (sAdzA - sLdzL ) / sx Stochastic Calculus (cont.) Mathematical DFA Model (cont.) Can now determine the distribution of the state variable x at the end of the continuoustime segment: ln(x(t)) ~ N(ln(x(t-1))+mx-(sx2 /2), sx2 ) or ln(x(t)) ~ N(ln(x(t-1))+(sL2 /2)-(sA2 /2), sA2+sL2-2sAsL rAL ) Fuzzy Set Theory Insurance Problems • Risk classification – Acceptance decision, pricing decision – Few versus many class dimensions – Many factors are “clear and crisp” • Pricing – Class-dependent – Incorporating company philosophy / subjective information Fuzzy Set Theory (cont.) A Possible Solution • Provide a systematic, mathematical framework to reflect vague, linguistic criteria • Instead of a Boolean-type bifurcation, assigns a membership function: For fuzzy set A, mA(x): X ==> [0,1] • Young (1996, 1997): pricing (WC, health) • Cummins & Derrig (1997): pricing • Horgby (1998): risk classification (life) Markov Chain Monte Carlo • Computer-based simulation technique • Generates dependent sample paths from a distribution • Transition matrix: probabilities of moving from one state to another • Actuarial uses: – Aggregate claims distribution – Stochastic claims reserving – Shifting risk parameters over time Neural Networks • Artificial intelligence model • Characteristics: – – – – Pattern recognition / reconstruction ability Ability to “learn” Adapts to changing environment Resistance to input noise • Brockett, et al (1994) – Feed forward / back propagation – Predictability of insurer insolvencies Chaos Theory / Fractals • Non-linear dynamic systems • Many economic and financial processes exhibit “irregularities” • Volatility in markets – Appears as jumps / outliers – Or, market accelerates / decelerates • Fractals and chaos theory may help us get a better handle on “risk” Conclusion • A new actuarial science “paradigm” is evolving – Advanced mathematics – Financial sophistication • There are significant opportunities for important research in these areas of convergence between actuarial science and mathematics Some Useful Web Pages • Mine – http://www.math.uiuc.edu/~gorvett/ • Casualty Actuarial Society – http://www.casact.org/ • Society of Actuaries – http://www.soa.org/ • “Be An Actuary” – http://www.beanactuary.org/