02-15a012

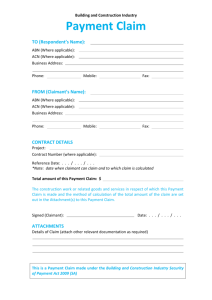

advertisement