file - leacock.com.au

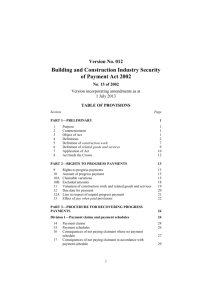

advertisement

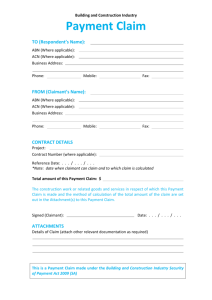

Building and Construction Industry Security of Payment Act 1999 (NSW) July 2003 Overview The Act provides a scheme for the recovery of progress payments. Where there is a dispute as to the amount to be paid, a claimant can still take legal proceedings to have the claim dealt with on a final basis by a court. However the Act provides for an interim Adjudication of the claim. The paying party must pay in accordance with that adjudication. The Act requires prompt action if important rights are not to be lost. The Act applies to subcontracts and head contracts. It applies to all construction contracts, consultant agreements and supply contracts which a commercial operator in the construction industry is likely to enter. Payment Claims The time for claiming payment as provided in the contract will continue to apply. Where the contract makes no provision for progress payments, a payment claim may be lodged every four weeks. The Act requires that a payment claim: “(a) (b) (c) must identify the construction work (or related goods and services) to which the progress payment relates, and must indicate the amount of the progress payment that the claimant claims to be due (the claimed amount ), and must state that it is made under this Act.” A payment claim may be served only within: “(a) (b) the period determined by or in accordance with the terms of the construction contract; or the period of 12 months after the construction work to which the claim relates was last carried out (or the related good and services to which the claim relates were last supplied), whichever is the later.” This provision will override any time bars in the contract. However, the ability of to submit “late” claims may still be lost. This is because under the Act the claimant can only serve one payment claim in relation to each “reference date”. If a payment claim is Leacock & Co 2 made on each reference date then there will be no scope for a “late” claim. Claims for final payment and claims for release of cash retention are payment claims under the Act. It is now clear, since the Supreme Court decision in Walter Construction Group Ltd v CPL (Surry Hills) Pty Ltd of April this year that claims for extensions of time, delay costs or other relief under the contract to which the claimant may or may not be entitled will not invalidate a payment claim. If a claim is made at a time when the claimant is entitled to make a payment claim, then the amount claimed (including damages, delay costs etc) will become due if a payment schedule is not issued in time. The case also demonstrates that informal agreements to bring forward the time at which a claim may be made can and will be enforced. Any agreement to the early submission of a claim will correspondingly bring forward the date on which a payment schedule becomes due. On the other hand, a payment claim submitted before time will not be valid and will not become valid later. "Pay when paid" and "pay if paid" Provisions in a contract of this type are rendered ineffective by the Act. Payment Schedules Once a payment claim is made, then unless the party receiving the claim intends to pay the whole amount claimed, it must issue a payment schedule within 10 business days after the claim. The payment schedule must: (a) identify the claim to which it is responding; (b) indicate the amount which is proposed to be paid; (c) if the amount proposed to be paid is less than the amount claimed, give reasons for the difference. If a payment schedule is not issued within this time, then: (a) there will be an entitlement to the amount claimed. That amount can be recovered in court as a debt due; Leacock & Co 3 (b) work1 can be suspended until 3 business days after payment is made2; (c) in the court proceedings to recover the debt the party liable to pay cannot bring a cross claim or defence3; and (d) the claimant can (instead of proceeding under (a) above) apply for adjudication4. The Walter case is a reminder of the consequences if a payment schedule is not issued. In the case the respondent (a Greencliff company) failed to issue a payment schedule. The result was that the claimant recovered $13.9m as a debt due by way of summary judgment. Lien In addition to the right to suspend, if a progress payment becomes due and payable, the claimant is entitled to exercise a lien in respect of the unpaid amount over any unfixed plant or materials supplied by the claimant for use in connection with the carrying out of construction work for the respondent. A lien is a charge over property which prevents the respondent having access to the unfixed plant or materials until the debt is paid. The lien is limited to the extent of the unpaid amount. Any prior existing lien will take priority. Adjudication If a payment schedule is issued in time but the amount shown in it for payment is less than the amount claimed (and the claimant wishes to recover the balance of the claim) then the claimant can apply for adjudication. Application is made to an adjudicator chosen by agreement between the parties or if no agreement by a nominating authority, such as the Institute of Arbitrators and Mediators. The adjudication application must be made within 10 business days after the payment schedule is served. 1 “work” includes supply of materials. 2 If as a result of suspension work is deleted from the contract then the claimant is entitled to “any loss or expense as a result of the removal” of the work from the contract. This includes loss of profit. It does not include costs of suspension. 3 This is because the cross claim or defence should have been set out in the payment schedule. If that were done then the cross claim or defence could have been considered in an adjudication. 4 If a respondent does not serve a payment schedule, then adjudication in these circumstances may seem an odd choice, given that the claimant can recover the amount claimed as a debt due. However, adjudication (through the resulting adjudication certificate) may be a shorter path to judgment than issuing a statement of claim for the “debt due”. The respondent does however in this case get a second chance to issue a payment schedule if the claimant chooses adjudication where no payment schedule has been issued. See s17(2). Leacock & Co 4 If a payment schedule is issued but the payment actually made by the due date5 is less than the amount set out in the payment schedule then the claimant can: (a) recover the balance in court as a debt due. The respondent cannot bring a cross claim or defence; (b) apply for adjudication (within 20 business days after the due date for payment); (c) suspend work if after giving 2 days notice payment has still not been made. The Act sets out the procedure for adjudication. The preparation of an adjudication application and the adjudication response (i.e. the response to the adjudication application) will require legal assistance. The application and response will contain the party’s submissions to the adjudicator. A party must serve its adjudication response within 5 days after it receives the application or 2 days after it receives the adjudicator’s notice accepting the application, whichever is later. It is important to note that the adjudicator must in reaching a decision only consider the Act, the contract, the claim, the payment schedule, submissions duly made in accordance with the adjudication procedure and any inspection by the adjudicator. Note that submissions made out of time cannot be considered. Note also that the adjudicator does not have any power to call witnesses or take evidence under oath. Since the response must not contain reasons for non payment which were not included in the payment schedule, it is very important that payment schedules give adequately detailed reasons for the difference between the amount claimed and the amount to be paid. The determination must be made by the adjudicator within ten days of the date on which the adjudicator notified the parties of his acceptance of the appointment, unless the parties agree to an extension. The adjudicator’s costs must be paid by the parties in such proportions as the adjudicator directs. Interest is payable on the unpaid portion of a progress payment that has become due and payable at the rate provided in the contract or the Supreme Court rate, whichever is the greater. The adjudicator also has the power to award interest. Enforcement of the Adjudicator’s Decision 5 The “due date” is the date for payment under the contract. (If there is no date in the contract then the “due date” is 10 business days after the payment claim is made.) Leacock & Co 5 Once the adjudicator has determined an amount to be paid, it must be paid within 5 days unless the adjudicator provides a longer time. If payment is not made in accordance with the determination then the unpaid party can obtain (from the nominating authority) an adjudication certificate and then enforce the determination as if it were a court judgment. The unpaid party can also suspend work if the amount remains unpaid after 2 days notice of the intention to suspend. Proceedings after Adjudication As noted above, adjudication is an interim measure. Therefore, although payment must be made in accordance with the determination, the payment is similar to “payment on account”. It is subject to the final decision of a court (or arbitrator where applicable). That final decision may well differ significantly from the adjudicator’s determination. The court can take into account cross claims6, defences legally available and can take evidence from witnesses. It may also be possible to obtain a stay of an adjudication determination pending a court decision on other disputes between the parties. However, given the objects of the Act and the recent amendments it is not likely that stays will be readily granted. Contractors Debts Act The Contractors Debts Act has been amended to enable a subcontractor to apply for a Debt Certificate solely on the basis of an adjudication certificate. Once the Debt Certificate is served on a principal, all or part of the amount owing (to the extent of the adjudication determination) is assigned to the subcontractor. The principal must then pay the amount which it owed to the contractor directly to the subcontractor (to the extent of the amount certified in the Debt Certificate). 6 An adjudicator can take cross claims into account only where the dispute is as to the amount stated in a payment schedule. Leacock & Co 6 No Contracting Out The relevant provision is cast in wide terms: “A provision of any agreement (whether in writing or not): (a) under which the operation of this Act is, or is purported to be, excluded, modified or restricted (or that has the effect of excluding, modifying or restricting the operation of this Act), or (b) that may reasonably be construed as an attempt to deter a person from taking action under this Act, is void.” Conclusion The far reaching provisions of the Act in relation to claims and payment mean that every person involved in the administration of a construction contract must be familiar with its principles. Where a doubt arises as to the proper course then advice must be obtained very swiftly if serious liability (including, potentially, personal liability) is to be avoided. Leacock & Co 7