MMS Leads the Sales & Marketing Compliance Consortium

Managing Sales & Marketing

Compliance With Technology

The Seventh Annual

Pharmaceutical Regulatory and

Compliance Congress

November 9 th 2006

Bill Van Nostrand

William F. Hills

The MMS Sales and Marketing Compliance

Consortium

MMS Leads the Sales & Marketing Compliance Consortium

About the Consortium

The Consortium is a group of companies collectively specializing in Regulatory Compliance programs as they pertain to Federal (OIG) and State legislation targeted at the Pharmaceutical industry.

The Mission of the Consortium

To assist the biopharmaceutical companies in assessing and managing the legal business risks associated with biopharmaceutical sales and marketing activities

To assist companies in designing and implementing processes, procedures and technologies to reduce the business risks associated sales and marketing activities

Sales & Marketing Regulation Escalating Rapidly at

National Level…

Public, political and healthcare industry group scrutiny of pharma sales & marketing increasingly contentious

•

• Frequent articles in the media

American College of Physicians ( Opt Out Program )

Industry Groups Responding to Public Pressure

•

• PhRMA Guidelines (2002)

AMA Guidelines

Federal and State regulation governing/impacting all pharma sales & marketing activity increasing dramatically

•

•

•

•

•

•

•

• Sarbanes-Oxley

Prescription Drug Marketing Act

Medicare Part D

OIG 2003: Compliance Program Guidance for Pharmaceutical

Manufacturers

SEC False Claims Act

Whistle Blower Law (Qui Tam)

FDA (DDMAC)

Individual and independent state regulations (50 state 50 separate regulations)

Exposure for Pharma Companies

Increasing

Phama companies spend more than $19 billion on sales & marketing promotional expenses annually

Number of sales reps in US topped 100,000 in 2006 – triple the number of reps 10 years ago

There’s nearly 1 pharma sales rep for every 7 practicing US physicians

Increasing use of outsourced sales resources diluting impacts of training and hampering control efforts

Unprecedented market pressures to increase sales increasing pressure to sell at all costs.

Whistle Blower Law increased number of people looking for impropriety

In excess of $6billion in fines source: eyeforpharma & InPharm

A new mandate for Pharma Companies

Given a climate of increasing and contentious public scrutiny along with increasingly restrictive, aggressive and complex regulation leading companies must:

•

•

Demonstrate good faith efforts to be fully and proactively compliant with all relevant and applicable legislation and regulation governing sales and marketing activities at all levels of the company.

Work toward achieving a fully integrated sales and marketing compliance management capability

(processes, procedures and systems) that adequately safe guards them and their stockholders from the aberrant behavior of a few individuals, groups or departments.

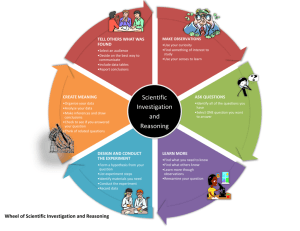

Sales & Marketing Compliance Management

Maturity Curve

Proactive

Management

Reactive

Response

Passive

Training &

Policy

Response

Level 3

• Integrated, enterprise strategy for managing sales and marketing compliance and risk

• Autonomous department/function responsible for compliance monitoring, forensic investigation and reporting

• Dynamic business rules development process that keeps pace with regulatory changes

• Ongoing/near real-time monitoring of multiple signal detection sources

•

Established credibility with OIG, other regulatory authorities & insurance underwriter for proactive compliance mgt

• Dominantly proactive identification and investigation of suspected problems

Level 2

• Department/function dedicated to

Sales & Mkt compliance management

• Well defined set of business rules

• Limited, largely manual monitoring of key indicators

• Certification of key compliance steps

• Mix of reactive & proactive investigation of suspected problems

Level 1

• Fragmented organizational governance for sales & marketing risk mgt

•

Key Policies & mgt Procedures in Place

• Limited Business Rules Defined

•

Primary mechanism of enforcement is training

• Reactive investigation of reported problems

LEVEL OF RISK MITIGATION

Source: VantagePoint Research & Industry

Survey

Early Findings : Organizational & Operational

Proactive

Management

Reactive

Response

Passive

Training &

Policy

Response

Enormous reluctance to discuss compliance strategies, operations or technology usage (CIA)

All companies have policies in place but few companies have well articulated and comprehensive strategy for holistic management of Sales & Marketing Compliance Risk

Most recent activity (beyond training) in response to some formal or informal regulatory finding or actions

Nearly all companies have a compliance officer at some level with responsibility for sales and marketing compliance

Limited number of companies with dedicated sales and marketing compliance functions

Most organizations heavily reliant to self policing & reporting by sales and marketing organization

Most compliance activity buried in myriad of functional groups within Sales and Marketing and/or legal

LEVEL OF RISK MITIGATION

Source: VantagePoint Research & Industry

Assessment

Early Findings: Technology Application

Proactive

Management

There is little industry consensus on approach

Few well defined commercial technology solutions

Most organizations using a mix of “one-off,” point technology solutions heavily supplemented with manual intervention

Technology solutions dominated by custom built applications

Reactive

Response

Passive

Training &

Policy

Response

Many companies have multiple, not necessarily well coordinated technology initiatives to address sales and marketing compliance

A few companies and vendors have begun adapting other compliance tools for sales and marketing

LEVEL OF RISK MITIGATION

Source: VantagePoint Research & Industry

Assessment

Sales & Marketing Compliance

Technology Landscape

Forensic

Investigation

Signal Detection & Activity

Monitoring

Business Rules Management,

Process Execution, Reporting,

Tracking and Certification

Training & Training Support

Sales & Marketing Compliance

Technology Landscape

Mature solutions exist for training

Forensic

Investigation

Signal Detection & Activity

Monitoring

Business Rules Management,

Process Execution, Reporting,

Tracking and Certification

Training & Training Support

Eduneering

Midi

Zenosis

Sales & Marketing Compliance

Technology Landscape

Numerous emergent tools Exists

Forensic

Investigation

Signal Detection & Activity

Monitoring

Business Rules Development

Process Execution, Reporting,

Tracking and Certification

Training & Training Support

Keane SCORE

Polaris Mgt Partners (audit)

Dendrite/Buzzeo

Porzio

Sales & Marketing Compliance

Technology Landscape

Forensic

Investigation

Signal Detection & Activity

Monitoring

Business Rules Management,

Process Execution, Reporting,

Tracking and Certification

Training & Training Support

• Emergent Solutions on the ‘drawing boards’

• Custom built, narrowly focused warehouse-based technologies being deployed

Sales & Marketing Compliance

Technology Landscape

Forensic

Investigation

Signal Detection & Activity

Monitoring

Business Rules Management,

Process Execution, Reporting,

Tracking and Certification

Training & Training Support

• Few comprehensive solutions even on the ‘drawing board’

• Potential platforms include:

Documentum, Opentext, SDMS…

Automation:

Based upon our research and assessment of industry and regulatory trends we believe a comprehensive signal detection and forensic investigation tool is critical to costly State and Federal Fines

Allows Pharma to gain visibility into daily risks for management

Allows Pharma to search and respond to agency questions in real time

Allows Pharma to take remedial action sooner rather then later

“Near Real-Time” Intelligence

Up to date intelligence ( Arnold & Porter, Buzzeo)

Market Risks and Indicators

Internal Signals of Risk

Risks

Signals

Importance

Macro Measures, System

(Aggregation Theme)

Text, Image, Voice Fax,

Oracle (and other databases),

Word, SAS, PowerPoint, Call

Center, Prescription data, backup images, documents

(e.g., Documentum)

The only way to get ahead of the game is to receive near real-time intelligence on potential risks and indicators (signals) of those risks

Executive

Dashboard

Forensic

Investigation

Remediation

SWAT Team

Risk “Signal Detection” System

We believe it is possible to build a robust risk management

“signal detection” system — Showing Best Effort Compliance

Field Operations

Doctor calls

Promotions

Co-Promotions

Sample Management eDetailing

Direct sales to Physicians

Special Events

Doctor Dinners

Conventions

KOL Portals

Medical Education

3rd party

Academic

Symposia

Medical Affairs

Phase 4 trials

Medical Info Center

Academia

Grants

Studies

Training

Management

Field Force

CSOs

Certification

Contracts

Pharmacy

Contracting

Rebates

In store promotions

Typical

Sales and Marketing

Touch points

Medicare

Part D

Rx Card

State Programs

Marketing

Promotional Programs

Direct Mail

Off Label Promotions

Outbound Call Centers

DTC

Internet Portals

Compliance Office

Federal (OIG)

State

AMA

Pharmaceutical

Manufacturers Assn.

Post Marketing

Surveillance

BUYING GROUPS

PBMs

Insurance

Hospitals/retailers

Wholesalers

Government contracts

Physicians-direct shipment

Specialty Buying Groups

Risk “Signal Detection” System

Typical

Sales &

Marketing

Touch points

Federal & State

Compliance

Regulations

Out of

Compliance

Caution

In

Compliance

Signal Sources

INTERNAL

• E-mails & Faxes

• Voice mails

• Print jobs (Promotional materials in the field)

• Trend reports (sales)

• Adverse event monitoring

• Fiduciary systems (e.g., sample mgmt)

• Compliance systems

• Call systems

• SFA call notes

• Speakers Programs Dinner/lunch and learn meetings - contracts, expenses

• CME-speakers contracts

• Pharmacy, Wholesaler, GPOs, PBMs,

Formulary and Hospital programs

• T&E Financial Systems

• MSL - Academic Sales Representative

Notes and Programs (studies)

• Training - Senior Mgmt & Field Sales Force

• Representative Contracts (CSOs)

EXTERNAL

• Market share

• Physician/pharmacist surveys

• Independent assessments

• Focus groups

• Databases (IMS, NDC, Verispan,

Dendrite)

• Independent calls through call centers

• 800# to report fraud

• Government-Federal (OIG) and

State

• U.S. Attorney’s office

Signals can come from internal and external sources

Guidelines for Moving Forward

Forget ROI think Risk/compliance spend

Move from a fixing the dike mentality to a comprehensive strategy for compliance monitoring and investigation

Design holistic, integrated system architecture designed to support all layers compliance technology support

Purchase external State Regulatory updates

Take a proactive Forensic approach

Our vision….

Architectural Map

Thank You!!

Bill Van Nostrand

President/CEO

Medical Marketing Solutions

908-229-5220 bvannostrand@medmarksolutions.com

William F. Hills

Partner

VantagePoint Consulting Group

908-788-7350 wfhills@vantageptconsult.com

DELETED SLIDES PLACED AFTER THIS

Sales and Marketing Compliance Challenges:

…….Fraud and Abuse

Training

Anti-Kick legislation

Off-Label Promotion

Channel Management

Physician Spending

Training: (Key is Certification)

Types of training:

• Traditional

:

–

–

–

Face to face

Text

Paper Tests

• Web Based

:

–

–

–

–

Content Driven

LMS backend

On-line testing

Some Certification

• Simulation:

–

–

–

–

Yellow Brick Road

Choices and Options

Review and Correct

Certification

Anti-Kickback Legislation:

Buying/influencing the business:

• Wholesellers:

•

•

•

•

•

–

Charge Back/Rebate programs

Retailers:

–

Chain and independent promotional programs

Robinson Patman Act (Price and Service discrimination)

Hospitals:

–

Clinical studies and education grants

Third Party Formulary Plans:

–

Paid Outcome studies

Physicians:

–

Paying for Nurse/staff symposia attendance

Medicare Part D:

–

Paying for programs reimbursed by Medicare in States that prohibit such

Channel Management:

Distribution to Wholeseller:

• All products/distribution sites/quantities by NDC code

Ability to track the distribution flow to and from the retail stores:

• Downstream tracking, line item invoice, B2B

Ability to track the distribution to and from direct sale to Physician practices/hospital chains and mail order distributors:

• Now can see Charge Backs because of reports vs. 1-

2% stuffing fees

Physician Spending: ($100 per

Physician/month/year/rep?)

Office and staff gifts…..food:

• Example: Dunkin donuts/coffee/pizza

KOLs…..fee equals level of effort:

• Example: $25,000 for 1 speaking engagement

One on One dinners:

• Example: Le Cirque for 2 but expense it as 5 people

Lunch and Learn:

• Example: Reps providing lunches to residents

Group KOL dinner meetings:

• Example: Exaggerate the number of people in attendance vs. cost of dinners

State Reporting:

• Example: 50 sets of expense reports…………….????????

Off-Label Promotion:

New Studies:

• Unapproved indications being discussed….not through medical director

KOL speakers:

• Speaking on unapproved indications under the guise of medical education

MSL influence:

• Allowing one-off studies of unapproved indications with large grants to influence academic centers or KOLs

Specialty Drugs (Cancer/HIV):

• Under the guise of cocktail mixes and critical use

Pharma Response to Sales & Marketing Compliance

Management is Emergent

Corporate Compliance focused on Sales & Marketing in transition

• Most compliance activity buried in myriad of functional groups within Sales and Marketing and/or Legal

• Limited number of companies with dedicated sales and marketing compliance functions

• Most embedded in corporate legal departments

Rapidly evolving regulatory environment a continual challenge

•

•

Costs of keeping up for a small firm > 2.5 percent of its annual budget

(source:

Mass Chamber of Commerce Study on Biotech and Life Sciences Companies

)

Staff sizes are growing rapidly

Technology Solutions are predominately inadequate or incomplete

•

•

•

• Training Centric

Heavy reliance on self reporting at the departmental level

Manual monitoring and investigation practices

Limited number of emerging point technical solutions

Early Findings

Proactive

Management

Reactive

Response

Passive

Training &

Policy

Response

Source: VantagePoint Research & Industry

Assessment

LEVEL OF RISK MITIGATION

Compliance Spend Effectiveness

Approach - 3 Month Compliance Spend Review

Financial Review

Compliance

Risks/Signals

Current and

Potential

Compliance Audit

Systems and

Infrastructure

Risk per

Compliance $

Spend

Together, the compliance spend analysis and the compliance effectiveness audit provide a scorecard of compliance spend effectiveness

— the basis for moving forward