Captive Risk Financing, A Structured Approach

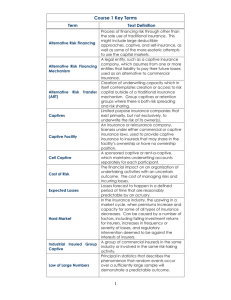

advertisement

SWAN Captive Risk Financing – A Structured Approach • 38th Annual OESAI Conference • 25 August 2015 Agenda 01 Rationale for Captive Structures – Risk spend efficiency – Risk / Cover flexibility – Comparison to no insurance 02 Practical Approach – – – – 03 Risk Bearing Capacity Risk Costing Structuring Testing Captive Structure Options – Types of vehicles and their advantages / disadvantages – Suitability testing 04 Mauritius as domicile – Local business – (South) African business – Other opportunities 05 Looking to the future Rationale for Captive Structures - 01 01 Rationale for Captive Structures Risk spend efficiency — Insurers are profit-driven — Insurers require stringently controlled capital bases — Opportunity costs in various risk avenues to insurers — Captives (Risk finance) focused on cost of risk only — Reduced pooling, cross subsidies 01 Rationale for Captive Structures Risk flexibility — Limited where reliance placed on reinsurance protection — Full retention provides highest flexibility — Cover of uninsurable risks and differences in conditions or limits — Administratively complex structures easier to accommodate — Ease of amendment 01 Rationale for Captive Structures Captive vs no insurance — No dedicated capacity, direct impact on operating results — Potential for double-whammy at worst possible time — No pooling or cross-subsidies possible — Higher (explicit) administration and cost component require economy of scale — Potential reduction in risk management coincreasing TCoR. ordination, Practical Approach - 02 02 Practical Approach Approach – The RF Process Own Data Financial Capacity Risk Profile External Data Exposure Analysis -RBC -Risk Appetite -Risk Tolerance -Update -Amend -Cost Profile -Characteristics RF Structure Retention vs Transfer -Options -Limitations -Cost / Benefit -Economy of scale -Risk characteristics -Requirements Conventional Market -Flexibility -Price -Security TCo(I)R -Optimise -Allocate -Manage -Report 02 Practical Approach Approach – The RF Process Captives Own Data Financial Capacity Risk Profile External Data Exposure Analysis -RBC -Risk Appetite -Risk Tolerance -Update -Amend -Cost Profile -Characteristics RF Structure Retention vs Transfer -Options -Limitations -Cost / Benefit -Economy of scale -Risk characteristics -Requirements Conventional Market -Flexibility -Price -Security TCo(I)R -Optimise -Allocate -Manage -Report 02 Practical Approach Approach – Captive Development — Understand client & requirements — Process - — Risk Bearing Capacity Risk Costing Risk Structuring Structure Testing Captive type selection Implement, Integrate, Manage, Update Important to demonstrate value on on-going basis to client Approach – Risk Bearing Capacity — Estimate of ability to retain risk without compromising key plans and operations — Effective risk budget of organisation — Considers all risk, need to assess and evaluate comprehensive risk profile — Need to include all sources of RBC contributions and drains 02 Practical Approach Approach – Risk Bearing Capacity 02 Practical Approach Approach – Risk Costing — Understand mathematical and operational drivers of risk cost - Develop risk cost curves under all sensible structural scenarios Overlay operational and financial realities (MPL, MFL, RBC etc.) — Integrate with market realities — Optimise overall TCoR — Integrate into risk management process and reporting 02 Practical Approach Approach – Risk Costing Attritional Losses Risk Retention Losses Excess Layer Losses Catastrophe Losses Loss Severity 02 Practical Approach Approach – Risk Structuring Line 2 Expected Cost 11,907,800 Assets Opt (5%, 10%, 85%) Maximum Worst Case 0 75,000,000 150,000,000 Expected Cost 11,907,800 Best Case Worst Case Stopper Best Case 0 75,000,000 Expected Cost 0 Expected Cost Best Case 0 0 Worst Case 0 Expected Cost 0 75,000,000 Expected Cost Recommended Premium 9,631,900 18,277,600 Best Case 0 Breach Probabilities Deductible Structure: Inner Individual 2.6% Worst Case Aggregate 0.0% 0 Best Case 0 Best Case 0 0 Worst Case 34,791,700 Worst Case Expected Cost 57,872,000 Breach Probability Best Case 12,300,700 Worst Case 45,000,000 No Limit Aggregate 5.3% 129,467,300 02 Practical Approach Approach – Risk Structuring Ratios P1 – 2.01 P2 – 1.47 P3 – 0.997 (IOP) P4 – 0.481 P5 – 0.345 Transfer Retained Current SIR IO P 02 Practical Approach Approach – Risk Structure Testing RBC % 02 Practical Approach Approach – Risk Structure Testing Captive Structure Options - 03 03 Vehicles & Structures Approach – Captive Type Selection Complexity, Flexibility Low High Cost Contingency Policy / RAC Domestic Captive PCC Group / Mutual Captive International Captive 03 Vehicles & Structures Approach – Captive Type Selection Considerations - Premium volume & Risk exposure Risk complexity, nature of (insurance) liabilities Diversification / Concentration of Risk Relative costs, including risk transfer costs Planning horizon Options available Existing skills / cost of outsourcing Capital requirements Governance requirements 03 Vehicles & Structures Approach – Captive Type Selection Suitability testing - Is a structure possible that minimises TCoR? Is the criteria for minimisation of TCoR defined and understood? What structural options are available and what are explicit costs of each? Does retention structure create sufficient premium to generate economies-of-scale on frictional costs? Is market efficient / hardening / softening? Does sufficient access to (re)insurance protection exist? Options available What internal capabilities exist? Is suitable training / recruitment possible? Mauritius as domicile - 04 04 Mauritius as domicile Mauritius as domicile Regulatory Environment - Dedicated PCC legislation Pro-(cell)captive solvency and administration requirements Geographic Location & Economic Environment - Proximity to (South) Africa, India and Pacific Rim Small time differences Stable socio-political environment Currency flexibility Cost & Expertise - Frictional expenses lower than many domiciles Significant expertise available locally or with relative ease 04 Mauritius as domicile Mauritius as domicile Local Opportunities (on-shore insurers) - Limited economy Some potential for PCC / Mutual structures (South) African Opportunities - Significant spread of multi-national operations (Africa & Pacific Rim) Tax and other treaties Reinsurance regulation under SAM (solvency relief) Other regions - Multi-national companies in India, Malaysia & Pacific Rim Internet / Virtual & related companies Looking to the future - 05 05 Looking to the future Looking to the future • Clients and risks are becoming more sophisticated and complex, necessitating specialist input in order to manage their TCoR efficiently. • Governance requirements in most countries require risk financing to be sensibly structured within relevant framework of parent to be efficient, compliant, transparent and properly integrated. • Captives are a powerful business tool but should be developed and managed as any other venture and held to same requirements to remain relevant within company. Thank you