MOOD AND ECONOMIC DECISION MAKING: EXPERIMENTAL

advertisement

MOOD AND ECONOMIC DECISION MAKING: EXPERIMENTAL EVIDENCE

JUDD B. KESSLER

ANDREW MCCLELLAN

ANDREW SCHOTTER

September 6, 2015

ABSTRACT

In this paper we investigate the impact of short-term fluctuations in happiness (i.e. a

positive mood) on decision-making. The emotional fluctuations we analyze are

orthogonal to the fundamentals of the decision maker’s wellbeing and standard theory

suggests they should have no effect. We perform an experiment in a sports bar on the

Upper East Side of Manhattan while subjects watch an NFL football game. During

numerous commercial breaks, we monitor subjects’ happiness and ask them to perform a

set of standard experimental tasks involving charitable giving, risk taking, trust, and

willingness to pay. We find that the events of the game not only affect the mood of our

subjects but that these changes in mood lead to predictable changes in decisions. Our

experiment introduces a new method for inducing a dynamic mood sequence and

provides a model that can explain why changes in short-term emotions influence

economic decisions.

I. Introduction

Every day we face myriad opportunities to buy things, be generous, take risks,

and trust others. Between making these decisions, we face the outcomes of numerous

unrelated events: whether it is a sunny, whether the barista making our coffee is friendly,

whether the episode of TV that we are watching has an entertaining ending, or whether

our favorite sports team wins a game. While these events no doubt make us happy for a

short while, we know that they are orthogonal to the fundamentals of our wellbeing and

should not affect our decisions. Indeed, if such emotions were to systematically affect the

choices we make, we might want to be conscious of this relationship to avoid taking

actions we would later regret. Those who might potentially profit from our behavior

would also want to understand the relationship between our emotions and our choices.

Despite a rich literature in Psychology, Neuroscience,1 and Economics showing

that emotions affect decisions including: trust and trustworthiness (see, e.g., Capra

[2004]; Dunn and Schweitzer [2005]; Kirchsteiger, Rigotti, and Rustichini [2006]; Myers

and Tingley [2011]); risk (see, e.g., Johnson and Tversky [1983]; Nygren et al. [1996];

Lerner and Keltner [2000], [2001]; Loewenstein, Weber, Hsee, and Welch [2001]);

willingness to pay (see, e.g., Lerner, Small, and Loewenstein [2004]); and helping

behavior (see, e.g., Aderman [1972]; Isen and Levin [1973]; Rosenhan, Underwood and

Moore [1974]; Konow and Earley [2008]), and despite the urging of prominent

researchers to integrate emotions into economic models of decision-making (see, e.g., Jon

1

For the Neuroscience literature, see, e.g., LeDoux (1996), Lempert and Phelps (2013), and

Bechara et al. (1997).

Elster [1998] and George Loewenstein [2000]), Economics has generally ignored the role

of emotions on behavior.2

To the extent that Economic theory has considered emotions, it has tended to do

so in the framework of Psychological Game Theory — making specific emotions, like

guilt, a byproduct of beliefs or unfilled expectations (see, e.g., Charness and Dufwenberg

[2006], Battigalli and Dufwenberg [2007]; see Caplin and Leahy [2001] for a treatment

where the goods people contemplate have an emotional component). Other, more applied

papers introduce emotions into the calculus of decision making but do not provide an

associated model to explain this (see, e.g., Loewenstein and Ariely [2005] on willingness

to engage in risky sexual activity in response to sexual arousal; Edmans, Garcia, and

Norli [2007] on stock markets dips in response to a country’s elimination from the world

cup; Card and Dahl [2011] on spikes in domestic violence when a city’s football team

suffers a surprise loss).3

In this paper, we introduce a new experimental paradigm for investigating the

impact of fluctuations in one important emotion, happiness (i.e. a positive mood), on

behavior. Our design allows us to leverage naturally occurring short-term variations in

2

There is, of course, a now well established literature on the relationship between happiness and

utility (see, e.g., Kahneman et al. [2004]; Frey, Luechinger, and Stutzer [2008]; and the paper by

Kimball and Willis [2006], which presents a model describing the relationship between these two

concepts.). There is also a rich literature that looks at happiness as an outcome measure following

Bentham (1789). Much of this research focuses on how subjective well-being has changed over

time (see, e.g., Stevenson and Wolfers [2008] and Sacks, Stevenson, and Wolfers [2010], [2012]).

More recent work has found that individuals do not choose the things that maximize suggestive

well-being, identifying systematic wedges between suggestive-well being and utility (see, e.g.,

Benjamin et al. [2012], [2014]), and identifying an alternative way of measuring subjective wellbeing that could serve as a better proxy for utility (see, e.g., Benjamin et al. [2014]). While we

differ from this important research — we treat happiness as an input into the utility function

rather than a measure of its level — our findings complement the work by revealing another

rationale for measuring happiness, namely it can have a direct effect on economic decisionmaking.

3

While Card and Dahl (2011) do provide some theoretical structure in their paper, their model

tailored to fit the situation they are trying to describe.

happiness from exogenous events — orthogonal to the fundamentals of well being —

while holding all other aspects of the subjects’ lives constant.4 In particular, we leverage

the short-term fluctuations in happiness induced when subjects watch an NFL football

game. During commercial breaks of the game they are watching, we repeatedly measure

each subject’s mood and present the subject with a set of decision tasks.5

As will be described in detail in the following sections, watching the game

generated variation in self-reported happiness for the vast majority (81%) of subjects.

Swings in happiness were not random; events in the game lead to predicable responses in

happiness.6 For example, we observe a significant increase in happiness when a subject’s

favored team scores a touchdown, an even larger decrease in happiness when the

opposing team does so, a smaller increase when a favored team kicks a field goal and no

significant effect on happiness when the opposing team kicks a field goal.7

We find that changes in happiness affect the behavior of our subjects in each of

the four tasks presented to them: willingness to pay for consumer goods, risk taking,

willingness to donate money, and trust or trustworthiness. In addition, we find that all

effects are in the “same direction,” such that people are more willing to give up money

4

This method ensures we avoid changes in happiness that might come from more substantial

changes in economic or other conditions (e.g. performance at work, stock market returns, new

romantic relationships) that might have direct effects on economic decisions unrelated to mood.

5

In particular, to measure mood we ask: “How do you feel right now?” on a 7-point Likert scale

with answers ranging from: (1) “very unhappy” to (7) “very happy”. As will be described in the

experimental design section, we also ask subjects other questions about the game as controls to

ensure the changes in behavior we see result from changes in happiness (rather than from changes

in these other things about the game).

6

We log events of each game, which allows us to investigate how events that took place since

last subject data entry (e.g., whether there was a touchdown, field goal, etc.) affect subject

happiness.

7

This substantial variation in happiness arises despite the fact that subjects were not watching

games that involved their local team (subjects came from a New York City subject pool and

neither the New York Jets nor the New York Giants played in either of the games subjects

watched). Our results would presumably be stronger if subjects were more engaged in the game.

(including paying more for a consumer good, giving more to charity, and being

trustworthy) and take risks (including buying a lottery and trusting others) when they are

relatively happier. We present a simple model of decision-making under the influence of

emotions that puts mood into the utility function and can rationalize all our results about

how happiness affects decision with a very simple assumption that can be interpreted

simply as: being happy makes you feel richer.8

Our experimental design differs significantly from designs used by others. In a

typical experiment investigating the relationship of emotions to decision making, the

experimenter induces one or two emotions (e.g. happiness and sadness) at one point in

time by either: (a) showing a subject a happy or sad movie clip (see, e.g., Kirchsteiger,

Rigotti, and Rustichini [2006]; Zarghamee and Ifcher [2011]) or (b) having them

recollect in writing a sad or happy event in their life using the Autobiographical

Emotional Memory Task (see, e.g., Strack, Schwarz, and Gschneidinger [1985]; Myers

and Tingely [2011]). After subjects are primed with these emotions, they engage in a

decision task and the behavior of those primed with different emotions is compared.

Our design differs from these previous studies in several important ways. First,

we do not induce emotions per se but rather ask our subjects to watch a sporting event in

a natural setting and allow the events of the game to alter their emotional state. Second,

and perhaps more importantly, our design is dynamic in the sense that we do not induce

an emotion at one point in time and then measure the impact of that primed emotion on

behavior. Rather, we allow our subjects to take an emotional journey over a three-hour

8

Formally, the key assumption is that the cross partial of utility with respect to wealth and

happiness is negative, that is the marginal utility of money is lower when someone is happier.

This is equivalent to happiness making individuals feel richer. Some results additionally require

an additional assumption on the form of the marginal utility with respect to mood.

timespan — of the kind they might experience during many naturally occurring events of

their life — and track how changing emotions affect their decision behavior. 9 Since

during the game the fundamentals of a subject’s wellbeing are not changing, we can

impute the changes in their decisions to the impact of the game on their happiness.10

This paper proceeds as follows. In Section II we present our experimental design.

In Section III we present our results. Since our results indicate that emotions have a

predictable impact on decision-making, in Section IV we offer a model of decision

making under the influence of emotions that puts mood into the utility function and can

rationalize our results. In Section V we offer some conclusions.

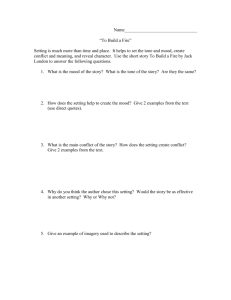

II. Experimental Design

The experiment involved two experimental sessions at two sports bars in the

Upper East Side neighborhood of New York City. Subjects were recruited from an NBC

Sports subject pool consisting of people who had volunteered in the past to take part in

focus groups.11 Recruitment information informed potential subjects that in the study they

would watch an NFL game in a sports bar, be given $15 to subsidize their food

consumption, be guaranteed $30 for showing up, and have the chance of earning more

money during the experiment depending on the decisions they made.

9

Put another way, our experiment generates a time series of self-reported happiness and

associated decisions rather than a response to an emotion at a signal point in time.

10

We are not the only researchers to recognize that sports can be a useful way to vary emotions of

sports fans. A paper by Lambsdorff, Giamattei, Werner, and Schubert (2015) uses soccer as an

emotional prime. However, their set up is quite different from ours on a number of

dimensions, the most prominent difference is that subjects only make one decision and do so

before the game begins.

11

The project was funded by NBC Sports as part of a larger program investigating the impact of

sports viewing on decision-making.

Since subjects were invited to a sports bar they had to be at least 21 years old to

participate in the study. Consequently, our subjects are demographically distinct from the

university undergraduates traditionally used in laboratory experiments. In addition to

being older, our sample is almost all working rather than in school (49 out of 64 subjects

reported having full-time employment while only 1 out of 64 was a student) and our

sample has relatively high earnings (48 out of 64 subjects reported earning $50,000 or

more). The average age of subjects was 41 years old and 51 of 64 had completed at least

a Bachelor’s degree with 30% having an advanced degree. Table 1 reports the

demographics of our subject population.

Table 1: Subject Demographics

Demographics

Mean (SD)

Number of Subjects

64

Female

38%

Age

41.0(12.1)

Education

PhD

2%

Masters Degree

28%

Bachelors Degree

50%

Some College

19%

High School

2%

Employment

Full time employed

77%

Part time employed

17%

Student

2%

Unemployed

5%

Income

Income over $100,000

33%

Income $50,000 to $99,999

42%

Income $25,000 to $49,999

19%

Income less than $25,000

6%

Notes: Table 1 reports the percentage of the subjects

who reported being in each demographic category.

Means (with standard deviations in parentheses) are

reported for continuous variables.

Subjects arrived one hour before the game started and were instructed about the

content of the experiment. It was explained that they would engage in four incentivized

decision-making tasks and answer four un-incentivized questions at the start of the game

and at a number of commercial breaks during the broadcast. On average, subjects entered

data (i.e., made decisions and answered questions) 15 times over the course of the study.

Subjects were told that at the end of the experiment, the computer would randomly pick

one of the decision tasks and one of the entry times and their decision in that task and

entry time would determine payoffs.

II.A. Demographic Questionnaire

Before the game, we recorded demographic information about our subjects by

asking them their work status, education, gender, age, and income, the results of which

are reported in Table 1. In addition, they were asked their feelings about watching sports,

football, and the particular game they were about to watch (see the full list of questions in

Appendix A). The subjects were also asked to choose among a set of charities to which

they might donate and a set of consumer goods that they might buy during the experiment

(as will be described in the following subsections).

II.B. Four Decision Tasks and Emotion Question

In the following subsections we describe the four decision tasks that subjects

faced as well as the un-incentivized questions we had them answer. Each time subjects

provided data in the experiment, these tasks and questions were displayed in the order

described below.

II.B.1 Charitable Giving

In the charitable giving task, subjects were told they had the opportunity to donate

money to a charity. At the start of the experiment, they were asked to choose a favorite

charity from a set of three: (a) United Way, (b) American Cancer Society, and (c) World

Wildlife Fund. Each time subjects entered data, they were asked how much of a $40

endowment they wanted to donate to the charity they had chosen at the start of the

experiment (see Instructions in Appendix B). If this task was chosen for payment at the

end of the experiment, any money not donated was given to the subject. Subjects were

explicitly told that any money donated would actually be given to the charity they

selected.12

II.B.2 Willingness to Pay for Consumer Good

In the willingness to pay task, subjects had a $40 endowment that they could use

to buy a consumer good. At the start of the experiment, subjects had the option to choose

a good from a set of three options: (a) a wool hat (they could choose between a men’s or

women’s hat), (b) Sony headphones, or (c) a “Chromecast”, Google hardware for

streaming video. Each of these goods had a retail price of $30 to $40. Each time subjects

entered data, they were asked how much out of their $40 endowment for this task they

were willing to pay for the good they had selected. We used the Becker-DeGrootSubjects were told verbally: “You can be 100% confident that the money will be donated.”

Donations were made after both sessions of the study were run.

12

Marschak mechanism (BDM) to elicit their willingness to pay. The mechanism was

explained to subjects and they were explicitly told it was in their best interest to report the

highest amount of money they would be willing to pay for the good but not more (see

Instructions in Appendix B). If this task was chosen to be payoff-relevant for a subject,

the BDM mechanism was employed. A price was randomly selected and the subject

either kept the $40 endowment (if the randomly determined price was above the stated

willingness to pay) or bought the good at the randomly selected price (if the price was

below the stated willingness to pay).

II.B.3 Willingness to Pay for a Risky Gamble

This decision task was nearly identical to the consumer good task except that

subjects were asked about willingness to pay for a lottery ticket that offered a 50%

chance of receiving $40 and a 50% chance of receiving $0. Again, each time subjects

entered data, they were asked how much out of their $40 endowment for this task they

were willing to pay for the good using the BDM mechanism (see Instructions in

Appendix B). If the subject ended up buying the lottery ticked at the BDM determined

price, that price was subtracted from their $40 endowment and the risky lottery was

realized (they either received an extra $40 or $0). If they did not buy the lottery ticket,

they kept their $40 endowment.

II.B.4 Trust Game

The final task was a discretized trust game. In this game, each subject interacted

anonymously with another subject in the session. Subjects were randomly assigned to be

either a sender (“Player A” in the instructions) or a receiver (“Player B” in the

instructions). Subjects were told that the sender started with $32 and the receiver started

with $0. The sender could choose to send $0, $8, $16, $24, or $32 of his $32 to the

receiver. The receiver would get three times the amount of money transferred by the

sender and have the opportunity to transfer money back — from $0 up to the total amount

received from the sender’s transfer. This money was returned one-for-one to the sender

without being multiplied.

Each sender was asked to choose one amount ($0, $8, $16, $24, or $32) to send to

the receiver. Each receiver was asked to choose one amount to return for each of the

possible amounts they might get from the sender using the strategy method. In particular,

all receivers were asked how much they wanted to return to the sender if they got $24, if

they got $48, if they got $72, and if they got $96 (see Instructions in Appendix B). No

feedback was given during the experiment, but subjects were told that if this decision

problem was chosen for cash payment, the game would be played out and payoffs

determined accordingly.

II.B.5 Questionnaire

After subjects engaged in each of the four decision tasks, they made self-reports

about their current emotional state and their reaction to the recent events in the game.

Subjects were asked to report (on a scale from 1 to 7) answers to the following four

questions, in the following order:

1. How surprised are you about the recent events in the game, i.e. events since the

last commercial break entry? (7-point Likert scale where 1 is “not at all,” 3 is

“somewhat,” 5 is “a lot,” and 7 is “incredibly.”).

2. How exciting do you find the game you are watching? (7-point Likert scale

where 1 is “not at all,” 3 is “somewhat,” 5 is “a lot,” and 7 is “incredibly.”).

3. How do you feel right now? (7-point Likert scale where 1 is “very unhappy,” 2

is “unhappy,” 3 is “somewhat unhappy,” 4 is “neither happy nor unhappy,” 5 is

“somewhat happy,” 6 is “happy,” and 7 is “very happy.”).

4. What do you think the chances are that the team you said you were rooting for

will win? (Scale from 0 to 100 where 0 is “definitely won’t win” and 100 is “definitely

will win.”)

We were primarily interested in how being in a good mood would affect the

decision tasks noted above and so we were most concerned with the answer to question 3

about happiness. However, we wanted to make sure we could control for other features of

the game that might affect choices in the decision tasks — and might be correlated with

self-reported happiness — but not work through an effect on mood. To address this issue,

we asked about excitement and surprise, which we thought might be affected by events in

the game and could potentially serve as controls for other things about the game that

might influence decisions without working through an effect on happiness.

II.C. Comments on our experimental design

A few things about our experimental design are worth noting. First, doing

experiments in sports bars is not common. In a field setting like a sports bar, you may not

be able to maintain the same control over the environment that you typically have in the

lab.13 One particularly important element of the lack of control in a sports bar is alcohol.

Subjects in our experiment were each given a voucher worth $15 for food but had to buy

their own drinks if they wished. While some subjects did drink, our observation was that

alcohol consumption was relatively light (e.g. no one became obviously intoxicated

during the study). While alcohol consumption has been known to influence choice (see

Burghart, Glimcher, and Lazzaro [2013] on how alcohol affects the ability to satisfy

GARP), we had no indication that it was a major factor in the behavior of subjects and, as

will be discussed below, in all our results we control for how many entries the subject has

made, suggesting that an increase in alcohol consumption over the course of the evening

is not driving results.

Second, since subjects were recruited from a pool maintained by NBC Sports, the

experiment did not select a random sample of the population but was skewed toward

sports fans. This feature of the design serves our purpose well as we are interested in

using the random variation of events in the games to generate swings in mood, and this is

more likely to be successful with sports fans. This also heightens the realism of our

paradigm since people who dislike sports are unlikely to watch sports on a regular basis.

13

In Session 1, we ran our experiment on a floor of the sports bar designated for our study. In

Session 2, conducted in a different sports bar, we had the entire back end of the bar, which was

isolated from the rest of the bar. While in both sessions we ensured that all screens subjects could

see were showing our game, other patrons cheering for other games in other parts of the bars

could have theoretically distracted subjects. In addition, subjects completed the experiment on

web-based software (written specifically for this experiment) that was accessible on tablets that

could be used from anywhere in the bar. This had the advantage of allowing subjects to sit

wherever they wanted in our designated sections and watch the football game as they would have

otherwise; however, we did not force subjects to stay seated, so they could leave the bar to smoke

or to go to the bathroom and thus miss an opportunity to enter data.

Third, while subjects were incentivized in the decision tasks they performed, they

were not incentivized for their responses to our questionnaire about emotions or beliefs.

We know of no scheme that truthfully elicits people’s emotions, and self-reports of

emotions have been successfully used in Economics (see, e.g., van Winden [2007]) and

in Psychology (e.g. the many papers cited above).14

Fourth, as stated above, our design uses a naturally occurring event, an NFL

football game, to induce a dynamic path of emotions rather than inducing one static

emotion at one point in time. This introduces realism into the experiment insofar as it

generates the kind of common swings in emotions people experience on a day-to-day

basis and it allows us to view the same person as the mood fluctuates reported as it is

likely to do outside the lab.

III. Results

On average, subjects enter data — that is, complete the four decision tasks and

report their mood — 14.77 times during the study.15 Importantly for our study, the vast

majority of subjects display variation in their emotional state over the course of the game.

Table 2 reports the percentage of subjects who change their emotional state and change

their decision task choices at least once during the course of the game.

14

Of course, one could try to measure subjects' emotional states using some type of physical

measurement like fMRI or skin conductance, but it is not clear to us that those measures are

reliable enough and such tests are obviously hard to administer in a sports bar.

15

The minimum number of entries was 10 and the maximum was 18. Not every subject

completed entered data every time it was requested. Subjects may have been otherwise occupied

(e.g. eating or in the restroom) when asked to enter data. In addition, subjects were technically

able to enter data at times other than when we asked them to do so. Nevertheless 55% of subjects

submitted exactly 15 reports, and 89% of subjects submitted either 14, 15, or 16 reports.

A total of 52 of the 64 subjects (81%) changed their answer to the happiness

question: “How do you feel right now?” at least once in the study. It is reassuring to see

this variation in reported mood, since such variation is necessary for us to evaluate how

emotional changes affect economic decision-making. In addition, as we will show below,

this variation in emotions is not random. Instead, it predictably responds to the events of

the game. Events that constitute good news for a subject’s preferred team on average

make that subject happier. Consequently, when we investigate how changes in reported

emotions correlate with changes in economic decisions, we can be confident that we are

leveraging variations in emotions induced by exogenous events in the game.

We also observe variation in the economic decisions subjects made over the

course of the game. In particular, 30 of the 64 subjects (47%) change the amount they

choose to donate; 36 of the 64 subjects (56%) change the maximum amount they are

willing to pay for a good they selected at the start of the experiment, and the same

number, 36 of the 64 subjects (56%), change the maximum amount they are willing to

pay for a lottery ticket that pays out $40 with 50% probability. In total, 89% of subjects

display variation in at least one decision task. That there is variation in these economic

decisions allows us to investigate the cause of this variation and whether changes in

happiness correlate with these changes in behavior.

Table 2: Variation in Questions and Decisions

% of subjects who

Question or Decision

show variation

Happiness

81%

Surprise

95%

Excitation

95%

Donation to charity

47%

Willingness to pay for good

56%

Willingness to pay for gamble

56%

Transfer to trustee (out of 32 subjects)

50%

Return/transfer by trustee to any (out of 32 subjects)

78%

Return/transfer by trustee to 24 (out of 32 subjects)

44%

Return/transfer by trustee to 48 (out of 32 subjects)

44%

Return/transfer by trustee to 72 (out of 32 subjects)

63%

Return/transfer by trustee to 96 (out of 32 subjects)

72%

Variation in at least one decision task

89%

III.A. What determines mood?

In this subsection, we investigate the mood that subjects report and show that it

responds predictably to events in the game. At the start of each session, we asked subjects

which of the two teams playing in the game they favored. 29 out of the 30 subjects

watching the December 29, 2013 game between the Philadelphia Eagles and the Dallas

Cowboys reported that they favored either the Eagles or the Cowboys, and 32 out of the

34 subjects watching the January 4, 2014 game between the Philadelphia Eagles and the

New Orleans Saints reported that they favored either the Eagles or the Saints.16

For these 61 subjects, we can code scores in the game — i.e. touchdowns and

field goals — as either being a touchdown for their favored team, a touchdown for their

disfavored team, a field goal for their favored team, or a field goal for their disfavored

16

Subjects could refuse to answer the question by selecting a team that was not playing that day

to be their favored team for that game. In the December 29, 2013 game between the Philadelphia

Eagles and the Dallas Cowboys, 17 subjects favored the Eagles and 12 subjects favored the

Cowboys. In the January 4, 2014 game between the Philadelphia Eagles and the New Orleans

Saints, 13 subjects favored the Eagles and 19 favored the Saints.

team.17 We asked subjects to report their emotions in the commercial break that followed

each score, so we can compare how responses to the emotions questions change over the

course of game, comparing how emotions respond when no score occurs to when subjects

experience one of the four outcomes listed above. Note that when a score occurs, it will

be coded as a score for the favored team for some subjects and a score for the disfavored

team for other subjects, depending on which team they prefer. In the results that follow,

we restrict the effect of the score for a favored team to be the same, regardless of the

team the subject favors.

Table 3 reports regression results displaying how happiness changes as a result of

scores in the game. Looking at regression (1), we see that subjects asked how they feel

immediately following a favored team scoring a touchdown report being happier than

they are on average throughout the game. The same pattern arises for a favored team field

goal, although the coefficients are smaller in magnitude, suggesting a directionally

smaller effect of a field goal on mood. The effect of a disfavored team touchdown leads

to a decrease in happiness and there is no significant effect associated with a disfavored

team field goal.

Regression (2) additionally controls for a subject’s self-reported probability that

their favored team will win the game, elicited at the same time as the happiness measure.

Comparing regressions (1) and (2) we see that controlling for the probability that the

favored team wins the game shrinks the magnitude of the coefficients associated with the

scores, suggesting that at least some of the effect on happiness associated with the scores

is driven by scores leading to a change in their subjective probability that the favored

17

No safeties were scored in either of the games in our experiment. In addition, in this analysis

we ignore points scored post touchdown. Since fumbles and interceptions were very rare events

in the games our subjects watched, our results on them are inconclusive.

team will win the game which also affects happiness. Nevertheless, an effect of the scores

on happiness persists even excluding the effect that works through the change in belief

that the favored team will win.18

Table 3: How Mood Responds to Events in the Game

Self-Reported Happiness (0-6)

(1)

(2)

Favored Team TD

0.34

0.25

(0.081)***

(0.074)***

Favored Team FG

0.26

0.14

(0.081)***

(0.077)*

Disfavored Team TD

-0.33

-0.24

(0.12)**

(0.11)**

Disfavored Team FG

-0.027

0.067

(0.10)

(0.091)

Prob. favored wins (0-100)

0.017

(0.0035)***

Constant

3.92

2.79

(0.027)***

(0.22)***

Subjects

61

61

Obs.

912

912

R-Squared

0.667

0.698

Notes: Table 3 shows the effect of scores in the game on selfreported happiness elicited in a Likert-scale measured on a 0 to

6 scale. The regressions control for average happiness of each

subject and cluster the coefficients by subject. Significance

denoted as * p < 0.1, ** p < 0.05, *** p < 0.01.

The same scores that generate fluctuations in subject happiness also increase selfreported excitement and surprise (see Table A1 in the Appendix).19 This suggests that to

isolate the effect of happiness on economic decisions may require controlling for surprise

and excitement that are correlated with happiness (see Table A2 in the Appendix).

18

As might be expected, subjects with an above median interest in sports in general and in

football in particular had directionally bigger swings in emotion resulting from scores.

19

As might be expected, the relationship between scores and excitement and surprise do not

appear to be mitigated by controlling for the probability the favored team will win the game.

In total, the pattern of results suggests that happiness responds predictably to

events in the game, suggesting that the observed emotional swings are not random but

rather result from subjects’ experiences watching the game. We now turn to investigating

how such swings in happiness affect decision-making.

III.B. How mood affects decision making

Subjects’ self-reported happiness strongly predicts observed variation in subjects’

choices in the experiment. Tables 4 and 5 show results for the economic decisions for all

subjects during the experiment. Regressions include subject fixed effects and control for

the number of times the subject had previously entered data. The even numbered

regressions additionally control for self-reported excitement and self-reported surprise,

which are correlated with happiness and might have independent effects on the economic

decisions. Including these additional controls does not affect the relationship between

happiness and the decisions.

Table 4 reports on each of the decision tasks independently. Charitable giving,

willingness to pay for the consumer good, willingness to pay for the lottery (a measure of

risk aversion), and transfer in the trust game all statistically significantly increase (at

p<0.1 or p<0.05) with happiness. The charitable donation, willingness to pay for the

good, and willingness to pay for the lottery each increase by between $0.46 and $0.56 per

point of happiness on the 7-point scale, with only slight variation across task and

specification. The amount transferred by senders in the trust game increases by about $1

out of a potential $32 for each point of happiness on the 7-point scale. Percent of transfer

returned is the percentage of the amount that a receiver gets from the sender that is

returned. This amount also directionally increases with happiness, but the relationship is

not statistically significant.

Since all the response in Table 4 are in the “same direction”, Table 5 collapses

data across all economic decisions. Regressions (1) and (2) combine the three decision

tasks in which subjects choose a gift or willingness to pay out of a $40 endowment. On

average, a one-point increase on the happiness scale increases the amount given or the

willingness to pay by just over $0.50. Regressions (3) and (4) combine all choices in the

experiment — including the trust game choices — by representing each decision as a

percentage of the action space the subject is willing to give, pay, transfer, or return (i.e.

the percentage of the $40 endowment in the first three games, the percentage of the $32

for the senders, and the percentage of the amount the receiver gets for the receivers). This

percent of action space increases by 1.31 to 1.39 percentage points per point on the

happiness Likert-scale.

Table 4: How Each Choice Responds to Emotional State

Happiness (0-6)

Constant

Charity

WTP for Good

WTP for Lottery

Transfer

Percent of Transfer

($ out of 40)

($ out of 40)

($ out of 40)

(0, 8, 16, 24, or 32)

Returned

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

0.55

0.46

0.48

0.56

0.53

0.51

1.12

0.81

1.24

1.06

(0.28)*

(0.27)*

(0.21)** (0.21)*** (0.29)*

(0.27)*

(0.50)** (0.35)**

(0.94)

(0.87)

15.7

15.3

18.1

18.5

15.6

15.4

15.7

14.8

29.9

25.8

(1.08)*** (1.65)*** (0.78)*** (1.21)*** (1.71)*** (2.19)*** (2.43)*** (2.54)*** (5.22)*** (7.12)***

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Time Controls

Additional

Controls

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

Subjects

64

64

64

64

64

64

32

32

32

32

Observations

949

949

949

949

949

949

463

463

1,872

1,872

R-squared

0.938

0.940

0.945

0.946

0.873

0.878

0.886

0.893

0.749

0.755

Notes: Table 4 shows regressions of the incentive-compatible economic decisions of how much to donate to a charity (chosen by the

subject at the start of the experiment, either: the United Way, the American Cancer Society, or the World Wildlife Fund); willingness

to pay (WTP) for a good (chosen by the subject at the start of the experiment, either: a wool hat, a pair of headphones, or a video

streaming device); willingness to pay (WTP) for a lottery that is a 50% chance of winning $40; how much to transfer in a trust game;

and how much to transfer back out of what was sent on self-reported happiness. Time Controls include non-parametric controls for

how many commercial break entries the subject has made interacted with session. Additional Controls are non-parametric controls for

self-reported measures of excitement and surprise interacted with session. Happiness, excitement and surprise were each elicited with

a Likert-scale on a 0 to 6 scale. The regressions control for the average of the dependent variable of each subject and cluster the

coefficients by subject. Significance denoted as * p < 0.1, ** p < 0.05, *** p < 0.01.

Table 5: How Choices Respond to Emotional State

All excluding trust game

All choices

($ out of 40)

(% of action space)

(1)

(2)

(3)

(4)

Happiness (0-6)

0.52

0.51

1.39

1.31

(0.19)***

(0.17)***

(0.59)**

(0.55)**

Constant

16.5

16.4

38.6

36.2

(0.85)***

(1.23)***

(2.98)***

(4.27)***

Time Controls

Yes

Yes

Yes

Yes

Additional Controls

No

Yes

No

Yes

Subjects

64

64

64

64

Observations

2,847

2,847

5,182

5,182

R-squared

0.489

0.490

0.413

0.415

Notes: Table 5 shows regressions of the incentive-compatible economic decisions in the

experiment. Time Controls include non-parametric controls for how many commercial

break entries the subject has made interacted with session. Additional Controls are nonparametric controls for self-reported measures of excitement and surprise interacted with

session. Happiness, excitement and surprise were each elicited with a Likert-scale on a 0

to 6 scale. The regressions control for the average of the dependent variable of each

subject and cluster the coefficients by subject. Significance denoted as * p < 0.1, ** p <

0.05, *** p < 0.01.

Our results are surprising. It is curious that people’s moods are so malleable that

they can change repeatedly over a period of a few hours merely by watching a football

game. What’s more puzzling, however, is that such changes in mood brought upon by

objectively frivolous events are capable of altering the economic decisions that

individuals make. These results have a variety of important implications.

First, our results offer insights into the $518 billion a year advertising market

(Zenith Optimedia [2014]). Advertisers who pay for television airtime should be aware of

the relationship between events in a broadcast and their impact on mood and decisions,

since the relationship might suggest a more sophisticated advertising policy that

conditions advertisements based on the expected mood of viewers. For example, in the

context of football games, if a touchdown makes fans rooting for the scoring team

happier, and thus, for example, temporarily more risk seeking, advertisements for the

state lottery or a Las Vegas vacation may be relatively more effective. On the other hand,

the fans of the scored-upon team who are temporarily more risk averse might be more

responsive to an advertisement for car insurance. Given that most sporting events feature

teams from different cities — and thus different media markets — our results might

suggest advertising different goods in these different cities depending in the events of the

game. Even more targeted opportunities exist in new media where advertisers can

potentially target advertisements to specific content — that they believe to induce good

or bad moods — to take advantage of the relationship between mood and generosity,

trust, risk, and willingness to pay.

Our results similarly open the door for advertisers to manipulate mood themselves

in an effort to sell products. Advertisements the emphasize happiness (like those for

Coca-Cola or McDonald’s) may be aimed at — among other things — manipulating

mood in an effort to sell goods that some consumers might otherwise not buy. In other

words, advertisers need not wait for external content (e.g. the events of a sporting event,

news article, or television show) to alter mood in order to leverage this relationship

between mood and decision-making; they might instead induce the mood themselves.

Finally, our results speak to economic theory in general and discrete choice theory

in particular. In the next section, we propose a specific way for utility theory to

incorporate mood, but our results suggest that mood may already play a roll in the error

terms of existing models. In the theory of discrete choice, it is assumed that when a

decision maker chooses between several discrete objects, her utility for any object is

affected by a random utility shock drawn from a particular distribution (e.g. an Extreme

Value Type I distribution). However, the source of these shocks is rarely discussed. Our

results suggest that one source for these shocks is the mood that the decision maker

happens to be in at the precise time the decision needs to be made. Since in our daily

lives we are bombarded by exogenous events that constantly change our mood, it may not

be surprising if these utility shocks were in some way related to these shocks to our

happiness.

IV. A Model of Mood and Decision Making

In this section, we develop a simple utility model of mood and decision-making

that can rationalize the results described in the previous section and can serve as a

framework for thinking about how mood might affect economic behavior more

generally.20

In standard economic theory, utility is typically a function of material payoff.

However, in recent years scholars have extended this construct to include such factors as

the payoff of others (see, e.g., Fehr and Schmidt [1999]; Bolton and Ockenfels [2000]),

beliefs (see, e.g., Geanakopolos, Pearce and Stacchetti [1989]; Rabin [1993];

Brunnermeier and Parker [2005]), and other factors. But utility may also be a function of

the mood one is in when making a decision. Such a link has been described by

20

There is an interesting relationship between what we present here and the model of Kimball

and Willis (206) where it is assumed that happiness and utility are included in a model of lifecycle utility maximization. Happiness, in that framework, is considered as a shock to lifetime or

long-run utility. What is interesting in our paper is that we see an effect of short-term happiness

on decisions and the short-term happiness is induced by events that have absolutely no effect on

lifetime satisfaction. Hence, we find that happiness can affect behavior even when it is well

known that it has no impact of long-term outcomes.

Loewenstein (2000), which posits that one can model such dependency in a statedependent framework.

Here we propose a model of mood-dependent decision-making that allows us to

give some theoretical insights into the decisions made by our subjects. The model we

propose is flexible enough to explain our data yet structured enough to provide an

explanation of how mood can influence a decision maker’s choice in a variety of settings.

To start, we need to distinguish two types of situations where mood may be

relevant: one-person decisions and multi-person interactions. In both situations, we model

mood as an exogenous parameter that, in the case of our experiment, is affected by the

events in the game being watched and not by their choices in the decision tasks. In other

words, the act of stating that they will give money to a charity or pay a certain amount for

a good does not change subjects’ mood during the experiment over and above the

exogenous mood induced by watching the game.21

In the case of a one-person decision task, we propose a simple utility function

where utility is a function of exogenous mood and material payoff as follows:

𝑢𝑖 (𝜎𝑖 , 𝜋𝑖 )

(1)

where 𝜎𝑖 , is the exogenous mood (determined by the events of the game) and 𝜋𝑖 is the

material payoff of person 𝑖.

In the case of a two-person interaction between 𝑖 and 𝑗, we posit the following

utility function:

21

Note that the assumption that mood does not depend on choices in the experiment does not

mean that a subject is not made happier by a purchase or that a subject does not receive a “warm

glow” utility from helping others. It simply means that helping others does not alter his mood. We

think this is realistic given that the decisions subjects are making will not be implemented until

the end of the experiment and so are unlikely to affect happiness during the experiment. Put

succinctly, we look at decision making conditional on mood where the mood is determined

exogenously.

𝑈𝑖 (𝜎, 𝜋𝑖 , 𝜋𝑗 ) = 𝛽𝑖 𝑢𝑗 (𝜎𝑗 , 𝜋𝑗 ) + 𝑢𝑖 (𝜎𝑖 , 𝜋𝑖 )

(2)

where 𝜎𝑖 is again the decision maker’s exogenous mood and 𝜎𝑗 is the exogenous mood of

person 𝑗, with whom person 𝑖 is interacting, 𝛽𝑖 is the weight given by person 𝑖 to 𝑗's

utility. 𝜋𝑗 is the material payoff of person 𝑗.

While a decision maker 𝑖 can be assumed to know his own mood at any time, he

may only know the distribution from which the mood of 𝑗 is drawn, so we can write the

utility function as:

𝑈𝑖 (𝜎, 𝜋𝑖 , 𝜋𝑗 ) = ∫ [𝛽𝑖 𝑢𝑗 (𝜎𝑗 , 𝜋𝑗 ) + 𝑢𝑖 (𝜎𝑖 , 𝜋𝑖 )]𝑑𝜇(𝜎𝑗 )

𝑗

In order to simplify the notation, we define 𝑢1 =

𝜕𝑢𝑖 (𝜎𝑖 ,𝜋𝑖 )

𝜕𝑢𝑖 (𝜎𝑖 ,𝜋𝑖 )

𝜕𝜎𝑖

𝜕𝜋𝑖

, 𝑢2 =

, and 𝑢12 =

𝜕2 𝑢𝑖 (𝜎𝑖 ,𝜋𝑖 )

𝜕𝜎𝑖 𝜕𝜋𝑖

.

IV.A. Charitable Giving

In our experiment, the charitable giving task is framed as a Dictator game in

which subjects transfer money to a charity they select at the start of the session. In the

data, we observe that an increase in happiness leads to an increase in charitable giving. In

order to model this, we consider a model with some “warm glow” utility from giving

money to charity. In the experiment, a subject was given an endowment of 𝑤 ($40 in the

experiment) from which he could donate 𝑐 ≤ 𝑤 to charity and keep 𝑤 − 𝑐 for himself.

Since the subject’s choice has an externality on the charity we use (3) to represent the

subject’s utility function.

𝑈𝑖 (𝜎, 𝜋𝑖 , 𝜋𝑗 ) = ∫ [𝛽𝑖 𝑢𝑗 (𝜎𝑗 , 𝑐) + 𝑢𝑖 (𝜎𝑖 , 𝑤 − 𝑐)]𝑑𝜇(𝜎𝑗 )

𝑗

Note that we are modeling the recipient of money, person 𝑗 , with the utility

function 𝑢𝑗 (𝜎𝑗 , 𝑐). Since the recipient of the transfer in this case is a charity, however,

this implies that the charity has a mood. We prefer, instead to think of the recipient as the

person to whom the charity makes a transfer. Hence, the charity is merely a conduit for

giving to others. (As will be shown below, as long as 𝛽𝑖 𝑢𝑗 (𝜎𝑗 , 𝑐) does not change with the

mood of subject 𝑖, the results are independent of any assumption about its structure.)

The dictator’s utility is a linear combination of his own “direct” utility, 𝑢𝑖 (𝜎𝑖 , 𝑤 −

𝑐) , and the recipient’s utility, 𝑢𝑗 (𝜎𝑗 , 𝑐) . We want to look at how giving changes

systematically with mood. To start, we assume 𝑢12 < 0, meaning that as the subject has a

more positive mood, his own marginal utility of consumption decreases. Let 𝑐 ∗ be the

current equilibrium amount given to charity and suppose that mood increases. Giving one

more dollar to charity entails a smaller marginal decrease in 𝑢𝑖 . However, the marginal

utility to the Dictator of giving an extra dollar (over the current equilibrium amount) is

𝛽𝑖 𝑢𝑗 (𝜎𝑗 , 𝑐 ∗ ) and has not changed. Hence, if the Dictator was in equilibrium with respect

to charitable giving before a change in mood then as his mood increases his giving will

increase since, due to his increased mood, the marginal cost of giving has decreased

while the marginal benefit has remained constant. This will lead to an increase in

charitable giving as mood increases. If we instead assume that 𝑢12 > 0, we get the

opposite result. We can summarize this in the following proposition (note: all proofs are

in Appendix C)

Proposition 1:

If 𝑢12 <0, then charitable giving is increasing in mood.

If 𝑢12 >0, then charitable giving is decreasing in mood.

IV.B. Willingness to Pay for a Good

Since this decision contains no externality, we use (1) to represent the subject's

utility. Under the BDM mechanism, once a subject states a price for a good, they either

receive it or not depending on the realization of the random variable of the mechanism.

Let 𝑐 ∈{0,1} be a variable which indicates whether subject 𝑖 received the good and

expand the utility function to 𝑢𝑖 (𝜎𝑖 , 𝜋𝑖 , 𝑐𝑖 ). His utility function is 𝑢𝑖 (𝜎𝑖 , 𝑤 − 𝑝, 1) when

he wins the good at price 𝑝 and 𝑢𝑖 (𝜎𝑖 , 𝑤, 0) when he does not. Then subject 𝑖 is asked to

choose a 𝑝∗ such that

𝑢𝑖 (𝜎𝑖 , 𝑤 − 𝑝∗ , 1) = 𝑢𝑖 (𝜎𝑖 , 𝑤, 0)

Assume that the utility of good consumption and money is separable and that the utility

of receiving the good does not depend on mood and denote 𝑣𝑖 (1) as the utility

component of the good so that the utility when the subject wins the good is

𝑢𝑖 (𝜎𝑖 , 𝑤 − 𝑝, 1) = 𝑣𝑖 (1) + 𝑢𝑖 (𝜎𝑖 , 𝑤 − 𝑝)

(4)

With this form, we again get a clean characterization of how the optimal choice of

𝑝 changes with mood. As with the previous tasks, whether 𝑝 is increasing or decreasing

in mood depends on whether the marginal utility of money is increasing or decreasing in

mood (i.e., whether 𝑢12 is greater or less than 0). For example, if 𝑢12 < 0, then the

marginal value of money is decreasing in mood while the marginal increase in the

probability of winning the good remains constant. Hence, it is less costly to increase the

probability of wining the good so if the decision maker was in equilibrium before the

mood change, he would be willing to increase 𝑝 as his mood increased. This leads to an

increase in the willingness to pay and the following proposition:

Proposition 2:

Let utility be additive in the good. If 𝑢12 < 0, then willingness to pay is increasing in

mood. If 𝑢12 > 0, then willingness to pay is decreasing in mood.

IV.C. Gamble

We again use utility function (1) since there is no externality in the subject's

choice about the gamble. In the experiment, we asked the subjects to choose 𝑥 where 𝑥 is

the amount they are willing to pay for a gamble offering $40 or $0 with equal probability.

The subjects started off with $40. Using a BDM mechanism, a number 𝑦 ∈ [0,40] is

drawn and a subject receives the gamble if 𝑦 < 𝑥 and would have final wealth levels

80 − 𝑦 if he won the gamble and 40 − 𝑦 if he lost. Subjects therefore choose the 𝑥 that

solves:

𝐸[𝑢|𝑔𝑎𝑚𝑏𝑙𝑒 𝑎𝑡 𝑝𝑟𝑖𝑐𝑒 𝑥] = 𝐸[𝑢|𝑛𝑜 𝑔𝑎𝑚𝑏𝑙𝑒]

1

(𝑢 (𝜎 , 𝑤 − 𝑥) + 𝑢𝑖 (𝜎𝑖 , 2𝑤 − 𝑥)) = 𝑢𝑖 (𝜎𝑖 , 𝑤)

2 𝑖 𝑖

To look at how the willingness to pay for the gamble changes with mood, we need

to look at how risk aversion changes with mood. To do this, we consider how the

coefficient of absolute risk aversion changes with mood and make an additional

assumption concerning the form of 𝑢1 . This leads us to the following proposition:

Proposition 3:

If 𝑢1 is a convex transformation of 𝑢𝑖 , then the willingness to pay for the gamble will be

increasing in mood. If 𝑢1 is a concave transformation of 𝑢𝑖 , then the willingness to pay

for the gamble is decreasing in mood.

The condition that 𝑢1 is a convex transformation of 𝑢𝑖 has a sensible interpretation

in the case when 𝑢12 < 0. We can show that convexity condition implies that

−

𝑢22

𝑢122

≤−

𝑢2

𝑢12

which is equivalent to the coefficient of absolute risk aversion 𝐴(𝑤, 𝜎𝑖 ) =

−𝑢22 (𝜎𝑖 ,𝑤)

𝑢2 (𝜎𝑖 ,𝑤)

decreasing in 𝜎𝑖 . If we interpret mood as acting as an increase in wealth, then this

condition is similar to the usual condition for decreasing absolute risk aversion. Consider

a utility function of the form 𝑢𝑖 (𝑓(𝜎𝑖 ) + 𝑤). Then

𝑢122

𝑢12

=

𝑢𝑖 ′′′(𝑓(𝜎𝑖 )+𝑤)

𝑢𝑖 ′′(𝑓(𝜎𝑖 )+𝑤)

and

𝑢22

𝑢2

=

𝑢𝑖 ′′(𝑓(𝜎𝑖 )+𝑤)

𝑢𝑖 ′(𝑓(𝜎𝑖 )+𝑤)

,

so the convexity condition implies that

−

𝑢𝑖 ′′(𝑓(𝜎𝑖 ) + 𝑤)

𝑢𝑖 ′(𝑓(𝜎𝑖 ) + 𝑤)

≤−

𝑢𝑖 ′′′(𝑓(𝜎𝑖 ) + 𝑤)

𝑢𝑖 ′′(𝑓(𝜎𝑖 ) + 𝑤)

which is the standard assumption for decreasing absolute risk aversion. Hence, the

convexity assumption translates well into standard assumptions on the utility function

when 𝑢12 < 0.

IV.D. Trust Game

Unlike the previous three decision tasks, this task actively involves two players in

a game and is therefore a bit more involved. In the Trust Game, the sender starts off with

𝑤 and can choose an amount 𝑡 ≤ 𝑤 to send to the receiver. The amount the receiver gets

is 3𝑡, from which he can choose and amount 𝑐 ≤ 3𝑡 to return to the sender. Thus, the

monetary outcomes for the sender and receiver are 𝑤 − 𝑡 + 𝑐 and 3𝑡 − 𝑐, respectively.

Using our utility functions, we have that the utility of the sender, when he sends 𝑡 and

receives 𝑐 in return is:

∫ [𝛽𝑖 𝑢𝑗 (𝜎𝑗 , 3𝑡 − 𝑐) + 𝑢𝑖 (𝜎𝑖 , 𝑤 − 𝑡 + 𝑐)]𝑑𝜇(𝜎𝑗 |𝑐).

𝑗

The receiver’s utility when he gets 3𝑡 and returns 𝑐 is:

∫ [𝛽𝑖 𝑢𝑗 (𝜎𝑗 , 𝑤 − 𝑡 + 𝑐) + 𝑢𝑖 (𝜎𝑖 , 3𝑡 − 𝑐)]𝑑𝜇(𝜎𝑗 |𝑡)

𝑗

Since this is an extensive form game, we can analyze it by working backwards.

Let us think of the problem of a receiver 𝑗 who gets 3𝑡 when 𝑢12 < 0. Let us fix the

transfer at 3𝑡 and equilibrium amount returned to be 𝑐 ∗ . We will look at what happens as

the receiver’s exogenous mood increases. Since 𝑢12 < 0, his own marginal utility of

money will be decreasing. Thus, we should expect him to give more money back to the

sender as his mood increases since the extra money for the sender will have a positive

marginal utility of 𝛽𝑗 𝑢𝑖 (𝜎𝑖 , 3𝑡 − 𝑐 ∗ ), which has remained constant, but will cost the

receiver less in terms of his egoistic utility 𝑢𝑗 than it did before the increase in mood.

When 𝑢12 > 0, a similar logic leads to the conclusion that the amount sent back by the

receiver is decreasing in mood.22

Moving back to the sender 𝑖, he can infer what the receiver will return given the

receiver’s mood. However, since players are anonymously matched, the sender doesn’t

know what the receiver’s mood will be. In this way, sending money to the receiver is

22

This part of the analysis is very similar to our discussion of charitable giving in subsection

IV.A.

similar to a gamble, where the amount the receiver returns is equivalent to winning or

losing the gamble.

First, suppose that 𝑢12 < 0 and that the sender is at an interior equilibrium in the

sense that the amount sent, 𝑡, is less than the sender’s endowment of 𝑤. Now assume that

for any given amount a sender transfer 𝑡, we can split the receivers into two types: those

who transfer back 𝑐 > 𝑡 and those who transfer back 𝑐 < 𝑡 . When facing those who

return 𝑐 > 𝑡, the sender would always prefer to send more endowment (since they will

both have higher wealth). Therefore, in order to have an interior solution in the amount

sent, it must be that there are enough people who will return at a rate less than one. Now,

consider an increase in the emotional state of the sender. Since 𝑢12 < 0, the sender now

has a lower marginal utility of wealth for himself. However, given that he was willing to

transfer an interior amount before the mood increase, he is willing to transfer even more

now for reasons related to the decision in the charitable giving task.

Now suppose that 𝑢12 > 0. The analysis here is not as straightforward. If, for any

amount sent, the sender was facing only receivers who return 𝑐 < 𝑡, then the sender

would like to reduce the amount of money sent since, by 𝑢12 > 0, an increase in mood

causes him to place more relative weight on his own egotistic utility. However, there

might also be types that return 𝑐 > 𝑡. When facing these types, the sender would prefer to

transfer more. However, we can use the fact that from the sender’s perspective,

transferring money to the receiver is like a gamble. Supposing that a change in own mood

is independent of the receiver’s mood, then how much the sender sends will depend on

how risk aversion changes with mood. As we showed in the gamble task, this behavior

requires an assumption on 𝑢1 being a concave transformation of 𝑢𝑖 . If this condition

holds, then the coefficient of risk aversion increases with mood and the sender would

prefer to send less money. Combining all these results, we get our final proposition:

Proposition 4: If 𝑢12 < 0, then the transfer by sender and amount returned by the

receiver are both increasing in mood. If 𝑢12 > 0, then the amount returned by the

receiver is decreasing in mood. If 𝑢1 is a concave transformation of 𝑢𝑖 and 𝑢12 > 0,

then the transfer by the sender is decreasing in mood.

Our utility model that incorporates mood generates sharp predictions about

behavior in each of our four decision tasks in the experiment as a function of the sign of

𝑢12 (and in some cases the form of 𝑢1 ). These predictions are summarized in Table 6

alongside the empirical results. As can be seen from the table, our empirical results can

be rationalized in this model with the simple assumption that 𝑢12 < 0.23

23

While our model is agnostic to the specific utility function that generates the negative crosspartial of 𝑢12 < 0, our empirical results would be rationalized by a utility function of the form

𝑢𝑖 (𝑓(𝜎𝑖 ) + 𝑔(𝜋𝑖 )) where 𝑢12 < 0 is guaranteed by 𝑓’>0, 𝑔 ‘>0 and the concavity of 𝑢𝑖 . This

formulation suggests that mood and money are substitutes, that a positive mood shock increases

utility, and makes it easy to interpret our results as suggesting being in a better mood makes

subjects feel richer.

Table 6: Empirical Results and Predictions of Model in Decision Tasks

as Mood Increases

Task

Empirical

Results

+

+

+

+

+3

𝒖𝟏𝟐 <0

𝒖𝟏𝟐 =0

Charitable Giving

+

0

Gamble

+1

0

WTP

+

0

Trust Game: Sender

+

0

Trust Game:

+

0

Receiver

1

requires additional assumption that 𝑢𝑖,1 is a convex transformation of 𝑢𝑖,1

2

requires additional assumption that 𝑢𝑖,1 is a concave transformation of 𝑢𝑖,1

3

not significant at conventional levels.

𝒖𝟏𝟐 >0

−

−2

−

−2

−

V. Conclusion

This paper investigates the impact of short-term changes in mood on decisionmaking. Surely, many life events can have long lasting influences on emotions (e.g. the

death of a parent or child, divorce, career setbacks, etc.) and choices made under the

cloak of these events may be distorted in ways that are understandable. However, we

focus on short-term fluctuations in mood because they are regularly affected by a variety

of factors and it is perhaps less understandable why economic decisions would be

distorted by such emotional swings that are known to be orthogonal to the fundamentals

of our wellbeing. Standard economic theory has no role (or tolerance) for mood to effect

behavior and yet we find that subjects have systematic changes in behavior when they are

temporarily made happier or less happy by the events of an NFL football game.

In particular, we find that watching the game affects viewers’ mood, as measured

by self-reported happiness, and that these changes in mood are predictably related to the

events of the game. More importantly, this self-reported happiness is highly correlated

with behavior in the four decision tasks subjects engage in during our experiment. When

the mood of subjects’ increases — that is, when they report being happier — they give

more to charity, pay more for a good, are less risk averse, and are more trusting of others.

Our results have a number of interesting consequences. First, economic theory

and its emphasis on revealed preference rely heavily on the assumption that people

behave consistently when making decisions. Such consistency has been documented by

Fisman, Kariv, and Markovits (2007), which finds that subject behavior is consistent with

GARP. Nevertheless, there is always a seemingly irreducible amount of inconsistency in

human decision making, and our papers suggests that some of this inconsistency might be

attributable to variations in mood that decision makers can experience over even short

periods of time. Such emotional swings may lead to the appearance that people choose

stochastically when, in fact, their choice may be state-dependent with mood being a main

mover of states.

From a methods point of view, our paper is unique in that we present a paradigm

in which mood is varied by naturally occurring events over the course of an NFL football

game. Watching the game alters the emotional states of viewers over the course of a few

hours. Hence the data generated by our experiment allows us to observe not only the

impact of mood on decisions but also the impact of changing mood on changes in

decision making, a type of data not generated by other investigators in this area.

Finally, in this paper we present a simple theory that incorporates mood directly

into a decision maker’s utility function that allows us to succinctly explain the data

generated by our experiment. The result has a natural interpretation that being in a good

mood makes individuals feel richer. We see this as providing a foundation for future

researchers on the relationship between mood and decision-making. If other emotions can

be as parsimoniously included into models of decision making, we may be able to

generate some traction in getting economic theory to consider the role of emotions more

generally.

VI. References

Aderman, David, “Elation, depression, and helping behavior,” Journal of Personality and

Social Psychology, 24 (1972), 91-101.

Andrade, Eduardo and Dan Ariely, “The Enduring Impact of Transient Emotions on

Decision Making,” Organizational Behavior and Human Decision Processes, 109

(2009), 1-8.

Andreoni, James “Impure Altruism and Donations to Public Goods - A Theory of Warm

Glow Giving,” Economic Journal, 100 (1990), 464-477.

Andreoni, James and John Miller, “Giving According to GARP: An Experimental Test of

the Consistency of Preferences for Altruism,” Econometrica, 70 (2002), 737-753.

Anik, Lalin, Lara B. Aknin, Michael I. Norton, and Elizabeth W. Dunn “Feeling Good

about Giving: The Benefits (and Costs) of Self-Interested Charitable Behavior,”

Harvard Business School Working Paper 10-012, 2009.

Ariely, Dan and George Loewenstein, “The Effect of Sexual Arousal on Sexual Decision

Making,” Journal of Behavioral Decision Making, 19 (2006), 87-98.

Battigalli, Pierpaolo and Martin Dufwenberg, “Guilt in Games,” American Economic

Review Papers and Proceedings, 97 (2007), 170-176.

Bechara, Antione, Hanna Damasio, Daniel Tranel, and Antonio Damasio, “Deciding

Advantageously Before Knowing the Advantageous Strategy,” Science, 275 (1997),

1293-1295.

Benjamin, Daniel, Ori Heffetz, Miles S. Kimball, and Nichole Szembrot, “Beyond

Happiness and Satisfaction: Toward Well-Being Indices Based on Stated

Preferences,” American Economic Review, 104 (2015), 2698-2735.

Benjamin, Daniel, Ori Heffetz, Miles Kimball, and Alex Rees-Jones, “What Do You

Think Would Make You Happier? What Do You Think You Would Choose?” American

Economic Review, 102 (2012), 2083-2110.

---------- “Can Marginal Rates of Substitution Be Inferred from Happiness Data?

Evidence from Residency Choices,” American Economic Review, 104 (2014), 34983528.

Bentham, Jeremy, An Introduction to the Principles of Morals and Legislation, 1789.

Brunnermeier, Markus, and Jonathan Parker, “Optimal Expectations,” American

Economic Review, 95 (2005), 1092-1118.

Bolton, Gary and Axel Ockenfels, “ERC: A Theory of Equity, Reciprocity, and

Cooperation,” American Economic Review, 90 (2000), 166-193.

Bosman, Ronald, Matthias Sutter and Frans van Winden, “The Impact of Real Effort and

Emotions in the Power-to-Take Game,” Journal of Economic Psychology, 26, (2005),

407-429.

Boyce, Chrisopher, Mikołaj Czajkowski, Nick Hanley, Charles Noussair, Michael

Townsend, and Steve Tucker, “The Effects of Emotions on Preferences and Choices for

Public Goods,” University of St. Andrews Discussion Papers in Environmental

Economics, 2015.

Burghart, Daniel, Paul Glimcher, and Stephanie Lazzaro, “An Expected Utility

Maximizer Walks Into A Bar…,” Journal of Risk Uncertainty, 46 (2013), 215-246.

Capra, C. Monica, “Mood-Driven Behavior in Strategic Interactions,” American

Economic Review Papers and Proceedings, 94 (2004), 367-372.

Caplin, Andrew and John Leahy, “Psychological Expected Utility Theory and

Anticipatory Feelings,” Quarterly Journal of Economics, 116 (2001), 55-79.

Card, David and Gordon Dahl, “Family Violence and Football: The Effect of Unexpected

Emotional Cues on Violent Behavior,” Quarterly Journal of Economics, 126 (2011), 103143.

Charness, Gary and Martin Dufwengerg, “Promises and Partnerships,” Econometrica, 74

(2006), 1579-1601.

Choi, Syngjoo, Ray Fisman, and Douglas Gale, “Revealing Preferences Graphically: An

Old Method Gets a New Tool Kit,” American Economic Review Papers and Proceedings,

97 (2007), 153-158.

Dunn, Jennifer and Maurice Schweitzer “Feeling and believing: The influence of emotion

on trust,” Journal of Personality and Social Psychology, 88 (2005), 736–748.

Earely, Joseph and James Konow “The Hedonistic Paradox: Is Homo Economicus

Happier?” Journal of Public Economics, 92 (2008), 1-33.

Edmans, Alex, Diego Garcia, and Øyvind Norli, “Sports Sentiment and Stock Returns,”

The Journal of Finance, 62 (2007), 1965-1998.

Elster, Jon “Emotions and Economic theory,” Journal of Economic Literature, 36 (1998),

pp. 47-74.

Fehr, Ernst and Klaus Schmidt, “A Theory of Fairness, Competition, and Cooperation,”

Quarterly Journal of Economics, 114 (1999), 817-868.

Fisman, Raymond, Shachar Kariv, and Daniel Markovits, “Individual Preferences for

Giving,” American Economic Review, 97 (2007), 1858-1876.

Frey, Bruno , Simon Luechinger, and Alois Stutzer, “The Life Satisfaction Approach to

Valuing Public Goods: The Case of Terrorism,” Public Choice, 138 (2008), 317-345.

Geanakopolos, John, David Pearce, and Ennio Stacchetti “Psychological Games and

Sequential Rationality,” Games and Economic Behavior, 1 (1989), 60-79.

Gilbert, Daniel, Stumbling on Happiness (New York, NY: Random House).

Ifcher, John and Homa Zarghamee, “Happiness and Time Preference: The Effect of

Positive Affect in a Random-Assignment Experiment,” American Economic Review, 101

(2011), 3109-3129.

Isen, A.M., and Levin, P.F., “The effect of feeling good on helping: Cookies and

Kindness,” Journal of Personality and Social Psychology, 21 (1972), 384-388.

Johnson, Eric and Amos Tversky, “Affect, Generalization and the Perception of Risk,”

Journal of Personality and Social Psychology, 45 (1983), 20-31.

Kahneman, Daniel, Alan Krueger, David Schkade, Nobert Schwarz, and Arthur Stone,

“A survey method for characterizing daily life experience: The Day Reconstruction

Method,” Science, 306 (2004), 1776-1780.

Kimball, Miles and Rober Willis, “Utility and Happiness,” University of Michigan,

Mimeo, 2006.

Kirchsteiger, George , Luca Rigotti, and Aldo Rustichini, “Your morals might be your

moods,” Journal of Economic Behavior & Organization, 59 (2006), 155-172.

Lambsdorffl, Joseph, Marcus Giamatei, Katharina Werner, and Manuel Schubert “The

Origin of Cooperation – Experimental Evidence from the 2014 Soccer World Cup,”

Working Paper, 2015.

LeDoux , Joseph E, “The Emotional Brain”, (New York, NY: Simon and Schuster)

Lempert, Karolina and Elizabeth Phelps, “Neuroeconomics of Emotion and Decision

Making,” In P.W. Glimcher and E. Fehr (eds). Neuroeconomics: Decision Making and

the Brain, 2nd ed. (Waltham, MA: Academic Press).

Lerner, Jennifer and Dacher Keltner, “Beyond Valence: Toward a Model of Emotion

Specific Influences on Judgement and Choice,” Cognition and Emotion, 14 (2000), 473493.

----------, “Fear, Anger, and Risk,” Journal of Personality and Social Psychology, 81

(2001), 146-159.

Lerner, Jennifer, Deborah Small, and George Loewenstein, “Heart Strings and Purse

Strings- Carryover Effects of Emotions on Economic Decisions,” Psychological Science,

15 (2004), 337-341.

Loewenstein, George, “Emotions and Economic Behavior,” American Economic Review

Papers and Proceedings, 90 (2000), 426-432.

Loewenstein, George and Jennifer S. Lerner, “The Role of Affect In Decision Making,”

in Handbook of Affective Science, Richard Davidson, Hill Goldsmith, and Klaus Scherer,

ed., (Oxford: Oxford University Press).

Loewenstein, George and Scott Rick, “The Role of Emotions in Economic Behavior,” in

Handbook of Emotions, 3rd ed. (New York, NY: Guilford Press).

Loewenstein, George, Elke Weber, Christopher Hsee, and Ned Welch, “Risk and

feeling,” Psychological Bulletin, 127 (2001), 267-286.

Myers, Dan and Dustin Tingley, “The Influence of Emotions on Trust,” Mimeo, PLESS,

Princeton University, 2011.

Nygren, Thomas, Alice Isen, Pamela Taylor, and Jessica Dulin, “The Influence of

Positive Affect on the Decision Rule in Risk Situations: Focus on Outcome (and

Especially Avoidance of Loss) Rather Than Probability,” Organization Behavior and

Human Decision Making, 66 (1996), 59-72.

Rabin, Matthew, “Incorporating Fairness into Game Theory and Economics,” American

Economic Review, 83 (1993), 1281–1302.

Reuben, Ernesto and Frans van Winden, “Fairness Perceptions and Prosocial Emotions in

the Power to Take,” Journal of Economic Psychology, 31 (2010), 908-922.

Rosenhan, D. L., Underwood, B., and Moore, B. “Affect moderates self-gratification and

altruism,” Journal of Personality and Social Psychology, 30 (1974), 546-52.

Sacks, Daniel, Betsey Stevenson, and Justin Wolfers, “The New Stylized Facts About

Income and Subjective Well-Being,” American Economic Review Papers and

Proceedings, 12 (2012), 1181-1187.

---------- ,“Growth in income and subjective well-being over time,” NBER Working

Paper No. 16441, 2012.

Simons, Eric, The Secret Lives of Sports Fans: The Science of Sports Obsession, (New

York, NY: The Overlook Press).

Stevenson, Betsey, and Justin Wolfers, “Economic growth and subjective well-being:

reassessing the Easterling paradox,” Brookings Papers on Economic Activity, 1 (2008),

1– 84.

Strack, Fritz, Norbert Schwarz, and Elisabeth Gschneidinger, “Happiness and

Reminiscing: The Role of Time Perspective, Affect, and Mode of Thinking,” Journal of

Personality and Social Psychology, 49 (1985), 1460-1469.

van Winden, Frans “Affect and Fairness in Economics,” Social Justice Research, 20

(2007), 35-52.

Zenith Optimedia,“Executive summary: Advertising Expenditure Forecasts December

2014”, (http://zenithoptimedia.com, Zenith Optimedia)

Online Appendix

Appendix A: Demographic Questionnaire and Additional Tables

Demographic Questionnaire

Question

1. Name

Entry

Users entered on text interface.

2. Work Status

Full time employed, Part time employed, Student,

Unemployed.

3. Gender

Male, Female.

4. Highest Education

Achieved

PhD, Masters Degree, Bachelors Degree, Some

College, High School.

5. Do You Like Watching

Sports in general?

Likert scale where 1 is “Not very much” and 7 is

“More than all other types of entertainment.”

6. Do you like watching

football in particular?

Likert scale where 1 is “Not very much” and 7 is

“Football is my favorite sport to watch.”

7. What is your favorite

team?

Any of the 32 NFL teams.

8. Which team are you

rooting for in the game

today?

One of the two teams playing in the game.

9. How strongly do you care

for the team you are

Likert scale where 1is “Not at all”, 3 is “Somewhat”,

rooting for in the game

5 is “A lot”, and 7 is “Passionately.”

today?

10. How strongly do you

dislike the team you are

not rooting for in the

game today?

Likert scale where 1 is “I hate them with a passion”,

3 is “I dislike them somewhat”, 5 is “I like them”,

and 7 is “I like them almost as much as the other

team.”

11. Why do you want the

team you are rooting for

today to win?

“They are my favorite team,” “Several players on

that team are on my fantasy football team,” “I need

that team to win in order for my truly favorite team

to make the playoffs,” and “I bet on that team.”