Chapter 4 - #7 - Trail Balance

advertisement

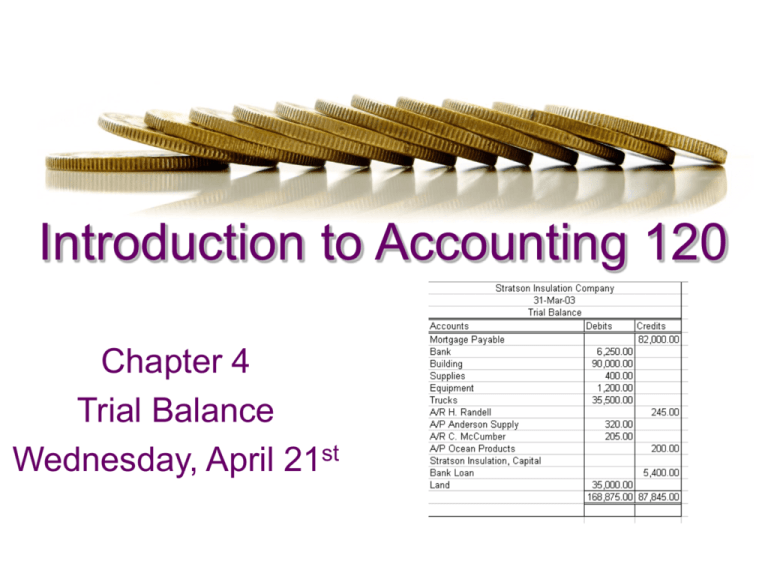

Introduction to Accounting 120 Chapter 4 Trial Balance Wednesday, April 21st In Today’s Class • Reminder: All outstand assignments are now overdue. • Check Engrade.ca for you Midterm MC marks and to see any assignments you’re missing. • Moving on: The Trial Balance The Trial Balance • A ledger must always balance. When establishing a ledger, the originating data (opening account balances) is obtained from a balance sheet. This ensures the ledger begins in a balanced position. The total of the accounts with debit balances equals the total of the accounts with credit balances. The Trial Balance • • After a series of transactions have been recorded, it is necessary to verify that the ledger is still in balance. This is accomplished by preparing a trial balance. A trial balance is a listing of all of the accounts and their balances. It assures that the total debit balances equals the total credit balances. If the total of the debits does not equal the total of the credits, the ledger is said to be "out of balance." Preparing a Trial Balance • Computerized accounting applications eliminate the responsibility of manually preparing a trial balance. The programs produce the document automatically. Prior to computerized accounting, trial balances were often "taken" with a printing calculator or adding machine. The bookkeeper simply added all debit balances in a ledger and subtracted all credit balances. If the end result were zero, the ledger was thought to be in balance. Preparing a Trial Balance • • • • For businesses utilizing computers but not yet using an accounting software application (and for the purpose of this course), a spreadsheet application can be used to prepare trial balances. Examine the following trial balance noting: The heading is similar to a balance sheet heading (who? what? when?). Asset accounts are listed first, in order of liquidity. Liability accounts are listed next, in order of retiring debt. Preparing a Trial Balance • • • • • • • There are no classification headings (asset, liability, owner's equity) within the account listing. There is no indenting of receivables or payables. Debit balances are entered in the first monetary column. Credit balances are entered in the second monetary column. The total debits equal the total credits. The balanced figures are double underlined. The trial balance is not a formal document; therefore, abbreviations are used (exception - headings are not abbreviated). Preparing a Trial Balance Trial Balance Errors • It is not uncommon for a trial balance to be out of balance. This indicates to accounting personnel that at least one accounting error has been made. It is an accountant's job to locate and correct errors. • There are numerous reasons why a ledger may be out of balance: • Faulty addition • An unbalanced transaction • Recording two debits or two credits rather than equalizing debits and credits Trial Balance Errors • Errors of this type are eliminated with computerized accounting. • There are also times when the ledger is in balance, but due to an accounting error, it is not correctly balanced. These mistakes are more difficult to fix because they are not necessarily found by means of a trial balance. For example: • Suppose a debtor pays $100 on their account, but $10 is recorded in both the Bank and the debtor's account. The entry is balanced, thus the ledger would balance. Trial Balance Errors • Another error is termed transposition. A transposition error occurs when numbers are switched in place value. Suppose $120 worth of supplies is purchased for cash but is recorded as a debit of $210 to supplies and as a credit of $210 to cash. The transaction entries do balance and again the trial balance would balance, yet the ledger balances are overstated/understated by $90. • Mistakes such as these are generally found during an audit or some other type of post-trial balance verification procedure. Trial Balance Error Detection • The following suggested steps might help you locate an error when a trial balance does not balance. • Step 1 Check the accuracy of the trial balance addition. • Step 2 Double check the figures from the ledger to ensure they were carried to the trial balance properly. • Step 3 Check the accuracy of the T-Account balances. • Step 4 Verify that each accounting entry affecting the TAccounts was balanced. Do the debits equal the credits for each transaction? Trial Balance Error Detection • Verifying that each accounting entry affecting the ledger is balanced (step 4) is the most complicated step of error detection. • This requires tracing through T-Accounts, ensuring that debits equal credits, for each transaction. T-Accounts are not organized in a manner that allows this to happen systematically. Thus in the event where error detection reaches this stage, "patience is a virtue." Trial Balance Error Detection • Examine the following T-Account ledger. You will find it does not balance. Can you easily locate a possible transaction error? Imagine the size of an actual company ledger and the difficulty locating the "needle in the haystack"! Trial Balance Error Detection • To avoid an unbalanced ledger and challenging problems, such as that shown below, ledger verification should happen regularly and often. The more transactions to check, the longer and more frustrating the process becomes. Error Detection Scenario - 1 • Consider the following: • A new desk is purchased for $600 cash. Bank is credited for the correct amount, but equipment rather than furniture, is debited $600. • Is the trial balance in balance? • Is the trial balance correct? • What is the effect on the equipment account? • What is the effect on the furniture account? Error Detection Scenario - 1 • Is the trial balance in balance? – Yes, the trial balance is in balance. • Is the trial balance correct? – No, two accounts have incorrect balances. • What is the effect on the equipment account? – The effect on the equipment is that it is overstated by $600. • What is the effect on the furniture account? – The effect on the furniture account is that it is understated by Error Detection Scenario - 1 • Review the position of the accounts and the trial balance with both the incorrect and correct procedure: • A new desk is purchased for $600 cash. Bank is credited for the correct amount, but equipment rather than furniture, is debited $600. Error Detection Scenario - 2 • Consider the following: • Cash of $200 was received from a customer, for services performed. Bank was debited for $200 and Capital was credited for $20. • Try to answer the following questions – Is the trial balance in balance? – Is the trial balance correct? – What is the effect on the Bank account? – What is the effect on the Capital account? Error Detection Scenario - 2 • Try to answer the following questions – Is the trial balance in balance? • No, the trial balance it not balanced. It is out $180. – Is the trial balance correct? • No, the trial balance is not correct. It does not balance. – What is the effect on the Bank account? • There is no effect on the Bank account. – What is the effect on the Capital account? • Capital is understated $180. Error Detection Scenario - 2 • Consider the following: Cash of $200 was received from a customer, for services performed. Bank was debited for $200 and Capital was credited for $20. Error Detection Scenario - 3 • Consider the following: • A $500 service is performed for a customer who pays immediately with cash. Cash is debited $500 and Capital is debited $500. Try to answer the following questions – Is the trial balance in balance? – Is the trial balance correct? – What is the effect on the Bank account? – What is the effect on the Capital account? Error Detection Scenario - 3 • A $500 service is performed for a customer who pays immediately with cash. Cash is debited $500 and Capital is debited $500. Try to answer the following questions – Is the trial balance in balance? • No, the Trial Balance is out $1000. – Is the trial balance correct? • No, the Trial Balance does not balance. – What is the effect on the Bank account? • There is no effect on the Bank account. – What is the effect on the Capital account? • It is understated $1000. Error Detection Scenario - 3 • A $500 service is performed for a customer who pays immediately with cash. Cash is debited $500 and Capital is debited $500. Error Detection Scenario - 3 • Notice the entry involved the sum of $500, but the account and trial balance are "out" by $1000. This is the effect of an entry to the wrong side of a ledger account. Error Detection Scenario Practice • Consider the following: • Supplies are purchased for $100 cash. When entering the transaction, Supplies are debited $100 and Bank is debited $10. Error Detection Scenario Practice • Consider the following: • Supplies are purchased for $100 cash. When entering the transaction, Supplies are debited $100 and Bank is debited $10. Let's Review • Now that the unit is completed, you should be able to discuss: – An account and a ledger – Proper and exceptional account balances – Double entry accounting – The rules of debit and credit theory as it relates to transactions – The term "on account" – Pencil footings – The purpose and importance of a trial balance – The types of errors in accounting that affect the trial balance Assignment: U4A4 • Go to the O:\Binet\Intro to Accounting folder. • Open U4A4.doc and U4A4.xls and complete! • Due Friday at the beginning of class.