Demand Industries Revenue Growth

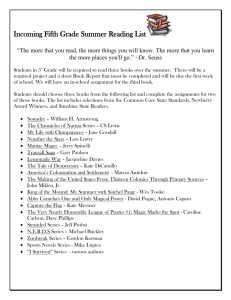

advertisement

WABASH NATIONAL CORPORATION (NYSE:WNC) Presented on Dec, 8 2015 Investment Managers Sashikanth (Sash) Yenika Siwei (Lerissa) Li Vanditha M Ravindranath Agenda Screening Criteria Company Introduction Segment Profiles Industry Overview Key Macroeconomic Drivers Comparable Valuation Financial Analysis Financial Projections DCF Valuation Technical Analysis Recommendation Screening Criteria Industry – NOT(Energy, Financials, IT, Healthcare) Market Cap < $1B Current Share Price < 1.2*52wk low Piotroski Score > 5 P/BV < 2x 3 Year Avg. Revenue Growth > 10% P/E < 15x Company Introduction Founded in 1985; 2014 Revenue: $1.86B Designs, manufactures and markets standard and customized truck and tank trailers, and related transportation equipment WABASH NATIONAL CORPORATION Commercial Trailer Products Diversified Products Composites Source: Annual report 2014 Aviation & Truck Equip. Tank Trailer Retail Process Systems Segment Profile: Commercial Trailer SALES & GROSS PROFIT MARGINS 2014 Sales: $1.3B 2014 new trailer shipments: 53,550 Portfolio: Dry vans, refrigerated vans, platform trailers Industry leader in van and platform trailer manufacturing In USD m 9% 8% 7% 6% 5% 4% 3% 2% 1% - 1,200 1,000 800 600 400 200 2010 2011 PRODUCT MIX 8% 2012 2013 2014 END MARKETS 3% 6% Dry Vans 9% 1,400 Refrigerated Vans 8% General Freight Truckload 1% Refrigerated Freight 2% Platform Freight 9% < Truckload Freight Platforms 80% 74% Other Dramatic margin improvement since 2010 Source: Investor Presentation August 2015, November 2015 and Annual reports Used Trailer Sales Other Segment Profile: Diversified Products SALES & GROSS PROFIT MARGINS 2014 Sales: $0.5B 30% Higher growth (81% - CAGR 2010-2014 and higher margin businesses 25% Portfolio: Sanitary, chemical trailers, aircraft refueler, vertical silos, portable storage containers 15% Possess industry leading stainless steel trailer brands: Walker, Brenner, Bulk In USD m 500 400 20% 300 200 10% 100 5% - 2010 2011 PRODUCT MIX 2012 2013 2014 END MARKETS Food, Dairy & Beverage Tank Trailers 12% Process Systems 15% 6% Chemical 24% 6% Energy General Freight 7% Aviation 53% 20% 5% Composites Aviation & Truck Equipment 8% 22% 10% 12% Pharma Parts & Service Aerodynamic Services Other Diverse Products and End Markets Source: Investor Presentation August 2015, November 2015 and Annual reports Segment Profile: Retail SALES & GROSS PROFIT MARGINS 2014 Sales: $0.2B Dealership model, selling new and used trailers, aftermarket parts, and maintenance and repair services 12% 9% 150 Expansion into new markets with mobile service and third party maintenance 6% 100 3% 50 In USD m - 2010 PRODUCT MIX 44% 2011 2012 2013 2014 COMPANY-OWNED RETAIL LOCATIONS 9% 47% 200 New Trailers Parts & Service Used Trailers Source: Investor Presentation August 2015, November 2015 and Annual reports Overview - Truck Trailer Manufacturing KEY PRODUCTS Flatbed trailer Refrigerated trailers Freight trailers MAJOR PLAYERS Wabash National Corporation 14% 45% 20% 21% Utility Trailers Great Dane Limited Partnership Other LIFECYCLE Mature stage of the industry’s life cycle Slight product saturation has been reached Source: IBISWorld OUTLOOK Trailer with fuel saving technologies for heavy duty trucks will spur new sales during the next five years Industry will face cost pressures from product development Porter’s Five Analysis Rivalry •High: high price competition, lack of products differentiation Bargain Power of Supplier •Moderate: volatile price of steel and aluminum Bargain Power of Buyer •Moderate: high price competition Threats of New Entrants •Moderate: high initial capital cost, limited access to competitive raw material price Threats of Substitution Source: IBISWorld • Low: no substitute for trailer Industry Drivers Key Economics Drivers • • • Supply Industries • • Aluminum manufacturing Iron & Steel manufacturing Source: IBISWorld Price of crude oil Total trade value Price of Steel Demand Industries Truck Trailer Manufacturing • • • Local freight trucking Long-distance freight trucking Tank & refrigeration trucking Economic Drivers Economic Drivers Growth 30% YoY % Change 20% 10% (10%) (20%) (30%) (40%) (50%) 2014 2015 2016 World Price of Crude Oil • • Source: IBISWorld 2017 2018 Total Trade Value 2019 2020 2021 Price of Steel Increase in the total trade value will lead to increased demand for truck trailer manufacturing Increasing price of steel and crude oil may pose potential threat for the industry Demand Industry Demand Industries Revenue Growth 6% YoY % Chamge 5% 4% 3% 2% 1% 2016 2017 Local freight trucking 2018 2019 2020 2021 Long distance freight trucking Tank and refrigeration trucking • Source: IBISWorld Growing demand industries revenue will lead to increased demand for truck trailer manufacturing industry Comparable Companies Provide mechanical, mechatronic and electronic technologies for braking, stability and transmission automation systems for commercial truck, bus and trailer manufacturers Revenue: $2.6B Market Cap: $5.74B • • Provide axle, brake and suspension solutions to commercial truck, trailer, bus and coach and off-highway machinery manufacturers • • Revenue: $3.8B Market Cap: $0.8B Comparable Valuation Price/ Company Name WABCO Holdings Inc. Meritor, Inc. Average Wabash National Corporation Implied Price per Share Weight Ticker WBC MTOR WNC LTM Earnings 23.8x 13.2x 18.5x $1.35 $24.92 33.30% Estimated Price per Share $24.14 Post 20% discounting – Share Price $19.31 Source: Bloomberg, Capital IQ, Annual Reports LTM Sales 2.2x 0.2x 1.2x $28.02 $33.62 33.30% EV LTM EBIT/Share 15.7x 4.9x 10.3x $1.84 $13.94 33.30% Activity Ratios & Profitability Ratios PROFITABILITY RATIOS ACTIVITY RATIOS 20% 30x 2,000 25x 1,600 - 20x 1,200 15x 10x 800 (20%) 400 5x 2011 2012 Fixed Asset Turnover 2013 A/R Turnover 2014 A/P Turnover (40%) 2010 Revenue 2011 2012 Gross Profit Margin 2013 2014 Net Profit Margin The Value of Profit Margin is high due to the income tax benefit that they received in 2012 Source: Annual reports 2014, 2013, 2012 Profitability & Leverage Ratios PROFITABILITY RATIOS LEVERAGE RATIOS 3 60% (1x) 45% 2 (2x) (3x) 30% 1 (4x) 15% (5x) - 2011 ROA 2012 ROE (Book Value) 2013 2014 Adjusted Net Margin The Value of ROE is very high due to the income tax benefit received in 2012 Adjusted Net Margin is the value of Net Profit Margin had the tax benefit not been availed Source: Annual reports 2014, 2013, 2012 (6x) 2011 Debt/Assets 2012 2013 Debt/Equity 2014 Interest Coverage DuPont Analysis & Greenblatt Ratios DUPONT ANALYSIS 2010 118% NM (2%) Tax Burden Interest Burden Operating Profit Margin Asset Turnover Leverage ROE 2011 99% 77% 2% 3x 3x 11% 2012 217% 57% 6% 2x 3x 51% 2013 60% 75% 6% 2x 3x 16% 2014 62% 80% 7% 2x 3x 17% GREENBLATT RATIOS 40% 32% 24% 16% 8% 2011 2012 EBIT/Tangible Asset Source: Annual reports 2014, 2013, 2012, Ycharts 2013 EBIT/EV 2014 This was considered as NM as the value was an outlier I/S PROJECTION Source: Annual Reports and Investor update Nov-2015 KEY INPUTS KEY INPUTS Source: Yahoo! Finance WEIGHTED AVERAGE COST OF CAPITAL DISCOUNTED CASH FLOW Present Value of Equity Source: Annual report, industry report SENSITIVITY ANALYSIS Technical Analysis Source: Yahoo! Finance – Dec 7, 2015 RECOMMENDATION Expanding Margins Increased Share Repurchase Strategic Acquisitions Entry to diversified growth markets and less cyclical industries Stock Price DCF Valuation : $13.63 Current Stock Price:$11.55 Relative Valuation: $19.31 Recommendation: BUY 500 shares at Market Price Target Price: $14.77 Stock Price Global Economic Weakness Rise in raw materials & competition Stringent Regulations DIVERSIFICATION OF EXISTING PORTFOLIO Source: Yahoo! Finance