File

advertisement

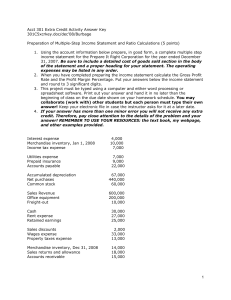

BAT4M Exam Review 2014 150 minutes Breakdown of exam: Part A: Multiple Choice Part B: Amortization Part C: Inventory Cost Flow Assumptions Part D: Journalizing Part E: Closing Entries Part F: Financial Statements Part G: Partnerships Sample Theory Questions 1. Transactions are initially recorded in the: a. general ledger. b. general journal. c. trial balance. d. balance sheet. 2. The right side of an account is referred to as the a. b. c. d. footing. chart side. debit side. credit side. 3. A purchase of office equipment for cash requires a credit to a. b. c. d. Office Equipment. Cash. Accounts Payable. Owner’s Equity. 4. The equality of the accounting equation can be proven by preparing a a. b. c. d. trial balance. journal. general ledger. T account. 5. Which of the following accounts would be increased with a debit? a. b. c. d. Rent Payable Owner’s Capital Fees Earned Owner’s Drawings 7. Transactions are initially recorded in the a. b. c. d. general ledger. general journal. trial balance. balance sheet. 8. The right side of an account is referred to as the a. b. c. d. footing. chart side. debit side. credit side. 9. A purchase of office equipment for cash requires a credit to a. b. c. d. Office Equipment. Cash. Accounts Payable. Owner’s Equity. 10. The equality of the accounting equation can be proven by preparing a a. b. c. d. trial balance. journal. general ledger. T account. 11. Which of the following accounts would be increased with a debit? a. b. c. d. Rent Payable Owner’s Capital Fees Earned Owner’s Drawings 12. If the ending inventory is overstated: a. net income will be understated. b. net income will be overstated. c. net income will be correct. d. gross profit will be understated. 13. If the ending inventory is understated: a. net income this year will be overstated. b. net income next year will be understated. c. the beginning inventory the next year will be understated. d. the beginning inventory the next year will be overstated. 14. In a period of rising prices, the cost of the ending inventory will be highest to lowest in this order: a. LIFO, FIFO, average cost. b. FIFO, average cost, LIFO. c. LIFO, average cost, FIFO. d. average cost, FIFO, LIFO. 15. Which of the following statements is not true?: a. Specific identification exactly matches costs and revenues. b. Moving weighted average tends to smooth out price changes. c. FIFO assigns an amount to inventory that is the lower of cost or market, which satisfies the conservatism principle. d. LIFO assigns the most recent costs incurred to cost of goods sold, and likely better matches current costs with revenues. 16. When perpetual inventory is maintained, the cost of goods sold is recorded by a journal entry in which a credit is made to the: a. Cost of Goods Sold account b. Merchandise Inventory account c. Accounts Receivable account d. Purchases account 17. Each of the following is an attribute of internal control except: a. segregation of duties. b. establishment of responsibility. c. independent performance reviews. d. a sound marketing plan. 18. A company issues a cheque for $75 but records it incorrectly as $57. On the bank reconciliation, the $18 error should be: a. deducted from the balance per bank. b. added to the balance per bank. c. deducted from the balance per books. d. deducted from the balance per books and added to the balance per bank. 19. Bourque Company has the following assets at the balance sheet date: Cash in bank – savings account $5,000 Amounts due from customers 14,000 Post-dated cheques 4,000 Chequing account balance 10,000. Which amount should be reported as cash in the balance sheet? a. $ 9,000 b. $15,000 c. $19,000 d. $24,000 20. A $100 petty cash fund has cash of $21 and valid receipts for $80. The journal entry upon replenishment would include: a. credit to Cash for $80. b. credit to Cash Over and Short for $1. c. debit to Cash for $80. d. debit to Cash Over and Short for $1. 21. A partnership a. is an association of one or more individuals. b. pays income tax on partnership income. c. has a limited life. d. is not an accounting entity for financial reporting purposes. 22.A general partner in a limited partnership a. has unlimited liability for all partnership debts. b. is always the general manager of the firm. c. is the partner who lacks a specialization. d. is liable for partnership liabilities only to the extent of that partner's capital equity. 23. The individual assets invested by a partner in a partnership a. revert back to that partner if the partnership liquidates. b. determine that partner's share of net income or loss for the year. c. are jointly owned by all partners. d. determine the scope of authority of that partner. 24. Which one of the following would not be considered a disadvantage of the partnership form of organization? a. Limited life b. Unlimited liability c. Mutual agency d. Ease of formation 25. A limited liability partnership is designed to a. protect innocent partners from the negligent acts of employees working on behalf of the partners. b. ensure all partners get an equal share of partnership earnings. c. allow partners to enter into several different partnerships simultaneously. d. protect partners from the negligence claims resulting from the acts of other partners. 26. Which of the following is not a principal characteristic of the partnership form of business organization? a. Mutual agency b. Association of individuals c. Limited liability d. Limited life 27. Which of the following statements is true regarding the form of a legally binding partnership contract? a. The partnership contract must be in writing. b. The partnership contract may be based on a handshake. c. The partnership contract may be implied. d. The partnership contract cannot be oral. 28. Which of the following statements about a partnership is correct? a. The personal assets of a partner are included in the partnership accounting records. b. A partnership is required to file an income tax return. c. Each partner's share of income is taxable to the partnership. d. A partnership represents an accounting entity for financial reporting purposes. 29. In a partnership, mutual agency means a. each partner acts on his own behalf when engaging in partnership business. b. the act of any partner is binding on all other partners, only if partners act within their scope of authority. c. an act by a partner is judged as binding on other partners depending on whether the act appears to be appropriate for the partnership. d. that partners must pay taxes on a mutual or combined basis. 30. A partnership agreement generally contains all of the following except a. the names and capital contributions of all the partners. b. the expected life of the partnership. c. the rights and duties of all partners. d. the basis for sharing net income or loss among the partners. 31. The partner in a limited partnership that has unlimited liability is referred to as the a. lead partner. b. head partner. c. general partner. d. unlimited partner. 32. Canadian Tire Corporation is an example of a(n) a. not-for-profit corporation. b. publicly held corporation. c. privately held corporation. d. income trust. 33. Shareholders of a corporation directly elect a. the president of the corporation. b. the board of directors. c. the controller of the corporation. d. all of the employees of the corporation. 34. The purchase of a company’s shares on the TSX will a. cause total shareholders’ equity to increase. b. cause total assets to decrease. c. cause retained earnings to decrease. d. have no effect on the operating activities of the corporation. 35. A factor which distinguishes the corporate form of organization from a sole proprietorship or partnership is that a a. corporation is organized for the purpose of making a profit. b. corporation is subject to numerous federal and provincial government regulations. c. corporation is an accounting economic entity. d. corporation’s temporary accounts are closed at the end of the accounting period. 36. Which one of the following would not be considered an advantage of the corporate form of organization? a. Limited liability of owners b. Separate legal existence c. Continuous life d. Government regulation 37. The concept of a "separate legal existence" refers to which form of business organization? a. Partnership b. Proprietorship c. Corporation d. Limited partnership 38. The ways that a corporation can be classified by purpose are a. general and limited. b. profit, nonprofit and income trust. c. provincial and federal. d. publicly held and privately held. 39. The two ways that a corporation can be classified by ownership are a. publicly held and privately held. b. shares and non-shares. c. inside and outside. d. majority and minority. 40. Which of the following would not be true of a privately held corporation? a. It is sometimes called a closely held corporation. b. Its shares are regularly traded on the Toronto Stock Exchange. c. It does not offer its shares for sale to the general public. d. It is usually smaller than a publicly held company. 41. Which of the following is not true of a corporation? a. It may buy, own, and sell property. b. It may sue and be sued. c. The acts of its owners bind the corporation. d. It may enter into binding legal contracts in its own name. 42. Allen Barron has invested $800,000 in a privately held family corporation. The corporation does not do well and must declare bankruptcy. What amount does Barron stand to lose? a. Up to his total investment of $800,000. b. Zero. c. The $800,000 plus any personal assets the creditors demand. d. $400,000. 43. A transaction involving an exchange of property, plant and equipment is deemed to be a non-monetary transaction when a. no cash is exchanged between parties. b. the fair market values of the assets exchanged are equal. c. the cash exchanged between parties amounts to less than 10% of the consideration involved. d. the assets exchanged perform similar functions. 44. All of the following are examples of property, plant and equipment except a. equipment. b. timber stand. c. land. d. building. 45. A company purchased land for $70,000 cash. $7,000 was spent for demolishing an old building on the land before construction of a new building could start. Under the cost principle, the cost of land would be recorded at a. $77,000. b. $70,000. c. $63,000. d. $7,000. 46. Which one of the following items is not considered a part of the cost of a truck purchased for business use? a. Insurance during transit b. Truck licence c. Freight charges d. Cost of lettering on side of truck 47. Which of the following assets does not decline in service potential over the course of its useful life? a. Equipment b. Furnishings c. Land d. Fixtures 48. The four subdivisions for property, plant, and equipment are normally a. land, land improvements, buildings, and equipment. b. intangibles, land, buildings, and equipment. c. furnishings and fixtures, land, buildings, and equipment. d. property, plant, equipment, and land. 49. The cost of land does not include a. costs to clear the land. b. annual property taxes. c. accrued property taxes assumed by the purchaser. d. legal fees. 50.Merry Clinic purchases land for $80,000 cash. The clinic assumes $2,000 in property taxes due on the land. The legal fees totalled $1,000. The clinic has the land graded for $2,200. What amount does Merry Clinic record as the cost for the land? a. $82,000. b. $80,000. c. $85,200. d. $84,200. 51.Kelly Company buys land for $150,000 on December 31, 2008. As of March 31, 2009, the land has appreciated in value to $165,000. On December 31, 2009, the land has an appraised value of $169,000. By what amount should the Land account be increased in 2009? a. $0. b. $15,000. c. $19,000. d. $800. 52.Juang Company acquires land for $56,000 cash. Additional costs are as follows: Removal of shed $ 1,800 Filling and grading 1,500 Residual value of lumber from shed 600 Paving of parking lot 10,000 Closing costs 690 Juang will record the acquisition cost of the land as a. $56,000. b. $60,590. c. $69,390. d. $59,990. 53. Which one of the following is not necessary in order for a corporation to pay a cash dividend? a. Adequate cash b. Approval of shareholders c. Declaration of dividends by the board of directors d. Retained earnings 54. A distribution of a corporation’s earnings to its shareholders is referred to as a. a shareholder bonus. b. wages and salaries expense. c. a share distribution. d. a dividend. 55. The date on which a cash dividend becomes a binding legal obligation is on the a. declaration date. b. date of record. c. payment date. d. last day of the fiscal year end. 56. The effect of the declaration of a cash dividend by the board of directors is to Increase Decrease a. Shareholders' equity Assets b. Assets Liabilities c. Liabilities Shareholders' equity d. Liabilities Assets 57. The cumulative effect of the declaration and payment of a cash dividend on a corporation's financial statements is to a. decrease total liabilities and shareholders' equity. b. increase total expenses and total liabilities. c. increase total assets and shareholders' equity. d. decrease total assets and shareholders' equity. 58. Common Stock Dividends Distributable is classified as a. an asset account. b. a shareholders' equity account. c. an expense account. d. a liability account. 59. The effect of a stock dividend is to a. decrease total assets and shareholders' equity. b. change the composition of shareholders' equity. c. decrease total assets and total liabilities. d. increase total shareholders’ equity. 60. If a corporation declares a 10% stock dividend on its common shares, the account to be debited on the date of declaration is a. Common Stock Dividends Distributable. b. Common Shares. c. Cash. d. Stock Dividends (Retained Earnings). 61. Which one of the following events would not require a formal journal entry on a corporation's books? a. 2-for-1 stock split b. 100% stock dividend c. 2% stock dividend d. $1 per share cash dividend 62. Which one of the following is not a characteristic generally evaluated in analyzing financial statements? a. Liquidity b. Profitability c. Marketability d. Solvency 63. In analyzing the financial statements of a company, a single item on the financial statements a. should be reported in bold-faced type. b. is more meaningful if compared to other financial information. c. is significant only if it is large. d. should be accompanied by a footnote. 64. Short-term creditors are usually most interested in evaluating a. solvency. b. liquidity. c. marketability. d. profitability. 65. Long-term creditors are usually most interested in evaluating a. liquidity and solvency. b. solvency and marketability. c. liquidity and profitability. d. profitability and solvency. 66. Shareholders are most interested in evaluating a. liquidity and solvency. b. profitability and solvency. c. liquidity and profitability. d. marketability and solvency. 67. A shareholder is interested in the ability of a firm to a. pay consistent dividends. b. appreciate in share price. c. survive over a long period. d. all of these. 68. Assume the following sales data for a company: 2007 $1,000,000 2006 900,000 2005 750,000 2004 500,000 If 2004 is the base year, what is the percentage increase in sales from 2004 to 2006? a. 100% b. 180% c. 80% d. 55.5% Closing Entries The adjusted account balances of Stine Company, at December 31, 2008, are as follows: Cash Accounts receivable Prepaid insurance Equipment Amortization expense B. Stine, drawings Advertising expense Rent expense Salary expense Insurance expense $12,700 22,000 10,000 40,000 7,000 1,500 400 1,800 2,000 600 $98,000 Accounts payable Notes payable Accumulated amortization— equipment Service revenue B. Stine, capital Unearned service revenue $ 12,000 7,000 14,000 27,000 22,000 16,000 $98,000 Instructions (a) Prepare closing entries for December 31, 2008. Balance Sheet The adjusted trial balance for DVD Concepts at December 31, 2008, as follows: DVD CONCEPTS Adjusted Trial Balance Year Ended December 31, 2008 Accounts Debit Cash $ 8,000 Accounts Receivable 16,000 Supplies 6,000 Prepaid Insurance 8,000 Computer Equipment 210,000 Accumulated Amortization—Computer Equipment Accounts Payable Note Payable Salaries Payable J. Yan, Capital J. Yan, Drawings 12,000 DVD Rental Revenue Advertising Expense 26,000 Amortization Expense 12,000 Insurance Expense 4,000 Rent Expense 15,000 Salaries Expense 38,000 Supplies Expense 6,000 Totals $361,000 Credit $ 25,000 20,000 71,000 3,000 109,000 133,000 $361,000 Instructions (a) Prepare a classified balance sheet for DVD Concepts at December 31, 2008 assuming the note payable is payable on November 30, 2010. (b) Calculate the working capital and current ratio for DVD Concepts. OR The following items are taken from the adjusted trial balance of Sutch Video Productions at December 31, 2009: Accounts Payable Accounts Receivable Accumulated Amortization—Video Equipment Advertising Expense Cash J. Sutch, capital Amortization Expense J. Sutch, drawings Insurance Expense Note Payable (due 2012) Prepaid Insurance Rent Expense Salaries Expense Salaries Payable Service Revenue Supplies Supplies Expense Video Equipment $ 15,000 11,000 28,000 21,000 24,000 102,000 12,000 15,000 3,000 70,000 6,000 17,000 34,000 3,000 145,000 4,000 6,000 210,000 Instructions (a) Calculate the net income. (b) Prepare a classified balance sheet for Sutch Company at December 31, 2009. (c) Calculate the working capital and the current ratio. Which of the two measures is preferable for comparing Sutch’s liquidity with competitors’? Income Statement The following information from Chevalier Company's general ledger is presented below for the year ended December 31, 2008: Advertising expense $ 45,000 Amortization expense 125,000 Cost of goods sold 985,000 Delivery expense 25,000 G. Chevalier, capital 535,000 G. Chevalier, drawings 150,000 Insurance expense 15,000 Interest expense 70,000 Interest revenue 30,000 Loss on sale of equipment 10,000 Merchandise inventory 92,000 Salaries expense Sales Sales discounts Sales returns and allowances Unearned sales revenue 875,000 2,400,000 8,500 41,000 8,000 Instructions (a) Prepare a multiple-step income statement. OR The following selected information is for Okanagan Company for the year ended January 31, 2008: Accounts receivable 25,000 Freight in 10,000 Freight out 7,000 Insurance expense 12,000 Interest expense 6,000 Merchandise inventory, beginning 42,000 Merchandise inventory, ending 61,000 O. Pogo, capital 105,000 O. Pogo, drawings 42,000 Purchases 200,000 Purchase discounts 1,000 Purchase returns and allowances 6,000 Rent expense 20,000 Salaries expense 61,000 Salaries payable 2,500 Sales 315,000 Sales discounts 4,000 Sales returns and allowances 13,000 Unearned sales revenue 4,500 Instructions (a) Prepare a multiple-step income statement. Journalizing for a Periodic and Perpetual Inventory System The Furano Company had the following merchandise transactions in May: May 2 2 3 9 12 14 Purchased $1,200 of merchandise from Digital Suppliers, terms 2/10, n/30, FOB shipping point. The correct company paid $100 freight costs. Returned $200 of the merchandise to Digital as it did not meet specifications. Paid Digital the balance owing. Sold three-quarters of the remaining merchandise to SunDial Company for $1,500, terms 2/10, n/30. SunDial complained that some of the merchandise was slightly damaged. Furano gave SunDial a sales allowance of $100. 22 Received the correct balance owing from SunDial. Instructions (a) Prepare journal entries for Furano Company assuming it uses a perpetual inventory system. (b) Prepare journal entries for Furano Company assuming it uses a periodic inventory system. Inventory Cost Flow PERIODIC SYSTEM Zambia Company uses a periodic inventory system. Its records show the following for the month of May, with 25 units on hand at May 31: Units Unit Cost Total Cost May 1 Inventory 15 Purchases 24 Purchases Total 30 45 15 90 $8 11 12 $240 495 180 $915 Instructions Calculate the ending inventory and cost of goods sold at May 31 using the FIFO and average cost flow assumptions. Prove the cost of goods sold calculations. Dene Company uses a periodic inventory system and reports the following inventory transactions for the month of June. A physical inventory count showed 180 units were on hand on June 30. Units Unit Cost Total Cost June 1 12 16 23 Inventory Purchases Purchases Purchases 150 230 495 175 $5 6 8 9 $ 750 1,380 3,960 1,575 (a) Calculate the cost of the ending inventory and the cost of goods sold using the LIFO cost flow assumption. PERPETUAL SYSTEM Dene Company uses a periodic inventory system and reports the following inventory transactions for the month of June. A physical inventory count showed 180 units were on hand on June 30. Units June 1 12 16 23 Inventory Purchases Purchases Purchases 150 230 495 175 Unit Cost Total Cost $5 6 8 9 $ 750 1,380 3,960 1,575 (a) Assume there were sales of 250 units on June 14 for $10 each and 620 units on June 26 for $12 each. Calculate the cost of goods sold and the cost of the ending inventory under (1) FIFO, (2) average cost, and (3) LIFO, using a perpetual inventory system. OR Saunder Company uses the perpetual inventory system and the LIFO cost flow assumption. The following information is available for the month of May: May 1 Beginning inventory 20 units @ $ 8 10 Purchase 20 units @ $12 15 Sales 15 units 18 Purchase 10 units @ $14 21 Sales 15 units 30 Purchase 10 units @ $15 Instructions Prepare a schedule to show the value of the ending inventory and cost of goods sold for the month of May. Purchases Date Units Cost Cost of Goods Sold Total Units Cost Balance Total Units Cost Total $ $ $ 160 $ $ $ Amortization Partnerships Ted Karl has owned and operated a proprietorship for several years. On January 1, he decides to end this business and become a partner in the firm of Kurl and Karl. Karl's investment in the partnership consists of $12,000 cash and the following assets from the proprietorship: accounts receivable of $14,000 less an allowance for doubtful accounts of $2,000, and equipment of $20,000 less accumulated amortization of $4,000. It is agreed that the net realizable value of the accounts receivable should be $11,000 for the partnership. The fair market value of the equipment is $17,500. The partnership will also assume responsibility for Karl's accounts payable of $6,000. Instructions Journalize Karl's admission to Kurl and Karl on January 1. OR R. Huma and W. How have capital balances on July 1, 2007, of $50,000 and $40,000, respectively. The partnership income-sharing agreement specifies (1) salary allowances of $20,000 for Huma and $12,000 for How, (2) interest at 5% on beginning capital balances, and (3) for the remaining income or loss to be shared 60% by Huma and 40% by How. Instructions (a) Prepare a schedule showing the division of net income for the year ended June 30, 2008, assuming net income is (1) $45,000, and (2) $32,000. (b) Journalize the allocation of net income in each of the situations in (a). OR Here are the post-closing trial balances of two proprietorships on January 1 of the current year: Visanji Company Dr. Cash Accounts receivable Allowance for doubtful accounts Merchandise inventory Equipment Accumulated amortization—equipment Notes payable Accounts payable F. Visanji, capital P. Vanbakel, capital Cr. Vanbakel Company Dr. $ 9,500 15,000 Cr. $ 6,000 23,000 $ 2,500 28,000 50,000 $ 4,000 17,000 30,000 24,000 30,000 15,000 31,000 13,000 20,000 17,000 22,000 $102,500 $102,500 $76,000 $76,000 Visanji and Vanbakel decide to form the Varsity partnership and agree on the following market values for the noncash assets that each partner is contributing: Visanji Vanbakel Accounts receivable $15,000 Allowance for doubtful accounts 3,500 Merchandise inventory 32,000 Equipment 28,000 $23,000 5,000 15,000 15,000 All cash will be transferred to the partnership on January 1. The partnership will also assume all the liabilities of the two proprietorships. Further, it is agreed that Vanbakel will invest $15,500 cash. Instructions (a) Prepare separate journal entries to record the transfer of each proprietorship's assets and liabilities to the partnership on January 1. (b) Journalize the additional cash investment.