Course Syllabus for Income Taxation

advertisement

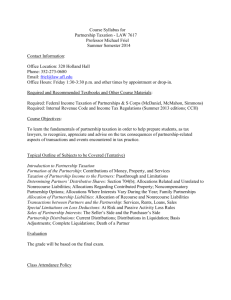

Course Syllabus for Income Taxation - LAW 6600 Professor Michael Friel Fall Semester 2015 Contact Information: Office Location: 320 Holland Hall Phone: 352-273-0680 Email: friel@law.ufl.edu Office Hours: Friday 1:30-3:30 p.m. and other times by appointment or drop-in. Required and Recommended Textbooks and Other Course Materials: Required: Taxation of Individual Income (Burke & Friel)(11th edition; LexisNexis) Required: Selected Federal Taxation Statutes & Regulations (2016 edition; West) Course Objectives: To learn the fundamentals of federal income taxation in order to help prepare students, as lawyers, to recognize and appreciate income tax issues of transactions and events encountered in the general practice of law. Topical Outline of Subjects to be Covered (Tentative) Introduction: The Structure of Federal Income Taxation Income: Gross Income: Concepts and Limitations; Gains from Dealings in Property; Gifts and Bequests; Sale of a Principal Residence; Discharge of Indebtedness; Compensation for Personal Injuries; Fringe Benefits Deductions: Business Expenses; Capital Expenditures; Depreciation: Losses & Bad Debts; Deductible Personal Expenses; Limitations on Deductions Timing: Cash Method Accounting; Accrual Method Accounting; Annual Accounting Characterization: Capital Gains & Losses; Quasi-Capital Assets; Recapture of Depreciation The Appropriate Taxpayer: Assignment of Income; Tax Consequences of Divorce Property Transactions: Nonrecourse Debt; Like-Kind Exchanges; Installment Sales Evaluation The grade will be based on the final exam. Class Attendance Policy Regular class attendance and preparation are required. Students should notify the professor by email of the reason for any class absence. Policy related to make-up exams: The law school policy on delay in taking exams can be found at: http://www.law.ufl.edu/students/policies.shtml#12. Statement related to accommodations for students with disabilities: Students requesting classroom accommodation must first register with the Office of Disability Resources. The UF Office of Disability Resources will provide documentation to the student who must then provide this documentation to the Law School Office of Student Affairs when requesting accommodation. Information on UF Law Grading Policies: Grade: Points A 4.0 (Excellent) A3.67 B+ 3.33 B 3.0 (Good) B2.67 C+ 2.33 C 2.0 (Satisfactory) C1.67 D+ 1.33 D 1.0 (Poor) D0.67 E 0.0 (Failure) The law school grading policy is available at: http://www.law.ufl.edu/students/policies.shtml#9. SYLLABUS INCOME TAXATION FALL 2015 PROF. FRIEL Office hours: Room 320; Friday 1:30 - 3:30 p.m. and other times by appointment or drop-in. Please email me at friel@law.ufl.edu regarding any class absences. The chapters referred to below are chapters in the course textbook, Taxation of Individual Income (11th edition). This syllabus is subject to change as we move through the semester. Any changes will be announced in class and a revised syllabus will be distributed as necessary. I do not anticipate adding any additional chapters, but it’s possible we’ll spend more time than scheduled on one chapter and less on another, or cancel a chapter. In addition, from time to time, the assigned reading and problems contained in each chapter may be modified by announcement in class, either to reflect recent developments or to cope with time constraints. There are also some matters not covered in any of the chapters below that will be covered by brief lecture. Chapter Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 9 Chapter 10 Chapter 11 Chapter 12 Chapter 13 Chapter 14 Chapter 15 Chapter 18 Chapter 21 Chapter 22 Chapter 26 Chapter 27 Chapter 28 Chapter 29 Chapter 30 Chapter 31 Chapter 32 Chapter 33 Chapter 34 Chapter 37 Chapter 38 Chapter 39 Chapter 41 Chapter 44 Classes 3 Classes 2 Classes 1 Class 2 Classes 2 Classes 2 Classes 2 Classes 1 Class 1 Class 2 Classes 1 Class 3 Classes 2 Classes 1 Class 1 Class 2 Classes 2 Classes 1 Class 2 Classes 2 Classes 1 Class 3 Classes 2 Classes 2 Classes 2 Classes 2 Classes 2 Classes 3 Classes 2 Classes 2 Classes