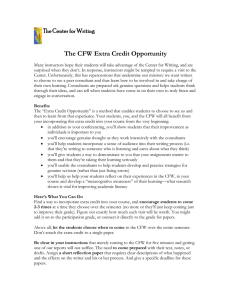

CH9 Section 3 p. 238 Terms:

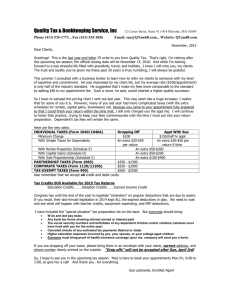

advertisement

Brief Response • What are the purposes of government collecting taxes and other revenue? (5) • Government offices and equipment • Government employees • Government services • Government debt • Discourage unwanted, yet legal, behavior CH9 Section 3 p. 238 Terms: • Intergovernmental revenue • 238 funds collected by one level of government that are distributed to other levels of government. • Federal government to states. Property tax • 241 a tax on possessions • Tangible: real estate, buildings, furniture, automobiles, farm animals • Intangible: stocks, bonds, bank accounts • Tax assessor: • Government person authorized to put a value on property for tax purposes. • Must know “reasonable” value of property. On your “other sheet”, if you still have room or start a new “other sheet” • How much is the tax for year 2012-13? • What is another term for “taxes” used on the form? • There is one more problem coming up the next page, so do not turn this in. Payroll withholding statement • 242 summary statement attached to a paycheck, detailing – Two-weeks, month’s pay (gross income) – Withholding and deductions – Payments and deductions so far in the year – What employee is actually receiving (net income) – Last question for your “other sheet”: What is the withheld amount for the pay check? (Turn in your “other page” when you are done). On your “other sheet”, if you still have room or start a new “other sheet” • How much is the tax for year 2012-13? • 4263.82 $2131.91 +$2131.91 =$4263.82 • What is another term for “taxes” used on the form? • levies Payroll withholding statement – What is the withheld amount for the pay check? – $7.82 Section 4 p. 244 Terms: • Accelerated depreciation • 245 tax relief from the early 1980s allowing businesses to – Depreciate capital more than normal • Allowing them to reduce their taxes substantially. Investment tax credit • 245 a reduction in business taxes that are tied to investment in – New plants and equipment • Business taxes went from 12.5% in 1980 to – 6.2% in 1983 • Most ordinary citizens still pay an average of 15% of their income. – “Trickle-down economics” surcharge • 245 additional tax above and beyond the base rate – 1986 tax restructuring intended to prevent rich from not paying taxes at all Alternative minimum tax • Personal income rate that applies whenever the amount of taxes paid falls below the designated level • People at a prescribed income rate, have to pay a minimum tax of 20%, regardless of – Deductions – loopholes Recent AMT rates Status Single Married Joint Married Separate Trust Corporation Tax Rate: Low 26% 26% 26% 26% 20% Tax Rate: High 28% 28% 28% 28% 20% High Rate Starts $175,000 $175,000 $87,500 $87,500 n/a Exemption 2009 $46,700 $70,950 $35,475 $22,500 $40,000 Exemption 2010 $33,750 $45,000 $22,500 $22,500 $40,000 Exemption phase out starts at $112,500 $150,000 $75,000 $75,000 $150,000 Zero 2009 exemption at $299,300 $433,800 * $216,000 $165,000 $310,000 Zero 2010 exemption at $247,500 $330,000 * $165,000 $165,000 $310,000 Capital gain rate 25% 25% 25% 25% 20% Capital gains • 246 profits from the sale of an asset held for 12 months. – Long-term investments • Republicans reduced this tax in 1997 – 28% to 20% Value-added tax • 247 aka: VAT • A tax placed on the value that manufacturers add at each stage of production • Like a national sales tax – European Union (VAT) – Japan (“shohizei”) • US does not have one. Flat tax • 249 proportional tax on individual income after a prescribed level has been reached. • Advantages – Simple – Minimizes loopholes – Easy to prepare • Disadvantages – Taxes used for incentive would disappear • Charities, environment, investment/reinvestment, consumption – Difficulty in deciding the rate levels • EC: Often proposed by some members of which party? Explain. • Republican • Would reduce taxes on wealthy individuals and businesses. Hwk Assessments, Class Work, to Know Assessments: Checking for Understanding CH9, S3 • 1 • Funds collected by one level of government that are distributed to other levels of government for expenditures. CH9, S3 Assessment • • • • • • 3 Sales tax Intergovernmental revenues Individual income taxes Employee retirement contributions Assessments levied on state employees CH9, S3 Assessment • 4 • State: – – – – Collect from intergovernmental revenues Sales taxes Employee retirement contributions Individual income taxes • Local: – – – – Collect from intergovernmental revenues Property taxes Public utilities and state liquor store sales Sales taxes CH9, S3 Assessment • • • • • 5 Federal income tax State income tax City income tax (not LA) FICA taxes Assessments: Checking for Understanding CH9, S4 • 1 • To influence and reward behavior – Investment/Reinvestment – Charity – Environment – Consumption CH9, S4 Assessment • • • • • • 3 (just list – review in text) Economic Recovery Tax Act of 1981 Tax reform act of 1986 Omnibus Budget Reconciliation Act of 1993 Taxpayer Relief Act of 1997 2001 tax reform CH9, S4 Assessment • 4 • Advantages: – Hard to avoid – Widely spread tax incidence – Easy to collect – Encourages savings • Disadvantages: – Invisible to consumers – Competes with state sales taxes CH9, S4 Assessment • 5 • Advantages – Simple – Minimizes loopholes – Easy to prepare • Disadvantages – Taxes used for incentive would disappear • Charities, environment, investment/reinvestment, consumption – Difficulty in deciding the rate levels CH9, S4 Assessment • • • • 6 Tax code is more complex now Record tax revenues of the 1990s Political power changes image, p. 239 • • • • Question Intergovernmental revenue Sales taxes + which one(s) do you directly pay into at your age? – Sales tax – Hospital fees – Utility and liquor stores – Other image, p. 240 • Question • Highest: Hawai’i and New York • Lowest: New Hampshire and South Dakota image, p. 241 • Question • About 27% (.26663…), • +how did we get that number? (800 – 586.69) ÷ 800 image, p. 243 • • • • • Questions 1 By using credits to reduce its tax liability 2 Because they are able to take advantage of favorable tax rules and regulations – Most can afford expensive tax lawyers and accountants that ordinary cannot. Image, p. 245 • Question • Tax credits for children • + Was the American Revolution about having to pay taxes? • No, it was about – Having the right to decide if a tax was necessary and proper. • Taxation WITH representation Image, p. 246 • Question • The Bush Tax Cuts (tax relief, tax credits, loopholes, and deductions) that will last 10 years (2010) and must be renewed. Bush Tax Cuts • On your “other paper” • Monday, November 15, 2010, the battle in the “Lame Duck: Congress began….. Jon Stewart describes the conservative media and political blitz warning the public about the dangers of the liberal’s plans with the Bush tax cuts. – Liberals want – them to end • Wealthy individuals and business pay the proper share of current taxes. – Conservatives want – to make them permanent • Business and wealthy individuals pay less or no tax because of tax credits, deductions, etc. • Ordinary Americans have no such advantages and pay same taxes. Image, p. 247 • • • • • Questions 1 Tax revenues as a percentage of GDP 2 Canada’s rate increased slightly throughout the period Image, p. 248 • Question • VAT tends to be regressive because – persons with lower and fixed incomes tend to spend a larger percentage of their incomes on tax. Brief Response • What are the arguments for and against tax credits and deductions? (2) • Pro (for): • Con (against):