Cost Recovery Webinar PowerPoint Presentation

advertisement

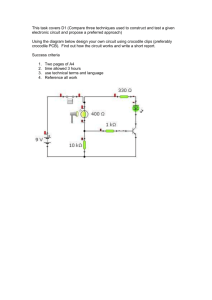

PURSUING eDISCOVERY COST RECOVERY A CASE LAW REVIEW WELCOME Thank you for joining Numerous diverse attendees Please feel free to submit questions Slides, recording and survey coming tomorrow SPEAKERS Matthew Verga – Director, Content Marketing and eDiscovery Strategy AGENDA Cost Recovery Mechanisms Race Tires at the District Court Race Tires at the Third Circuit Country Vintner at the Fourth Circuit CBT Flint at the Federal Circuit Implications and Recent Decisions Key Takeaways / Engage with Modus COST RECOVERY MECHANISMS COST RECOVERY MECHANISMS Traditionally, some litigation costs have been recoverable by prevailing parties: – – – – Court fees, Transcript fees, Costs for interpreters, Costs for copying and exemplification Electronic discovery has complicated this issue by adding new costs: – Where do processing and hosting and technology-assisted review fit into the existing framework? – Can modern discovery expenses be recovered under existing rule and case law? Today’s program: – Cost recovery mechanisms in the Federal Rules of Civil Procedure – Some of the key case law surrounding them COST RECOVERY MECHANISMS, CONT. Cost Shifting During Discovery The first cost shifting mechanism is available during the course of discovery and is found in Rule 26. – In that Rule, judges are given the option of shifting discovery costs from the producing to the requesting (discovering) party under certain circumstances. Subsection (b)(2)(C) of Rule 26 tasks judges with limiting discovery if – “the burden or expense of the proposed discovery outweighs its likely benefit.” The goal of this provision is to introduce the idea of proportionality to discovery, to help judges keep discovery from being weaponized. COST RECOVERY MECHANISMS, CONT. Proportionality means that the burden and costs associated with requested discovery should be weighed against its potential value and uniqueness to strike a reasonable balance. Subsection (b)(2)(C) of Rule 26 offers a list of factors to be considered in making this determination: – – – – – The needs of the case, The amount in controversy, The parties’ resources, The importance of the issues at stake in the action, and The importance of the discovery in resolving the issues COST RECOVERY MECHANISMS, CONT. Judges have a great deal of flexibility in how they act to limit discovery and maintain proportionality: – In subsection (c) of Rule 26, judges are empowered to issue protective orders to protect a party from undue burden or expense. – Although cost shifting is not listed explicitly in that subsection as an available remedy, it has long been recognized as an option. Advisory Committee Notes to the 1970 Amendment to Rule 34 – “. . . the courts have ample power under Rule 26(c) to protect respondent against undue burden of expense, either by restricting discovery or requiring that the discovering party pay costs.” COST RECOVERY MECHANISMS, CONT. Pending FRCP Amendments: – One currently pending amendment to Rule 26 would revise subsection (c) to make “the allocation of expenses” an explicit judicial option – Another currently pending amendment to Rule 26 would move the proportionality factors o from subsection (b)(2) “Limitations on Frequency and Extent” o into the definition of discovery scope itself in subsection (b)(1) “Scope in General” COST RECOVERY MECHANISMS, CONT. The leading articulation of the proportionality test is a seven factor test from Zubulake v. UBS Warburg LLC, 216 F.R.D. 280 (S.D.N.Y. 2003): – The Benefit Factors (a.k.a. the Marginal Utility Test) o The extent to which the requests are specifically tailored to discover relevant information o The availability of such information from other sources – The Cost Factors o The total cost of production, compared to the amount in controversy o The total cost of production, compared to the resources available to each party o The relative ability of each party to control costs and its incentive to do so – The Remaining Factors o The importance of the issues at stake in the litigation o The relative benefits to the parties of obtaining the information COST RECOVERY MECHANISMS, CONT. Limits on the application of this cost recovery mechanism: – Cannot alleviate the fundamental burden of engaging in discovery – Does not change the presumption that responding parties must bear the expense of responding to discovery requests Advantages of this cost recovery mechanism: – Can be used while discovery is ongoing – Can be used to fight for reasonable limits on discovery as well as for the shifting of costs beyond those limits to the requesting party COST RECOVERY MECHANISMS, CONT. Cost Recovery Post-Trial The second cost recovery mechanism is available post-trial to the prevailing party post-trial and is found in Rule 54. Section (d) of Rule 54 provides: – In subsection (1), for the prevailing party’s recovery of costs and – In subsection (2), for the prevailing party’s recovery of attorney’s fees The precise scope of the costs recoverable under Rule 54(d)(1) are established by statute and refined by case law. Our focus today is on attempts by prevailing parties to recover eDiscovery costs pursuant to subsection (1). COST RECOVERY MECHANISMS, CONT. The applicable statutory provision is 28 U.S.C. § 1920 “Taxation of Costs,” which states: – A judge or clerk of any court of the United States may tax as costs the following: o o o o (1) Fees of the clerk and marshal; (2) Fees for printed or electronically recorded transcripts necessarily obtained for use in the case; (3) Fees and disbursements for printing and witnesses; (4) Fees for exemplification and the costs of making copies of any materials where the copies are necessarily obtained for use in the case; o (5) Docket fees under section 1923 of this title; o (6) Compensation of court appointed experts, compensation of interpreters, and salaries, fees, expenses, and costs of special interpretation services under section 1828 of this title. – A bill of costs shall be filed in the case and, upon allowance, included in the judgment or decree. COST RECOVERY MECHANISMS, CONT. The provision dates back to 1948 and has undergone only minor revision since then, making this another area where the law has not caught up to the realities of modern litigation. Consequently, courts have struggled to determine what application, if any, this provision should have to the new costs of electronic discovery. Perhaps they are the legal equivalent of “exemplification” and “making copies,” perhaps not. RACE TIRES AT THE DISTRICT COURT RACE TIRES AT THE DISTRICT COURT Race Tires America, Inc. v. Hoosier Racing Tire, Corp., 2011 WL 1748620 (W.D. Pa. May 6, 2011) – September 2007 – Tire supplier “Race Tires” initiated litigation against competitor tire supplier “Hoosier” and motorsports racing sanctioning body “DMS” – September 2009 – After two years of contentious discovery, the court granted summary judgment for Hoosier and DMS – October 2009 – Race Tires appealed – July 2010 – Race Tires lost on appeal – August 2010 – Race Tires petitioned for rehearing/rehearing en banc and was denied RACE TIRES AT THE DISTRICT COURT, CONT. As prevailing parties, Hoosier and DMS file bills of costs. – Both include eDiscovery costs in them. – Together, they request almost $400,000 in eDiscovery costs. Race Tires objected to both bills of costs, on the grounds that 28 U.S.C. § 1920 does not list eDiscovery costs among the taxable types. The Clerk of Court ultimately awarded the costs, after slight downward revisions to just below $370,000 total. Race Tires moved for the Judge to review the Clerk’s determination regarding the taxation of the eDiscovery costs. RACE TIRES AT THE DISTRICT COURT, CONT. The question is whether eDiscovery costs can be treated as “exemplification” or “copying” under 28 U.S.C. § 1920(4). The Judge reviews prior decisions from a variety of jurisdictions, finding a mixture of decisions holding both ways. Among those he reviews are decisions holding that: – – – – scanning and other electronic discovery tasks are the equivalents of copying and exemplification; scanning is the equivalent of copying but other electronic discovery tasks are not; it does not matter because scanning and other electronic discovery tasks are for the convenience of counsel and, therefore, not “necessary” as required by the statue; and, scanning and production costs are recoverable, if the parties agreed to electronic production. Prior, persuasive examples, but no mandatory authority from the Third Circuit The Judge elected to follow the courts that found eDiscovery costs could be recovered under the statue, focusing on the necessity and agreement factors. RACE TIRES AT THE DISTRICT COURT, CONT. The Judge decided Hoosier and DMS could recover the eDiscovery costs. In so doing, he emphasized that the determination was fact specific and stressed the importance of the following facts: – – – – The parties, including Race Tires, had agreed to electronic production Race Tires aggressively pursued electronic discovery from Hoosier and DMS Hoosier and DMS produced “a massive quantity of ESI” to Race Tires’ requests The tools and services in question were necessary to retrieve and produce the ESI Race Tires then appealed this decision and renewed its argument against the recoverability of eDiscovery costs at the Third Circuit. RACE TIRES AT THE THIRD CIRCUIT RACE TIRES AT THE THIRD CIRCUIT Race Tires America, Inc. v. Hoosier Racing Tire, Corp., 674 F.3d 158 (3d Cir. 2012) The Circuit Court starts with the history of 28 U.S.C. § 1920: – It originated with the Fee Act of 1853. – Before that act, cost recovery had been governed by state rules and local practices, leading to wide disparities in recovery from jurisdiction to jurisdiction. – According to the Supreme Court decisions and other sources reviewed by the Circuit Court, the Fee Act was intended to accomplish two goals: o First, it was intended to standardize cost recovery in the federal courts nationally. o Second, it was intended to enhance “egalitarian” access to the courts by limiting the types of costs for which a losing party might be made to pay, thereby reducing the risk of bringing suit. RACE TIRES AT THE THIRD CIRCUIT, CONT. Turning to subsection (4), the Circuit Court reviews the amendments affecting it since its origination in 1853: – In 1948, the original phrase “obtained for use on the trials” was replaced with the current phrase “obtained for use in the case,” which slightly broadened its potential coverage. o (No longer restricted to recovery just for materials admitted/used at trial.) – In 2008, the original phrase “copies of papers” was replaced with the current phrase “copies of any materials,” which expanded coverage to include the costs of copies of non-paper materials. o (Making the cost of ESI copies recoverable.) RACE TIRES AT THE THIRD CIRCUIT, CONT. The Circuit Court next applies the subsection to the case at hand. The District Court had asserted a general equivalency between exemplification/copy-making and modern eDiscovery, but the Circuit Court undertakes a more granular evaluation. First the Court reviews the claimed costs to see if they could be “exemplification.” – Reviewing two past interpretations of “exemplification” from other Circuits, the Circuit Court concludes that the eDiscovery activities at issue would not qualify because they were not related to illustration or authentication. RACE TIRES AT THE THIRD CIRCUIT, CONT. The Court turns next to the “costs of making copies” The Court does conclude that precedent and the 2008 amendment mitigate in favor of allowing recovery of costs for electronic copies, But, after reviewing the records of the costs claimed, the Court concludes that the only eDiscovery costs that qualify as making copies within the meaning of 28 U.S.C. § 1920(4) are: – “converting native files to TIFF” and – “scanning paper documents to create electronic images” RACE TIRES AT THE THIRD CIRCUIT, CONT. The Circuit Court made its reasoning for this narrow reading of subsection (4) very clear: – “The decisions that allow taxation of all, or essentially all, electronic discovery consultant charges . . . are untethered from the statutory mooring. Section 1920(4) does not state that all steps that lead up to the production of copies of materials are taxable. It does not authorize taxation merely because today's technology requires technical expertise not ordinarily possessed by the typical legal professional . . . Section 1920(4) authorizes awarding only the cost of making copies [emphasis added].” RACE TIRES AT THE THIRD CIRCUIT, CONT. Essentially, in the view of the Third Circuit, courts and parties just have to live with the anachronistic boundaries of the law unless and until it is revised or replaced by Congress. In the meantime, Hoosier and DMS have to settle for recovering tens of thousands of dollars for TIFFing and scanning rather than recovering the hundreds of thousands of dollars for all activities awarded by the District Court. COUNTRY VINTNER AT THE FOURTH CIRCUIT COUNTRY VINTNER AT THE FOURTH CIRCUIT Country Vintner of NC, LLC v. E. & J. Gallo Winery, Inc., 718 F.3d 249 (4th Cir. 2013) Country Vintner of NC sued E. & J. Gallo Winery over its distribution, within North Carolina, of an Argentinian wine, to which Country Vintner claimed the exclusive North Carolina wholesale rights. The parties clashed early and often over the scope and cost of eDiscovery, resulting in a motion for a protective order from Gallo and a motion to compel from Country Vintner. Country Vintner prevailed on its motion, and Gallo began an extensive and expensive eDiscovery process. Ultimately, however, Gallo prevailed in having Country Vintner’s claims against it dismissed and denied on summary judgment. That victory was appealed by Country Vintner and affirmed by the Fourth Circuit. COUNTRY VINTNER AT THE FOURTH CIRCUIT, CONT. As the prevailing party, Gallo filed a bill of costs seeking to recover $111,047.75 in eDiscovery expenses, broken down as follows: – – – – – – $71,910 for “flattening” and “indexing” ESI $15,660 for “Searching/Review Set/Data Extraction” $178.59 for “TIFF Production” and “PDF Production” $74.16 for electronic “Bates Numbering” $40 for copying images onto CD or DVD $23,185 for “management of the processing of the electronic data,” “quality assurance procedures,” “analyzing corrupt documents and other errors,” and “preparing the production of documents to opposing counsel” COUNTRY VINTNER AT THE FOURTH CIRCUIT, CONT. The District Court adopted the reasoning of the Third Circuit in Race Tires, allowing recovery only for what it deemed to be literally “copying”: – TIFF production, – PDF production, and – Copying onto CDs and DVDs These charges totaled just $218.59 out of the $111,047.75 sought. Gallo appealed this determination back to the Fourth Circuit. Before the Circuit Court, Gallo argued that eDiscovery processing expenses should qualify as “making copies” under the statute because the nature of ESI requires processing to make meaningful copies. COUNTRY VINTNER AT THE FOURTH CIRCUIT, CONT. The Court summarized Gallo’s argument: – “ESI is ‘more easily and thoroughly changeable than paper documents,’ it contains metadata, and it often has searchable text . . . Gallo contends that converting native files to PDF and TIFF formats ‘produce[d] static, two-dimensional images that, by themselves, [we]re incomplete copies of dynamic, multi-dimensional ESI’; other ‘processing . . . was necessary to copy all integral features of the ESI.’” Gallo described in some detail the steps involved in processing and their import, but the Fourth Circuit was not persuaded. COUNTRY VINTNER AT THE FOURTH CIRCUIT, CONT. Like the Third Circuit, the Fourth Circuit reviewed: – The history of 28 U.S.C. § 1920, – Its language and plain meaning, and – The Supreme Court’s narrow interpretation of other subsections Based on this review, the Fourth Circuit reached the same conclusion as the Third Circuit regarding the narrow scope of 28 U.S.C. § 1920(4). Based on this, it affirmed the District Court’s decision to allow recovery in this instance only for the $218.59 associated with the TIFF production, PDF production, and copying onto CDs and DVDs. COUNTRY VINTNER AT THE FOURTH CIRCUIT, CONT. While this decision does further narrow the potential viability of eDiscovery cost recovery under 28 U.S.C. § 1920(4), the Court does leave open two interesting possibilities in footnotes: – First, the Court suggests that, in a case where the production of metadata or other unique ESI features was required, the associated technical costs would be recoverable. o (In Country Vintner, there was no such requirement.) – Second, the Court suggests that, in a case where the parties have clearly agreed to production in a particular format or in a particular review database, the associated technical costs would be recoverable. o (In Country Vintner, there was no such agreement between the parties.) CBT FLINT AT THE FEDERAL CIRCUIT CBT FLINT AT THE FEDERAL CIRCUIT CBT Flint Partners, LLC v. Return Path, Inc. and Cisco Ironport Systems, LLC, 737 F.3d 1320 (Fed. Cir. 2013) 2007 – CBT Flint sued Return Path and Cisco for patent infringement. 2009 – after two years of discovery and motions practice, CBT Flint conceded one of its claims and summary judgment was granted against it on the other. – – – As the prevailing party, Cisco then moved to recover its costs, including those paid to vendors for eDiscovery tasks. The District Court granted Cisco’s motion, reasoning that eDiscovery tasks were the modern equivalent of making copies. The matter of cost recovery was tabled, however, by CBT Flint’s appeal of that summary judgment decision. 2011 – CBT Flint prevailed on appeal; case remanded 2012 – summary judgment granted against CBT Flint again on different grounds. 2013 – award of summary judgment affirmed on appeal CBT FLINT AT THE FEDERAL CIRCUIT, CONT. Return Path and Cisco each submitted bills of costs that included fees paid to eDiscovery vendors – Return Path – $33,858.51 – Cisco – $243,453.02 The Clerk taxed the full cost amounts requested by Return Path and Cisco, including those related to eDiscovery vendors – The District Court declined to review the taxation of costs by the Clerk, and referred back to its decision on Cisco’s cost recovery motion from 2009. CBT Flint appealed this taxation of costs back to the Court of Appeals for the Federal Circuit. CBT FLINT AT THE FEDERAL CIRCUIT, CONT. Like the Third and Fourth Circuits, the Federal Circuit reviewed: – The history of 28 U.S.C. § 1920, – Its language and plain meaning, and – The Supreme Court’s narrow interpretation of other subsections – (Additionally, it reviewed relevant case law from the Eleventh Circuit, where the case originated.) Based on this review, the Federal Circuit reached substantially the same conclusion regarding the narrow scope of 28 U.S.C. § 1920(4). – Broad recovery of modern eDiscovery costs as “copies” is not possible. CBT FLINT AT THE FEDERAL CIRCUIT, CONT. The Federal Circuit articulates the general rule this way in its opinion: – . . . we conclude that recoverable costs under section 1920(4) are those costs necessary to duplicate an electronic document in as faithful and complete a manner as required by rule, by court order, by agreement of the parties, or otherwise [emphasis added]. To the extent that a party is obligated to produce (or obligated to accept) electronic documents in a particular format or with particular characteristics intact (such as metadata [footnote omitted], color, motion, or manipulability), the costs to make duplicates in such a format or with such characteristics preserved are recoverable as “the costs of making copies . . . necessarily obtained for use in the case.” [citation omitted]. But only the costs of creating the produced duplicates are included, not a number of preparatory or ancillary costs commonly incurred leading up to, in conjunction with, or after duplication. CBT FLINT AT THE FEDERAL CIRCUIT, CONT. In the Federal Circuit’s formulation, recovery is still limited to the costs of making copies . . . – . . . but with an explicit allowance for the reality that electronic “copies” can be many different things, some of which require different steps. This articulation of the rule echoes the footnote comments from Country Vintner suggesting agreements as to format or other obligations might justify recovery for additional steps. CBT FLINT AT THE FEDERAL CIRCUIT, CONT. The Federal Circuit also deviates from the Third and Fourth Circuits in one small but important way: – In applying its articulation of the rule, the Court concludes that the: o “costs of imaging source media and extracting documents in a way that preserves metadata” o are recoverable as the cost of making copies, because the preservation and production of that metadata was required in this instance. IMPLICATIONS AND RECENT DECISIONS IMPLICATIONS AND RECENT DECISIONS What do these largely consistent decisions from the Third, Fourth, and Federal Circuits mean for practitioners going forward? Two primary things: – COPIES MEANS COPIES – DETAILS MATTER IMPLICATIONS AND RECENT DECISIONS, CONT. Copies Means Copies Unless and until 28 U.S.C. § 1920(4) is revised, cost recovery via that mechanism is going to continue to be limited narrowly to the costs of making paper and electronic copies. District Courts in Circuits without their own Circuit Court decision on the issue have turned to and largely followed Race Tires, et al. – Apple Inc. v. Samsung Electronics Co. Ltd., 2014 WL 4745933 (N.D. Cal. Sept. 19, 2014) (decision from a district in the Ninth Circuit following Race Tires, et al.); – Life Plans, Inc. v. Sec. Life of Denver Ins. Co., 2014 WL 2879881 (N.D. Ill. June 25, 2014) (decision from a district in the Seventh Circuit following Race Tires, et al.). IMPLICATIONS AND RECENT DECISIONS, CONT. One District Judge in the Northern District of California has been widely cited for explicitly rejecting the Race Tires approach and adopting a broader interpretation allowing broader recovery. – Petroliam Nasional Berhad v. GoDaddy.com, Inc., 2012 WL 1610979 (N.D. Cal. May 8, 2012); – In re Online DVD Rental Antitrust Litig., 2012 WL 1414111 (N.D. Cal. Apr. 20, 2012). That Judge relied for authority on a Ninth Circuit decision finding broad judicial freedom to interpret the cost categories listed in 28 U.S.C. § 1920. – Unfortunately, that Ninth Circuit decision was reversed by the Supreme Court a few weeks later on May 21, 2012. – Taniguchi v. Kan Pac. Saipan, Ltd., 132 S. Ct. 1997 (2012). IMPLICATIONS AND RECENT DECISIONS, CONT. The Taniguchi decision was not focused specifically on eDiscovery, but it addresses: – The limited nature of the recovery intended by 28 U.S.C. § 1920 and – The limited range of judicial discretion in interpreting it The Supreme Court’s narrow reading of the statute in Taniguchi is cited in both Country Vintner and CBT Flint – Probably forecloses any further attempts to broadly expand the meaning of “making copies” to cover other types of eDiscovery costs IMPLICATIONS AND RECENT DECISIONS, CONT. Although limited to copying costs for now, that limited recovery is still worth pursuing – Particularly for large matters where the recoverable costs can be tens or hundreds of thousands of dollars o Life Plans, Inc. v. Sec. Life of Denver Ins. Co., 2014 WL 2879881 (N.D. Ill. June 25, 2014) (granting prevailing party $16,793.97 in eDiscovery cost recovery); o Apple Inc. v. Samsung Electronics Co. Ltd., 2014 WL 4745933 (N.D. Cal. Sept. 19, 2014) (granting prevailing party $238,102.66 in eDiscovery cost recovery). IMPLICATIONS AND RECENT DECISIONS, CONT. Details Matter Recovery turns on a highly fact-specific determination: – What form and format of production was requested, required by circumstances, or ordered by the judge? Was there any requirement for the preservation and production of metadata? o Forensic collection and load file creation charges might be recoverable, if metadata production was required, but not if a simpler production would have sufficed. – How do the vendor invoices (or internal bills) underlying your cost recovery claims label and describe the task costs you are claiming as copying-related? o Clerks and judges look to the language used on invoices for evidence regarding what tasks are actually represented by the invoiced charges, so vague or inaccurate labeling or description can undermine efforts to establish recoverability. IMPLICATIONS AND RECENT DECISIONS, CONT. – Are the copying-related task charges easily separable on the invoices from the unrecoverable ones? Is itemization clear and sufficiently granular? o If recoverable task costs are mixed together with unrecoverable task costs in aggregated sums, or lumped together in undifferentiated blocks of hourly billing, it may be difficult or impossible to establish the amount of the recoverable task costs. – Can a sufficient connection be demonstrated between the claimed task charges and production? Can you separate the charges incurred for unproduced materials from those for produced ones? o You will need to be able to establish that the task costs for which recovery is sought have both a technical connection to production (i.e., that they are a required part of making necessary copies) and a substantive connection to production (i.e., that they were incurred for materials that were ultimately produced). KEY TAKEAWAYS KEY TAKEAWAYS Cost Recovery During Discovery – FRCP 26 tasks judges with limiting discovery to avoid undue burden or expense on producing parties and to maintain proportionality – Judges can, among other things, order cost shifting to accomplish this – The rule references 5 factors: the needs of the case, the amount in controversy, the parties’ resources, the importance of the issues at stake in the action, and the importance of the discovery in resolving the issues – The most-cited test applying this standard is the 7-factor Zubulake test, which places the most emphasis on: o The extent to which the requests are specifically tailored to discover relevant information o The availability of such information from other sources KEY TAKEAWAYS, CONT. Cost Recovery Post-Trial by Prevailing Parties – FRCP 54(d)(1), in combination with 28 U.S.C. § 1920, allow prevailing parties to recover specified categories of litigation costs – 28 U.S.C. § 1920(4) allows for the recovery of the costs of making necessary copies for the matter and this includes copies of electronic materials – The Third, Fourth, and Federal Circuits have all interpreted the scope of “copies” narrowly/literally and, in light of Taniguchi, that interpretation will likely stand – The scope of potential recovery for ESI copies will depend on: o The jurisdiction o The production requirements or agreements o The available documentation supporting the recovery sought ENGAGE WITH MODUS Modus email coming tomorrow with slides, recording, survey and invite to next webinar Visit us online at http://discovermodus.com/webinars/ for more information on next webinar on March 10th at 1:00PM EST entitled: – “Paralegalease – How to Simplify Your Life in eDiscovery as a Paralegal” Make sure to visit our website for valuable white papers, blogs and other information at www.discovermodus.com Thank you!